Up to date on December twenty first, 2023 by Bob Ciura

At Certain Dividend, we suggest buyers concentrate on the perfect dividend shares that may generate the very best returns over time.

In relation to dividends, buyers also needs to be centered on dividend security. There have been many shares with excessive dividend yields that finally minimize or get rid of their dividends when enterprise situations deteriorate.

Dividend cuts must be prevented at any time when attainable.

We have now created a singular metric referred to as Dividend Danger Rating, which measures a inventory’s capacity to keep up its dividend throughout recessions, and enhance the dividend over time.

With this in thoughts, we’ve compiled a free checklist of the 50 most secure dividend shares primarily based on their payout ratios and Dividend Danger Rating, which you’ll be able to obtain beneath:

The very best dividend progress shares are high-quality companies that may preserve their dividends, even throughout recessions. However investing in poor companies that minimize their dividends is a recipe for under-performance over time.

That’s why, on this article, now we have analyzed the ten most secure dividend shares from our Certain Evaluation Analysis Database with the most secure dividends primarily based on our Dividend Danger Rating ranking system.

The shares beneath all have Dividend Danger Scores of ‘A’, our high ranking, and with the bottom payout ratios. The shares even have dividend yields of no less than 1%, to make them interesting for revenue buyers.

Desk of Contents

Why The Payout Ratio Issues

The dividend payout ratio is just an organization’s annual per-share dividend, divided by the corporate’s annual earnings-per-share. It’s a measure of the extent of earnings an organization distributes to its shareholders through dividends.

The payout ratio is a helpful investing metric as a result of it differentiates corporations with low payout ratios which have a lot of room for dividend progress, from corporations with excessive payout ratios whose dividends will not be sustainable.

Certainly, analysis has proven that corporations with larger dividend progress have outperformed corporations with decrease dividend progress or no dividend progress.

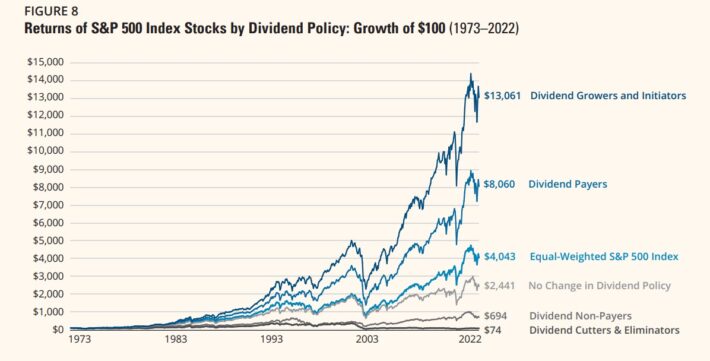

In analysis carried out by Ned Davis and Hartford Funds, it was discovered that dividend growers and initiators delivered whole returns of 10.24% per 12 months from 1973 by 2022, higher than the equal-weighted S&P 500’s efficiency of seven.68% per 12 months.

Apparently, the dividend growers and initiators analyzed on this research generated outperformance with much less volatility – a rarity and a contradiction to what fashionable tutorial monetary principle tells us.

A abstract of this analysis will be discovered beneath.

Supply: Hartford Funds – The Energy Of Dividends

Outperformance of two.56% yearly may not look like a game-changer, nevertheless it actually is because of the marvel that’s compound curiosity.

Utilizing information from the identical piece of analysis, buyers who selected to speculate completely in dividend growers and initiators have been able to turning $100 into $13,061. Throughout the identical time interval, the S&P 500 index turned $100 into $4,043.

Supply: Hartford Funds – The Energy Of Dividends

Shares that didn’t pay dividends couldn’t match the efficiency of all forms of dividend payers, turning $100 into $694 from 1973-2022. Dividend cutters and eliminators fared even worse, turning $100 into simply $74–which means these shares truly misplaced cash.

Consequently, buyers searching for shares with higher dividend progress (and long-term return potential) might take into account these 10 dividend shares with low payout ratios and Dividend Danger Scores of ‘A’.

Most secure Dividend Inventory #10: Ameriprise Monetary (AMP)

