Up to date on November twenty seventh, 2023

The Dividend Kings are a selective group of shares which have elevated their dividends for a minimum of 50 years in a row. We consider the Dividend Kings are among the many highest-quality dividend development shares to purchase and maintain for the long run.

With this in thoughts, we created a full checklist of all of the Dividend Kings. You may obtain the total checklist, together with essential monetary metrics similar to dividend yields and price-to-earnings ratios, by clicking the hyperlink beneath:

Walmart Inc. (WMT) is a Dividend King, and an American retail large.

Again in 1974, Walmart paid its preliminary dividend of $0.05 per share, which has been raised yearly since for 50 consecutive years, making it a Dividend King. In current instances, varied retailers have confronted challenges resulting from competitors from web retail, spearheaded by Amazon (AMZN).

However, Walmart has demonstrated its capability to thrive in a quickly altering atmosphere by adapting. The corporate has made substantial investments in its e-commerce platform. Not like many different retailers, Walmart has proven it could compete with Amazon.

This text will talk about the corporate’s enterprise overview, development prospects, aggressive benefits, and anticipated returns.

Enterprise Overview

In 1945, Sam Walton opened his first low cost retailer which served as the start line for what later turned often known as Walmart. Since then, Walmart has expanded to change into the world’s largest retailer, catering to over 230 million clients each week. The corporate’s income exceeded $600 billion in 2022 and its market capitalization is roughly $4201 billion.

As some of the outstanding employers globally, Walmart has a workforce of about 2.3 million folks.

Supply: Investor Presentation

Walmart has additionally expanded into quite a lot of completely different providers, making it a real conglomerate. The Walmart U.S. section consists of retail shops in all 50 U.S. states, Washington D.C., and Puerto Rico. It additionally consists of Walmart’s digital enterprise. Walmart Worldwide consists of operations in 25 nations outdoors of the U.S.

Lastly, Sam’s Membership consists of membership-only warehouse golf equipment and operates in 48 states within the U.S. and in Puerto Rico.

Development Prospects

Walmart posted third quarter earnings on November sixteenth, 2023, and outcomes had been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to $1.53, which was a penny forward of estimates. Income was up 5.2% year-over-year to $160.8 billion, and was $2.26 billion higher than anticipated.

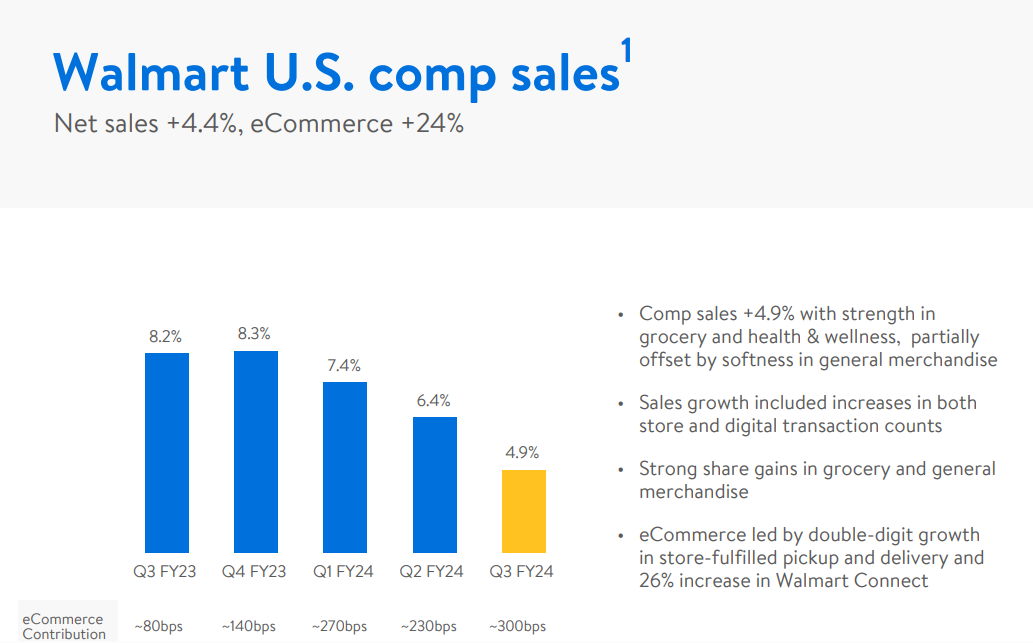

US comparable gross sales had been up 4.9% year-over-year, which was 150bps higher than anticipated.

