US DOLLAR FORECAST – EUR/USD, USD/JPY, GBP/USD

The U.S. greenback sinks to its lowest stage since July, with the DXY index closing the week at 101.70No main occasions are anticipated within the week forward, however that doesn’t imply that volatility shall be low, as skinny liquidity situations might amplify market strikesThis text zooms in on the technical outlook for EUR/USD, USD/JPY, and GBP/USD, analyzing important worth thresholds to observe within the ultimate buying and selling periods of 2023

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication

Most Learn: US Greenback in Freefall Heading into 2024. What Now for EUR/USD, GBP/USD, Gold?

The U.S. greenback, as measured by the DXY index, dropped for the second consecutive week, closing at its lowest stage since late July (101.70) in a low-volume surroundings forward of the Christmas festivities and the ultimate buying and selling days of 2023.

Taking latest losses under consideration, the DXY index has fallen by about 4.21% within the fourth quarter and by roughly 1.75% in December, pressured by the numerous pullback in authorities bond yields, which have corrected sharply decrease from their cycle’s highs established in late October.

The Fed’s pivot has strengthened ongoing market traits, exacerbating the downward shift within the Treasury curve and the buck’s retreat. To elaborate, the FOMC adopted a dovish place at its final assembly, admitting that it had begun talks of price cuts and signaling 75 foundation factors of easing in 2024.

The next chart reveals the magnitude of the shift within the Treasury curve over the past two months or so.

US TREASURY CURVE DOWNWARD SHIFT

Supply: TradingView

Looking forward to the final week of 2023, there are not any impactful releases on the calendar that may considerably alter present traits. This might outcome within the consolidation of latest strikes, specifically the weakening of the U.S. greenback and falling yields. However, the absence of high-impact occasions on the calendar doesn’t assure low volatility and regular markets.

Lowered liquidity situations, attribute of the vacation interval, can typically amplify worth swings, as seemingly routine or moderate-sized trades can upset the fragile steadiness between provide and demand, with few merchants on their desks to soak up purchase and promote orders. Subsequently, warning is strongly suggested.

Refine your buying and selling expertise and keep one step forward. Get hold of the EUR/USD forecast for a complete breakdown of the pair’s basic and technical outlook!

