Gold, XAU/USD Speaking Factors:

Spot gold costs are exhibiting a close to 12% achieve in 2023 commerce, in stark distinction to the doji that constructed throughout 2022.

Gold worth motion tracked danger themes all year long and like shares, gold started to rally early within the yr and that largely continued save for a few pullbacks, one among which was extended from Might into October. The response to that pullback was intense.

Because the door opens into 2024 the massive query is the Federal Reserve and doable coverage pivots. And it’s an election yr within the US, so there could possibly be much more motivation for volatility in a market like gold.

One thing necessary occurred to the macro commerce in This fall of 2022, and that is evident in quite a few markets. That is when the S&P 500 was setting its present three-year low, and it’s proper across the time that markets began to gear up for the Federal Reserve to maneuver away from their heavy-handed charge hikes designed to mood inflation. On the time, gold was buying and selling across the $1650 degree and a robust bounce developed in This fall of 2022 as market individuals tried to get in entrance of a doable coverage pivot.

A yr later, and we’re nonetheless hanging on to the identical hope with a contemporary injection of optimism after the December FOMC charge choice during which FOMC Chair Jerome Powell famous that the financial institution had began the dialog round doable charge cuts. Whereas that’s been walked again by different Fed members within the days since, the bullish transfer in gold continues to be there, and if we take a look at the weekly chart its affect is kind of seen.

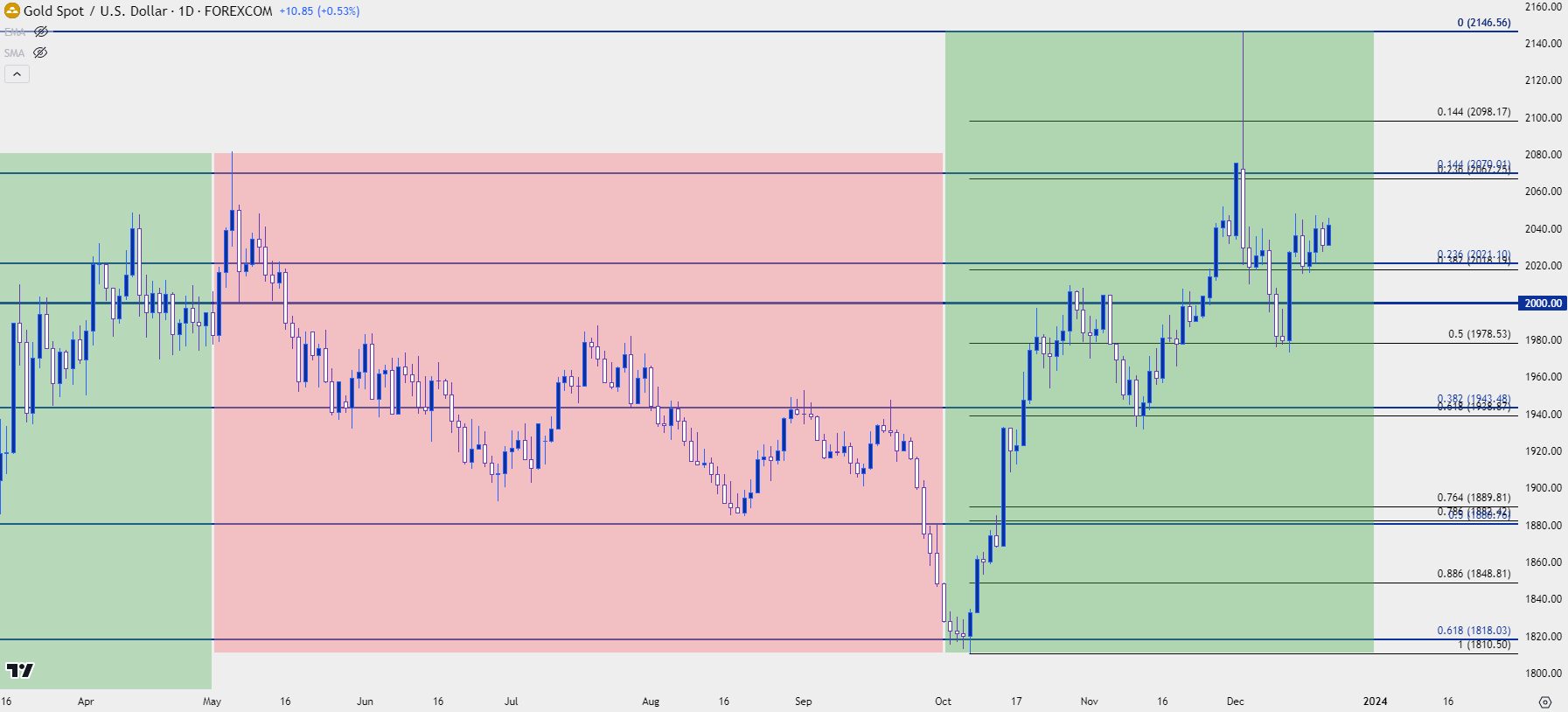

That optimistic bullish theme bumped into Might of this yr, after which it started to pullback. However to inform the story of 2023 worth motion in gold we actually have to drive again to This fall of 2022 when the present development began to run, and under is the origin story.

