ssucsy

Most of my followers know the virtues of constructing and holding a well-diversified portfolio via the market’s up-n-down cycles and that, as a part of such a portfolio, I counsel all medium and excessive net-worth traders to have publicity to treasured metals as a hedge in opposition to inflation and to protect in opposition to vital geopolitical and monetary dislocation. In the present day, I will check out the iShares MSCI International Gold Miners ETF (NASDAQ:RING) to see if it would make sense for inclusion into your portfolio.

Funding Thesis

Every time I consider gold as an funding, I’m reminded of the next anecdote:

Again within the early 1900’s, a U.S. minted 1 ounce gold coin had a face worth of $20. On the time, $20 was sufficient for a person to purchase a pleasant go well with and a shirt, tie, belt, sneakers, and top-hat to go together with it. In the present day, what would a $20 invoice get you? Possibly the belt? But the 1 ounce U.S. gold coin (at the moment price $2,184) might, you guessed it, nonetheless purchase a pleasant go well with, shirt, tie, belt, sneakers, and top-hot.

The ethical of the story is, after all, that gold is a retailer of wealth and a hedge in opposition to inflation. It’s also safety in opposition to a quickly deflating forex, as these in Germany came upon throughout each World Wars I & II.

In the present day, the world has two on-going wars (Russia/Ukraine and Israel/Gaza) and excessive pressure between the U.S. and China over Taiwan. Meantime, former U.S. Secretary of the Treasury Larry Summers not too long ago characterised the approaching U.S. presidential election as essentially the most very important and consequential election since World Warfare II. The purpose is: the present atmosphere of geopolitical dangers are arguably the best they’ve been in many years.

And because of this I like to recommend all medium and excessive net-worth traders have some publicity to treasured metals (significantly gold) … and the upper the net-worth of the person, the bigger the allocation to gold needs to be (i.e. they’ve far more to lose). It might be as little as 2-3% for some traders, and as excessive as 10-20% for the very rich.

With that as background, let’s take a more in-depth have a look at the RING ETF to see if it’s a great way so that you can get publicity to treasured metals like gold and silver.

Prime-10 Holdings

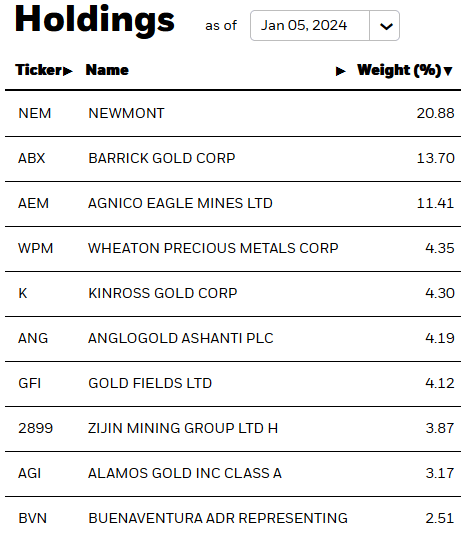

The highest-10 holdings within the RING ETF are proven beneath and had been taken immediately from the iShares RING ETF webpage, the place traders can discover extra detailed data on the fund:

iShares

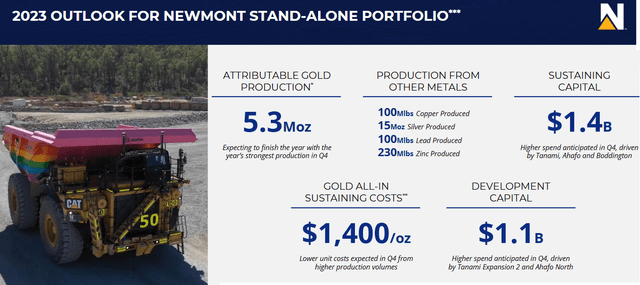

The #1 holding is Newmont (NEM) with a 20.9% weight. Newmont is among the largest gold producers on the planet with a big stock of confirmed and possible gold reserves. Because the slide beneath from a November presentation reveals, NEM expects to supply 5.3 million oz of gold this 12 months, as a comparatively engaging AISC (all-in sustaining price), whereas additionally having vital of copper, silver, lead, and zinc manufacturing:

Newmont

At one level I really helpful and owned Newmont for its anticipated dividend development and the potential for robust complete returns if gold went increased. Nonetheless, I modified from a BUY to a HOLD within the Fall of 2021 (see Gold Is not Working). I really bought my NEM shares previous to that article, however the inventory preserve shifting increased so I rated it a HOLD. Nonetheless, on reflection I ought to have lowered my score all the way in which to SELL as a result of the inventory has under-performed the S&P500 by ~20% since that article was revealed. Certainly, regardless of the massive rally within the inventory market final 12 months, NEM inventory is down 21% over the previous 12-months. It at the moment yields nearly 4%.

