Up to date on December thirteenth, 2023 by Bob Ciura

The healthcare sector is a good place to search out high-quality dividend development shares. Look no additional than the listing of Dividend Aristocrats for proof of this.

The Dividend Aristocrats are a choose group of 64 shares within the S&P 500 Index with a minimum of 25 consecutive years of dividend will increase. There are at the moment 8 Dividend Aristocrats that come from the healthcare sector.

The healthcare sector has a long-term development catalyst going ahead, which is ageing populations all over the world. Healthcare spending in lots of developed international locations is more likely to develop over the long run consequently.

With this in thoughts, we’ve compiled a listing of over 200 healthcare shares (together with essential investing metrics like price-to-earnings ratios and dividend yields) which you’ll be able to obtain beneath:

It’s straightforward to see why healthcare shares make for wonderful long-term investments. The U.S. healthcare sector broadly enjoys excessive profitability with stable money flows. In any case, folks usually can not go with out well being care, even in difficult financial climates.

The rankings on this article are derived primarily from our anticipated complete return estimates for each healthcare dividend inventory discovered within the Certain Evaluation Analysis Database.

For traders occupied with high-quality dividend development shares, this text will focus on the highest 7 dividend-paying healthcare shares to purchase now.

Desk Of Contents

The seven finest healthcare shares are listed beneath so as of complete anticipated returns over the following 5 years, from lowest to highest. You possibly can immediately bounce to any particular person inventory evaluation by clicking on the hyperlinks beneath:

Well being Care Inventory #7: CVS Well being (CVS)

5-year anticipated annual returns: 14.1%

CVS Well being Company is an built-in healthcare companies supplier that operates a pharmaceutical companies enterprise, together with the nation’s largest chain of pharmacies. The corporate operates greater than 9,900 retail places, 1,100 medical clinics, and companies greater than 102 million plan members. CVS Well being Company generates annual revenues of about $323 billion.

On November 1st, CVS Well being Company reported third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, income elevated 10.6% to $89.8 billion, topping estimates by $1.63 billion. Adjusted earnings-per-share of $2.21 in comparison with $2.09 within the prior 12 months, and was $0.08 forward of expectations.

Click on right here to obtain our most up-to-date Certain Evaluation report on CVS (preview of web page 1 of three proven beneath):

