Ingenious Buddy

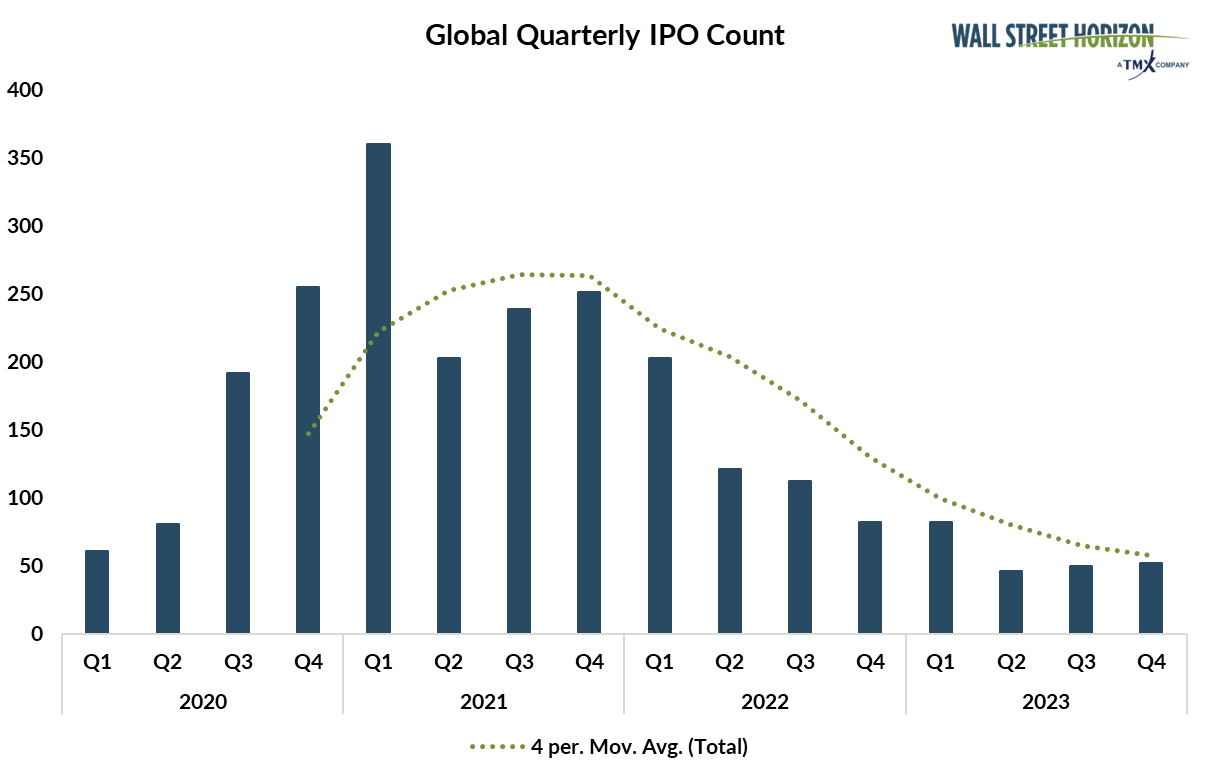

The worldwide IPO market continues to run chilly. The ultimate quarter of 2023 paces to be the softest This fall IPO rely since 2019 whereas the 4-quarter transferring common of recent choices retains on sagging, in accordance with Wall Road Horizon knowledge.

Regardless of a number of noteworthy IPOs in the course of the 12 months, general efficiency for these newcomers has been lackluster.

Then two Q3 headliners, Arm (ARM) and Instacart (CART), did not stay as much as the hype, with each shares experiencing vital drops from their preliminary highs.

Whereas Arm has managed to rally and retest its year-to-date peak, Instacart’s inventory efficiency stays weak.

Closing the Door on a Disappointing 12 months for IPOs

Supply: Wall Road Horizon

Robust Macro Circumstances for IPO Candidates

Closing the chapter on a lackluster 12 months for newly public shares, weak and unstable worth motion amongst vital IPOs in 2023 has possible made different rising personal corporations hesitant to enter the general public enviornment.

Tighter capital market circumstances, together with increased rates of interest in comparison with the IPO growth of 2020 and 2021, contribute to the difficult setting.

