Interim budget-cum-vote on account is prone to peg fiscal deficit for FY24-25 at 5.3-5.4 per cent of GDP (Gross Home Merchandise), sources within the authorities have mentioned. That is potential by means of greater assortment of taxes and cuts in income expenditure.

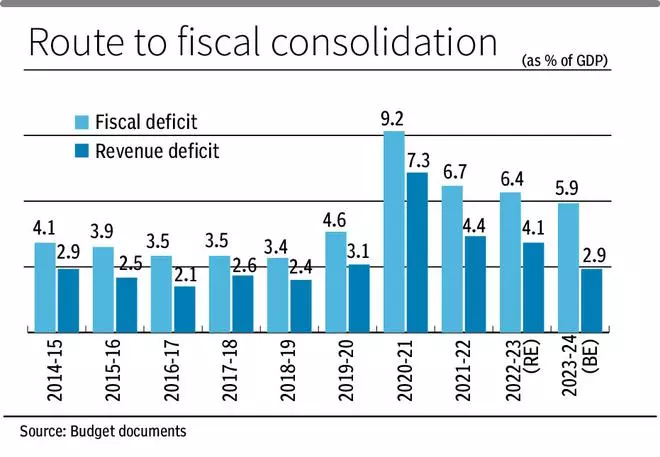

Although the federal government is hopeful of assembly the fiscal deficit goal of 5.9 per cent for the present fiscal, contraction in nominal development, as projected within the first advance estimate has solid a doubt on this chance. Revised estimate of fiscal deficit can be a part of the interim finances.

Fiscal deficit is the distinction between revenue and expenditure of the federal government. Finance Minister Nirmala Sitharaman will current the interim finances on February 1.

Reducing the goal for fiscal deficit is important for reaching the 4.5 per cent goal by FY25-26. Whereas saying the finances for the present fiscal, the federal government didn’t define any medium time period fiscal deficit goal citing continued world uncertainty. As an alternative, as introduced within the Funds speech for FY21-22, the federal government would proceed on the broad path of fiscal consolidation to succeed in a fiscal deficit-to-GDP ratio beneath 4.5 per cent by FY25-26. Consistent with this dedication, the central authorities attained the decrease ranges of fiscal deficit-to-GDP projected for FY21-22 and FY22-23, the ‘Statements of Fiscal Coverage as required below the Fiscal Duty and Funds Administration Act, 2003’ mentioned.

Aditi Nayar, Chief Economist with ICRA mentioned that with the belief of a sharper growth in income receipts (9.5 per cent) in comparison with income expenditure (3.9 per cent), the income deficit is anticipated to ivolve a considerable correction to ₹7.9-lakh crore (2.4 per cent of ICRA’s GDP estimate) in FY25 from the ₹9 lakh crore (3 per cent of GDP) projected for FY2024.

“Making an allowance for a modest goal for disinvestment receipts and a ten per cent growth in capex, ICRA expects the GoI to focus on a fiscal deficit of 5.3 per cent of GDP in FY25, halfway by means of the anticipated print of 6 per cent in FY24 and the medium-term goal of 4.5 per cent for FY26,” she mentioned.

Such a quantity would imply an absolute fiscal deficit determine of ₹17.1 lakh crore through the subsequent fiscal as towards the estimated ₹17.9 lakh crore of present fiscal. Whereas the sharp slowdown in capex development would weigh on the tempo of GDP growth, ICRA believes {that a} quantity greater than this may impinge on the GoI’s skill to bridge half the required consolidation within the coming fiscal.

“As per ICRA’s estimates, each 10 bps of growth within the fiscal deficit-to-GDP ratio would enable for extra capex of ₹32,400 crore. Nonetheless, this may make the duty at hand in FY26 more difficult,” Nayar mentioned.

So far as present fiscal is worried, first advance estimate has lowered nominal GDP to eight.9 per cent. Contemplating fiscal deficit on the finish of November at at ₹9.06 lakh crore or 50.7 per cent of BE and revised GDP quantity, enterprise as typical is prone to take deficit to little over 6 per cent. Nonetheless, in response to SBI analysis report, if the federal government curtails spending by over ₹37,000 crore, then 5.9 per cent goal might be achieved.