Supply: Investor Presentation

Transactions rose 3.4%, whereas common ticket rose 1.5%. E-commerce contribution to comparable gross sales was down 300bps.

Gross margins had been up fractionally, rising 32bps. Consolidated working bills as a share of gross sales rose 37bps, offsetting the rise in gross margins. Working earnings was up 3% year-over-year on an adjusted foundation. Walmart ended the quarter with web money of $12.2 billion, and whole debt of $55.4 billion.

Free money stream was $4.3 billion, up from $3.6 billion a yr in the past. Now we have up to date our estimate to $6.50 in earnings-per-share after Q3 outcomes. We at present forecast Walmart to develop its earnings-per-share by 8% per yr over the following 5 years.

Aggressive Benefits & Recession Efficiency

Walmart’s major aggressive benefit is its in depth scale, enabling it to take care of low transportation prices and excessive distribution efficiencies. Consequently, the corporate can move on these financial savings to clients by inexpensive costs, contributing to its on a regular basis low costs technique.

Promoting is one other power of Walmart that helps keep its model recognition. The corporate’s huge monetary sources permit it to take a position billions of {dollars} annually in promoting.

Furthermore, Walmart’s aggressive benefit ensures constant profitability, even throughout financial recessions. The corporate carried out remarkably properly through the Nice Recession, highlighting the resilience of its enterprise mannequin.

It steadily grew earnings-per-share annually in that point:

2007 earnings-per-share of $3.16

2008 earnings-per-share of $3.42 (8.2% improve)

2009 earnings-per-share of $3.66 (7% improve)

2010 earnings-per-share of $4.07 (11% improve)

Regardless of the financial recession being some of the extreme in many years, Walmart’s efficiency was commendable. The corporate managed to ship strong outcomes even through the coronavirus pandemic that led to a recession within the U.S.

Walmart’s development trajectory signifies that the corporate might probably achieve from recessions. As a retail chief providing low-cost merchandise, Walmart could expertise a surge in site visitors throughout financial downturns, as customers cut back from pricier retailers.

Valuation & Anticipated Whole Returns

Walmart shares at present commerce at a value of ~$157. Utilizing our earnings-per-share estimate of $6.50 for the present fiscal yr, the inventory has a price-to-earnings ratio of 24.1x. That is barely above out truthful worth estimate P/E ratio of 21x. Traders also needs to observe that retailers have sometimes not held P/E multiples above 20.

If the valuation a number of had been to revert to our truthful worth estimate within the subsequent 5 years, the corporate’s whole returns would see annual returns decline by 2.7% per yr. Walmart shares have carried out properly for an prolonged interval. Whereas this has rewarded shareholders with robust returns, we view Walmart as a barely overvalued inventory proper now.

Except for modifications within the P/E a number of, Walmart also needs to generate returns from earnings development and dividends. A projection of anticipated returns is beneath:

8.0% earnings-per-share development

1.4% dividend yield

-2.7% a number of reversion

On this situation, Walmart is projected to generate a complete return of 6.7% per yr over the following 5 years.

Ultimate Ideas

Whereas many retailers have struggled with adapting to the change in commerce buying habits, Walmart has made the right strategic investments. The corporate’s spectacular e-commerce development is reflective of this view.

The corporate has carried out properly by producing roughly 12% annualized whole returns prior to now 5 years. We discover the corporate’s dividend observe file to be spectacular, even when the newest dividend hikes had been on the small aspect.

Walmart is a secure, defensive inventory in instances of financial hardship, however the modest whole return profile prevents it from being a purchase right this moment. Because of this, we price it a maintain.

The next articles include shares with very lengthy dividend or company histories, ripe for choice for dividend development traders:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].