Up to date on January seventeenth, 2024

If you begin investing, the least about investing that you’ll ever know.

This could result in poor preliminary outcomes, and in the end ‘quitting’ investing with out ever benefiting from the prosperity creating results of compound curiosity.

If you’re ranging from scratch, it pays to start your funding journey with the data essential to succeed. This text is your information on the best way to make investments nicely, from the beginning.

Investing can appear extraordinarily sophisticated. There’s a staggering quantity of industry-specific data in investing. Fortuitously, you don’t must know all of it to do nicely.

The truth is, the best way to do nicely as an investor might be boiled down into the next sentence:

Spend money on nice companies with robust aggressive benefits and shareholder pleasant managements buying and selling at honest or higher costs.

You are able to do this by investing in high quality dividend development shares such because the Dividend Aristocrats, an elite group of 68 shares within the S&P 500 with 25+ consecutive years of dividend will increase.

You’ll be able to obtain a full listing of all 68 Dividend Aristocrats by clicking on the hyperlink under:

Shopping for top quality companies has traditionally been a successful technique. The bolded assertion above covers all there may be to learn about profitable dividend development investing. Nonetheless, it’s lacking some element.

The remainder of this text discusses intimately the best way to construct a dividend development portfolio, beginning with $5,000 or much less. You can too watch an in depth evaluation on the subject under:

Selecting a Inventory Dealer and Funding Your Account

The way in which that we buy shares has modified dramatically over the many years.

It was very costly to buy shares – a ‘dealer’ was a person, not a web-based platform. Shopping for shares concerned calling your inventory dealer and seeing if he knew anybody who was promoting your required safety.

Immediately, there are a plethora of on-line inventory brokers with easy-to-use buying and selling platforms. The largest consider choosing a web-based dealer was charges, however lately many brokers have gone to $0 buying and selling commissions, making investing extra accessible than ever.

As a self-directed investor, your value to purchase or promote a safety may very well be $0. Nonetheless, there are a selection of causes that it may nonetheless pay to give attention to long-term investing.

Except for merely shopping for and promoting securities, brokers will cost for issues like buying and selling on margin, choices and particular circumstances.

Some buyers will elect to commerce on margin as a strategy to improve returns (with a proportionate improve in danger). Which means that an investor will borrow cash from their inventory dealer to buy extra shares, utilizing present investments as a collateral.

Completely different brokers will cost totally different rates of interest on borrowed margin. Sometimes, the rate of interest will lower as portfolio measurement will increase.

For giant portfolios that commerce on margin, margin rates of interest can be a bigger issue than fee charges when figuring out which dealer to make use of.

An additional consideration is a dealer’s built-in analysis capabilities. For buyers which are new to the markets, some brokers could have devoted in-house inventory screeners and funding seminars that can assist flatten the training curve as you construct your dividend development portfolio.

All of those components ought to come into play when deciding which inventory dealer to make use of.

Upon getting chosen a inventory dealer, you could then ‘fund’ your account. There are numerous totally different mechanisms by way of which you’ll be able to fund your funding account. Some brokers will settle for checks delivered by way of mail. Others settle for funds by way of a invoice cost out of your monetary establishments. Preparations can usually be made to have cash routinely withdrawn out of your checking account on a periodic foundation (which is good for the systematic investor).

Directions for funding your first funding account can be out there in your dealer’s web site.

Ought to You Construct Your Portfolio With Shares or ETFs?

Previously, the one strategy to acquire publicity to the monetary markets was by investing in particular person securities. Buyers would purchase stakes in corporations like Walmart (WMT), Exxon Mobil (XOM), or Johnson & Johnson (JNJ) straight.

That modified with the introduction of the mutual fund and later the exchange-traded fund (ETF). These choices are monetary merchandise the place retail buyers such as you and I buy a fund and our cash is professionally managed by an funding supervisor.

Whereas we usually oppose mutual funds due to their excessive charges, ETFs are a low-cost means for buyers to achieve diversification and entry to the monetary markets.

ETFs are traded by way of the identical mechanism as shares on the inventory change (which isn’t the case with mutual funds). You should buy ETFs in your brokerage account and maintain them for as lengthy (or as brief) as you want, simply as with shares.

There’s a lot back-and-forth within the investing {industry} about what is best: ETFs or particular person shares.

The reality is that each choices have professionals and cons.

Associated: The Execs and Cons of Dividend Investing.

Listed below are some professionals and cons of ETFs versus particular person shares.

Associated: The Full Checklist Of Dividend Change-Traded Funds.

Professional: Investing in dividend ETFs gives large diversification.