Beneficial by Diego Colman

Get Your Free EUR Forecast

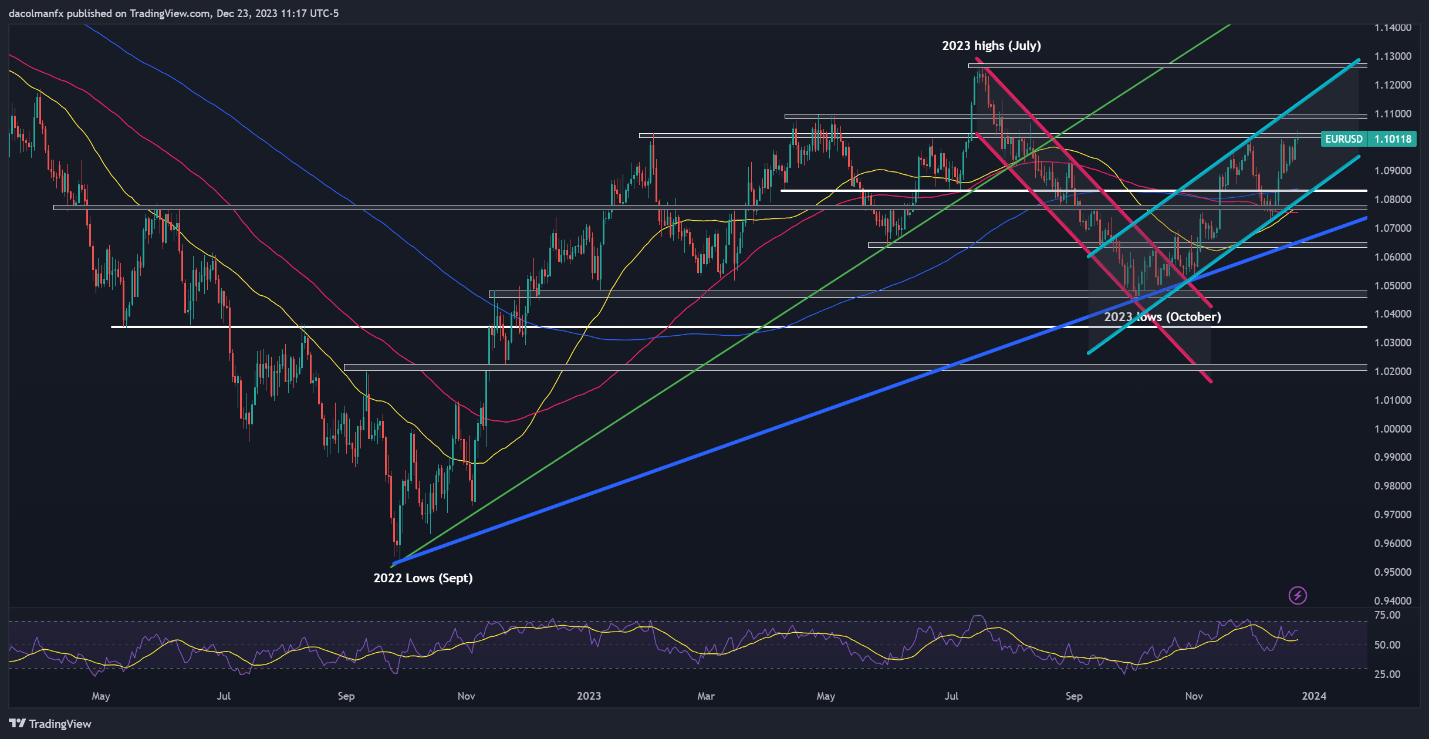

EUR/USD TECHNICAL ANALYSIS

Following latest positive aspects, the EUR/USD now confronts a pivotal resistance zone between 1.1000 and 1.1025. If this ceiling is taken out decisively within the coming days, we might see a rally in direction of 1.1085. On additional power, the main target shifts to 1.1140, which corresponds to the higher restrict of a rising channel in play since September.

On the flip aspect, if patrons’ efforts to drive costs greater fail and finally end in a downturn off present ranges, preliminary help turns into seen at 1.0830, close to the 200-day easy transferring common. The pair is prone to backside out on this space earlier than resuming its advance, however within the occasion of a breakdown, a stoop in direction of 1.0770 could possibly be within the playing cards.

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Utilizing TradingView

Entry unique insights and techniques for USD/JPY by downloading the Japanese yen buying and selling information!

