IcemanJ/iStock by way of Getty Photographs

Thesis Assessment

In my final article on Ares Capital (NASDAQ:ARCC), I proposed a ‘Impartial/Maintain’ ranking for the inventory because of a bunch of headwinds that have been rising at the moment. Now, I’m altering my stance to a ‘Sturdy Promote’ as I imagine the relative bear case is extra compelling. To be clear, this bearish view is on Ares Capital’s alpha era potential vs the S&P 500 (SPY) (SPX) and in addition the broader BDC sector that could be represented by the VanEck BDC Revenue ETF (BIZD). This isn’t essentially a bearish view of absolutely the return potential of Ares Capital.

Earlier than moving into the brand new thesis, as at all times I evaluation my efficiency because the final article; Since July 31, 2023, Ares Capital has generated a complete shareholder return of +5.84% vs the S&P 500’s +4.38%. This interprets to an alpha creation of +1.46%. Subsequently it appears my earlier downgrade from a ‘purchase‘ to a ‘impartial/maintain’ was too early.

Right here is why I’m nonetheless bearish on Ares Capital now:

The possibilities of an easing within the charges are growing Ares Capital just isn’t the very best beneficiary of easing charges Relative efficiency outlook of ARCC vs the BDC sector confirms the elemental view

The possibilities of an easing within the charges are growing

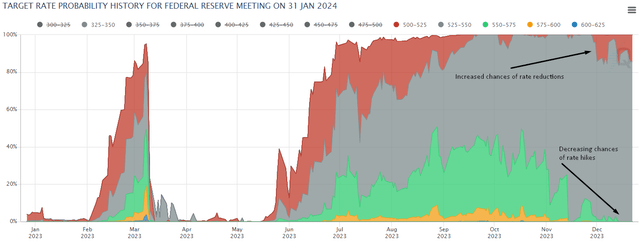

Federal Reserve Goal Charge Possibilities (CME FedWatch Instrument)

As will be seen on this annotated graphic of the CME FedWatch Instrument’s goal charge chances, the possibilities of a charge discount to the 500-525bps stage have elevated in December 2023 to face at a modest 14.47% from nearly 0% within the months prior. This elevated probability of a dovish view on charges has come on the expense of a decreased probability of a charge hike; the possibilities of a 550-575bps charge stage has decreased to 0%. It is a dramatic fall from 40%+ ranges in October 2023.

A fall in charges is a sectoral tailwind as this reduces the stress on portfolio corporations and triggers waves of recent borrowing and therefore new funding alternatives. Certainly, that is what Fitch Scores’ trade analysis suggests as effectively:

[BDC] deal exercise is predicted to enhance in 2024, and several other BDC managers have pointed to bettering pipelines…

– December 2023 Fitch Wire Report on the BDC sector

The advantage of charge reductions is most felt by corporations in cyclical industries, benefiting the BDCs with better publicity to extra risky sectors.

Ares Capital just isn’t the very best beneficiary of easing charges

The corporate’s administration workforce has usually described Ares Capital as a defensively-oriented BDC:

And when you concentrate on our portfolio, which I feel is extra defensively positioned and as we at all times talked about, much less oriented in direction of cyclical corporations…

– CEO Robert DeVeer within the Q3 FY23 earnings name

Q3 FY23’s information supplies numbers to help this narrative; 51% of Ares Capital’s $820 million backlog and pipeline is comprised of the Client Providers, Client Staples, Distribution & Retail sectors – all defensive, less-cyclical classes.

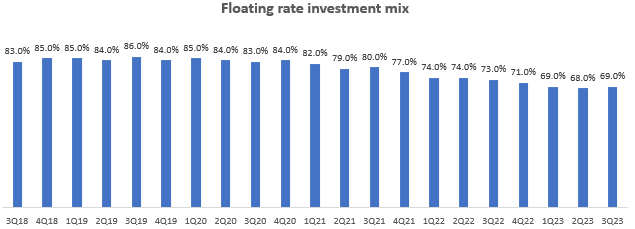

Furthermore, the bulk (69%) of Ares Capital’s funding combine is on floating charge phrases:

Floating Charge Funding Combine (Firm Filings, Writer’s Evaluation)

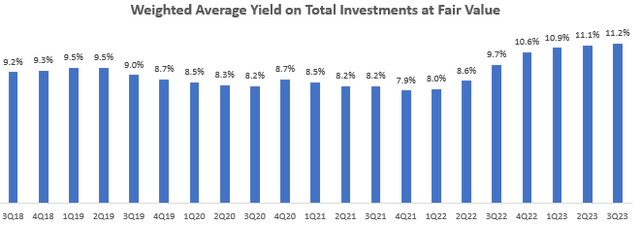

I anticipate this to result in a drag on funding yields from the present ranges of 11.2%:

Weighted Common Yield on Complete Investments at Truthful Worth (Firm Filings, Writer’s Evaluation)

