Andrii Dodonov

By Matthew Norton and Daryl Clements

A probable smooth touchdown and fee cuts paint an optimum backdrop for the muni market in 2024.

The municipal bond market completed 2023 on a excessive word and its 2024 prospects look simply as promising.

Munis whipsawed by sharp month-to-month selloffs and spikes for a lot of the 12 months. Ultimately, the Bloomberg Municipal Bond Index returned 6.4% for the 12 months, properly above the three.1% after-tax return for the Bloomberg 1-3 Month US Treasury Invoice Index.

Sadly, munis’ rollercoaster 12 months made many buyers reluctant to return to the market, leaving slightly below $6 trillion nonetheless sitting in cash market funds. Cautious buyers may additionally fear they’ve missed the rally.

However because of a positive mixture of traditionally excessive yields, expectations that the Federal Reserve will ease off higher-for-longer rates of interest, and enticing credit score spreads, munis have seldom held as sturdy a possible as they do at this time.

Falling Charges Forward

The Fed left its benchmark fed funds fee unchanged in December, citing extra victories in its struggle on inflation. With out committing to a concrete pivot, policymakers hinted at as much as three doable cuts in 2024.

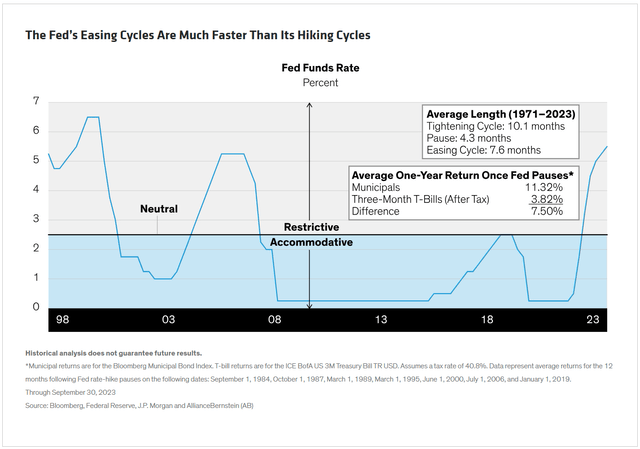

As soon as they begin, Fed easing cycles have a tendency to maneuver a lot sooner than climbing cycles. For instance, rising fee intervals have traditionally averaged 10.1 months, subsequent pauses about 4 months, and easing cycles simply 7.6 months. Furthermore, munis considerably outperformed T-bills after taxes over the 12 months following fee pauses (Show). With the Fed already in pause mode at this time, we predict it is time for buyers to get off the sidelines and again out there – and shortly.

Muni Market’s Time to Shine

Even after their prolonged rally since late October, munis have significantly extra room to run, in our evaluation. Given present yields, munis ought to proceed to outperform three-month Treasuries on an after-tax foundation if rates of interest merely keep the place they’re.

Municipal bond return potential appears even brighter if yields decline as we anticipate. If Treasury yields fall from present highs, we anticipate munis to learn, because of the inverse relationship between yield and worth.

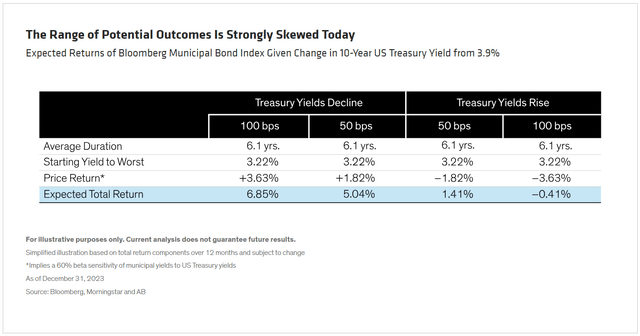

As an example, even a decline of fifty foundation factors (bps) in Treasury yields over the following 12 months might internet a virtually 2% worth acquire for munis, for an anticipated complete return of about 5.0%; a full 100 bps decline in Treasury yields would increase muni complete returns to six.9%. Against this, Treasury yields must rise a full proportion level – an unlikely situation in at this time’s financial setting – for municipal bond costs to fall far sufficient to offset their ample yield cushion (Show).

Muni Methods Tailor-Made for 2024

In our view, at this time’s backdrop raises the query: What are buyers ready for? On this setting, a number of methods might be efficient for getting essentially the most out of your munis.

Lengthen your period goal: Longer period will likely be particularly useful to bond costs if yields head decrease in 2024, as we anticipate them to.

Think about a barbell maturity construction: Though there isn’t any all-weather maturity-structure technique, within the present setting a barbell can harness at this time’s inverted yield curve with out rising rate of interest threat. As an example, investing in one- and 15-year munis in equal quantities presently yields greater than an eight-year bond, however with the identical sensitivity to interest-rate modifications.

Look to muni credit score: These embody BBB-rated bonds, which provide considerably extra yield than higher-rated points. This unfold has widened barely in latest months and stays compelling in comparison with long-term averages. Be selective with credit score, nonetheless, since issuer fundamentals can differ.

Headlines have steered a fiscally cloudy image for a lot of states and cities, whose tax revenues have been strained. However muni issuers total are of their greatest monetary well being in a long time. Whereas we do not presently anticipate a recession, we consider states are recession-ready. They’re additionally inherently resilient to fiscal challenges, which is why muni issuers have hardly ever defaulted.

Keep versatile: Given the numerous rally in municipal bonds, muni buyers ought to contemplate rotating into US Treasuries, as sure maturities supply an after-tax yield benefit over comparable munis. Because the relationship between munis and Treasuries is extremely variable, be able to toggle again when munis once more cheapen relative to Treasuries.

Municipal bonds have had a powerful run currently, however there’s nonetheless so much left within the tank. Although there’s hardly ever an ideal time to take a position, at this time’s excessive yields, together with expectations of a smooth touchdown and fee cuts, make for a well timed alternative for long-term municipal bond buyers.

The views expressed herein don’t represent analysis, funding recommendation or commerce suggestions and don’t essentially characterize the views of all AB portfolio-management groups. Views are topic to revision over time.

Unique Put up

Editor’s Word: The abstract bullets for this text have been chosen by Searching for Alpha editors.