SOPA Pictures/LightRocket by way of Getty Pictures

Funding Thesis

Comcast (NASDAQ:CMCSA) is about to report its FY23 earnings on the twenty fifth of January, so I needed to take a fast have a look at how the corporate’s financials developed since my final protection and try what to anticipate from the upcoming report. I am not anticipating any main top-line development from the corporate, however I want to see margin enhancements. Peacock TV has a number of potential however may be very removed from being a worthwhile phase. However, I consider the corporate continues to be undervalued and nonetheless has some room to develop if it continues to enhance its effectivity and profitability going ahead, even with the dearth of top-line catalysts.

Replace For the reason that final Protection

The final time I lined the corporate was again in April of ´23 after I argued that the CMCSA does not essentially want sturdy top-line development to create worth, so long as it will possibly change into extra environment friendly by enhancing its margins. So, let’s check out how among the firm’s metrics have advanced over the previous couple of quarters.

As of Q3 ´23, the corporate gathered $6.4B in money and equivalents, towards a whopping $94B in long-term debt, which has simply gotten barely worse since April of final 12 months. I do not suppose it is nonetheless an issue for 3 causes. First, the corporate’s debt-to-assets ratio is round 0.36, and something beneath 0.6 I contemplate to be not overleveraged. Secondly, the corporate’s debt-to-equity ratio is 1.15, and something beneath 1.5 is suitable to me. Lastly, and an important out of the three solvency metrics, is the corporate’s capability to cowl its debt obligations by way of annual curiosity bills. As of 9 months ended Sept. 30, the corporate’s curiosity protection ratio stood at round 6, which signifies that the corporate can simply cowl the bills with the working earnings obtained, six instances over as a matter of truth. As I discussed in my earlier article, many analysts contemplate a protection ratio of 2x to be adequate, and the corporate handed even my extra scrutinizing necessities of not less than 5, due to this fact, CMCSA isn’t liable to insolvency.

By way of revenues, we are able to see the corporate’s regular but gradual enhance in revenues during the last 12 months, which is as anticipated. The corporate does not appear to have any catalysts going for it, so I do not anticipate its high line to develop any quicker than it does proper now.

Income development (SA)

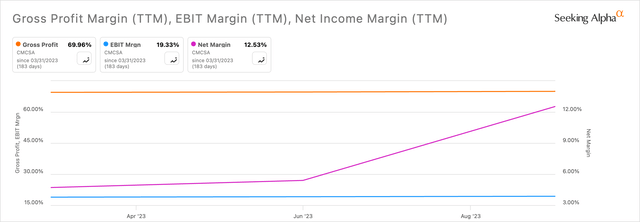

By way of margins, we are able to see that the corporate’s backside line has improved considerably as soon as the impairment fees went away. Round $8.5B in goodwill and long-lived asset impairments, which led to round 700bps enchancment within the backside line, whereas gross and EBIT margins stayed comparatively steady over the identical time.

Margins (SA)

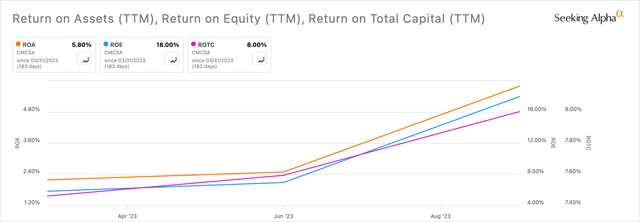

Persevering with on effectivity and profitability, we are able to see that the underside line enhancements helped the corporate’s ROA and ROE metrics massively. Plainly the administration is utilizing the corporate’s belongings and shareholder capital far more effectively now. Moreover, the corporate’s ROTC has seen the identical enchancment during the last whereas, which tells me that the corporate is gaining some type of a aggressive edge.

Effectivity and Profitability (SA)

So, we are able to see that during the last whereas, as soon as the corporate removed the impairment fees, the corporate’s profitability and effectivity considerably improved. The whole lot is trending upward, which is what I prefer to see. I do nonetheless suppose that many traders will are inclined to keep away from the corporate as a consequence of its huge debt pile, however as I confirmed you above, the debt isn’t that large of a threat, because it seems to be prefer it’s manageable.