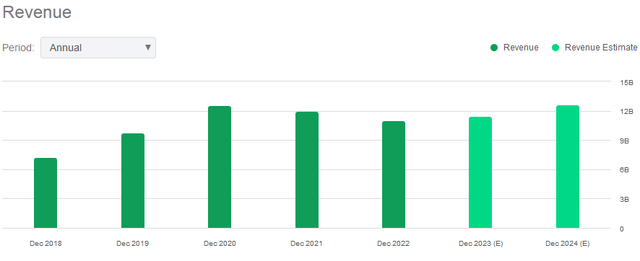

Barrick Gold (GOLD) is the #2 holding with a 13.7% weight. Like NEM, Barrick can be a number one world producer of gold and copper, however its demonstrated income development and estimated income development going ahead has been comparatively tepid over the previous few years:

Searching for Alpha

GOLD inventory is down 6.9% over the 12-month and at the moment yields 2.3%.

Agnico Eagle Mines (AEM) is the #3 holding and again in October the corporate stated gold manufacturing will are available on the high-end of steering after Finland restored a mine allow. Extra not too long ago, Agnico made a ~C$23 million funding in Canada Nickel Firm (CNC:CA). AEM yields 3% and is down 3.5% over the previous 12 months.

The remainder of the top-10 holdings have single-digit share allocations in gold and diversified treasured metals miners like Wheaton Treasured Metals (WPM), Kinross Gold (KGC), and Gold Fields (GFI).

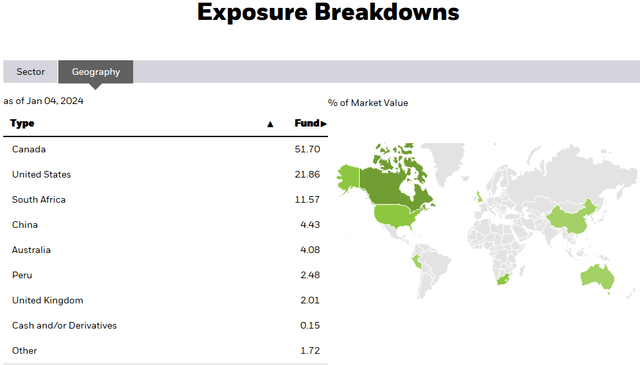

From a geographic perspective, the RING ETF has the overwhelming majority of publicity to comparatively protected belongings residing in Canada, the U.S., South Africa, Australia, and the U.Ok.:

iShares

This diversified asset base offers some degree of safety from international forex change dangers.

Efficiency

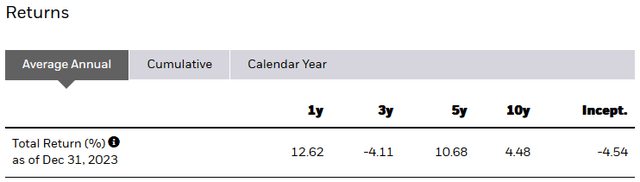

The efficiency of the RING ETF has been, in a phrase, horrible:

iShares

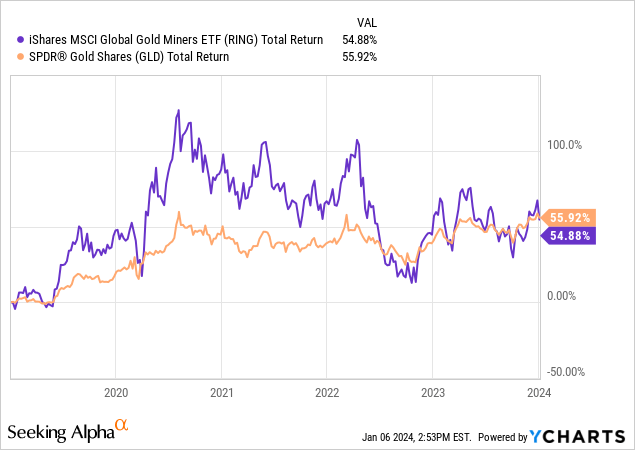

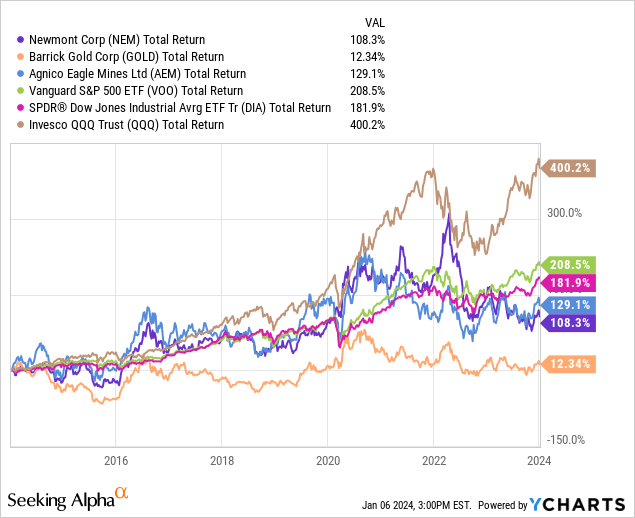

As you possibly can see, the 10-year common annual return is 4.5%, whereas since inception the annual common return of the RING ETF is strongly unfavorable. That being the case, the 10-year alternative prices of proudly owning RING versus the broad main indexes (the S&P500, DJIA, and Nasdaq-100), as represented by the (VOO), (DIA), and (QQQ) ETFs, has been huge:

Dangers

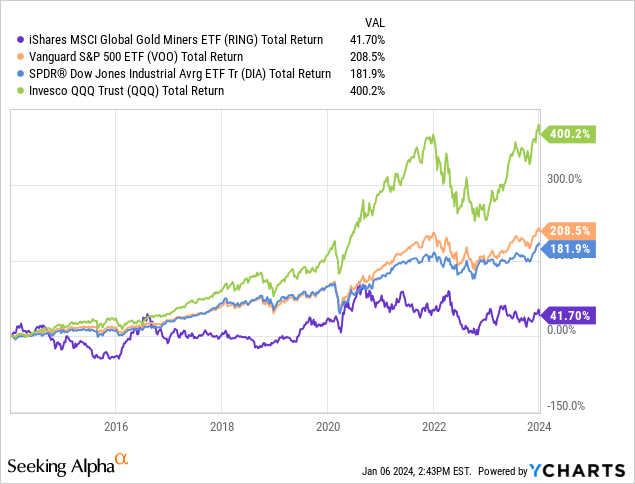

The dangers of proudly owning treasured metals miners is appreciable: excessive gasoline and diesel prices strain margins, gold & silver costs usually do not sustain with world financial development, and gold firm CEOs have arguably been poor stewards of capital as a result of they preserve pushing on the expansion string by making massive acquisitions which are presupposed to unleash vital shareholder worth which usually do not prove in addition to anticipated (and typically considerably worse. For instance, NEM closed the acquisition of Goldcorp for $10 billion of shareholder capital again in January of 2019, but 5-years later, the inventory worth has barely budged:

Lastly, the expense charge of the RING ETF is a comparatively excessive 0.39%. Whereas that is considerably typical of funds that maintain international equities, I’d be remiss to not level out that 0.39% is a whopping 36 foundation factors above the expense charge of the VOO S&P500 ETF (and sure, I do know I’m mixing asset courses right here, nonetheless the purpose about bills is legitimate for my part).

Abstract & Conclusion

As I’ve talked about in a lot of my articles on gold and silver with respect to constructing and holding a well-diversified portfolio, my recommendation for investing in treasured metals is – as a substitute of investing in gold and silver equities just like the RING ETF – to easily purchase (and maintain … without end …) U.S. minted gold and silver cash from respected websites like APMEX.com or Kitco.com. Certain, you pay for delivery and insurance coverage prices, and you must retailer the cash (silver particularly could be a heavy and hulking asset, even only some thousand {dollars} price). Nonetheless, you will have it in hand (or ought to not less than have it shut by ..), whereas “paper gold”, a class that features mining shares and ETFs, is simply that: paper. If there have been an precise monetary collapse that considerably impacted the inventory market, you would possibly discover out that your “protected gold investments” weren’t so protected in spite of everything.

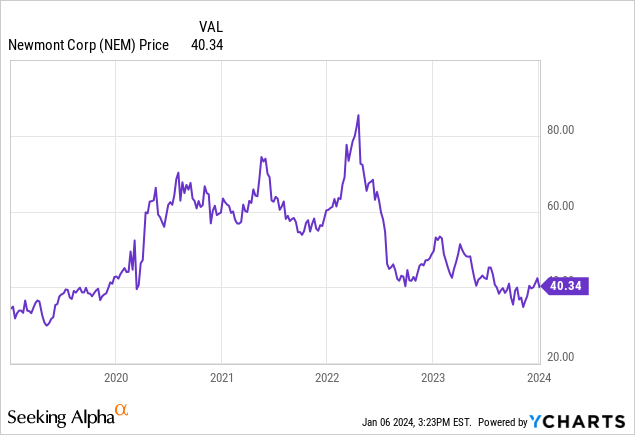

Meantime, observe that the RING ETF has not even stored up with the worth of gold, as represented by the SPDR Gold Belief ETF (GLD) – a comparatively straight in-line proxy on the worth of spot gold – over the previous 5-years:

Level being: do not chase or attain for vibrant shiny objects: I charge the RING ETF (and most gold producing shares as nicely…) a STRONG SELL. As an alternative, traders ought to transfer the proceeds into gold and silver cash as a substitute. The cash are one thing that, when you meet your required allocation degree, you merely put away and overlook about them. They’re a SWAN funding whereby you understand that the safety is there in the event you ever want it. And, over time, gold does respect … and that has been true since time immemorial.

Then again, “paper gold” belongings require fixed monitoring as a result of they’re risky and may transfer fairly quickly with geopolitical, international forex, acquisition, and mine closure/disruption developments. However the greatest cause to exit “paper gold” belongings is as a result of nearly all of them have terrible long-term efficiency observe data compared to the broad market averages. For instance, the graphic beneath reveals the chance prices of holding the top-3 shares within the RING ETF versus the broad market indexes over the previous 10-years:

So, SELL the RING ETF and purchase your self some U.S. minted gold & silver cash. Maintain them without end and hand them right down to your heirs.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.