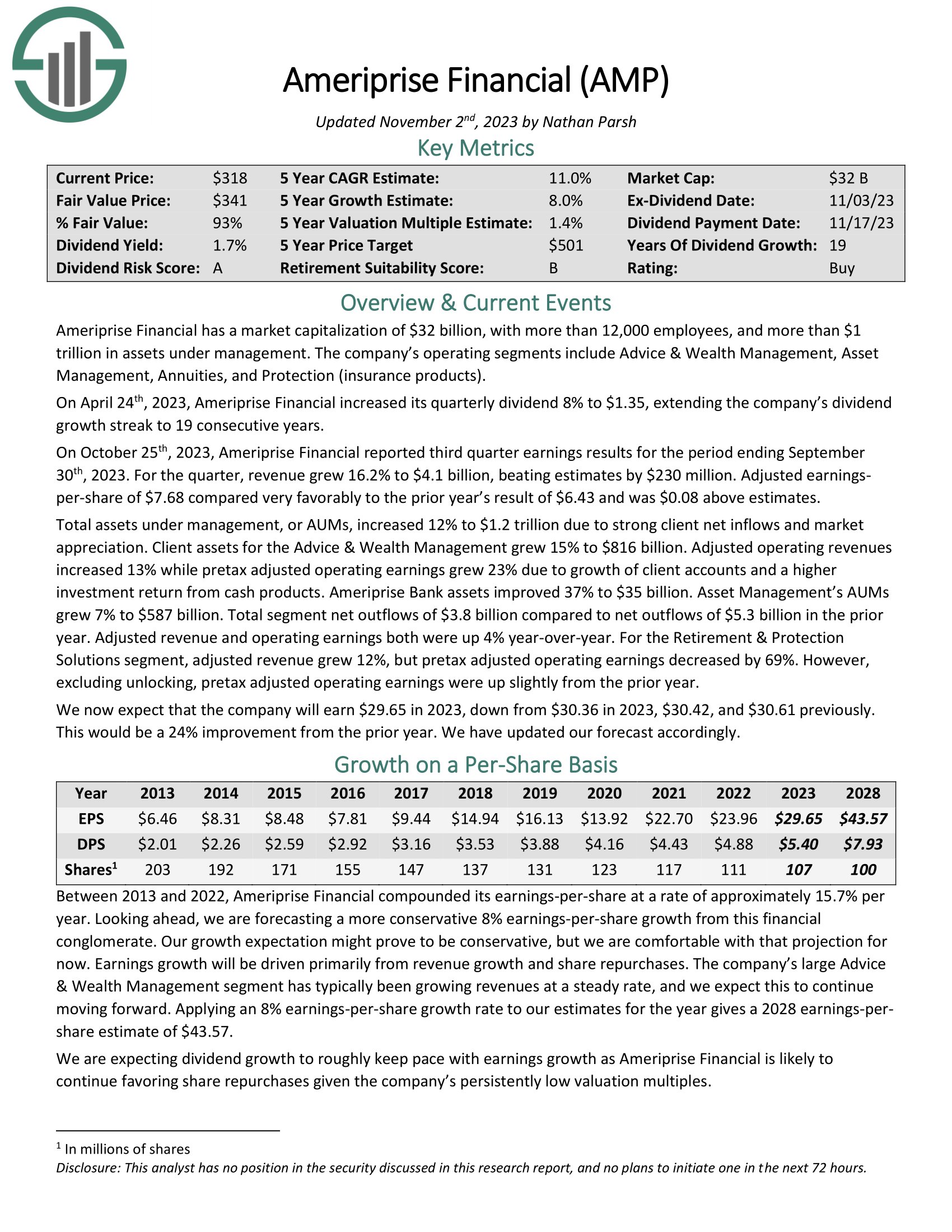

Ameriprise Monetary has a market capitalization of $32 billion, with greater than 12,000 workers, and greater than $1 trillion in belongings beneath administration. The corporate’s working segments embrace Recommendation & Wealth Administration, Asset Administration, Annuities, and Safety (insurance coverage merchandise).

On April twenty fourth, 2023, Ameriprise Monetary elevated its quarterly dividend 8% to $1.35, extending the corporate’s dividend progress streak to 19 consecutive years.

On October twenty fifth, 2023, Ameriprise Monetary reported third quarter earnings outcomes for the interval ending September30th, 2023. For the quarter, income grew 16.2% to $4.1 billion, beating estimates by $230 million. Adjusted earnings-per-share of $7.68 in contrast very favorably to the prior 12 months’s results of $6.43 and was $0.08 above estimates. Complete belongings beneath administration, or AUMs, elevated 12% to $1.2 trillion attributable to sturdy shopper web inflows and market appreciation.

Click on right here to obtain our most up-to-date Certain Evaluation report on AMP (preview of web page 1 of three proven beneath):

Most secure Dividend Inventory #9: Lindsay Company (LNN)

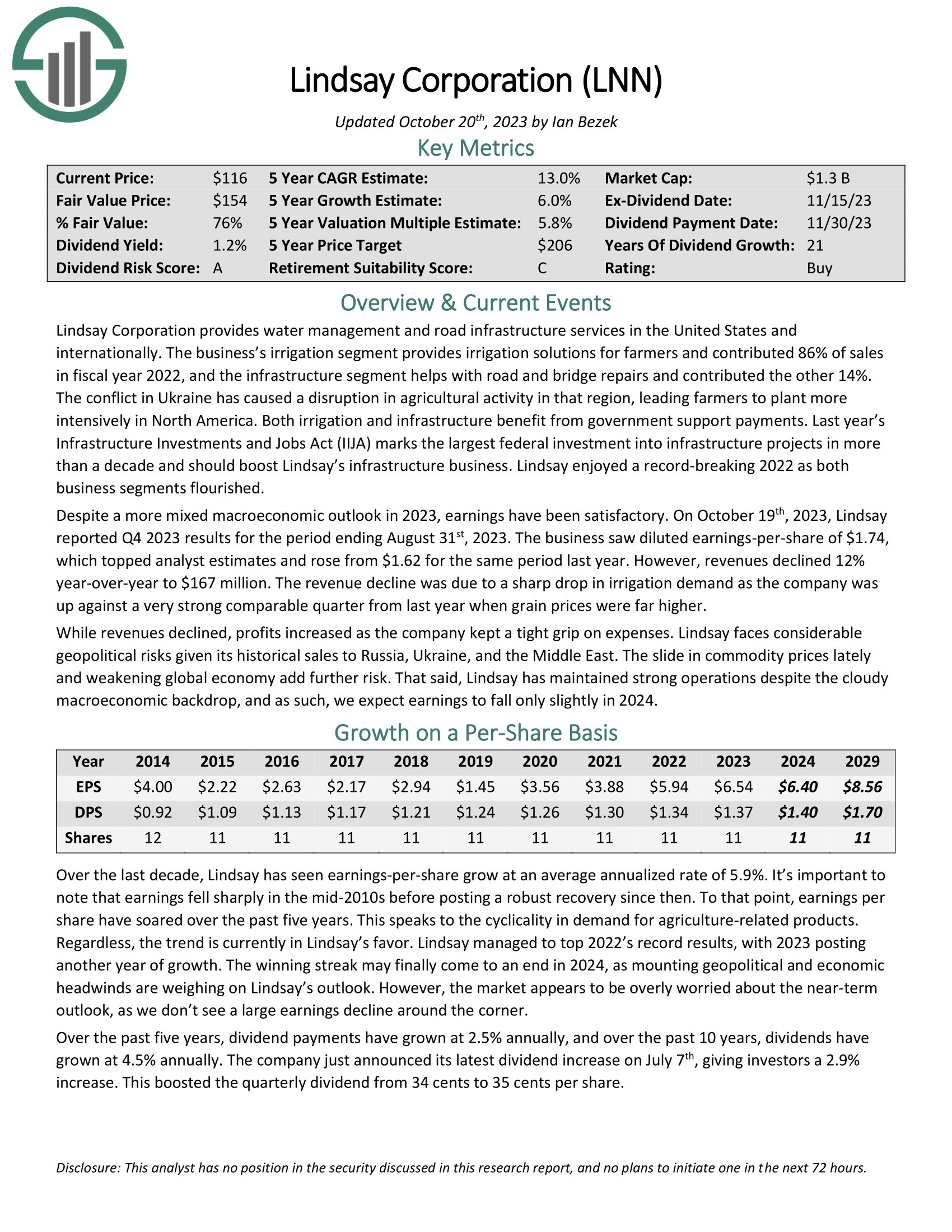

Lindsay Company supplies water administration and highway infrastructure providers in america and internationally. The enterprise’s irrigation phase supplies irrigation options for farmers and contributed 86% of gross sales in fiscal 12 months 2022, and the infrastructure phase helps with highway and bridge repairs and contributed the opposite 14%.

Lindsay is likely one of the high water shares.

On October nineteenth, 2023, Lindsay reported This autumn 2023 outcomes for the interval ending August thirty first, 2023. The enterprise noticed diluted earnings-per-share of $1.74, which topped analyst estimates and rose from $1.62 for a similar interval final 12 months. Nevertheless, revenues declined 12% year-over-year to $167 million. The income decline was attributable to a pointy drop in irrigation demand as the corporate was up in opposition to a really sturdy comparable quarter from final 12 months when grain costs have been far larger.