Beneficial by Diego Colman

The way to Commerce USD/JPY

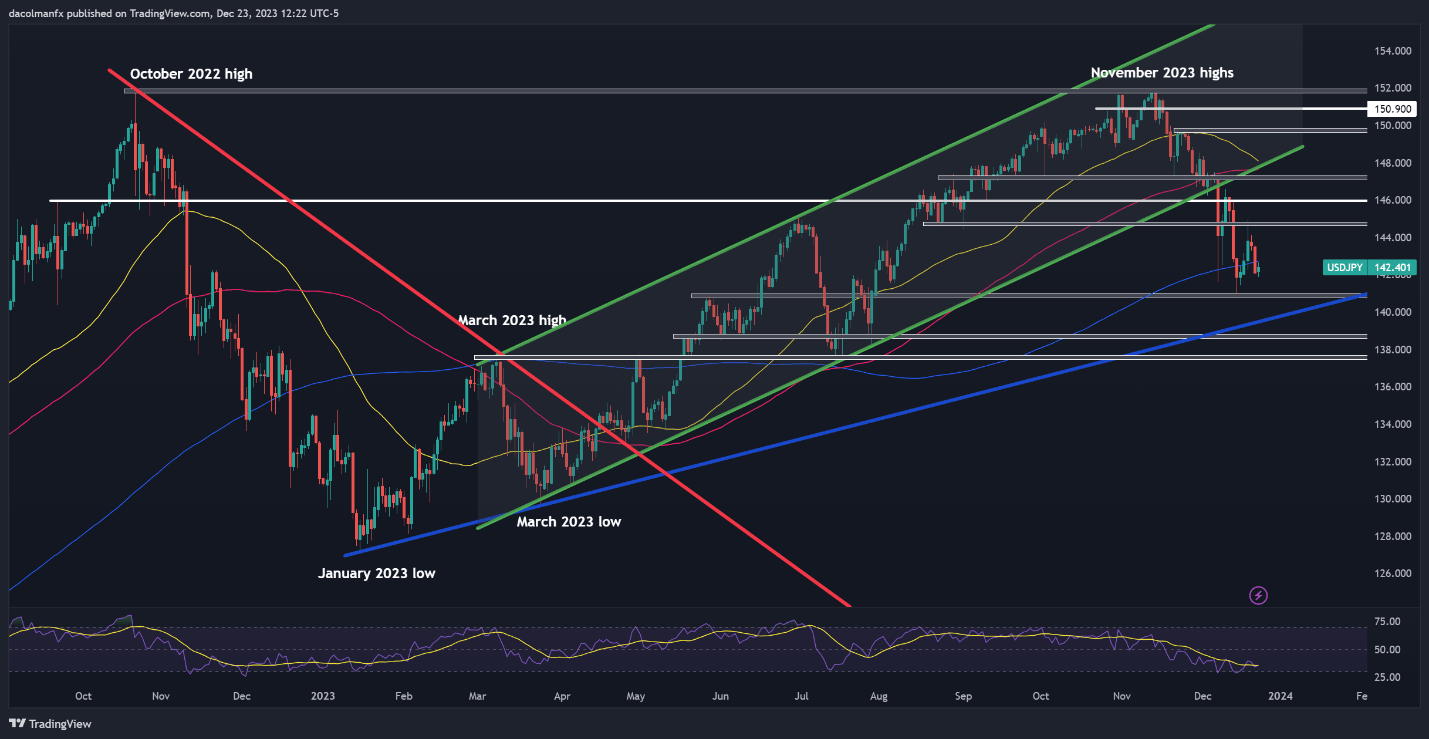

USD/JPY TECHNICAL ANALYSIS

USD/JPY ticked up on Friday however didn’t reclaim its 200-day easy transferring common. If the pair stays under this indicator within the coming days, promoting strain might begin constructing momentum, setting the stage for an eventual decline in direction of the December lows at 140.95. This ground have to be protected in any respect prices; failure to take action might spark a retracement in direction of trendline help at 139.50.

Conversely, if patrons regain the higher hand and propel USD/JPY above its 200-day SMA, resistance seems at 144.80. Surmounting this impediment will show difficult for the bullish camp, however a profitable breakout might create the correct situations for an ascent towards the 146.00 deal with. A continued show of power might embolden the bulls to goal for 147.20.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Utilizing TradingView

Wish to perceive how retail positioning can impression GBP/USD’s journey within the close to time period? Request our sentiment information to find the impact of crowd habits on FX market traits!