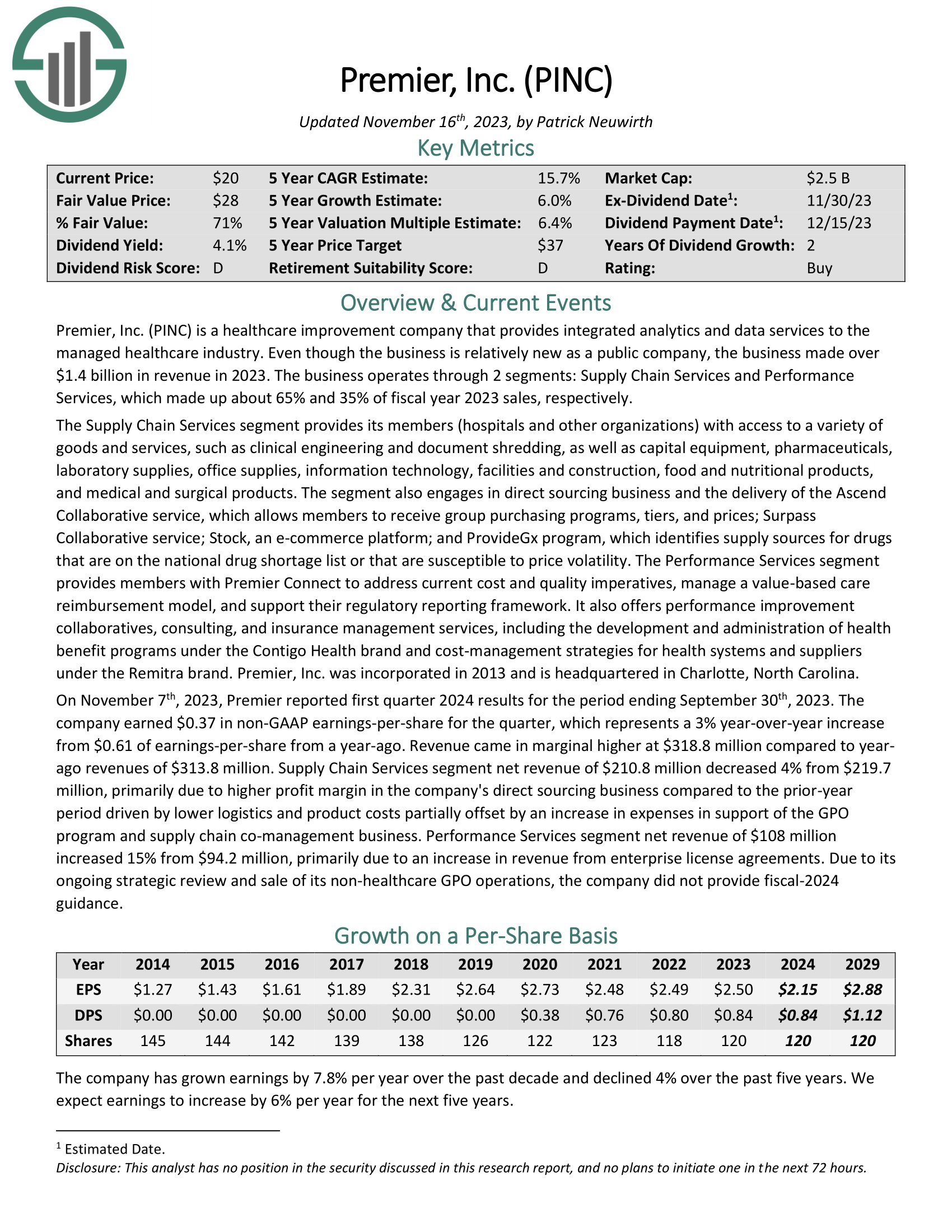

Well being Care Inventory #6: Premier, Inc. (PINC)

5-year anticipated annual returns: 14.5%

Premier, Inc. is a healthcare enchancment firm that gives built-in analytics and information companies to the managed healthcare business. The enterprise operates by way of 2 segments: Provide Chain Providers and Efficiency Providers, which made up about 65% and 35% of fiscal 12 months 2023 gross sales, respectively.

The Provide Chain Providers phase supplies its members (hospitals and different organizations) with entry to quite a lot of items and companies, akin to scientific engineering and doc shredding, in addition to capital gear, prescribed drugs, laboratory provides, and lots of extra.

The Efficiency Providers phase supplies members with Premier Join to deal with present value and high quality imperatives, handle a value-based care reimbursement mannequin, and help their regulatory reporting framework.

On November seventh, 2023, Premier reported first quarter 2024 outcomes for the interval ending September thirtieth, 2023. The corporate earned $0.37 in non-GAAP earnings-per-share for the quarter, which represents a 3% year-over-year enhance from $0.61 of earnings-per-share from a year-ago.

Click on right here to obtain our most up-to-date Certain Evaluation report on Premier (preview of web page 1 of three proven beneath):

