By Bruce Ikemizu, Consultant Director, Japan Bullion Market Affiliation

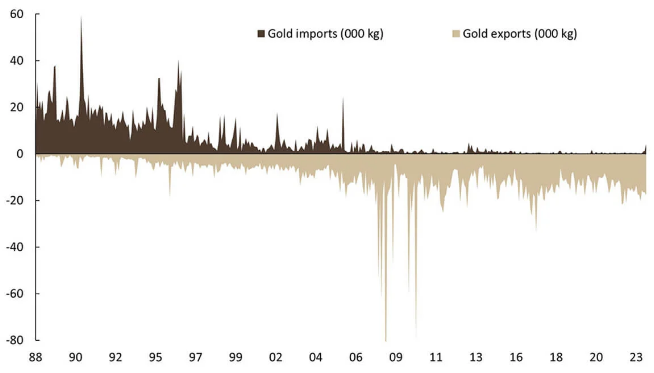

Previously, earlier than China appeared on the world gold market, Japan stood as one of many largest gold importers globally. Through the Nineteen Eighties and Nineteen Nineties, my main function in bodily gold buying and selling at a buying and selling home concerned importing bodily gold from Australia, Switzerland, London, South Africa and different sources. Nevertheless, the dynamics of this enterprise progressively shifted after the introduction of a consumption tax, and extra dramatically after the bursting of Japan’s financial bubble after the 2000s, following which the nation grew to become a internet exporter of the gold, marking a 180-degree flip in our enterprise operations.

Throughout my 14-year tenure at a Tokyo financial institution department, we imported gold solely as soon as however exported it numerous instances, primarily to Asia and when demand waned in Asia, to London. The consumption tax, initially launched in 1989 at 3%, escalated to five% in 1997, 8% in 2014 and at last 10% in 2019. What does this should do with gold funding? Properly, if you buy gold in Japan, it’s important to pay this tax, however you’re going to get it again if you promote it because the tax ought to be borne by the one that consumes it. In principle, this consumption tax mustn’t have a damaging impact on gold funding. As an alternative, it has its benefits, as now you can obtain 10% over the promoting worth, no matter whether or not you paid 0%, 3%, 5%, 8% or 10% tax if you purchased it.

Nevertheless, this consumption tax had considerably completely different impacts on Japanese gold market. We didn’t absolutely comprehend its profound impression it in the marketplace till maybe the early 2000s. In distinction to the tax therapy of gold in overseas international locations, comparable to Hong Kong, the place there is no such thing as a value-added tax on gold purchases, bringing gold from Hong Kong to Japan with out customs declaration and promoting it right here would mean you can add the consumption tax on prime of the worth, now at 10%. A ten% revenue on gold incentivised intensive smuggling by each people and large-scale felony organisations. Lengthy liquidation of gold on the greater yen worth and smuggling have been the 2 main causes behind Japan’s gold exports, regardless of having just one small gold mine that produces simply a number of tonnes yearly. The Japanese authorities ultimately took strict measure to fight gold smuggling by customs and instructed enterprise to not purchase gold if they may not show they’d formally paid the consumption tax. Though smuggling nonetheless persists to some extent, we assume the quantity is now decrease than it was prior to now, and its affect on the Japanese gold market is dinimishing.

Now, gold is garnering extra consideration in Japan than ever earlier than. In 1971 when US President Nixon introduced the detachment of the greenback from gold, the gold worth began to drift from $35 per troy ounce. 51 years after, gold reached $2,000 per troy ounce, marking a staggering 57-fold improve in worth in opposition to the US greenback. As of the timing of writing this text, the gold worth in US {dollars} hovers round $1,980 per troy ounce. This pattern displays a pure course of, as governments of the world freely print the fiat cash as they see match, whereas gold provide is restricted.

Determine 1: US Cash Provide and Gold Value

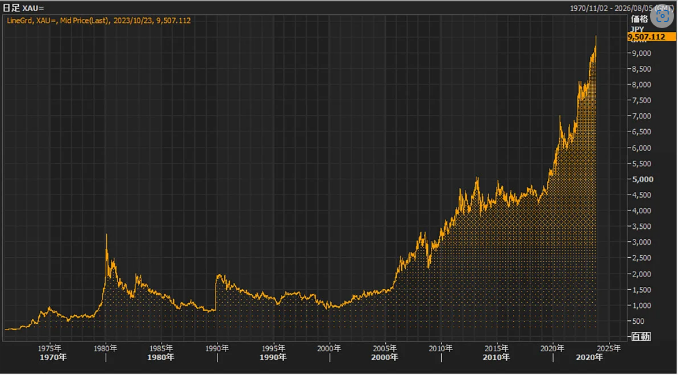

By and huge, the identical factor may be stated about gold in Japanese yen. Nevertheless, gold in yen broke its historic excessive two years after USD gold did. This 12 months, yen gold has damaged its historic excessive a number of instances, with the most recent worth,as I write this text, reaching 9,566 yen per gram. In 1971, gold in yen began round 250 yen per gram, so yen gold has appreciated roughly 38 instances over.

Determine 2: Gold in Yen within the Previous 54 Years

Previously, we noticed vital promoting of gold bars and jewelry every time the worth jumped by 500 yen per gram. There have been lengthy queues of sellers on the main retail outlets. The reverse held true when market declined, with individuals lining as much as purchase gold. Once I was buying and selling on Tocom at a buying and selling home a few years in the past, my easy but constantly worthwhile buying and selling technique trusted Japanese traders’ tendency to hunt for bargains, versus the Western traders’ trend-following model. When London and New York offered gold, inflicting costs to drop, Japanese traders entered the market to grab up bargains, and vice versa when traders within the West purchased and costs rose.