Gold Weekly Worth Chart (XAU/USD)

Chart ready by James Stanley, Gold on Tradingview

You’ll most likely discover from the above chart that it wasn’t all inexperienced pastures this yr for gold bulls, as there was a five-month pullback that started in Might and ran by early-October.

That was a 61.8% Fibonacci retracement of the bullish transfer, and help began to point out up in early-October. But it surely’s the sell-off that led into that which is of curiosity as that transfer was largely pushed by a extremely sturdy US Greenback. The USD was bid by a lot of the summer season as markets equipped for the potential of extra charge hikes from the Fed. However as that message started to melt and because the probability of one other hike started to fall, issues began to shift.

It wasn’t readily obvious in gold because it had come into the month of October in a deeply oversold state, finally taking place to sub-20 reads on each day RSI. As I had written on the time, that is fairly uncommon as there’s been lower than a handful of comparable occurrences over the prior 20+ years. However the affect was intense because the day after I printed that article gold began to point out topside drive, corresponding to a bullish outdoors each day bar on the morning of NFP on October sixth.

That weekend was when the Center East tensions rushed again into the information and the subsequent weekly open noticed the battle bid worth in, which launched a bullish continuation theme. Lower than two months later spot gold had set a contemporary all-time-high 18.56% away from the October low, taken from the morning of that NFP report. However issues aren’t as clear minimize, as worth was at a significant zone of resistance that wasn’t going to offer approach that simply.

