jetcityimage

Properly acknowledged for its charming mascot, Flo, Progressive Company (NYSE:PGR) is among the largest insurance coverage corporations on the earth by market cap, sitting narrowly underneath $100 billion as I write this. Curiously, the inventory is at its all-time excessive, with a P/E like a tech firm. Whereas many different corporations’ shares slumped in worth throughout the occasions of 2022, PGR stored plugging alongside.

It is price analyzing what precisely traders are getting with this established and pleasant model. I will evaluation the financials and the outlook for the corporate. Finally, nearly as good as the corporate is, I feel PGR is overpriced, and that makes it a SELL.

Present Enterprise

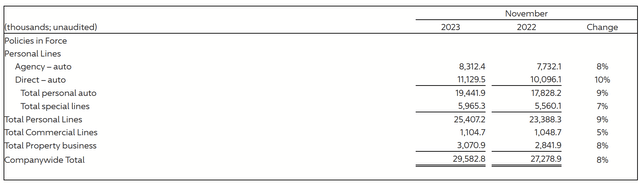

Progressive primarily offers in automobile insurance coverage. Additionally they supply merchandise associated to property, workman’s compensation, and numerous different merchandise. Automotive insurance coverage simply makes up the vast majority of their enterprise. With 29.5m insurance policies in impact as of November, 19.4m have been underneath their private auto line, with an extra 1.1m insurance policies of their skilled strains.

Progressive’s Nov. Outcomes (progressive.com)

As can be seen above, barely extra of those insurance policies are underwritten immediately by means of the corporate than by outdoors brokers. Direct gross sales happen on their web site, by means of their app, or over the cellphone. The place attainable, the corporate tries to bundle totally different insurance coverage merchandise right into a single providing so as to enhance income and construct stronger buyer relationships.

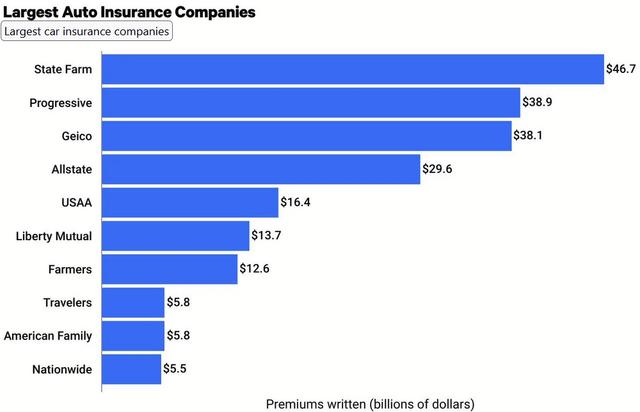

The automobile insurance coverage market could be very aggressive, and Progressive has many rivals in that area. In line with ValuePenguin, as of January 2024, Progressive had the second-largest slice of American market share for automobile insurance coverage, at 14.1%.

valuepenguin.com

Based mostly on the figures they supply, the highest 10 auto insurers management about 77% of that market. It is a tight area.

The corporate’s further money is invested, ideally to get a greater return and yield than merely preserving it within the financial institution, which is regular in insurance coverage.

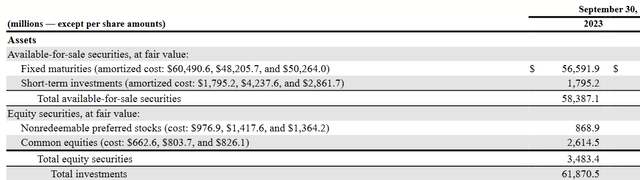

Q3 2023 For 10Q

In Q3 2023, the corporate reported $61.9 billion in investments on its stability sheet. Attributable to regulatory constraints, most of those are in fixed-income securities, and little or no is in equities.

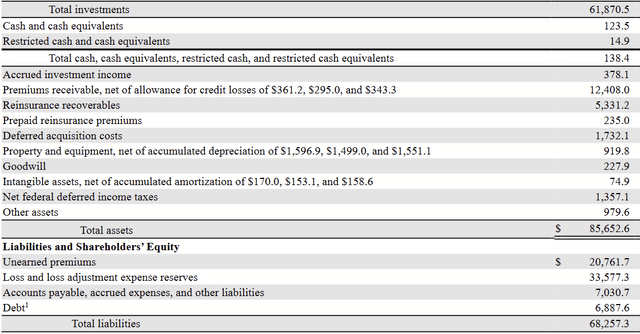

Q3 2023 Type 10Q

Total, the stability sheet in all fairness robust. The portfolio itself is ample to cowl most of its liabilities, and tangible property general are nicely in extra of that.