Optimists can level to the steep decline in yields since mid-October, nevertheless it stays to be seen whether or not that near-term macro development will heat the IPO market and Wall Road dealmaking.

Occasion Danger: IPO Lock-Up Expiration Dates

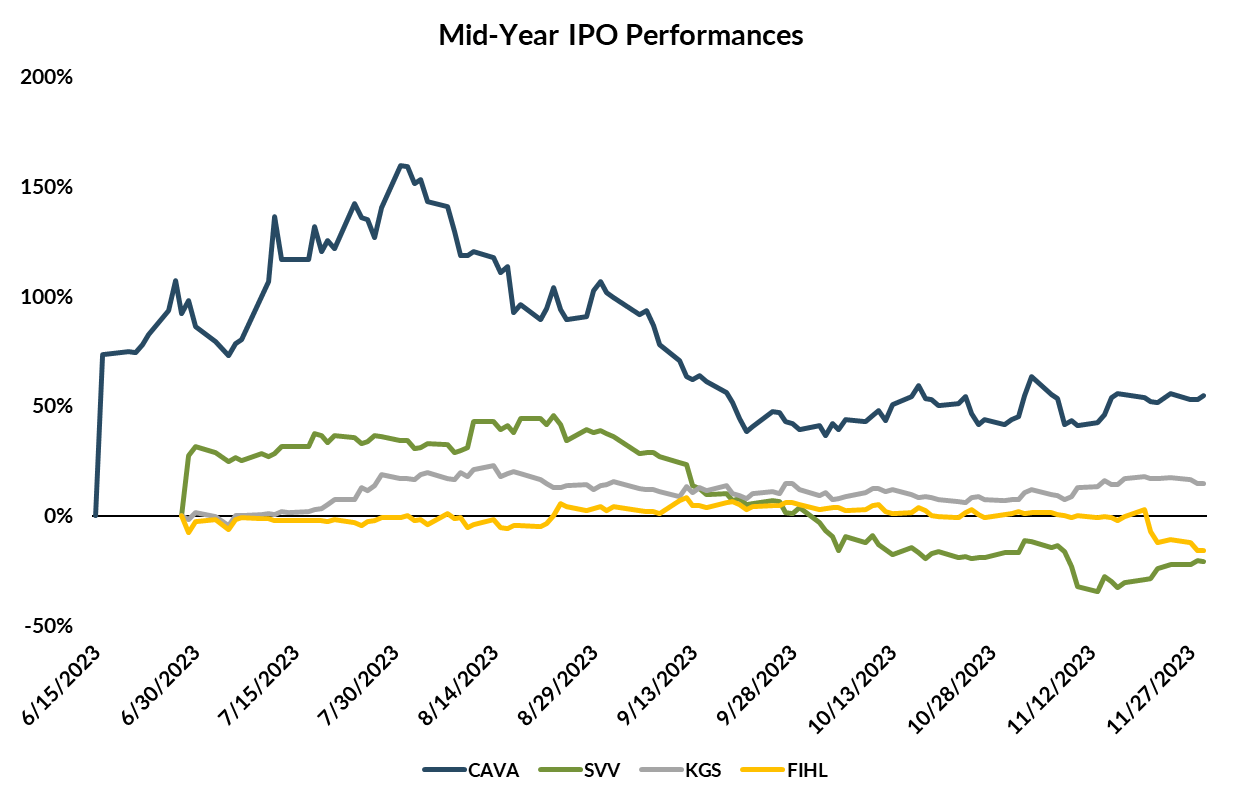

Again in July, we profiled a handful of corporations that went public amid excessive rate of interest volatility and shaky credit score markets.

The six-month mark is necessary within the lifetime of an IPO inventory since that is usually when a lock-up expiration date hits.

Traders ought to acknowledge the chance that insiders may promote shares, growing the provision in the marketplace, probably resulting in a decrease inventory worth.

CAVA Group (CAVA) faces a lock-up expiration on Monday, December 11. The proprietor and operator of fast-casual Mediterranean-style eating places issued a robust EPS beat in its November earnings report, although shares fell 7.7% the next buying and selling day, in accordance with Choice Analysis & Expertise Companies (ORATS).