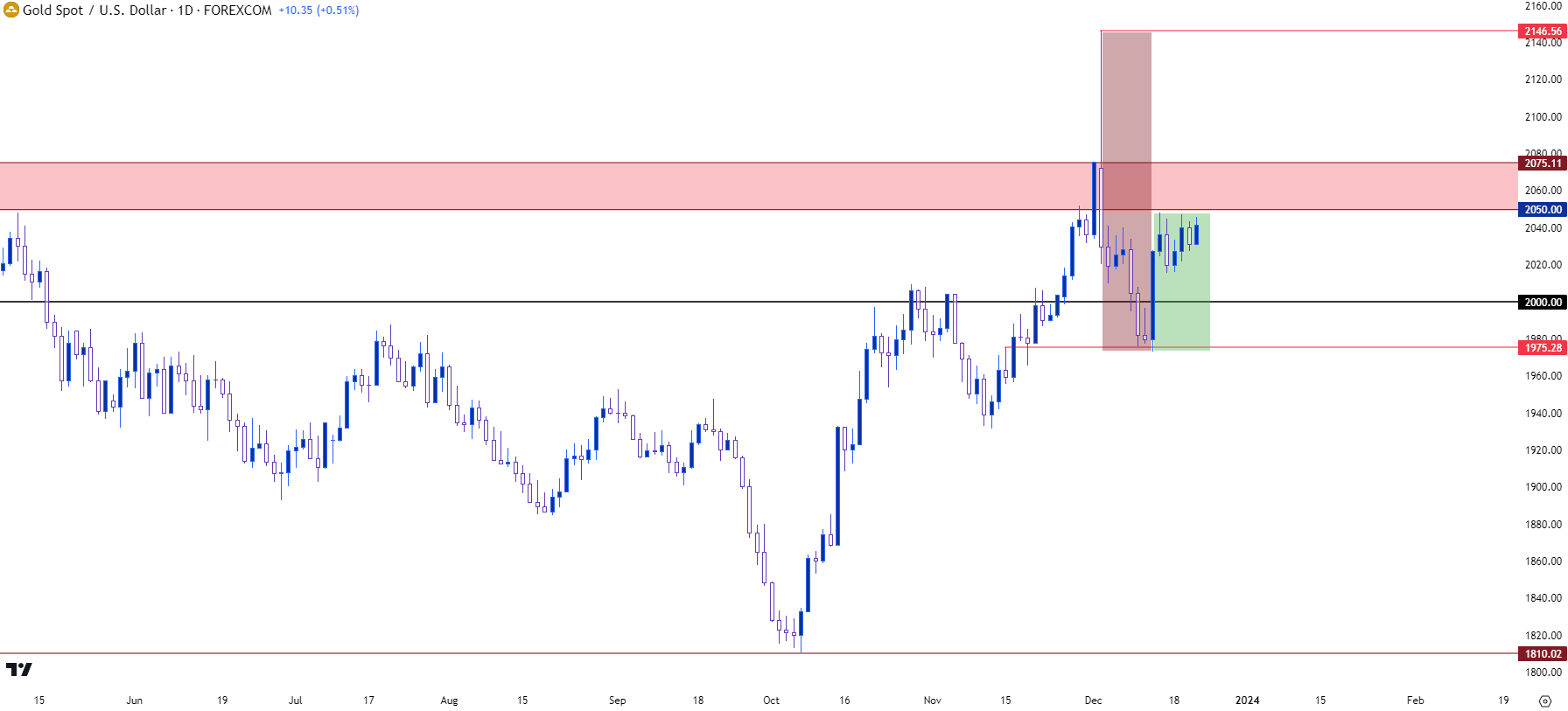

Gold Day by day Worth Chart (XAU/USD)

Chart ready by James Stanley, Gold on Tradingview

Chart ready by James Stanley, Gold on Tradingview

Gold Breakout Pretend-Out, Powell to the Rescue

It was the primary Sunday open of December however an intense transfer confirmed up in gold simply after the open, permitting for spot to hurry all the best way as much as a contemporary all-time-high at 2146. Given how rapidly that order had priced in together with the time that it occurred, it definitely appeared as if there was a liquidity perform there, as properly, as Sunday opens aren’t normally probably the most liquid time of the week for a commodity like gold.

Forward of this I had talked in regards to the prospect of a ‘capitulation wick’ to mark the highest of the transfer. This is able to be just like searching for a pin bar or a capturing begin to plot a reversal, and because the transfer reversed increasingly more, the prospect of bearish stress began to return again into the image. Quickly, we had been again under the $2k determine and as we moved into FOMC, gold was holding help round 1975.

Powell shocked in how dovish he was, no less than to me, and the online response was pretty clear because the Greenback took a heavy hit and this helped to spice up danger belongings, gold included. Gold put in one other bullish outdoors day after that charge choice and costs pushed again above $2k. However the motivation was clear because it was Powell speaking down the prospect or charge hikes and the potential for cuts in 2024 that acquired bulls excited, and this can provide us one thing to work with as we transfer into the New Yr. That has since been talked again a bit by different Fed members, and this can stay a cog within the equation as we transfer into 2024.