That is useful for buyers with small portfolios as they’ll get the required diversification from proudly owning a number of shares shortly.

Proof reveals that many of the good thing about a diversified portfolio comes from proudly owning ~20 shares. ETFs usually maintain tons of of positions, in order that they could be overdoing it a bit.

With that being mentioned, ETFs are a easy means for buyers to achieve diversified market publicity.

Professional: Investing in dividend ETFs has a low time dedication.

As soon as bought, buyers can “neglect” about their ETF. No extra analysis is required.

This low time dedication is a profit to people who find themselves not interested by choosing particular person shares.

Professional: Dividend ETFs nearly all the time have decrease expense ratios than their mutual fund counterparts.

There are a number of dividend ETFs which have annual expense ratios under 0.1%. Many dividend mutual funds have a charge of 1% or extra (which quantities to $1,000 in annual charges on a $100,000 portfolio).

Con: Dividend ETFs are all the time dearer than proudly owning particular person shares.

After the preliminary buy is made, particular person shares don’t have an expense ratio; checked out one other means, they are going to all the time have an expense ratio of 0.00%. There isn’t any value to carry a inventory, whatever the holding interval.

Con: You can’t hand-select which companies you personal with a dividend ETF.

Dividend ETFs provide you with no management over your portfolio. You can’t purchase or promote particular person shares, which suggests you can not fine-tune your technique to match your particular wants.

There are numerous circumstances the place you’d need to tweak your portfolio to fulfill sure wants. For instance:

Solely shares with 4%+ dividend yields (the Positive Retirement criterion)

For those who dislike a specific sector

Maintain solely shares with excessive ranges of insider possession

The infinite customization prospects are one of many main benefits of shopping for particular person shares over ETFs.

Conclusion: There’s nothing essentially fallacious with dividend ETFs.

For buyers with minimal time or curiosity in investing, ETFs are a superb various to high-fee mutual funds.

With that being mentioned, Positive Dividend prefers to spend money on particular person companies. The remainder of this text will discover this avenue.

Associated: Do Particular person Shares or Index Funds Make The Higher Funding?

The place to Discover Nice Companies

To spend money on nice companies, you need to discover them first.

Positive Dividend usually recommends two databases of shares as a supply of high-quality dividend-paying companies. Each of them are based mostly on consecutive streaks of dividend will increase.

Consecutive dividend will increase are vital as a result of they display two issues:

The enterprise is doing nicely

The administration is shareholder-friendly

With reference to the primary level, an organization can’t increase its dividend over the long-term if earnings will not be additionally growing.

Whereas dividends might outpace earnings within the short-term, that is unattainable over the long-term. A really lengthy streak of regularly rising dividends implies that an organization has grown dividends (and earnings) by way of every thing the market has thrown at it.

Secondly, shareholder-friendly administration groups are a telltale signal of an excellent enterprise. Distinctive individuals create distinctive corporations, plain and easy.

The primary supply of nice companies we advocate is the Dividend Aristocrats Index. With the intention to be a Dividend Aristocrat, an organization should:

Be within the S&P 500

Have 25+ consecutive years of dividend will increase

Meet sure minimal measurement & liquidity necessities

The Dividend Aristocrats have traditionally outperformed the general inventory market as measured by the S&P 500 Index.

One other excellent place to search for high-quality companies is the Dividend Kings.

Just like the Dividend Aristocrats, the Dividend Kings listing is predicated on historic dividend will increase – besides it’s much more unique. To be a Dividend King, an organization will need to have 50+ years of consecutive dividend will increase.

You’ll be able to see the listing of all 54 Dividend Kings right here.

The Positive Evaluation Analysis Database covers 150 companies with 25+ years of regular or rising dividend funds. (Together with many corporations past the Dividend Aristocrats and Dividend Kings).

How To Know If A Nice Enterprise Is Buying and selling At Honest Or Higher Costs

Discovering nice companies with shareholder-friendly administration is step one.

The second is to find out if these nice companies are buying and selling at honest or higher costs. Even the most effective firm turns into a poor funding if an investor pays too excessive a value.

“For the investor, a too-high buy value for the inventory of a superb firm can undo the results of a subsequent decade of favorable enterprise developments.”– Warren Buffett

A really quick-and-easy rule of thumb is to search for nice companies buying and selling at or under the S&P 500’s price-to-earnings ratio. If a enterprise is higher-than-average high quality, you’d assume it will command a better price-to-earnings ratio than the market common (as measured by the S&P 500).