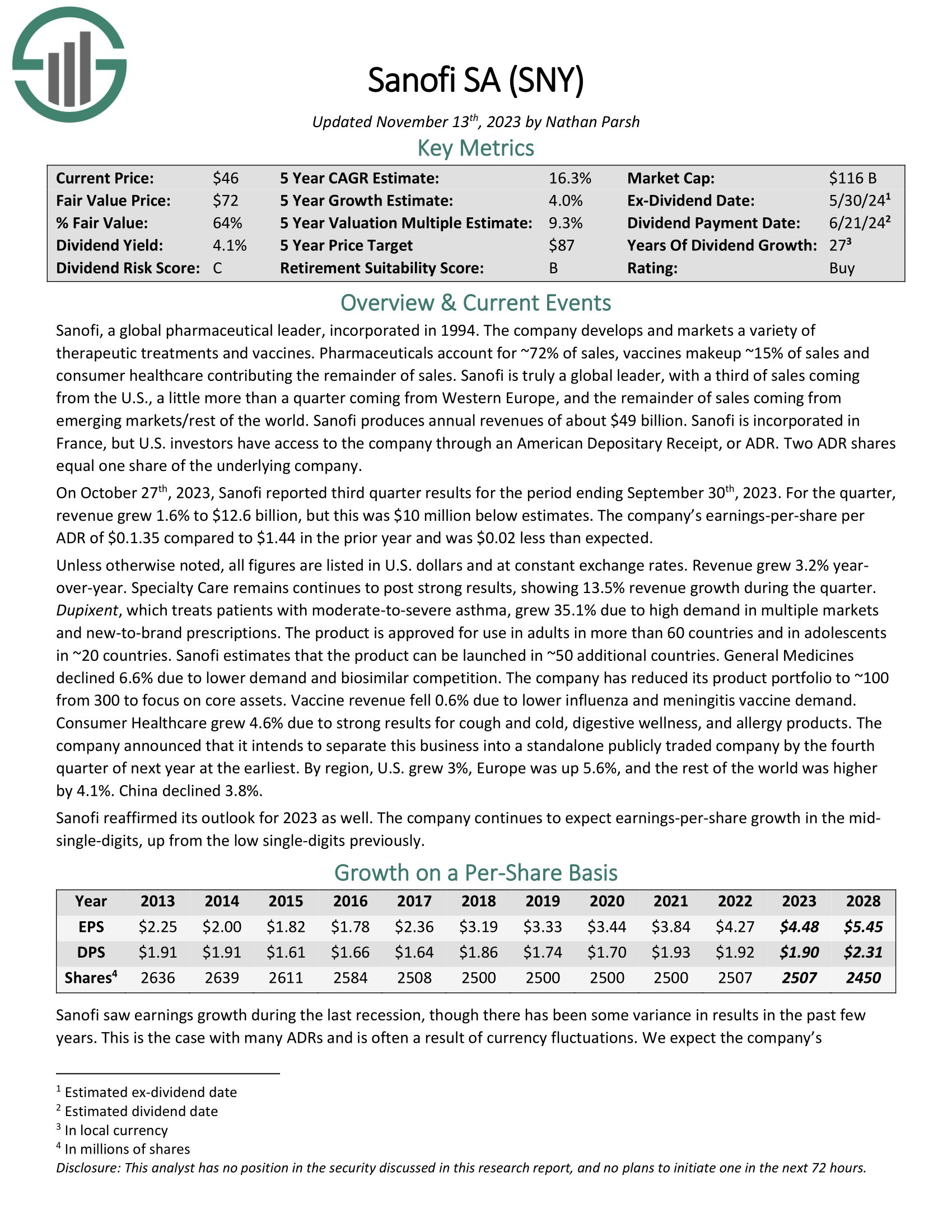

Well being Care Inventory #5: Sanofi SA (SNY)

5-year anticipated annual returns: 15.7%

Sanofi is a world pharmaceutical firm. The corporate develops and markets quite a lot of therapeutic therapies and vaccines.

On October twenty seventh, 2023, Sanofi reported third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, income grew 1.6% to $12.6 billion, however this was $10 million beneath estimates. The corporate’s earnings-per-share per ADR of $0.1.35 in comparison with $1.44 within the prior 12 months and was $0.02 lower than anticipated.

Click on right here to obtain our most up-to-date Certain Evaluation report on SNY (preview of web page 1 of three proven beneath):

