SDI Productions

On occasion, one can find an funding alternative that is smart to carry on to for a few years. This would be the case even when the funding in query achieves engaging upside. However for many investments, as soon as an preliminary quantity of upside is captured, it is smart to promote out and search for alternatives elsewhere. One specific agency that’s extra typical on this regard is Cadence Financial institution (NYSE:CADE). Again in July of this 12 months, after the corporate had skilled some significant draw back due to the banking disaster that started in March, I wrote a bullish article detailing why the inventory made for an interesting prospect. Shares have been low cost and administration had achieved some good progress within the firm over time. This led me to price the enterprise a ’purchase’.

Since then, the establishment has outperformed my expectations. Despite the fact that deposits of the establishment have declined, shares have skyrocketed by 57.5% at a time when the S&P 500 is up solely 7.9%. This vital transfer larger makes the inventory truly fairly dear, particularly relative to most of the different banks which might be on the market. I would not go as far as to say that I’m now bearish on the enterprise. Though I’ll say that I get awfully near that time. In all, I imagine that it makes for a greater ‘maintain’ than it does the rest, so within the spirit of that feeling, I’m downgrading the corporate accordingly.

In want of a downgrade

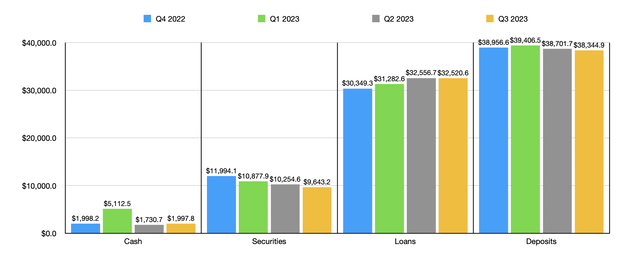

One of many largest points within the banking sector over the previous 12 months has been a decline in deposits. Though many banks have bucked the development, others haven’t. Along with issues in regards to the stability of the sector, there’s additionally the truth that excessive rates of interest have pushed depositors to search for engaging yields elsewhere. And one of many banks that has seen some weak point on this entrance is Cadence Financial institution. On the finish of 2022, the establishment had $38.96 billion value of deposits on its books. By the top of the primary quarter, deposits had grown to $39.41 billion. However ever since then, we’ve got began seeing declines. By the top of the third quarter of this 12 months, which is the newest quarter for which knowledge is accessible, Cadence Financial institution had seen its deposits drop to $38.34 billion. That is a decline of $1.06 billion within the span of two quarters.

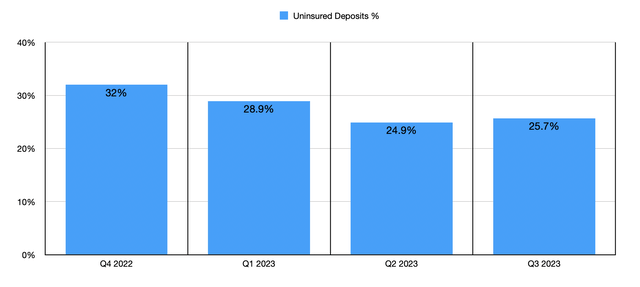

Creator – SEC EDGAR Information

The one excellent news on the deposit entrance is that the quantity of uninsured deposit publicity the financial institution has is decrease now than it was on the finish of the primary quarter. Again then, 28.9% of deposits have been uninsured. For readability, these figures seek advice from uninsured deposit publicity the place we exclude from the equation these with collateralized safety. By the top of the newest quarter, uninsured deposit publicity had dipped extra to 25.7%. This is not nice, however it may undoubtedly be worse.

Creator – SEC EDGAR Information

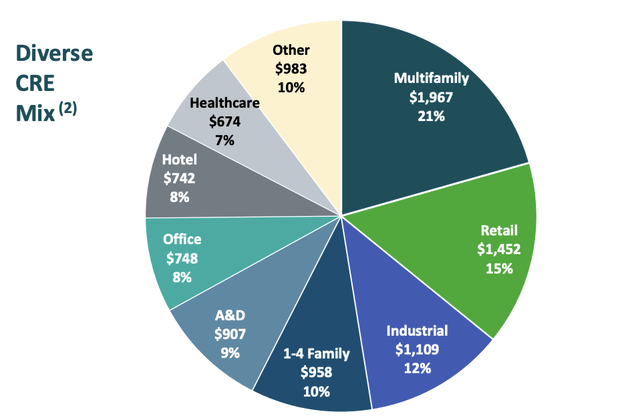

There are another vital methods through which the establishment has modified. For starters, the worth of loans on its books has finely flatlined. On the finish of 2022, the establishment had $30.35 billion in loans. This finally continued to develop, peaking at $32.56 billion within the second quarter of this 12 months. We’ve seen a slight decline since then to $32.52 billion. However that is not a fabric change for my part. Talking of loans, solely about $9.54 billion value of the corporate’s mortgage portfolio is within the type of industrial actual property. I perceive that many buyers are nervous presently about publicity to workplace properties. However the nice information is that solely $748 million, or 2.3%, of the corporate’s general mortgage portfolio falls beneath this class. To be clear, this does exclude some workplace house beneath the healthcare class comparable to physician workplaces. With healthcare workplaces as a complete accounting for one more $217.1 million, we’re not speaking about something materials right here.