Nice companies that commerce under the S&P 500’s price-to-earnings ratio are an excellent place to look into worth with extra element. The S&P 500’s price-to-earnings ratio is at present 25.6.

Past evaluating shares to the general market, buyers ought to evaluate a enterprise’ price-to-earnings ratio to each:

Its 10-year historic common price-to-earnings ratio

Its rivals’ price-to-earnings ratio

It is very important bear in mind to make use of adjusted earnings when evaluating price-to-earnings multiples.

GAAP earnings might be diminished by one time results reminiscent of acquisition prices or depreciation expenses. Equally, GAAP earnings might be artificially inflated if the corporate sells belongings.

These expenses are accounting based mostly, not actuality based mostly, and will not actually talk the long-term earnings energy of a enterprise.

One other inventory listing of curiosity is the excessive dividend shares listing: 5%+ yielding shares.

Shopping for Your First Inventory

Upon getting recognized a high-quality enterprise buying and selling at a gorgeous valuation, it’s time to purchase.

Shopping for shares can appear simply as sophisticated as analyzing shares. It’s not so simple as simply pushing ‘purchase’ – there are a variety of various order varieties that buyers can use, relying on the circumstances.

For simplicity’s sake, the start investor ought to solely be involved with two sorts of orders:

A market order is once you talk to your dealer ‘purchase this inventory at prevailing market costs’. Market orders are all the time the quickest strategy to execute a commerce.

Market orders have downsides. If the inventory value strikes shortly after you place your order, you might find yourself shopping for the inventory at a better value than you needed.

Restrict orders are the answer to this downside. A restrict order is once you talk to your dealer ‘purchase this inventory, however solely at a value of X or under‘.

For instance, if Goal (TGT) was buying and selling at $150 and also you needed to purchase at $130, you possibly can place a restrict order for $130 and the order may by no means be crammed except Goal inventory dropped to $130 (or under).

There are numerous different sorts of purchase orders and likewise equal promote orders.

Nonetheless, restrict orders are usually one of the best ways to make sure that you’re getting a good or higher value on a commerce.

Extra refined buyers may also reap the benefits of choices to purchase and promote shares to extend earnings.

Associated: Money-Secured Places: The Step-By-Step Information

Nonetheless, these methods are extra superior in nature and shouldn’t be pursued till buyers have a agency grasp of the opposite investing fundamentals and fundamentals which are described on this article.

How Many Shares Ought to You Maintain?

There’s a tradeoff with diversification.

The extra inventory you maintain, the safer you might be if any one in all them does poorly. Alternatively, you have got much less to achieve from the shares you maintain that do nicely.

Skilled buyers additionally expertise this divide. Warren Buffett, the CEO and Chairman of Berkshire Hathaway, manages a ~$300 billion frequent inventory portfolio the place his prime 4 holdings make up over 70% of his portfolio.

You’ll be able to see Warren Buffett’s prime 20 shares right here.

Buffett doesn’t have a really diversified portfolio.

Peter Lynch, then again, most definitely did (he’s now retired). Because the supervisor of the Magellan Fund at Constancy Investments between 1977 and 1990, Lynch’s portfolio averaged a 29.2% annual return – making him the best-performing mutual fund supervisor on the planet.

Though managing a lot lower than Buffett – round $14 billion at his peak – Lynch was recognized to carry greater than 1,000 particular person inventory positions. Lynch had a really diversified portfolio.

Who is true? The empirical knowledge suggests {that a} 1,000-position inventory portfolio is pointless. In response to research cited by Morningstar:

“About 90% of the utmost good thing about diversification was derived from portfolios of 12 to 18 shares.“

Holding a portfolio of ~20 shares offers 90% of the advantages of holding 100+ shares. There are additionally quite a few benefits to holding round 20 shares.

To begin with, holding 20 shares means you get to spend money on your finest concepts. You’ll be able to personal the companies you might be most comfy holding – those that you just imagine have the best whole return potential.

Associated: How To Calculate Anticipated Whole Return For Any Inventory

Holding a big portfolio of 100 or 200 shares additionally requires a big time dedication and is nearly unattainable to maintain up with. It’s exhausting to actually know 100+ companies. Maintaining with the quarterly earnings experiences of this many companies can be an enormous endeavor – a lot much less so for 20 companies.

So investing in round 20 companies is the ‘candy spot’ between investing in solely your finest concepts whereas nonetheless benefiting from diversification.

You’ll be able to’t simply personal any 20 shares and be diversified, nevertheless.

For example, should you owned 20 upstream oil companies, you wouldn’t be nicely diversified. Equally, proudly owning 20 biotech corporations doesn’t a diversified portfolio make.