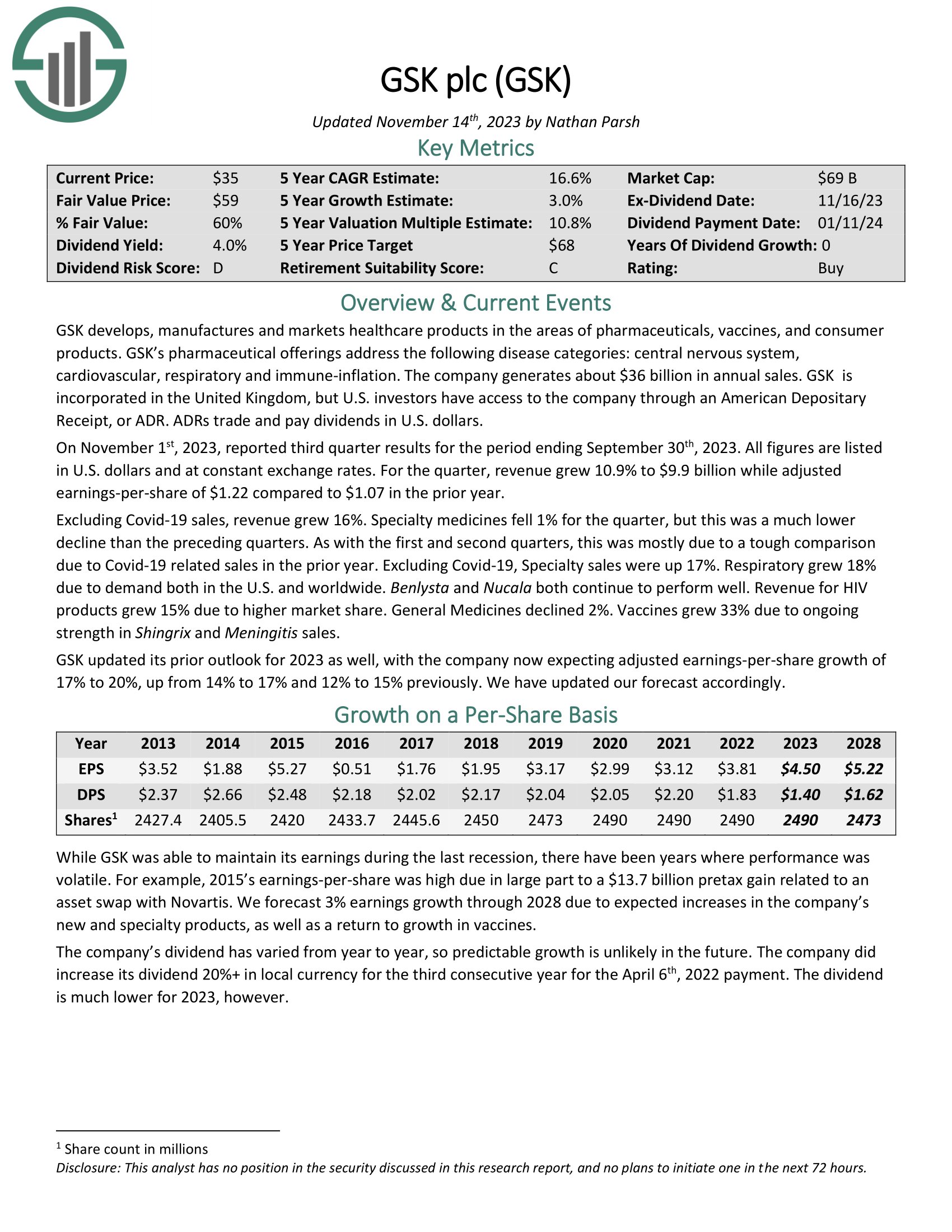

Well being Care Inventory #4: GlaxoSmithKline ADR (GSK)

5-year anticipated annual returns: 15.9%

GlaxoSmithKline develops, manufactures, and markets healthcare merchandise within the areas of prescribed drugs, vaccines, and shopper merchandise. GlaxoSmithKline’s pharmaceutical choices handle the next illness classes: central nervous system, cardiovascular, respiratory, and immune inflation. The corporate generates about $35 billion in annual gross sales.

On November 1st, 2023, reported third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, income grew 10.9% to $9.9 billion whereas adjusted earnings-per-share of $1.22 in comparison with $1.07 within the prior 12 months. Excluding Covid-19 gross sales, income grew 16%. Specialty medicines fell 1% for the quarter, however this was a a lot decrease decline than the previous quarters.

Click on right here to obtain our most up-to-date Certain Evaluation report on GlaxoSmithKline (preview of web page 1 of three proven beneath):