Change in

Longs

Shorts

OI

Each day

-11%

5%

-3%

Weekly

-4%

-1%

-3%

GBP/USD TECHNICAL ANALYSIS

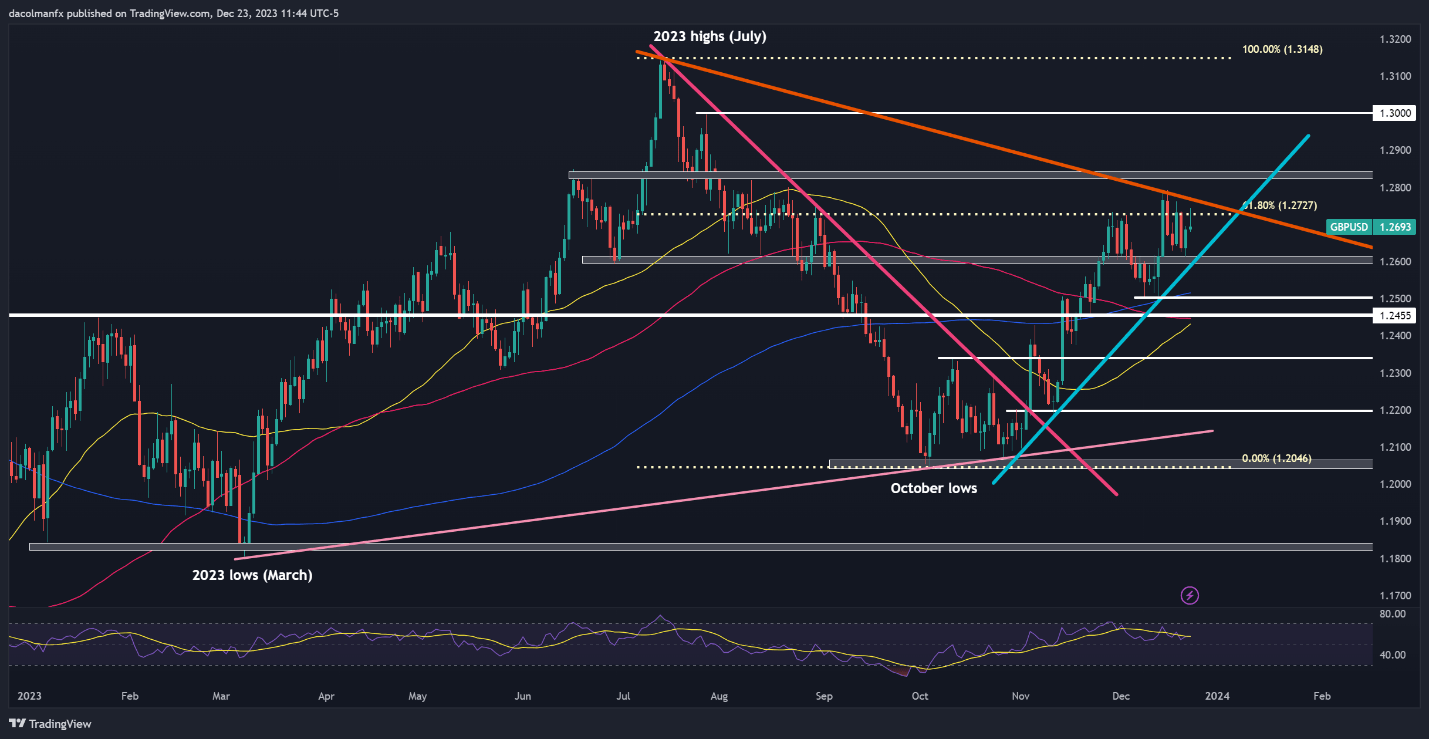

GBP/USD inched up heading into the weekend however hit a roadblock at cluster resistance stretching from 1.2727 to1.2769, the place a vital Fibonacci stage converges with a downtrend line prolonged from the 2023 peak. Reinforcing bullish momentum requires clearing this technical hurdle; with a profitable breakout possible paving the best way for a transfer in direction of 1.2800, adopted by 1.3000.

Alternatively, if sellers stage a comeback and provoke a bearish reversal, trendline help is situated across the 1.2600 space. This dynamic ground could supply stability throughout a pullback, however a push under it might usher in a retest of the 200-day easy transferring common hovering barely above the 1.2500 deal with. Additional weak spot might redirect consideration to 1.2455.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Utilizing TradingView

factor contained in the factor. That is most likely not what you meant to do!

Load your utility’s JavaScript bundle contained in the factor as a substitute.

Source link