Click on right here to obtain our most up-to-date Certain Evaluation report on Lindsay (preview of web page 1 of three proven beneath):

Most secure Dividend Inventory #8: Raymond James Monetary (RJF)

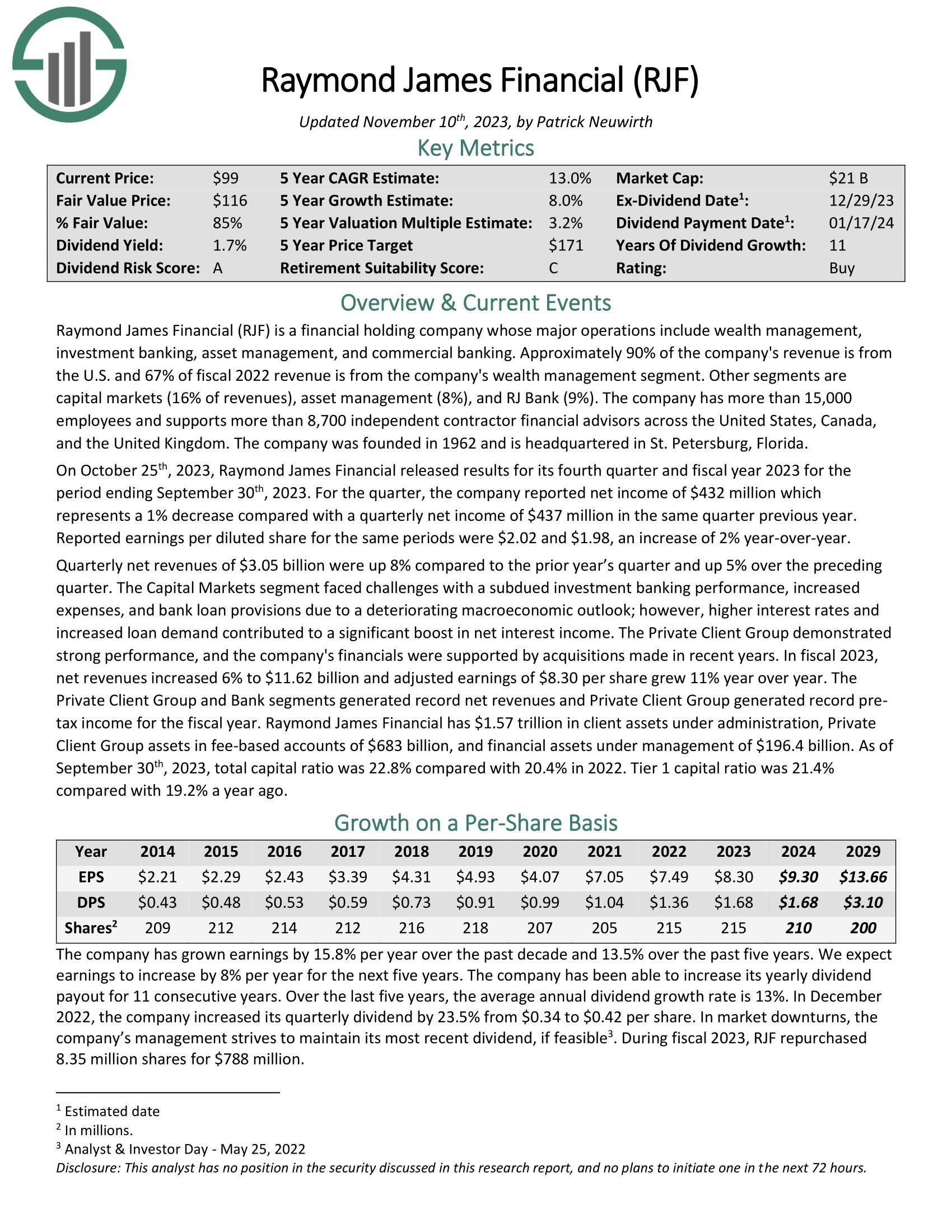

Raymond James Monetary (RJF) is a monetary holding firm whose main operations embrace wealth administration, funding banking, asset administration, and industrial banking. Roughly 90% of the corporate’s income is from the U.S. and 67% of fiscal 2022 income is from the corporate’s wealth administration phase. Different segments are

capital markets (16% of revenues), asset administration (8%), and RJ Financial institution (9%). The corporate has greater than 15,000 workers and helps greater than 8,700 impartial contractor monetary advisors throughout america, Canada, and the UK.

On October twenty fifth, 2023, Raymond James Monetary launched outcomes for its fourth quarter and financial 12 months 2023 for the interval ending September thirtieth, 2023. For the quarter, the corporate reported web revenue of $432 million which represents a 1% lower in contrast with a quarterly web revenue of $437 million in the identical quarter earlier 12 months. Reported earnings per diluted share for a similar durations have been $2.02 and $1.98, a rise of two% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on RJF (preview of web page 1 of three proven beneath):