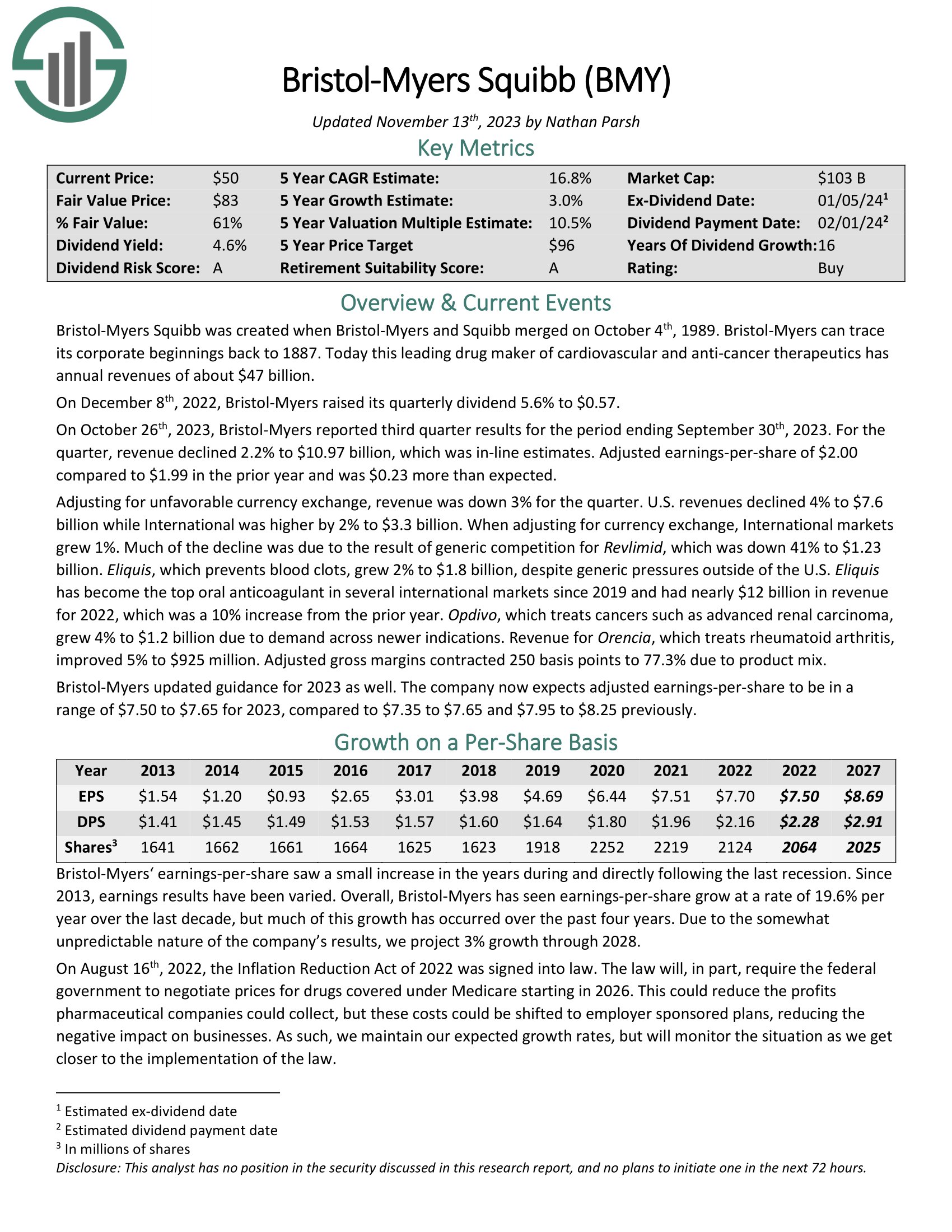

Well being Care Inventory #3: Bristol-Myers Squibb (BMY)

5-year anticipated annual returns: 16.8%

Bristol-Myers Squibb is a number one drug maker of cardiovascular and anti-cancer therapeutics with annual revenues of about $47 billion.

For the 2023 third quarter, income declined 2.2% to $10.97 billion, which was in-line estimates. Adjusted earnings-per-share of $2.00 in comparison with $1.99 within the prior 12 months and was $0.23 greater than anticipated.

Adjusting for unfavorable forex alternate, income was down 3% for the quarter. U.S. revenues declined 4% to $7.6 billion whereas Worldwide was larger by 2% to $3.3 billion. When adjusting for forex alternate, Worldwide markets grew 1%.