Gold Day by day Worth Chart

Chart ready by James Stanley, Gold on Tradingview

Chart ready by James Stanley, Gold on Tradingview

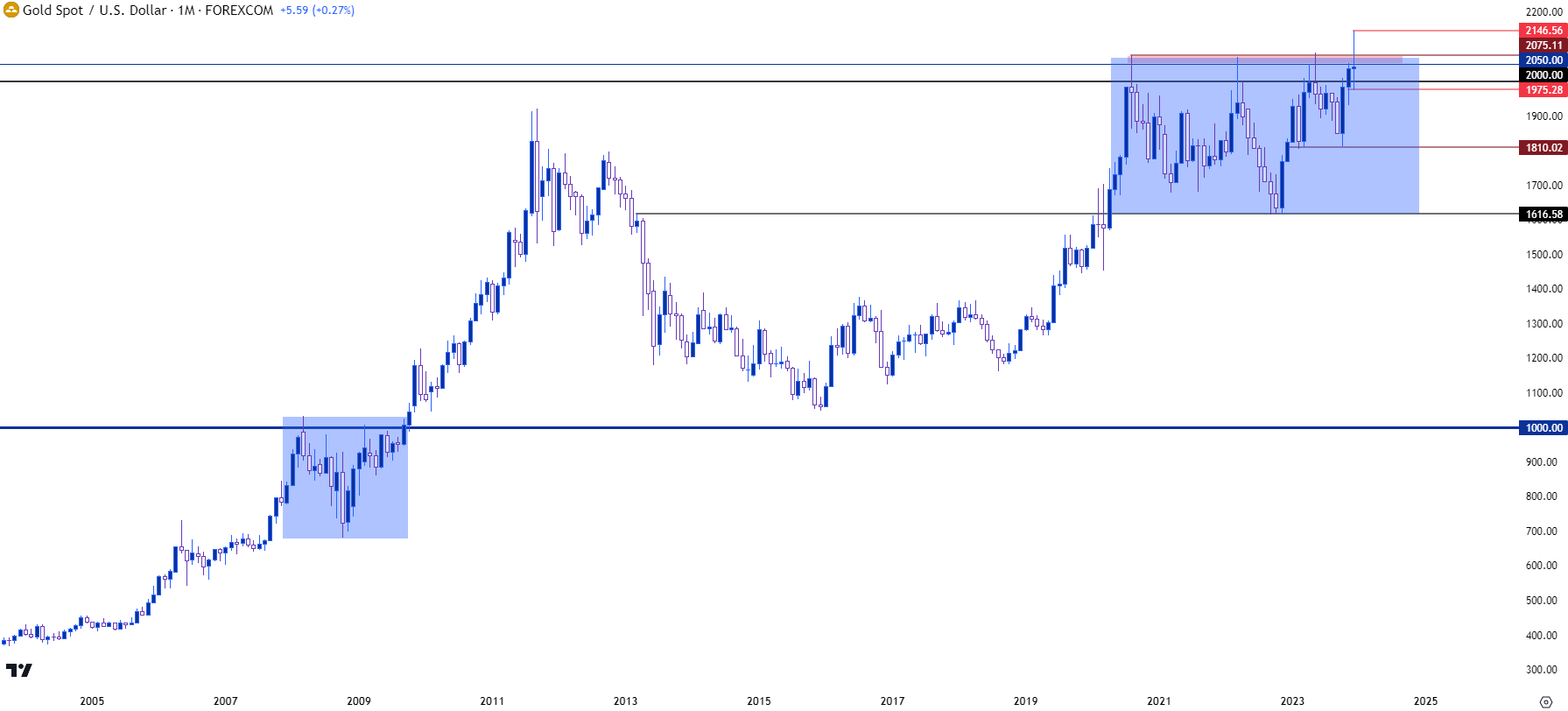

Gold Longer-Time period: Is 2024 The Yr of the Breakout?

I’ve lengthy mentioned that, for my part, gold can present that sustained breakout above $2k after the Fed formally pivots. Current historical past would recommend some type of relationship between expectations across the FOMC and gold worth motion. However, maybe extra to the purpose, there’s some historic relevance right here, as properly.

When gold was attempting to achieve acceptance over the $1k determine it took about 18 months, even with the Fed pumping aggressively after the Monetary Collapse. The primary check of $1k confirmed in March of 2008, across the time that Bear Sterns was hit. And whereas this supplied some shock to world markets it gave the impression to be shrugged off for a few months because the S&P rallied in April and Might of that yr.

Gold continued to pullback and by October of 2008, because the Monetary Collapse was creating, gold had given again -34% in six months. The second check of $1k occurred nearly a yr after the primary, in February of 2009 and as soon as once more, bulls had been stymied.

Gold lastly broke by the $1k degree in September of 2008 and hasn’t seemed again since.

The saga with $2k appears considerably related as the primary check of that degree got here in just a few months after covid got here into the image. And because the Fed pumped to a heavy diploma, gold engaged with the massive determine however nonetheless couldn’t achieve sufficient acceptance to proceed the drive. Apparently, it appeared the anti-USD consideration turned to Bitcoin as BTC/USD was buying and selling round $12k the primary time that gold tagged $2k. And as gold ranged for the subsequent yr and alter, Bitcoin broke out in a really massive approach.

In gold, this actually harkens to the worth or significance of psychological ranges, themselves, as these are huge costs that may create adjustments in shopper habits that may have repercussions on short-term developments and themes. The value of $1,000.01 appears rather more costly than simply two cents about $999.99; and that is simply part of the human situation during which our brains try and simplify. The larger quantity, even when simply two cents, appears a lot bigger given the additional digit and that is one thing that may affect shopper and investor habits, as we’ve seen for the previous three and a half years with gold.

The check at $2k has been for much longer than what was seen at $1k, however there’s additionally the matter of inflation to contemplate…