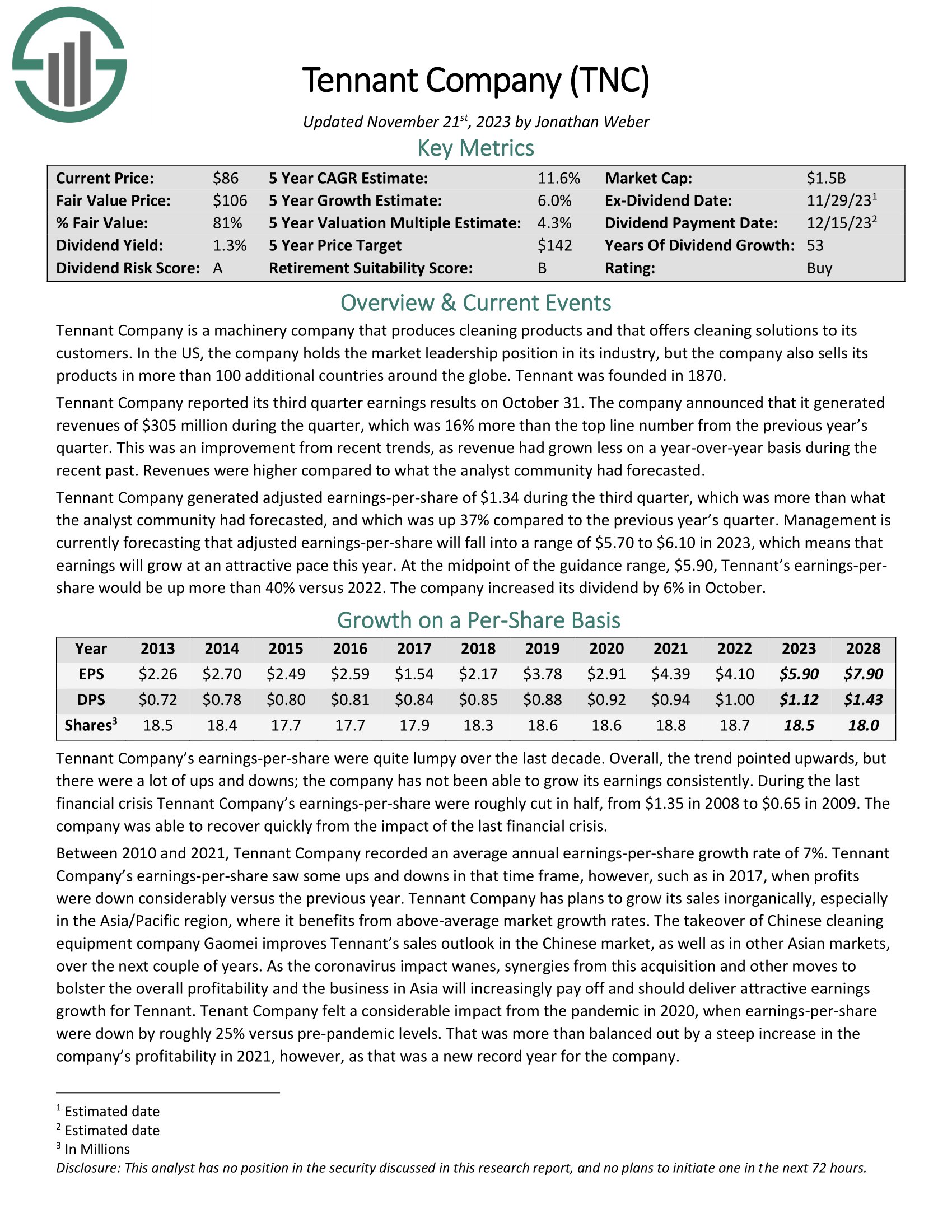

Most secure Dividend Inventory #7: Tennant Co. (TNC)

Tennant Firm is a equipment firm that produces cleansing merchandise and that provides cleansing options to its clients. Within the US, the corporate holds the market management place in its business, however the firm additionally sells its merchandise in additional than 100 extra nations across the globe. Tennant was based in 1870.

Tennant Firm reported its third quarter earnings outcomes on October 31. The corporate introduced that it generated revenues of $305 million throughout the quarter, which was 16% greater than the highest line quantity from the earlier 12 months’s quarter. This was an enchancment from latest tendencies, as income had grown much less on a year-over-year foundation throughout the latest previous. Revenues have been larger in comparison with what the analyst group had forecasted.

Tennant Firm generated adjusted earnings-per-share of $1.34 throughout the third quarter, which was greater than what the analyst group had forecasted, and which was up 37% in comparison with the earlier 12 months’s quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on TNC (preview of web page 1 of three proven beneath):

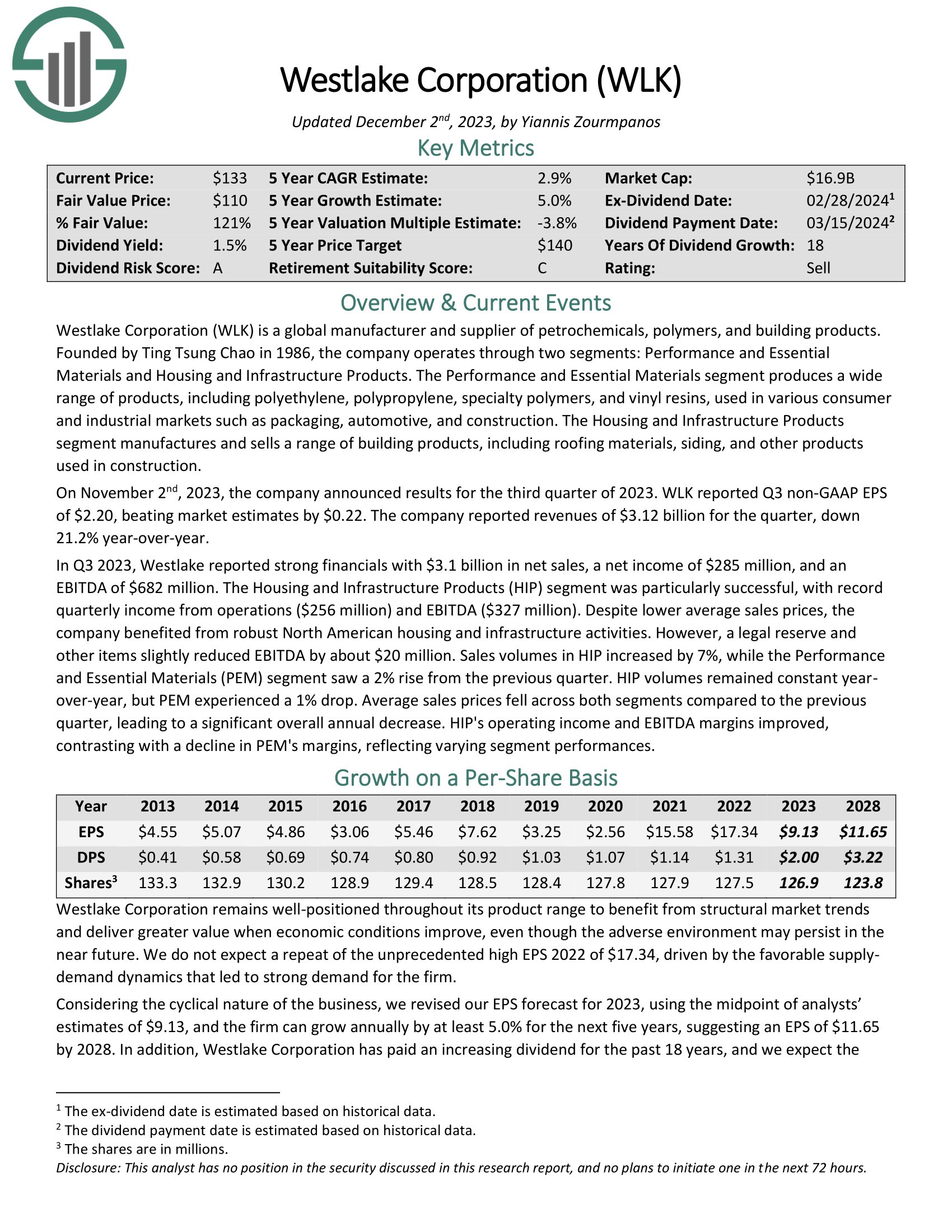

Most secure Dividend Inventory #6: Westlake Company (WLK)

Westlake Company is a worldwide producer and provider of petrochemicals, polymers, and constructing merchandise. Based by Ting Tsung Chao in 1986, the corporate operates by two segments: Efficiency and Important Supplies and Housing and Infrastructure Merchandise.