A lot of the decline was because of the results of generic competitors for Revlimid, which was down 41% to $1.23 billion. Eliquis, which prevents blood clots, grew 2% to $1.8 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on BMY (preview of web page 1 of three proven beneath):

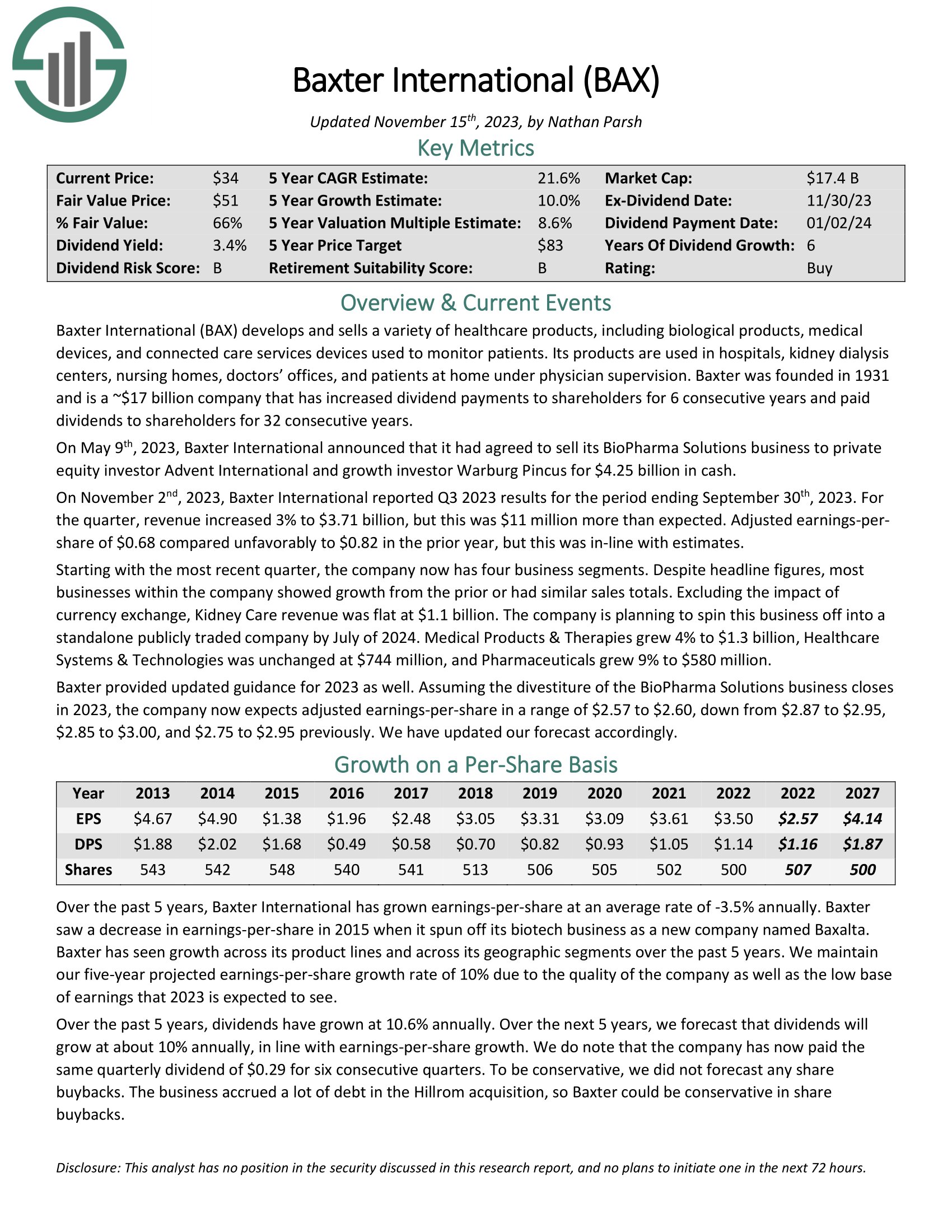

Well being Care Inventory #2: Baxter Worldwide (BAX)

5-year anticipated annual returns: 19.6%

Baxter Worldwide develops and sells numerous healthcare merchandise, together with organic merchandise, medical gadgets, and related care gadgets used to observe sufferers. Its merchandise are utilized in hospitals, kidney dialysis facilities, nursing houses, docs’ workplaces, and for sufferers at residence underneath doctor supervision.

