Rawf8

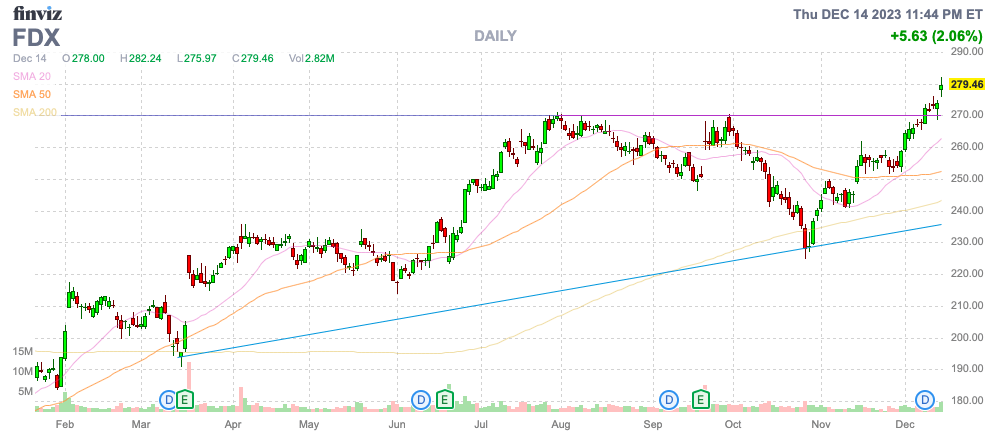

FedEx Company (NYSE:FDX) has come roaring again after a tough interval in 2022. As predicted over a yr in the past, the brand new CEO appeared to “kitchen sink” the forecasts, and now the worldwide transport firm is firing away heading into its fiscal Q2 2024 outcomes anticipated post-market on Tuesday, December nineteenth. My funding thesis stays Bullish on the inventory with the enterprise lastly heading again in the direction of development mode after eliminating substantial prices to enhance margins.

Supply: Finviz

Huge Week Forward

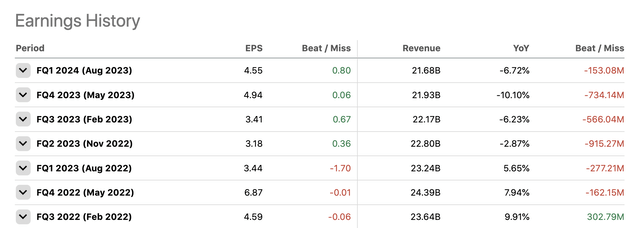

FedEx is ready to report November quarterly earnings after the market shut subsequent Tuesday. The bundle supply firm is predicted to report one other quarter of income slipping practically 2% to $22.4 billion, however the consensus estimates have EPS leaping 32% to $4.20.

The ironic half is that FedEx has missed consensus income estimates for the final 6 quarters. The inventory has positively traded unstable throughout the interval, however the pattern has been for the annual income declines to enhance with a shift again in the direction of development over the vacation interval pushing FedEx increased.

Supply: Searching for Alpha

Keep in mind, FedEx has rallied on the backs of continually lacking income targets. If the bundle supply firm lastly beats estimates, the inventory might have much more upside.

Our view turned optimistic on FedEx following the preliminary FQ1’23 report that brought about the inventory to droop. The corporate hasn’t overwhelmed income targets throughout this entire interval, but FedEx is already up over 70% throughout this era.

Whereas income development is essential to long-term positive factors, FedEx has turned the revenue image round. The corporate guided to adjusted EPS targets of as much as $18.50 for FY24.

The corporate has labored to structurally strip out $2 billion in working bills. For FQ1’24, FedEx boosted working margins to 7.3% from 5.3% whereas United Parcel Service, Inc. (UPS) reported an working margin of seven.7% for the same quarter and set a goal of 11% for the yr.