The Efficiency and Important Supplies phase produces a variety of merchandise, together with polyethylene, polypropylene, specialty polymers, and vinyl resins, utilized in numerous client and industrial markets akin to packaging, automotive, and building. The Housing and Infrastructure Merchandise phase manufactures and sells a variety of constructing merchandise, together with roofing supplies, siding, and different merchandise utilized in building.

On November 2nd, 2023, the corporate introduced outcomes for the third quarter of 2023. WLK reported Q3 non-GAAP EPS of $2.20, beating market estimates by $0.22. The corporate reported revenues of $3.12 billion for the quarter, down 21.2% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on WLK (preview of web page 1 of three proven beneath):

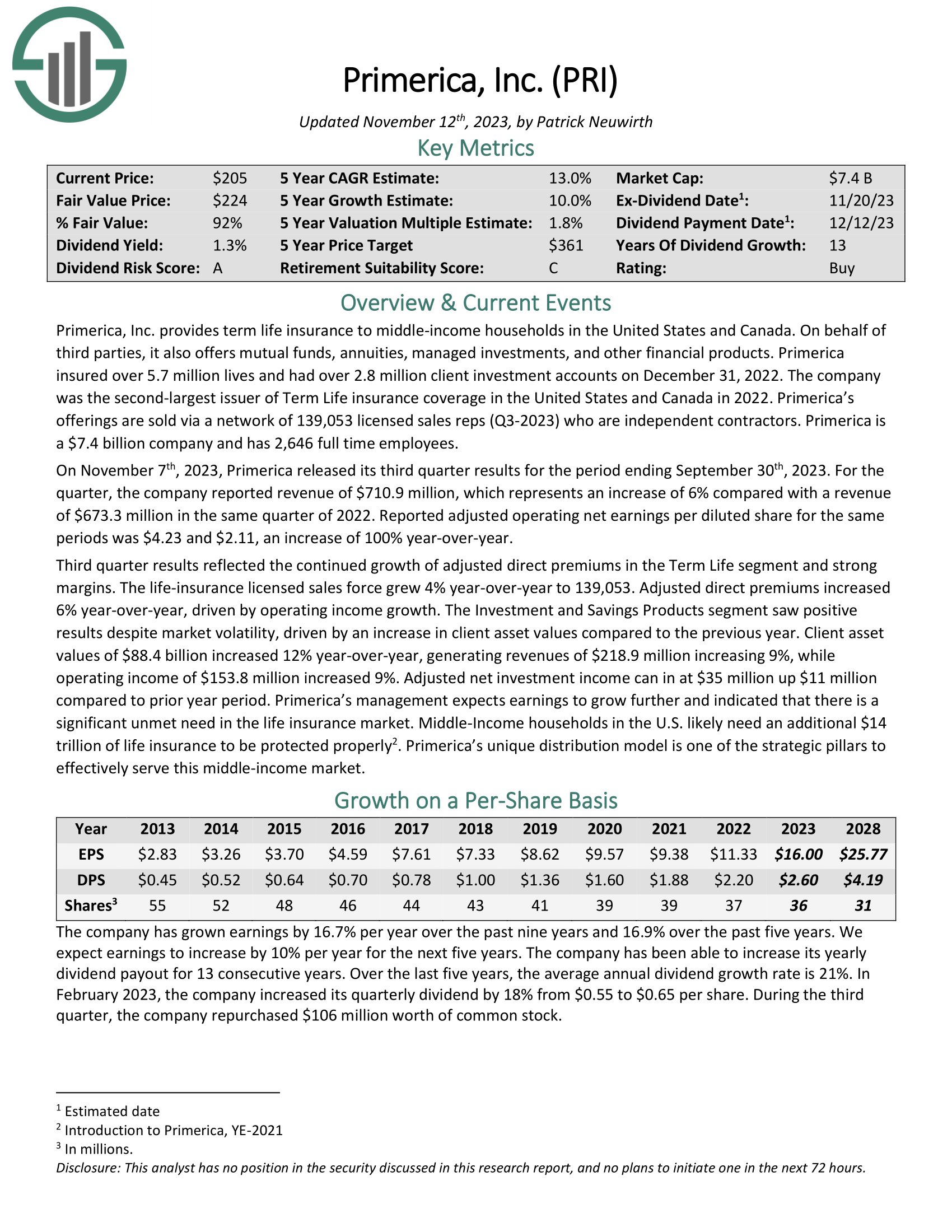

Most secure Dividend Inventory #5: Primerica Inc. (PRI)

Primerica, Inc. supplies time period life insurance coverage to middle-income households in america and Canada. On behalf of third events, it additionally provides mutual funds, annuities, managed investments, and different monetary merchandise. Primerica insured over 5.7 million lives and had over 2.8 million shopper funding accounts on December 31, 2022. The corporate was the second-largest issuer of Time period Life insurance coverage protection in america and Canada in 2022. Primerica’s choices are bought through a community of 139,053 licensed gross sales reps (Q3-2023) who’re impartial contractors.

On November seventh, 2023, Primerica launched its third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, the corporate reported income of $710.9 million, which represents a rise of 6% in contrast with a income of $673.3 million in the identical quarter of 2022. Reported adjusted working web earnings per diluted share for a similar durations was $4.23 and $2.11, a rise of 100% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on PRI (preview of web page 1 of three proven beneath):

Most secure Dividend Inventory #4: Deere & Co. (DE)