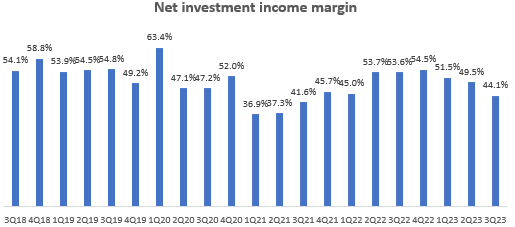

Up to now in 2023, Ares Capital’s internet funding revenue margins have been held again by low funding exercise and deal circulate however offset by greater charges. In 2024, I imagine these drivers will change round; funding exercise is predicted to rebound however decrease yields might hinder a fabric rebound in internet funding revenue margins:

Internet Funding Revenue Margin (Firm Filings, Writer’s Evaluation)

Relative efficiency outlook vs the BDC sector confirms the elemental view

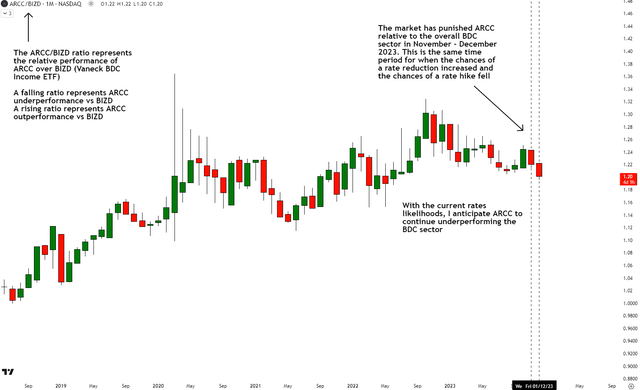

A have a look at the relative ratio of ARCC/BIZD reveals to us the efficiency of ARCC vs the Vaneck BDC Revenue ETF:

Relative Efficiency of ARCC vs BIZD (TradingView, Writer’s Evaluation)

I notice that ARCC has underperformed the BDC sector in November and December 2023; exactly when the possibilities of the Fed’s goal charge discount elevated on the expense of the possibilities of a charge hike. Thus, market sentiment appears to be responding consistent with the elemental thesis that’s based mostly on the implications of the present goal charge chances. This offers me confidence that we’ve got recognized the vital inventory driver.

I anticipate ARCC to proceed underperforming the BDC sector as long as the possibilities of easing charges don’t deteriorate.

Key Threat and Monitorable

My relative underperformance thesis on Ares Capital is extremely dependent in the marketplace’s Fed’s goal charge chances. The efficiency of the BDC additionally appears to be responding consistent with this driver. Therefore, this can be a key monitorable.

On the corporate facet of issues, Ares Capital can enhance its positioning in an easing charges setting if it will increase the combination of cyclical corporations in its portfolios or if it manages to lock in greater charges for its investments. Though I imagine that is unlikely to occur as it will be opposite to Ares Capital’s DNA, I preserve tabs on all these key metrics disclosed by the corporate to determine thesis-relevant modifications in a well timed means.

Takeaway

The BDC sector is ready for an exercise rebound, pushed by the elevated probability of a goal charge discount by the Federal Reserve. This bodes notably effectively for BDCs with extra risky and cyclical portfolios because the financing stress is eased most for these investee corporations.

Ares Capital, nonetheless, is a defensively oriented BDC with minimal cyclical publicity in its portfolio and predominantly floating funding yields. This highlights a drawback to Ares Capital relative to different BDCs.

The relative efficiency outlook of Ares Capital in opposition to the broader BDC sector as represented by the Vaneck BDC Revenue ETF helps the elemental view.

Therefore, I charge Ares Capital a ‘Sturdy Promote’ as I imagine it is extremely prone to underperform the broader BDC sector – which is the extra assured view – and in addition the S&P 500. I want to emphasize that this view relies on my outlook for relative efficiency (i.e. alpha). I would not have a equally sturdy bearish view on absolutely the efficiency prospects of ARCC.

I additionally perceive that that is fairly a controversial view as Ares Capital is ardently held by many income-seeking traders. Nonetheless, I’m comfy being the contrarian right here as I’ve gained confidence in my capacity to go in opposition to the herd when the state of affairs calls for it, as evidenced by profitable ‘Sturdy Promote’ outlooks on British American Tobacco (BTI) (OTCPK:BTAFF) and Cronos Group (CRON).

The way to interpret Looking Alpha’s rankings:

Sturdy Purchase: Anticipate the corporate to outperform the S&P 500 on a complete shareholder return foundation, with higher-than-usual confidence

Purchase: Anticipate the corporate to outperform the S&P 500 on a complete shareholder return foundation

Impartial/maintain: Anticipate the corporate to carry out consistent with the S&P 500 on a complete shareholder return foundation

Promote: Anticipate the corporate to underperform the S&P 500 on a complete shareholder return foundation

Sturdy Promote: Anticipate the corporate to underperform the S&P 500 on a complete shareholder return foundation, with higher-than-usual confidence