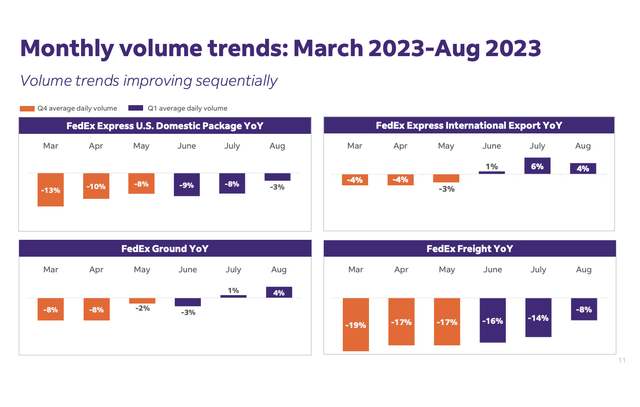

FedEx ended August with volumes enhancing dramatically after beginning in 2023 with large declines in all segments. The FedEx Floor and Specific Worldwide models have already turned volumes round to print development to the tip of the final quarter.

Supply: FedEx FQ1’24 presentation

Traders will wish to monitor this pattern. FedEx minimize the forecast for flat income metrics in FY24, and any indicators of enchancment right here will dramatically assist the inventory heading into 2024.

Nonetheless Low cost

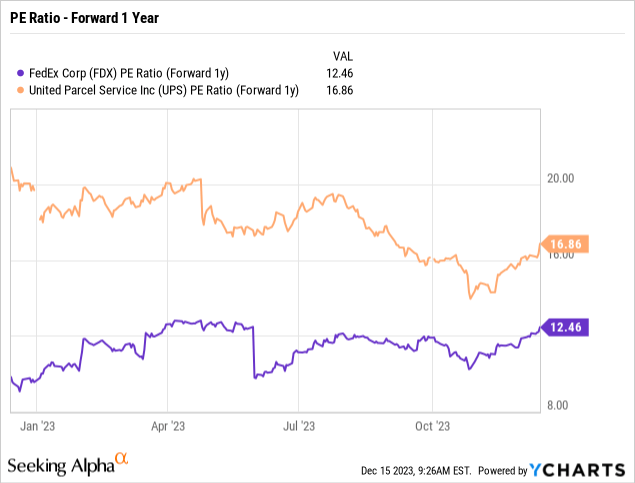

The loopy a part of the FedEx story is how low cost the inventory is, if the corporate can hit FY25 EPS targets. Because the bundle supply firm heads again in the direction of income development, income have the potential to soar again to earlier ranges, making the inventory nonetheless low cost regardless of leaping over $100 within the final yr.

The consensus EPS targets have FedEx producing a tremendous EPS enhance to $22.44 subsequent fiscal yr for 23% development. With the corporate having a current sample of beating EPS targets, the inventory might see one other EPS enhance.

The inventory solely trades at 12.5x FY25 EPS targets. By comparability, United Parcel Service, Inc. (UPS) trades at 16.9x EPS targets and has historically traded at even increased ahead P/E multiples.

The chance right here is for FedEx to considerably enhance income and develop the P/E a number of to lastly meet up with peer UPS. The 4-point a number of distinction on an earnings stream of $22 is an almost $90 distinction within the inventory value alone.

An enormous key to the funding story is the brand new CEO slicing out some extra prices by way of lowering Sunday deliveries, slicing pointless flights, and stripping out additional supply journeys. The corporate returning to development is a giant a part of the proof these value reductions aren’t costing FedEx with volumes in a trade-off.

The corporate plans to lift basic bundle supply charges by 5.9% in January. With enhancing volumes and the January charge hike, FedEx ought to lastly be again in development mode in FQ3.

Takeaway

The important thing investor takeaway is that FedEx Company ought to have one other huge step up in income and the inventory value forward. Traders ought to look ahead to enhancing tendencies in bundle volumes and margins to sign a capability for the inventory to shut the valuation hole with UPS. The inventory tends to dip following earnings with a pattern of income misses, however traders ought to clearly use such weak point to load up on FedEx, so long as the enhancing revenue image stays intact.