On November 2nd, 2023, Baxter Worldwide reported Q3 2023 outcomes for the interval ending September thirtieth, 2023. For the quarter, income elevated 3% to $3.71 billion, however this was $11 million greater than anticipated. Adjusted earnings per-share of $0.68 in contrast unfavorably to $0.82 within the prior 12 months, however this was in-line with estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on Baxter (preview of web page 1 of three proven beneath):

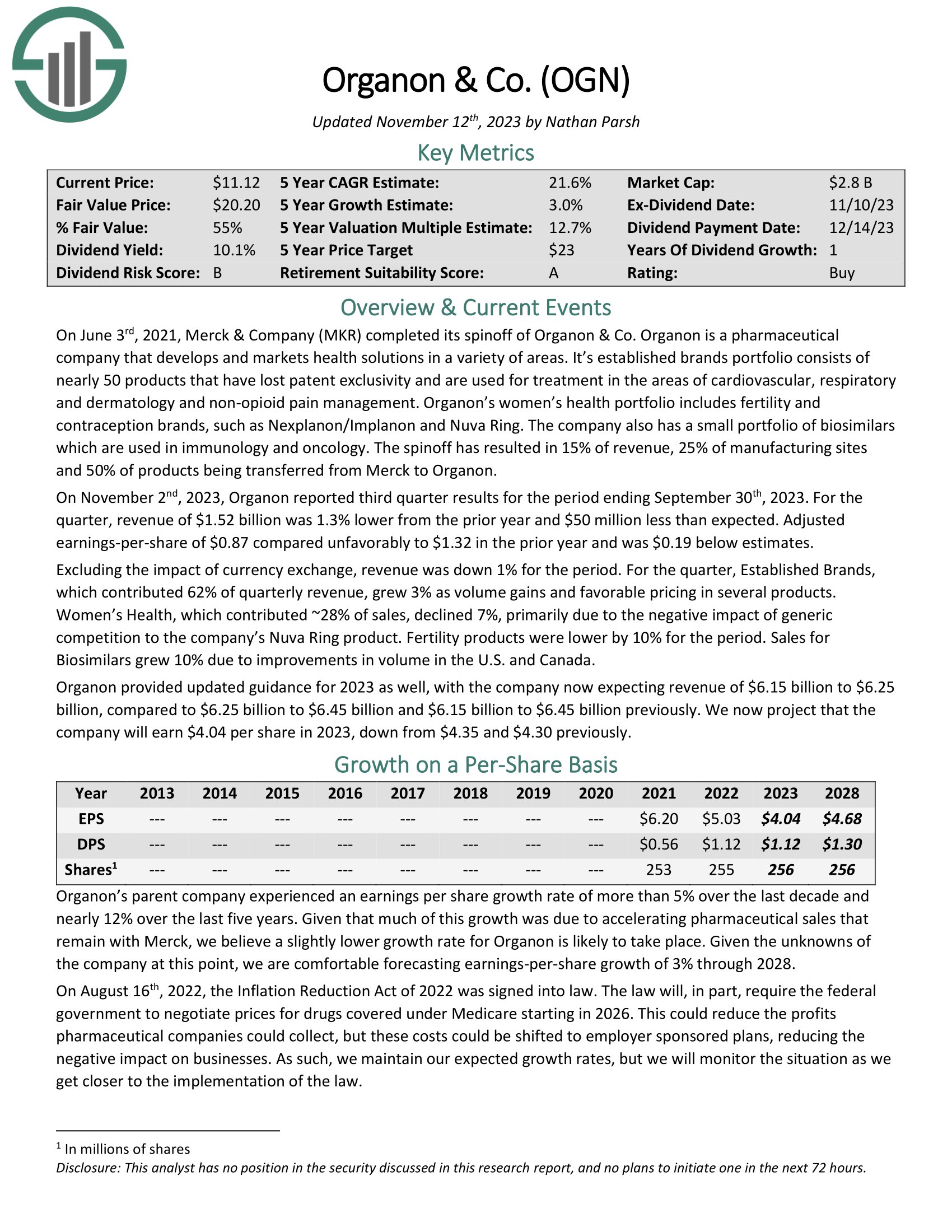

Well being Care Inventory #1: Organon (OGN)