Monetary Historical past

What sort of outcomes has this enterprise mannequin gotten? The corporate skilled profitable development over the previous decade to grow to be one of many main auto insurers within the nation. I will embrace YTD knowledge for 2023 (as much as Q3 and primarily based on the corporate’s information releases for October and November).

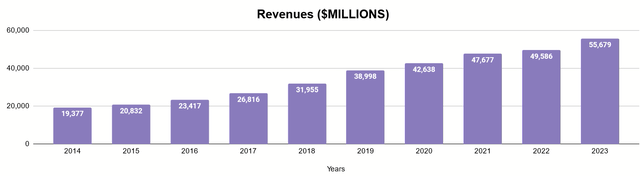

Writer’s show of 10K/10Q/reported knowledge

Progressive is and continues to be a gentle grower and compounder. How has this been mirrored in earnings and returns to shareholders?

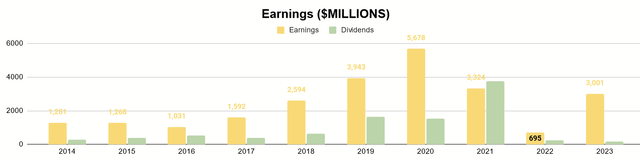

Writer’s show of 10K/10Q/reported knowledge

Their earnings have trended towards development. The unusual rise in 2020 was on account of an absence of claims amid lowered visitors (and due to this fact lowered accidents) throughout the COVID lockdowns. Dividend payouts present that these further earnings have been finally given out to shareholders.

Regardless of frequently rising revenues, earnings have been down in 2022. Of their 2022 Type 10K (pg. App.-A-51), administration defined within the Working Outcomes that this was a mixture of a decline out there worth of their portfolio’s securities, impairment of goodwill, and (importantly) losses incurred from their Property Line, primarily insurance policies within the Southeast, on account of storms.

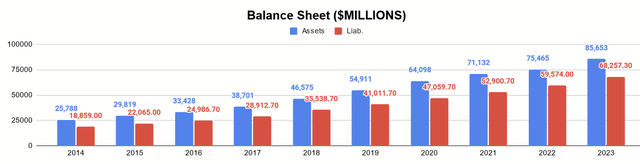

Writer’s show of 10K/10Q/reported knowledge

Steadiness sheet exhibits unsurprising development of property and liabilities, given what I’ve already talked about.

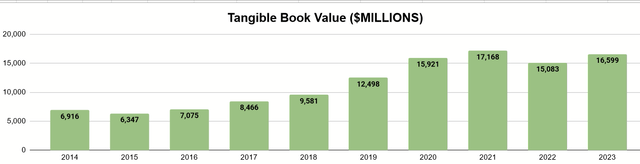

Writer’s show of 10K/10Q/reported knowledge

But, asset development has been 3.32x since 2014, whereas TBV has solely elevated 2.4x, considerably as a result of more moderen challenges.

A Look to the Future

As I discussed earlier, this firm, regardless of being insurance coverage, is buying and selling at a really excessive a number of. That means there may be optimism about development in earnings, so the place would the expansion be?

Auto Line

To reiterate, Progressive is the #2 automobile insurer by market share. The massive ten have 77% of this market. The alternatives are shrinking. Progressive already operates in all 50 U.S. states. There’s not a lot new territory to penetrate. For the Auto Line revenues to develop, they want to have the ability to increase costs with out dropping prospects, purchase shares from these robust opponents, or experience the wave of a rising market. Ought to something of these items happen, I imagine the affect shall be small. Let’s begin with pricing, and I will quote the corporate of their 2022 10K once more:

Whereas a number one model is essential to our success, we function in a really aggressive trade the place worth is a really robust consideration for customers after they store or determine to resume their insurance policies. Consequently, aggressive costs are one among our 4 technique pillars.