Down 20% from its IPO-day closing worth, CAVA presents a conundrum for one more fast-casual chain that’s suspected by some market pundits to be a 2024 IPO candidate: Panera.

The once-public Client Discretionary inventory was taken personal in 2017 by a European funding agency in a $7.16 billion transaction.1

CAVA shares may additionally face volatility this week as its administration crew is slated to current on the Morgan Stanley Client and Retail Convention in New York on Tuesday and Wednesday.

The following necessary lock-up expiration occasion is on December 25, so Tuesday, December 26, will likely be a key date for buyers to handle danger among the many different three mid-2023 IPO shares described beneath.

Small-Firm IPOs Wrestle

First, Savers Worth Village (SVV), a $2.3 billion market cap Broadline Retail business agency, has been beneath intense strain after peaking above $26 in August.

Shares fell on excessive quantity after it final reported earnings outcomes. In November, SVV’s CEO commented on a “robust quarter” and the administration crew introduced a brand new share repurchase authorization, which maybe helped buoy shares after notching a low beneath $12 in the course of the center of final month.2

Subsequent, Kodiak Fuel Companies (KGS) has held up nicely since its IPO date in June, although the inventory stays nicely off its August peak. Shares are up greater than 10% from the IPO-date closing worth with increased oil and gasoline costs offering a tailwind by Q3.

Amidst a downturn in world energy-commodity markets within the final two months, the oil and gasoline gear and companies inventory has outperformed the Power sector since September. We’ll discover out if the lock-up expiration later this month disrupts the first rate relative development.

Lastly, Fidelis Insurance coverage Holdings (FIHL), a $1.4 billion market cap property and casualty insurer inside the Financials sector had been performing nicely for stockholders earlier than its November 20 third-quarter 2023 earnings report.

Misses on the highest and backside traces have been possible the culprits3 – FIHL plunged from above $14 earlier than the report back to beneath $12 by late November. The inventory is now 15% beneath its $14 IPO worth.

2023 IPO Shares Off the Highs

Supply: Wall Road Horizon with TMX Cash historic pricing

Higher Days on the Horizon?

Trying forward, current IPO buzz has targeted on the Chinese language trend firm Shein. Reuters stories that the agency confidentially filed to go public within the U.S. with Goldman Sachs, JPMorgan Chase, and Morgan Stanley as lead underwriters.4

The IPO measurement could possibly be north of $60 billion, however controversy surrounds Shein given labor rights points, racketeering, accusations of mental property theft, and security issues.5

Larger image, current IPOs within the client and tech areas have disenchanted buyers. Birkenstock (BIRK), Instacart, and Arm Holdings have all fallen beneath their respective IPO costs in current weeks.

Elsewhere, Reddit and Kim Kardashian’s Skims are two corporations bantered about as 2024 IPO candidates. Additionally, Rubrik, a startup financed by Microsoft (MSFT), may go public early subsequent 12 months.6

Lastly, any rebound within the Chinese language market may lead to a slew of corporations from the world’s second-largest financial system serving to to revive world IPO exercise.

The Backside Line

The 2023 IPO window shuttered following weak debuts from a number of big-name corporations in September and October. There could also be trepidation later this month when 4 mid-year IPO shares face lock-up expiration dates.

Hope abounds for 2024, although, as a number of multibillion-dollar enterprises throughout sectors and geographies may enterprise into IPO waters.

1 Unique: Panera Laying Off 17% of Company Workers as It Eyes IPO The Wall Road Journal, Heather Haddon, November 1, 2023

2 Savers Worth Village, Inc. Studies Third Quarter Monetary Outcomes, Savers Worth Village, Inc., November 9, 2023

3 As in comparison with FactSet knowledge.

4 China’s Shein recordsdata for US IPO in main check for investor urge for food – sources, Reuters, Kane Wu, Anirban Sen, November 28, 2023

5 America cannot resist quick trend. Shein, with all its points, is tailor-made for it, NPR, Alina Selyukh, October 13, 2023

6 Reddit Leads Class of 2024 IPO Candidates Testing the Water, Bloomberg, Amy Or, Ryan Gould, Katie Roof, Gillian Tan, November 27, 2023

Authentic Put up