Vladimir Zakharov

Abstract

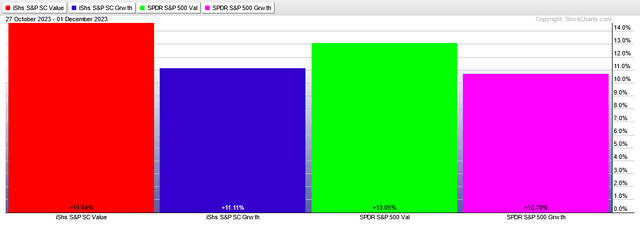

For the reason that uptrend resumed on 10/27, small-cap worth IJS gained 14.64%, higher than large-cap development SPYG, which gained 10.70%. There’s a chief rotation from development to worth and from large-cap to small-cap. We imagine that the present financial and market situations are favorable for investing in IJS.

IJS – iShares S&P Small-Cap 600 Worth ETF

Fund Particulars

Fund Kind U.S. Fairness

Issuer iShares

Inception 07/24/2000

Expense Ratio 0.18%

AUM $6.55B

# of Holdings 474

*Holdings as of 2023-11-29

The fund invests in small-capitalization shares with comparatively decrease valuations.

As of December 1, 2023, the iShares S&P Small-Cap 600 Worth ETF (NYSEARCA: IJS) has web property of 6.55B and 1.60% yield. The YTD complete return is 4.51%, with an expense ratio of 0.18%.

The holdings are concentrated within the following sectors: Monetary Providers 15.82%, Industrials 15.14%, Shopper Discretionary 20.56%, Actual Property 14.59%, Know-how 10.20%, Healthcare 7.76%, Power 3.94% and Fundamental Supplies 3.69%. Shopper Staples, Utilities, and Communication Providers all collectively contribute below 10%.

The holdings are well-distributed over numerous shares (474 as of 11/29/2023). The ten largest holdings maintain solely 8.30% of complete property.

Funding Thesis

I fee IJS as a BUY, with the expectation of wholesome beneficial properties over the following couple of months.

There are a variety of things that help the thesis.

On the elemental facet, the current lower in Treasury bond rates of interest creates a positive enterprise atmosphere for small-cap shares.

On the technical facet, IJS made a robust development reversal on the finish of October. Since then, the fund has been in a sustained uptrend.

The market sentiment has switched from development to worth and from massive to small-cap shares. The small-cap shares didn’t take part within the inventory market rally during the last twelve months. The present value reversal is a part of a “reversion to the imply” course of.

The intermarket evaluation is supporting a broad inventory market rally for the rest of this 12 months. All 4 threat indicators utilized in my AMI service are flashing risk-ON.

Worth Motion

IJS lagged badly over most of 2023. Its complete return of 4.50% versus a return of 21.38% for SPY is a results of market’s lack of breadth, many of the beneficial properties had been made by large-cap development shares.

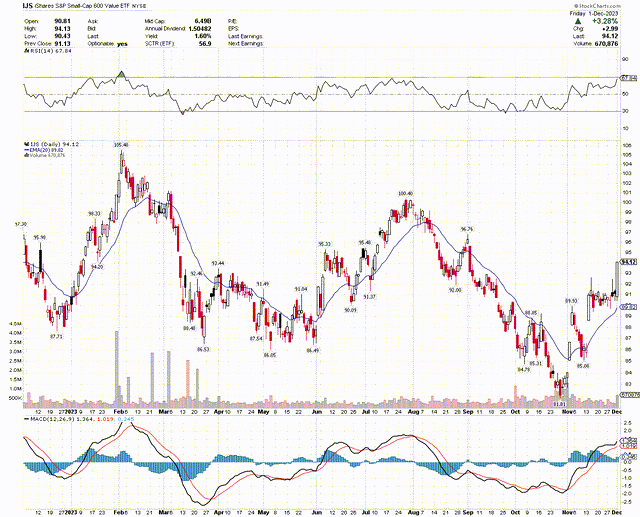

The chart beneath exhibits the worth motion during the last twelve months. It’s apparent that for the reason that finish of October, IJS has been in a robust uptrend.

StockCharts.com

As an extra illustration, the following determine exhibits the entire returns of 4 ETFs. We see that small-cap worth has taken the highest place for the reason that market reversal. Massive-cap development is on the backside now, though all are making first rate beneficial properties.

StockCharts.com

Market State

To find out the state of the market we compute the distinction in complete returns of the next 4 ETF pairs: (DBB, UUP), (XLI, XLU), (SLV, GLD) and (XLC, XLV) over an analysis interval. The analysis interval is variable. It’s a operate of market volatility.

At the moment, the analysis interval is 78 buying and selling days and all of the pairs point out risk-on.

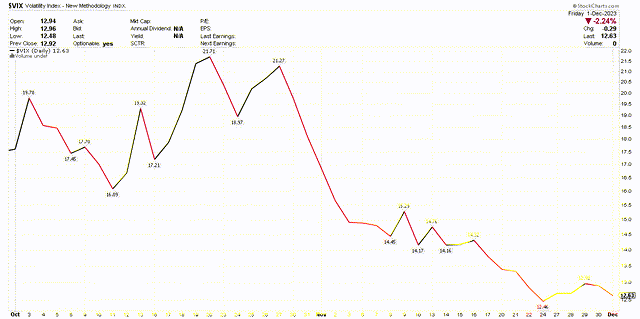

Moreover, I watched the conduct of the market implied volatility. The determine beneath exhibits the volatility degree during the last two months. In the course of the month of October, VIX oscillated between 16 and 22. In November VIX declined steadily, reaching a low degree below 13.

StockCharts.com

Conclusions

The indications counsel that the markets are in a risk-on state and that small-value shares outperform. Due to this fact, we imagine that now is an effective time to spend money on worth funds and IJS is an effective selection among the many small-cap ETFs.

I fee IJS a BUY.