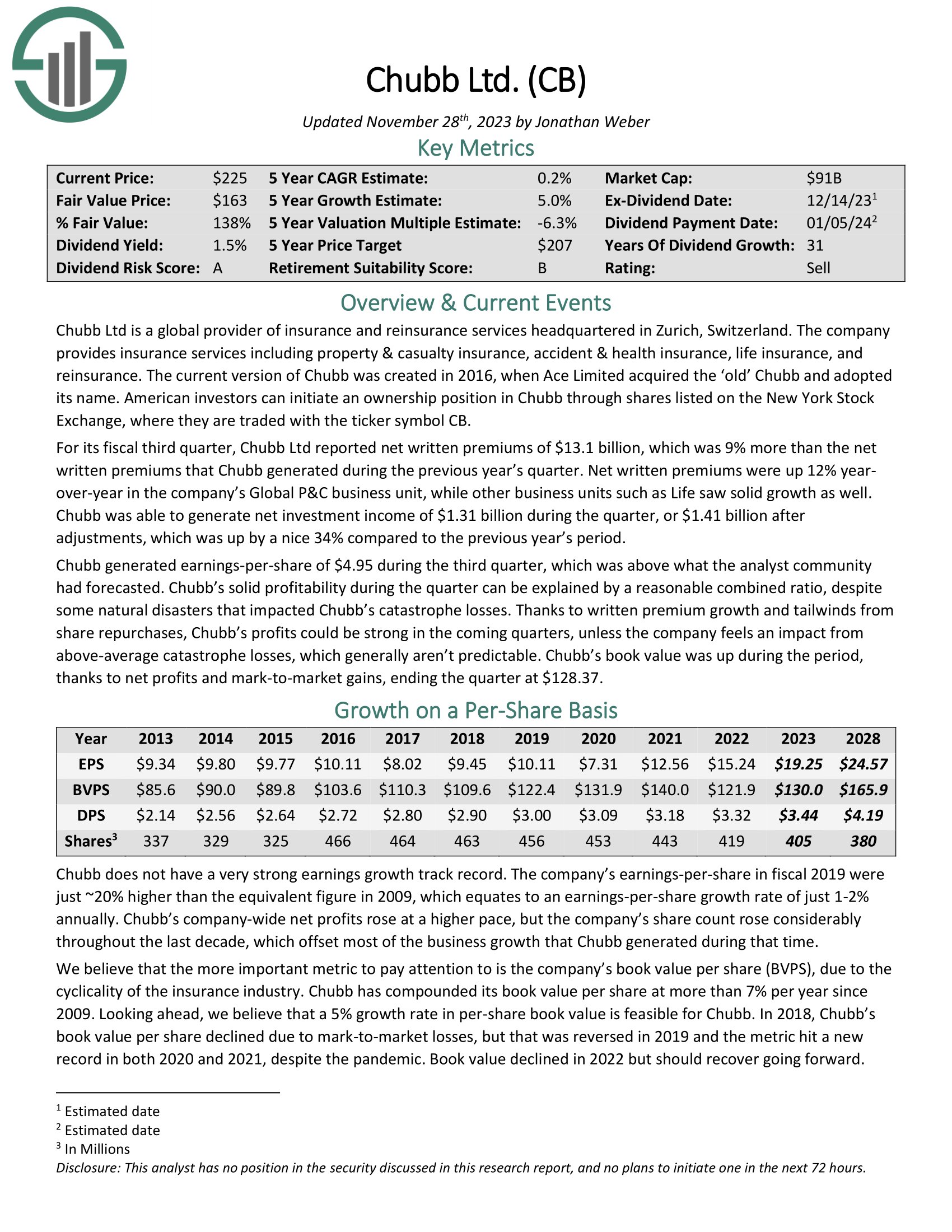

Chubb Ltd is a worldwide supplier of insurance coverage and reinsurance providers headquartered in Zurich, Switzerland. The corporate supplies insurance coverage providers together with property & casualty insurance coverage, accident & medical health insurance, life insurance coverage, and reinsurance.

For its fiscal third quarter, Chubb Ltd reported web written premiums of $13.1 billion, which was 9% greater than the online written premiums that Chubb generated throughout the earlier 12 months’s quarter. Web written premiums have been up 12% 12 months over-year within the firm’s International P&C enterprise unit, whereas different enterprise items akin to Life noticed stable progress as properly.

Chubb was capable of generate web funding revenue of $1.31 billion throughout the quarter, or $1.41 billion after changes, which was up by a pleasant 34% in comparison with the earlier 12 months’s interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on Chubb (preview of web page 1 of three proven beneath):

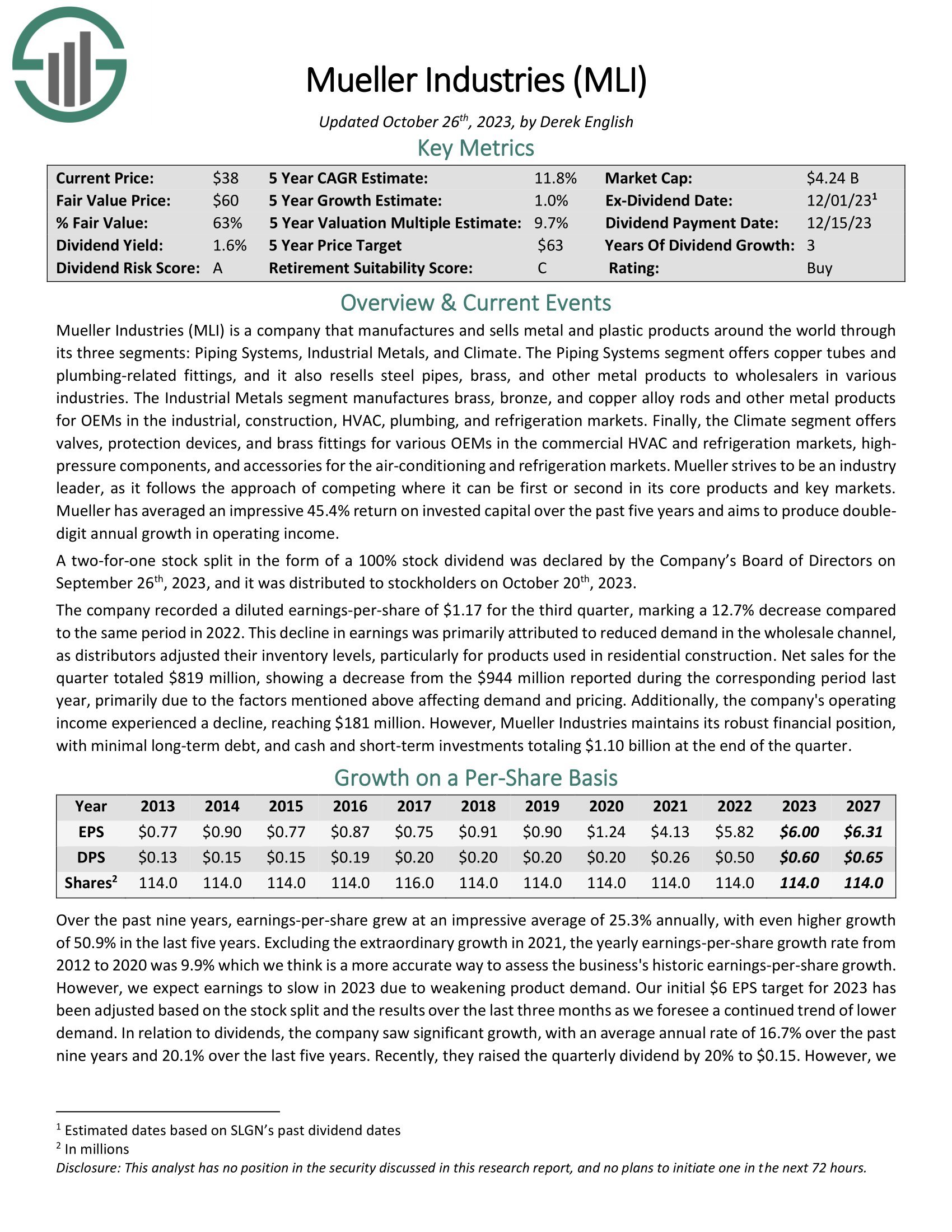

Most secure Dividend Inventory #3: Mueller Industries (MLI)

Mueller Industries is an organization that manufactures and sells metallic and plastic merchandise around the globe by its three segments: Piping Programs, Industrial Metals, and Local weather. The Piping Programs phase provides copper tubes and plumbing-related fittings, and it additionally resells metal pipes, brass, and different metallic merchandise to wholesalers in numerous industries.