5-year anticipated annual returns: 20.7%

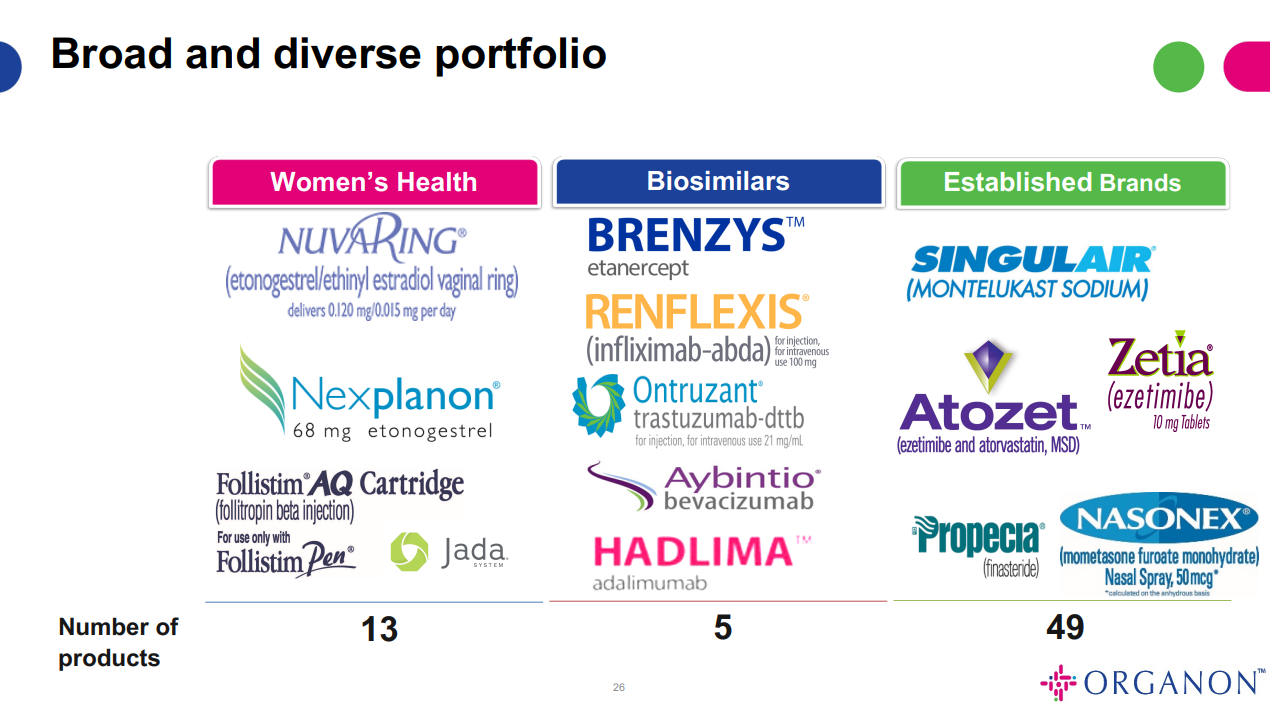

Organon is a healthcare firm that develops and delivers well being options by way of a portfolio of prescription therapies globally. The corporate focuses on girls’s well being by way of an extended listing of merchandise that deal with numerous indications.

Supply: Investor presentation

Organon was spun out of pharmaceutical large Merck (MRK) in the summertime of 2021.

On November 2nd, 2023, Organon reported third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, income of $1.52 billion was 1.3% decrease from the prior 12 months and $50 million lower than anticipated. Adjusted earnings-per-share of $0.87 in contrast unfavorably to $1.32 within the prior 12 months and was $0.19 beneath estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on Organon (preview of web page 1 of three proven beneath):

Ultimate Ideas

There are many high quality dividend shares to be discovered within the healthcare sector. Many massive healthcare corporations are extremely worthwhile, with long-term development up forward as a consequence of ageing populations.

Shareholders of many healthcare shares are more likely to obtain dividend will increase annually. These seven healthcare shares pay dividends to shareholders and are virtually all moderately valued, resulting in excessive anticipated returns over the following 5 years.

Different Studying

The Dividend Aristocrats listing just isn’t the one approach to shortly display screen for shares that frequently pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].