Determine 3: Japanese Gold Import and Export Steadiness

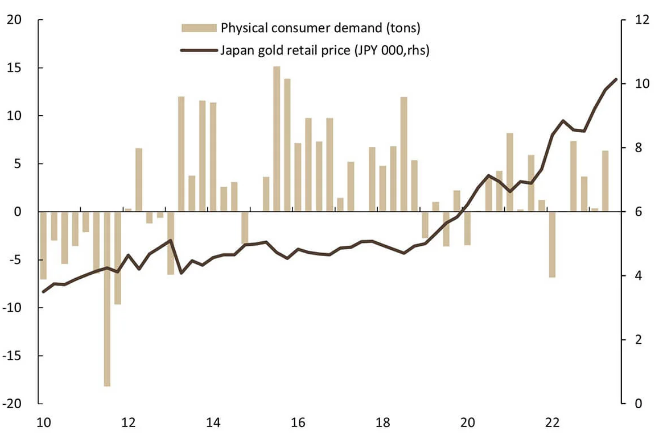

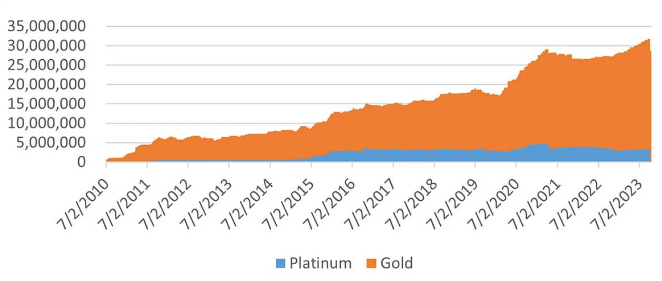

This bargain-hunting model of Japanese traders has been quickly altering lately, even with the worth of gold in yen has reached ranges we by no means noticed prior to now. One may naturally count on a surge in promoting from gold holders, however that’s not taking place with this sharply greater worth stage. For instance, stronger costs had at all times attracted sellers at main retail outlets, however these days, they report that gross sales and purchases are effectively balanced at their counters. Within the realm of gold ETFs, holdings within the US and Europe had been lowering, however in stark distinction, Japanese gold ETFs is constantly growing its holding regardless of the traditionally greater costs.

There are couple of causes for this new angle towards gold:

1.Buyers’ generational shiftOlder generations have been the first consumers of gold within the Nineteen Eighties and Nineteen Nineties, and even till just a few years in the past. Nevertheless, now the older technology is exiting the scene, promoting their gold, whereas a youthful technology is coming into the market. A decade in the past, greater than 90% of attendees at my funding seminar have been older women and men. Particularly after Covid, a a lot youthful demographic, each women and men of their 20s and 30s, has change into the bulk. These youthful traders haven’t witnessed a market the place gold was priced round 1,000 yen per gram. Previous worth ranges, which could have deterred older traders from investing on the present gold worth, maintain little which means for the youthful technology.

2.Persevering with yen depreciationThis 12 months, the Japanese yen started at 131 yen to the greenback and has since depreciated to 150 yen. The yen has devalued by roughly 8.7% in opposition to the US greenback. Mixed with inflationary pressures, Japanese traders are more and more involved about holding yen of their financial institution accounts. Whereas the security of financial institution deposits has historically been the choice of older generations, simply holding financial institution deposits is not a safeguard in opposition to the depreciating worth of yen. Extra traders are actually viewing gold as a hedge in opposition to inflation and yen depreciation. Funding in gold continues to rise regardless of greater costs. This new funding goal successfully explains the pattern of Japanese shopping for gold regardless of traditionally excessive costs.

Determine 4: Gold retail demand is growing regardless of sharply greater costs

3.Introduction of recent NISA accountThe NISA (Nippon Funding Saving Account) was launched in 2014 following the English ISA mannequin. People who use NISA are exempt from paying the 20.315% tax on buying and selling income. This account, which has a restrict of 1.2 million yen and a period of 5 years, is about to finish on the shut of this 12 months. The brand new NISA, which begins in 2024, will enable people to speculate as much as 18 million yen every, with no time restrict. This displays the federal government’s initiative to maneuver funds from dormant financial institution deposits into investments. Many individuals had shunned opening NISA accounts prior to now, contemplating the restrict too small and negligible. I used to be one in every of them. Nevertheless, the brand new 18-million-yen restrict with no time constraint modifications the panorama fully. Increasingly more traders are actually opening present NISA accounts as they’ll have each the 1.2 million and the brand new 18 million, making ready for the expanded framework beginning 4 January 2024. The brand new NISA will embrace 4 gold, three platinum, two silver, one palladium and one treasured metals basket funds. Along with bodily gold merchandise, we will naturally count on extra funding funds to move into treasured metals from Japanese traders. In truth, this pattern is already underway with the Gold ETF, as most new funding in to it’s coming from present NISA accounts. This pattern is prone to acquire momentum subsequent 12 months when the brand new NISA program launches with a considerably bigger framework. The Japanese gold market is present process a paradigm shift.

Determine 5: Japanese Gold ETF steadiness – constantly growing regardless of greater costs

BRUCE IKEMIZU is the chief director of the Japan Bullion Market Affiliation. He started his profession at Sumitomo Company as a gold dealer after graduating from Sophia College in 1986. He then labored for Credit score Suisse and Mitsui & Co. earlier than becoming a member of Normal Financial institution in 1996. He was the top of Tokyo department of ICBC Normal Financial institution till leaving the financial institution in 2019. Bruce is at present utilizing his data and relationships inside the sector to develop and develop the newly fashioned JBMA.