The Industrial Metals phase manufactures brass, bronze, and copper alloy rods and different metallic merchandise for OEMs within the industrial, building, HVAC, plumbing, and refrigeration markets. Lastly, the Local weather phase provides valves, safety units, and brass fittings for numerous OEMs.

Click on right here to obtain our most up-to-date Certain Evaluation report on MLI (preview of web page 1 of three proven beneath):

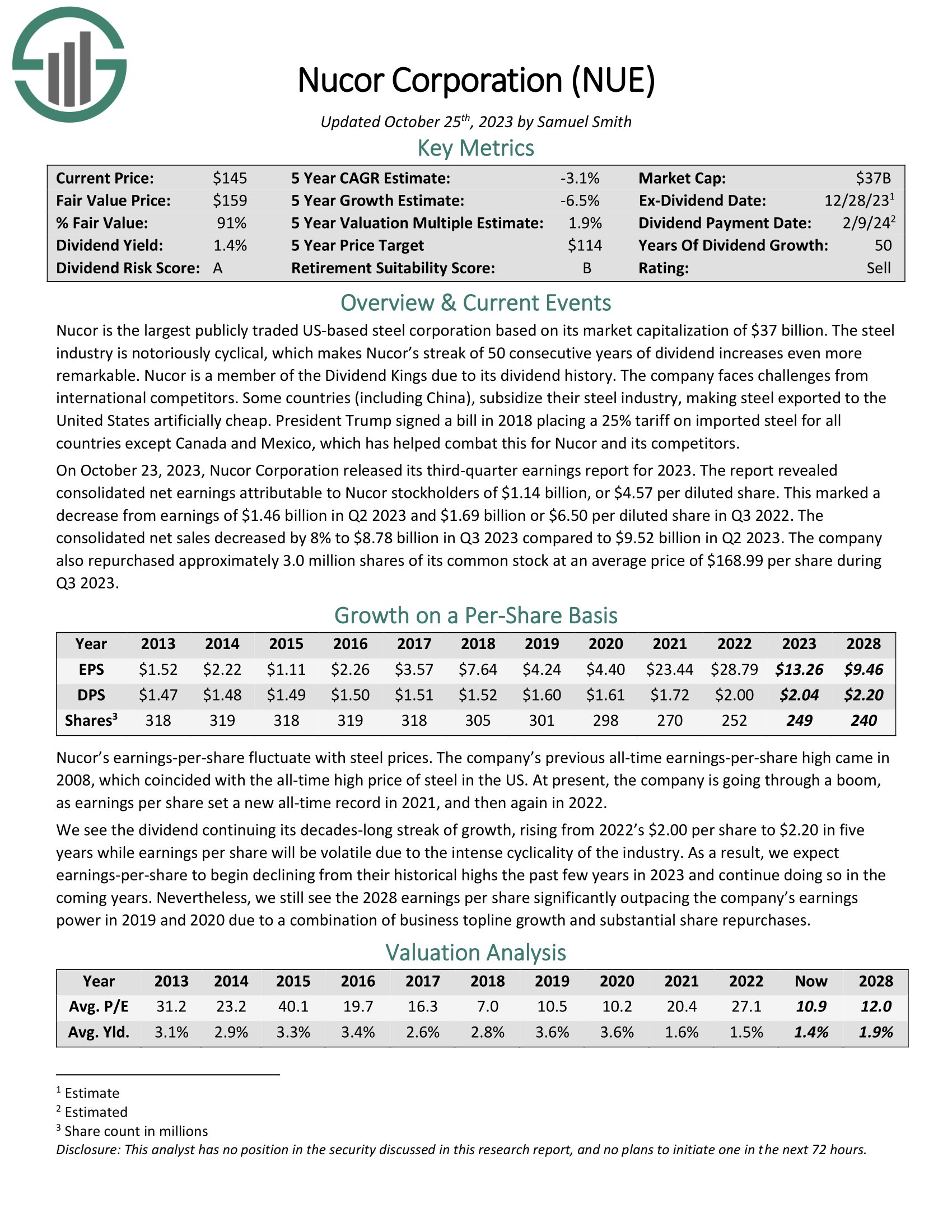

Most secure Dividend Inventory #2: Nucor Corp. (NUE)

Nucor is the biggest publicly traded US-based metal company. The metal business is notoriously cyclical, which makes Nucor’s streak of fifty consecutive years of dividend will increase much more exceptional.

On October 23, 2023, Nucor Company launched its third-quarter earnings report for 2023. The report revealed consolidated web earnings attributable to Nucor stockholders of $1.14 billion, or $4.57 per diluted share. This marked a lower from earnings of $1.46 billion in Q2 2023 and $1.69 billion or $6.50 per diluted share in Q3 2022. Consolidated web gross sales decreased by 8% to $8.78 billion.