Dividend development buyers ought to look to spend money on totally different sectors to achieve publicity to several types of nice companies.

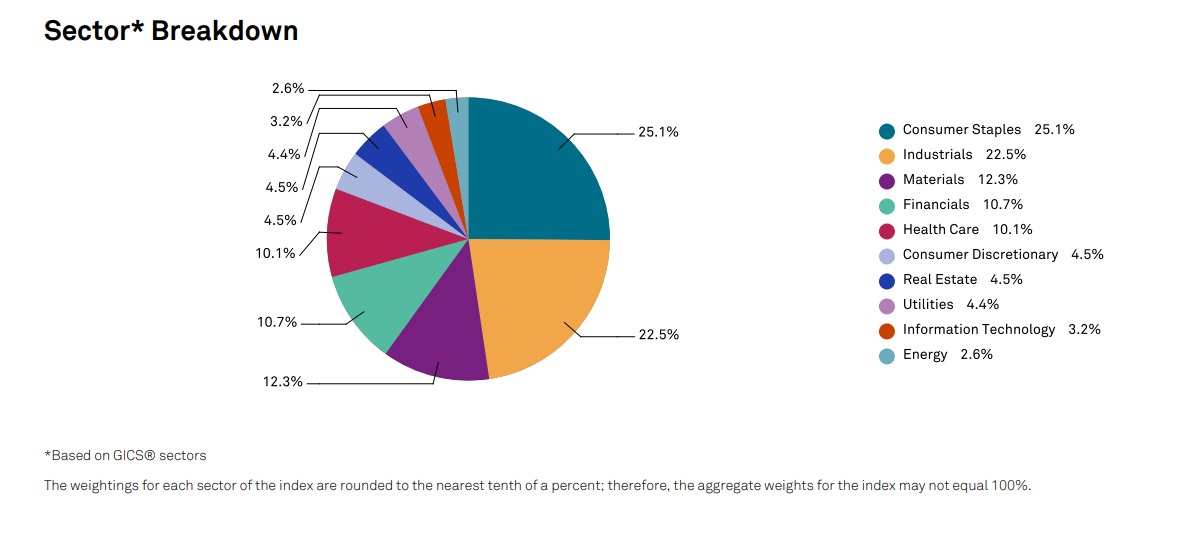

The listing of Dividend Aristocrats is balanced throughout market sectors.

Supply: Reality Sheet

Clearly, there exist high-quality enterprise in mainly each sector.

The following part discusses totally different portfolio constructing methods.

Dividend Development Portfolio Constructing Technique

There are two sorts of ‘new’ dividend development buyers:

These which are ranging from scratch

These with sizeable portfolios trying to switch over to dividend development investing

This text is about ranging from scratch. That’s what can be lined on this part.

Constructing a high-quality dividend development portfolio is a course of. Diversified dividend earnings is not going to be created in a single day. The method will take time, identical to most vital issues in life. The webinar replay under covers the best way to construct a dividend development portfolio for rising passive earnings intimately.

As a substitute of pondering you’ll ‘by no means make it’ since you don’t have $100,000 or $1,000,000 to construct your portfolio, give attention to saving and investing the identical quantity every month.

I like to recommend shopping for the very best ranked inventory you personal the least each month based mostly in your particular standards. Every criterion needs to be chosen to both improve returns or cut back danger.

Additional, every criterion needs to be supported by empirical proof with logical underpinnings (not clearly unrelated relationships like ‘corporations with CEOs named Jim have outperformed over the previous X years’).

The longer you make investments, the more cash you need to make investments, and the extra diversified your portfolio will turn out to be.

Regardless of how selective you might be when buying shares in your dividend development portfolio, you’ll ultimately should trim the ‘lifeless weight’. The composition of your portfolio will undoubtedly change over time.

The most effective investments are long-term in nature. As soon as a inventory is bought, buyers ought to favor to let it compound their wealth indefinitely.

An extended-term orientation additionally gives particular person buyers with a aggressive benefit over institutional buyers like pension plans and mutual funds, whose efficiency is judged on a quarter-over-quarter foundation.

“The one best edge an investor can have is a long run orientation”– Seth Klarman

With that being mentioned, holding a inventory for the long-term is just not all the time doable. Issues occur. Companies that have been nice at one time lose their aggressive benefit.

This could occur by administration dropping its means, expertise adjustments, or by rivals discovering a strategy to destroy or copy the corporate’s aggressive benefit.

When a enterprise loses its capacity to compound your wealth by way of rising dividend funds, it’s time to promote.