Upcoming Earnings

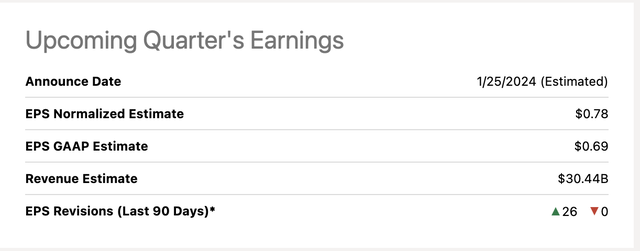

The corporate goes to announce its This fall earnings on the twenty fifth of January, so let’s see what the numbers appear like.

The corporate’s EPS GAAP and adjusted are estimated to be $0.69 and $0.78, respectively, whereas revenues anticipated to be at round $30.44B, which is a rise of round 1% sequentially and a slight decline year-over-year of round 30bps, in order anticipated nothing thrilling on the highest line development, on factor to notice, the corporate had 26 EPS provisions to the upside within the final 90 days, which can additionally imply that it could eke out a beat when it experiences in just a few days.

Earnings estimates (SA)

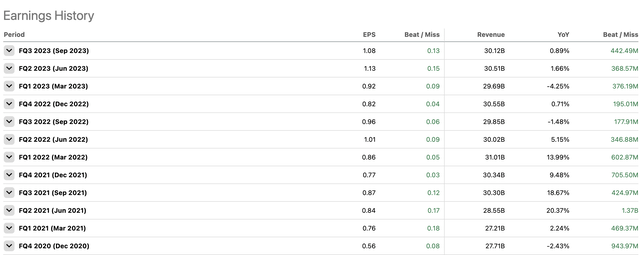

Talking of beats, the corporate managed to beat an estimated 12 out of the final 12 quarters, so it is seemingly the corporate will beat estimates this time round too, except we see a disastrous report.

Earnings Historical past beats (SA)

Feedback on the Outlook

By way of revenues, I don’t anticipate to see a lot development right here. It seems to be like the corporate has penetrated all that it will possibly by way of cable communications and can proceed to see subpar development going ahead.

Twine slicing might influence the corporate’s cable phase and I anticipate to see slowing subscriber development on this sector, nonetheless, a few of it could be offset by greater broadband speeds and information utilization.

I am very wanting to see how Peacock’s streaming service develops. The corporate expects to see decrease losses from the service, because the administration up to date their outlook from $3B in losses to round $2.8B. The service has seen a giant development in subscriber rely during the last 12 months, and it doubled within the third quarter from a 12 months in the past. I want to see this momentum proceed, and if there is a substantial slowdown, traders is not going to take it frivolously and I’d anticipate to see a number of volatility on the day of the announcement. It can take an extended whereas for the corporate to start out getting cash from the service, nonetheless, as I mentioned in my first article, if the corporate continues to take a position closely on this phase and make the fitting selections, it should finally flip worthwhile.

I additionally want to see the corporate not less than retaining the margins it has proper now, nonetheless, I wouldn’t be stunned if we do see some deterioration due to elevated spending on content material in relation to Peacock TV and its conventional cable channels. So long as the elevated spending turns into long-term acquire by way of attracting and retaining prospects, I am high-quality with that.

I am additionally keen to listen to what the administration has to say concerning the outlook going ahead for 2024. I’ll tune in to listen to the earnings name on the twenty fifth and can attempt to get a really feel of the administration’s tone concerning the future developments within the streaming service, its cable phase, and likewise the theme parks.

Closing Feedback

Total, I consider the corporate is not going to shock us an excessive amount of on the day of earnings. I do consider we’ll see a slight beat on all essential metrics. Nonetheless, I will be in search of the administration’s steerage and the general tone of the entire workforce. Even when the corporate beats estimates, we might see a meltdown in share worth if traders aren’t going to be pleased with the steerage.

My advice and PT of round $50 a share stays the identical as I consider the corporate nonetheless is slightly undervalued and in the long term must be an excellent funding if the corporate continues to enhance its margins. Moreover, if the corporate manages to revitalize its high line development, that’s going to be the cherry on the cake, however I am not holding my breath on that entrance.