So they’re conscious of this, and I anticipate they are going to be hesitant to lift costs considerably over time. Now, they’ve been making substantial will increase to maintain up with latest excessive inflation, and that is to be anticipated. After all, that is solely nominal development.

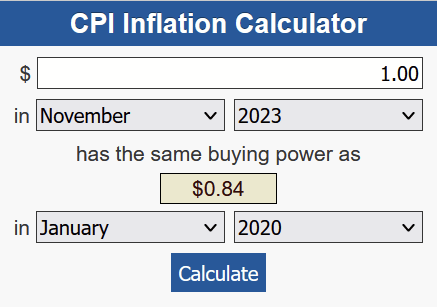

Inflation Calculator (Bureau of Labor Statistics)

When you look again on the chart on revenues, that $55.7b for 2023 is extra like $46.8b in 2020. So sure, Progressive a minimum of has some pricing energy in opposition to inflation, however let’s not let it warp our notion of development an excessive amount of.

So far as taking market share goes, they can try this with the smaller insurers, however I imagine the opposite huge 9 may also be doing that. Additionally they have potent advertising campaigns. Flo is pitted in opposition to the likes of the Gecko, Mayhem, and Jake from State Farm. It is a type of indicators the place Progressive is a superb enterprise however does not fairly have a moat all to itself.

Lastly, I imagine the variety of drivers who want insurance coverage is unlikely to rise by any main diploma. There are already 240m licensed drivers within the U.S. With the millennials all grown up now and declining delivery charges for years, there’s not a big, new cohort of drivers for insurers to scoop up anymore. Realistically, Auto Line’s development shall be incremental.

Property Line

Progressive’s House owner’s Insurance coverage

That is actually the place the corporate desires to lock in development and should clarify the excessive worth of PGR. As beforehand said, Progressive likes to bundle its merchandise with its Auto Line, as this isn’t solely a bigger sale, however they imagine these prospects usually tend to renew. This matter was a significant supply of dialogue within the Q3 Earnings Name. I will quote a few of the administration on it:

The factor to contemplate there, Josh, is which segments we’re rising in could be considerably indicative of the place they’re coming from. So we’re persevering with to develop nicely within the extra most popular segments of our enterprise, the “Robinsons,” but additionally we name “Wrights” who’re householders that don’t bundle but their dwelling and auto with Progressive. And now we have not been rising, truly this 12 months, we have been shrinking somewhat bit on the usual finish. So the nonstandard finish of the spectrum. In order that bodes rather well for our future development as a result of, clearly, these prospects follow us longer.

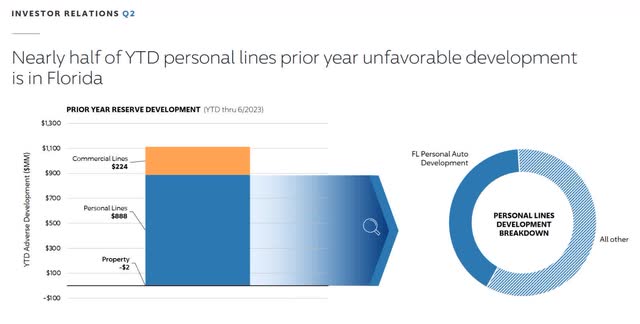

A part of the wrestle is that the Property Line has not been worthwhile currently, largely on account of massive storms in 2022 and the corporate’s publicity to Florida:

Q2 2023 Firm Presentation

Whereas I feel there may be some intelligence to the thought of leveraging their present e-book of Auto prospects and turning them into bundle prospects as a method of development, the execution has not began nicely. This was additionally talked about in that earnings name:

Sure. I feel we begin with what we began with a couple of 12 months in the past, and that was to de-risk the e-book and have much less new apps and insurance policies in risky states and extra in nonvolatile. And also you noticed the info on that within the queue that we imagine we’re doing an incredible job. We’re non-renewing about 115,000 insurance policies in Florida, we’re simply over listed in Florida. And so we love Florida. Now we have loads of Robinsons. Now we have loads of autos and we proceed to have loads of houses, however we weren’t earning money and we would have liked to non-renew some. So that may occur over the following 12 months or so.

Whereas the corporate goes to enhance its threat fashions to underwrite much less and with higher costs, I personally suppose this may very well be a warning. Maybe increasing right into a line that may very well be as huge as Auto is them deviating from their robust fits.