Cadence Financial institution

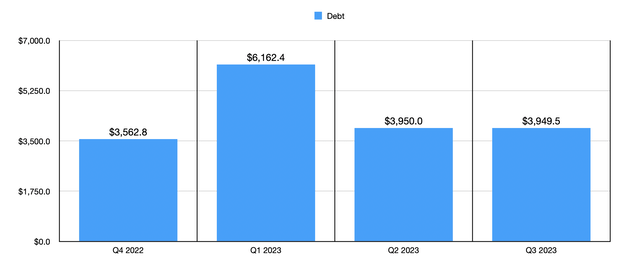

Seeing loans flatline for 1 / 4 or two will not be all that problematic. Nevertheless, what’s disagreeable is that the worth of each securities and money continues to drop. In 2022, the establishment had $11.99 billion value of securities on its books. This has fallen each quarter since then, hitting $9.64 billion throughout the newest quarter. The worth of money did spike from $2 billion on the finish of final 12 months to $5.11 billion within the first quarter. However by the top of the third quarter, it was right down to roughly $2 billion. The one constructive in relation to these declines is that it seems to be as if the cash was used to cut back debt. The agency had $6.16 billion value of debt on its books by the top of final 12 months. Quick ahead to in the present day, and it has round $3.95 billion in debt.

Creator – SEC EDGAR Information

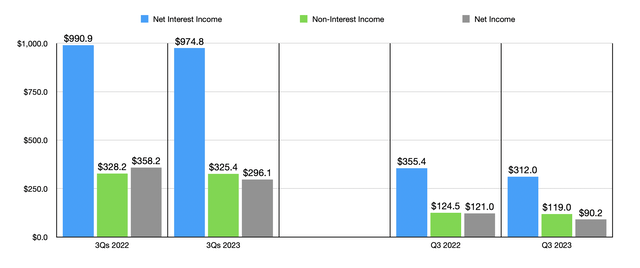

These adjustments, particularly the drop within the worth of securities and the weak point on the deposit facet of issues, have resulted in some reasonably materials adjustments within the firm’s profitability. Within the first 9 months of this 12 months, as an example, Cadence Financial institution generated internet curiosity earnings of $974.8 million. That is down solely barely from the $990.9 million reported one 12 months earlier. Equally, non-interest earnings dropped from $328.2 million to $325.4 million. Nevertheless, internet earnings took a success, declining from $358.2 million to $296.1 million. Sure rising prices, comparable to these related to salaries and advantages, have been liable for a lot of this backside line ache.

Creator – SEC EDGAR Information

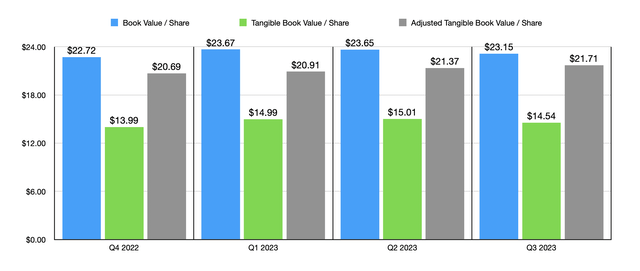

As for valuing the corporate, if we annualize outcomes skilled to this point for 2023, we might get internet earnings of $349.7 million in comparison with the $453.7 million reported for 2022. This may suggest a worth to earnings a number of of 15.9, which is amongst the best that I’ve seen within the banking sector. Even when we use final 12 months’s outcomes, the worth to earnings a number of could be 12.3. There are additionally three totally different measures of e-book worth for the establishment. And these end in a worth to e-book ratio of between 1.30 and a couple of.07. On the low finish, that is not horrible. But it surely’s not nice both.

Creator – SEC EDGAR Information

Takeaway

So far as banks go, Cadence Financial institution could possibly be doing higher. Frankly, I am shocked that shares have seen a lot upside at a time when deposits have continued to drop. The excellent news is that debt has come down, although that has come on the expense of bigger money and securities balances. If the inventory have been nonetheless low cost, I’d in all probability stay bullish on it. However between elementary adjustments that I already mentioned and the way a lot the inventory has risen, I’d argue {that a} downgrade to a tender ‘maintain’ is most sensible proper now.