masterzphotois/iStock by way of Getty Pictures

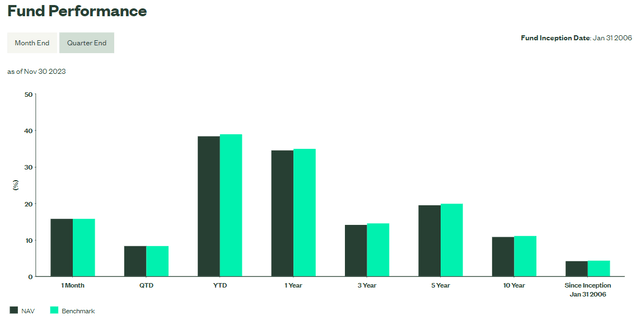

2023 has been a tremendous 12 months for homebuilders with the SPDR S&P Homebuilders ETF (NYSEARCA:XHB) registering a 52.3% achieve since we initiated our bullish view in November 2022. Valuations have additionally improved considerably with XHB at the moment buying and selling at extra affordable multiples of 15.4x Ahead P/E and three.6x P/B, in keeping with fund knowledge revealed by State Avenue International Advisors.

TradingView.com

Though we’re nonetheless bullish homebuilders on condition that the U.S. stays caught in a persistent housing scarcity, present valuations are now not as deeply discounted and enticing sufficient to generate significant alpha in our view. Therefore, we see a chance to take some revenue on XHB, and to attend for higher alternatives to purchase the dips.

To be clear, nevertheless, we aren’t abandoning the homebuilders theme completely. Sky-high mortgage charges and financial uncertainties can solely maintain again demand for housing briefly. We imagine that the pent-up demand for housing has but to be absolutely mirrored in house costs, and that there’s a multi-year runway for house costs to go even greater from right here. Homebuilders and actual property asset managers are prone to emerge as the largest beneficiaries of this development.

To precise our bullish view on this theme, we want to take a extra selective strategy by decreasing publicity to XHB and concentrating on high-quality names like D.R. Horton (DHI), which we nonetheless preserve a “Robust Purchase” ranking. Regardless of registering a 113% achieve since we initiated our view on DHI in October 2022, the inventory continues to be buying and selling at an undemanding Ahead P/E of 10.9x. One other high-quality title can be Lennar Company (LEN), which can also be buying and selling at round 10.4x Ahead P/E. Due to this fact, we see DHI and LEN having extra room for additional upside in comparison with XHB.

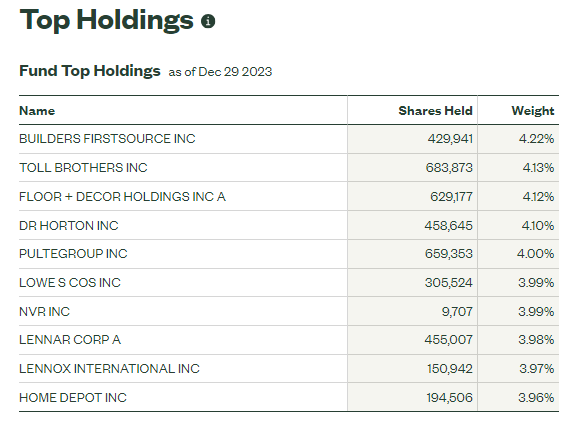

State Avenue International Advisors

The desk above reveals the latest prime ten holdings of XHB.

Performing a fast examine on the valuations of those firms revealed that almost all are nonetheless buying and selling at undemanding multiples of round 9x to 10x. XHB is carrying an elevated a number of of 15.4x simply because a handful of outlier firms are buying and selling at fairly exorbitant multiples. These outliers embrace Ground & Decor Holdings (FND), Lennox Worldwide (LII), and Residence Depot (HD), that are buying and selling at Ahead P/Es of fifty.7x, 24.8x, and 22.9x, respectively.

This provides to our core view that the low-hanging fruits for alpha will turn into more and more harder to search out in 2024. Thus, the technique of investing broadly throughout a complete sector is prone to lead to extra average returns going ahead.

State Avenue International Advisors

We imagine {that a} extra selective strategy can be essential to additional extract alpha for our bullish homebuilders theme, and observing self-discipline on valuations can be key in driving efficiency.

We additionally see growing dangers of an imminent pullback in fairness costs, because the bull market rally is wanting exhausted close to time period. Taking some income off our large winners makes loads of sense in the mean time, and we glance to re-enter ought to we see a good pullback in costs.

In Conclusion

Valuations on XHB are now not as deeply discounted and enticing sufficient to generate significant alpha in our view. We see a chance to take some revenue on XHB for now, and to attend for higher alternatives to purchase the dips.

Accordingly, we downgrade our “Purchase” ranking on XHB to a “Maintain”.