The corporate additionally repurchased roughly 3.0 million shares of its widespread inventory at a mean worth of $168.99 per share throughout Q3 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on NUE (preview of web page 1 of three proven beneath):

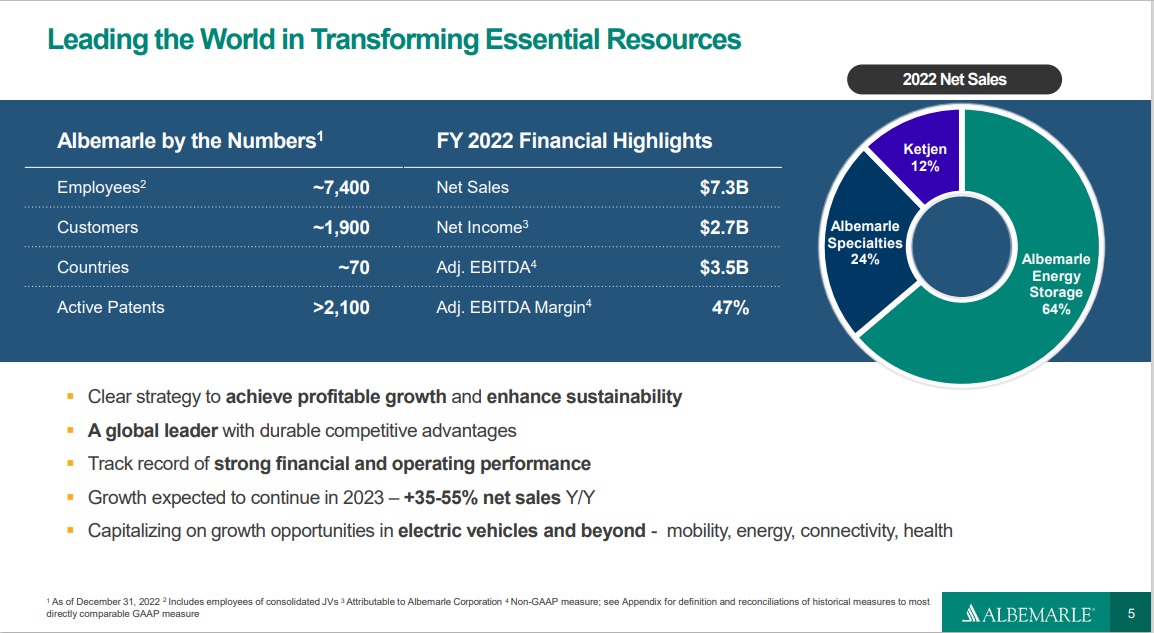

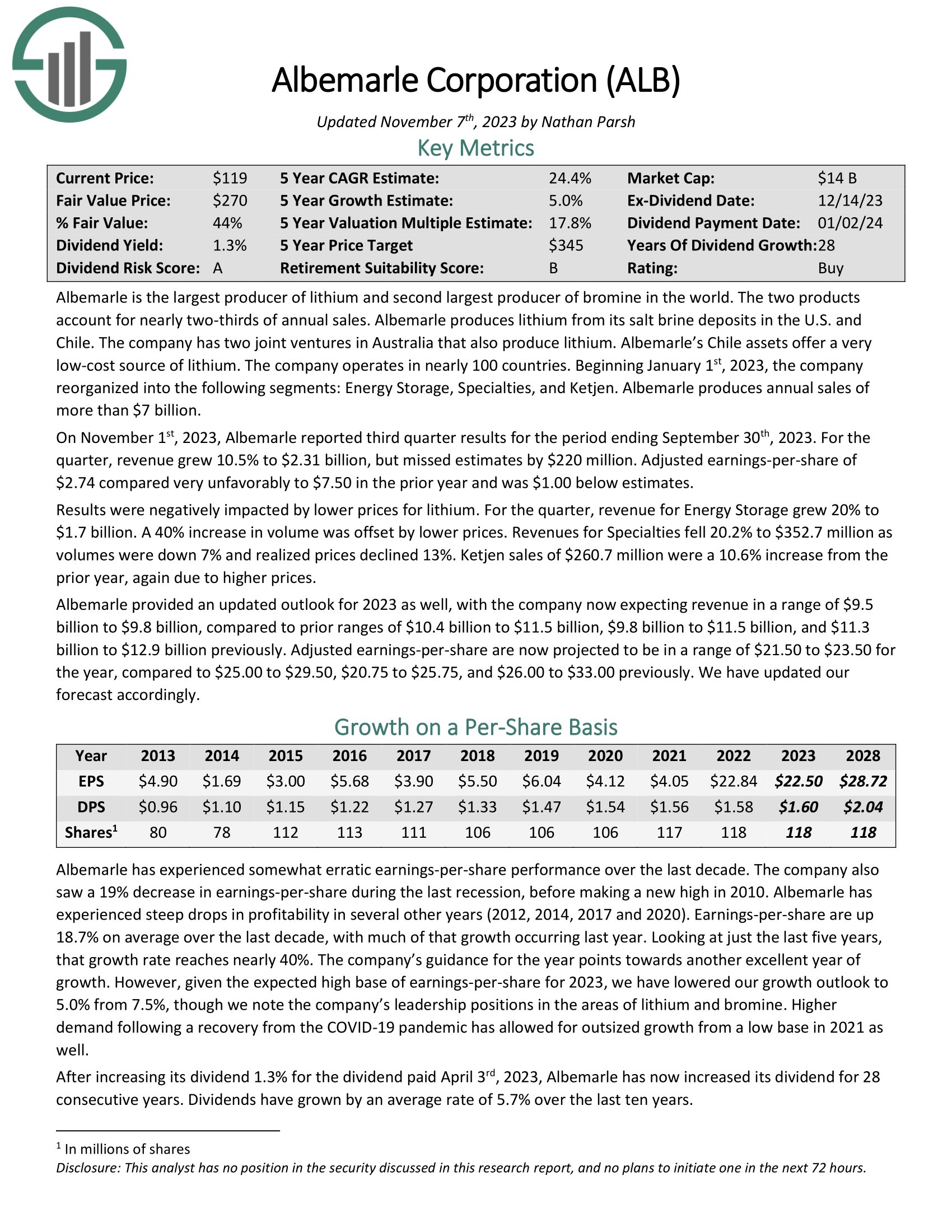

Most secure Dividend Inventory #1: Albemarle Corp. (ALB)

Albemarle is the biggest producer of lithium and second largest producer of bromine on the planet. The 2 merchandise account for almost two-thirds of annual gross sales. Albemarle produces lithium from its salt brine deposits within the U.S. and Chile. The corporate has two joint ventures in Australia that additionally produce lithium.

Associated: 2023 Lithium Shares Listing

Supply: Investor Presentation

On November 1st, 2023, Albemarle reported third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, income grew 10.5% to $2.31 billion, however missed estimates by $220 million. Adjusted earnings-per-share of $2.74 in contrast very unfavorably to $7.50 within the prior 12 months and was $1.00 beneath estimates.

Outcomes have been negatively impacted by decrease costs for lithium. For the quarter, income for Power Storage grew 20% to $1.7 billion. A 40% enhance in quantity was offset by decrease costs. Revenues for Specialties fell 20.2% to $352.7 million as volumes have been down 7% and realized costs declined 13%. Ketjen gross sales of $260.7 million have been a ten.6% enhance from the prior 12 months, once more attributable to larger costs.

Click on right here to obtain our most up-to-date Certain Evaluation report on Albemarle (preview of web page 1 of three proven beneath):

Extra Studying

Traders searching for extra dividend inventory concepts can discover extra studying beneath:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].