That is not to say that they will not pull this off, however the place automobile insurance coverage is steadier and extra predictable, property insurance coverage is a distinct product with totally different dangers. An investor has to ask, “If elevated revenues additionally include elevated prices, is it actually earnings development?”

Having mentioned that, if we assume that they realized from the issues of Florida and different Gulf States, profitable execution of the technique might develop earnings considerably.

Valuation

So let’s discuss in regards to the present valuation earlier than I do my very own. The market cap of Progressive sits slightly below $100b, an enormous firm! But, the TBV is simply $16.6b. Not many insurance coverage or monetary corporations will commerce that prime above TBV. YTD internet earnings for 2023 can also be $3b, so the place is the $100b in worth?

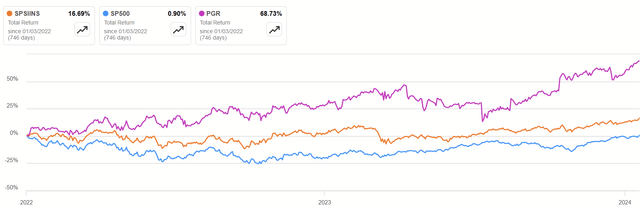

Properly, first contemplate that a few of this is because of market conduct because the occasions of 2022 (struggle in Ukraine, inflation).

Searching for Alpha

If we have a look at complete returns since Jan. 1, 2022 to at this time for the S&P 500, the S&P Insurance coverage Choose Business Index, and PGR, we’ll discover that each of the latter beat the previous. Insurance coverage corporations are sometimes seen as defensive shares, so the entire sector stayed up on that, no matter earnings. Insurance coverage corporations are seen as safer, so individuals pay extra for them.

Nonetheless, PGR’s return has been greater than that of the Index, so individuals should anticipate development. If earnings are usually round $3b, then to me that implies the market thinks they will develop to about $10b moderately quickly. What are the probabilities, then? If we assume progressive solely averages 3% earnings development every year, then $10b does not occur.

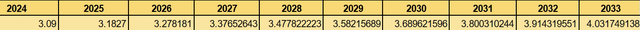

Writer’s calculation

If we assume Progressive solely averages 15% development (which might be commendable for the corporate of that dimension), it occurs in 2032, not precisely quickly.

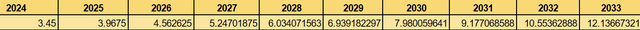

Writer’s calculation

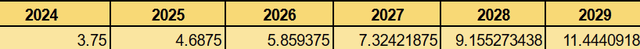

If we common 25% development for a minimum of the primary six years, we get there by 2029.

Writer’s calculation

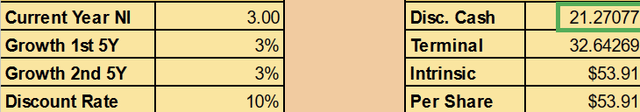

Even when it is not for a full decade, 25% is lots to perform, particularly for an enormous insurer like Progressive. It is particularly powerful if the supply of development nonetheless must be made a worthwhile phase first. Whereas I feel Progressive is a superb firm, I would like to purchase it with extra modest development assumptions. If I worth it for 3% development and apply my normal low cost price of 10%, right here is the worth of the following decade’s earnings.

Writer’s calculation

That is $21.3 billion. Added to the tangible e-book worth of $16.6b and divided by the variety of shares, which tells me the honest worth of the corporate is $64.50. The present worth of $170 appears wealthy to me.

Conclusion

Progressive is a wonderful firm with one of the recognizable manufacturers in insurance coverage. But, it is buying and selling at an all-time excessive, as if the #2 automobile insurer has a path to meteoric development. Slightly, the premium is borne out of investor preferences for “defensive” insurance coverage shares within the wake of 2022 and anticipation of development from the Property Line that is not earning money, on account of misguided threat assumptions.

The technique for development is a great one, however traders ought to watch a bit longer to substantiate that they will truly begin to do it, and even when that day comes, they need to watch out to not overpay for a vibrant future, or else they will not make cash. Possibly, at finest, this can be a $70b enterprise, however I do not see a justification for $100b. Within the meantime, I would not wish to threat my hard-earned cash shopping for PGR, and if I did personal it, it might be a simple SELL at this worth.