Gold Month-to-month Worth Chart: $1k to $2k

Chart ready by James Stanley, gold on Tradingview

Chart ready by James Stanley, gold on Tradingview

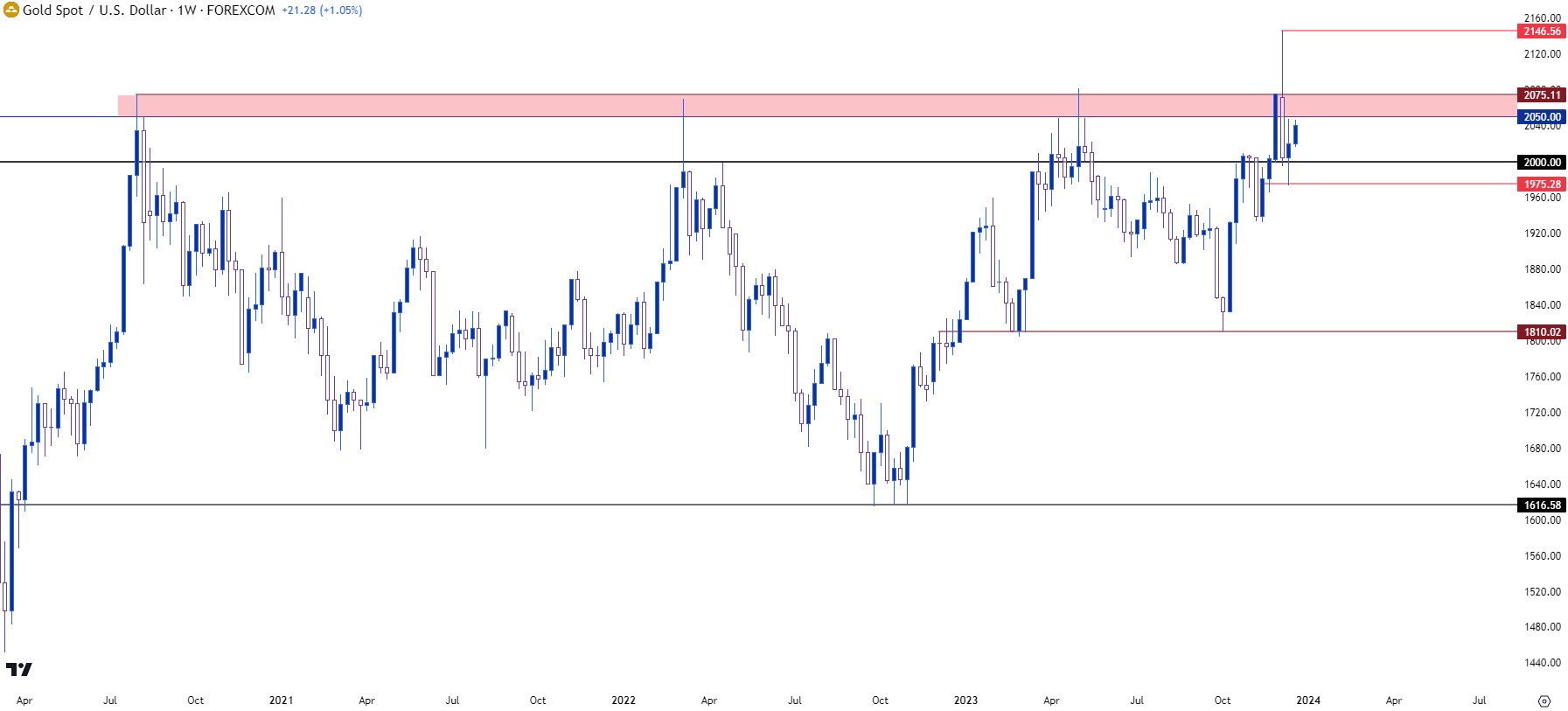

Gold Technique for 2024

Gold has now examined above the $2k degree on 4 separate situations because it first got here into play in August of 2020. The following check sarcastically occurred simply earlier than charge hikes began in March of 2022, however this was helped alongside by one other battle bid as Russia invaded Ukraine.

The third check occurred when banking stress confirmed up within the US in March, and together with it got here the expectation that the Fed wouldn’t hike regional banks right into a disastrous situation. But it surely was because the Fed began speaking up the prospect of extra charge hikes that gold started to turn-lower once more, and that five-month theme ran fairly clearly, all the best way till that deep oversold situation appeared which led to the slingshot breakout transfer and, finally, the fourth journey above the $2k marker.

An rising frequency of assessments on the massive determine point out rising acceptance of that worth and when coupled with the higher-lows which have proven, notably the latest merchandise in December, and bulls retain management and might push for that breakout theme.

There’s danger, nevertheless, because the Fed could not but be prepared to chop till later in 2024 and the $2050-$2075 space on the chart has been painful for bulls.

However maybe extra to the purpose, gold costs have been ranging for 3 and a half years; and if we do get that sustained break/bullish continuation theme, gold bulls would possibly lastly get some longer-term development potential to work with in some unspecified time in the future in 2024. However hoping for that to occur in March could possibly be a bit aggressive with Core CPI nonetheless at 4%. So this can be a later-in-the-year sort of factor, however stays related as we transfer into the New Yr with an election scheduled for November.

Gold Weekly Worth Chart

Chart ready by James Stanley, Gold on Tradingview

Chart ready by James Stanley, Gold on Tradingview

— written by James Stanley, Senior Strategist