The first promote standards in line with the final methodology at Positive Dividend is to promote when a enterprise cuts or eliminates its dividend. It is a very clear signal from administration that both:

The dividend is just not vital (shareholders don’t matter)

The enterprise can’t maintain its dividend (enterprise is in decline)

In both case, that’s not the kind of funding prone to generate long-term wealth. In fact, there are exceptions.

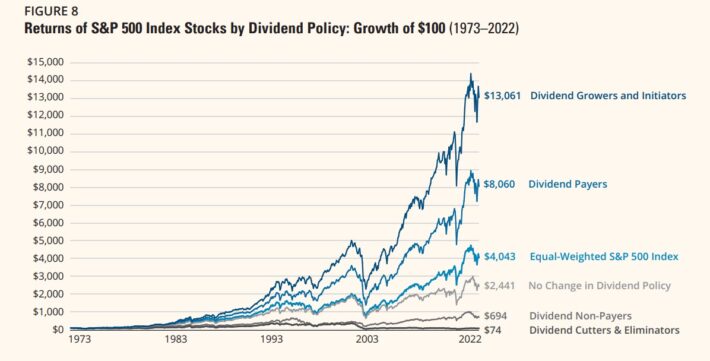

Generally companies rebound after dividend cuts. Nonetheless, the historic report reveals that dividend cutters make poor investments, on common.

Extra particularly, dividend cutters have had a decrease return and a better normal deviation than all different lessons of shares, leading to horrible efficiency on a risk-adjusted foundation.

Supply: Hartford Funds – The Energy Of Dividends

Fortuitously, there are sometimes many extra dividend growers & initiators than dividend cutters/eliminators at any given time. This makes it simpler (and fewer dangerous) for dividend development buyers to execute their funding technique.

There’s one different good cause to promote a dividend development inventory – if it turns into wildly and absurdly overvalued.

It’s higher to revenue from this overconfidence by promoting than to take part in it. Income might be reinvested into dividend development shares with sane valuations.

This advantages buyers in a variety of methods. Shares with decrease valuations have higher whole return potential, all else being equal.

Equally, two corporations which have the identical earnings and payout ratios however with totally different valuations may even have totally different dividend yields – the lower-valued firm will generate extra dividend earnings for shareholders.

Self-discipline Is The Key

What units aside those that will retire rich from the remaining is the quantity of self-discipline you need to follow the plan you lay out.

In case your funding technique is sound, and also you comply with it diligently, you might be prone to do nicely out there over time. The inventory market doesn’t go up in a straight line.

You’ll be able to expertise losses of fifty% or extra investing solely in shares. You probably have the fortitude to persevere by way of market downturns, you possibly can profit from the compounding impact of proudly owning incredible companies over lengthy intervals of time.

Alternatively, should you promote when issues look their worst – like March, 2009 – you’ll seemingly underperform the market by a large margin.

Staying totally invested all through market cycles seems to be the most effective technique. Lacking a number of key days over the long term can have a profound impact on funding efficiency.

Sadly, most particular person buyers have a tendency to purchase and promote far too usually.

The research The Behaviour of Particular person Buyers by Brad Barber and Terrance Odean revealed the unlucky fact about particular person buyers.

The authors analyzed knowledge from 78,000 particular person buyers. They discovered that when particular person buyers promote a inventory to purchase one other, the inventory they bought outperforms the inventory they bought (on common).

This implies we have a tendency to purchase and promote on the fallacious occasions… What’s the answer?

Observe ‘do nothing’ investing. Don’t promote shares with out an excellent cause. Worth declines will not be an excellent cause except the underlying enterprise has deteriorated.

For a second, evaluate investing to grocery buying. For those who purchased steak for $10 and it went on sale for $8, would you return and return the steak you had already bought? No! You’d purchase extra.

When a inventory’s value declines, you should buy extra for a greater deal (assuming the underlying enterprise has not considerably modified). This makes inventory declines the fitting time so as to add to your positions, not promote them.

Closing Ideas: Why Investing Issues

Why is investing vital?

As a result of making a passive earnings stream permits for monetary flexibility in your life. You’ll be able to take management of your time once you don’t have to fret about having a job to fund your wants. With each step alongside the best way, with every dividend examine that is available in, you might be nearer and nearer to the objective of monetary independence. It’s not a fast course of, however it’s definitely worthwhile.

The nationwide GDP has marched upward over time, but individuals are usually not capable of retire when they need or on their very own phrases.

Dividend development investing will make it easier to construct a retirement portfolio that pays rising dividend earnings. This could result in retirement on time – and even early retirement.

If you’re interested by discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases can be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].