Lemon_tm

I’ve over 50% of my internet price invested in Actual Property Funding Trusts, or REITs briefly.

I make investments so closely on this sector as a result of I believe that it affords a historic alternative to purchase actual property at a steep low cost to its truthful worth.

There are various REITs which might be at the moment priced at a 50% low cost relative to the truthful worth of their underlying actual property as a result of their share costs have crashed at the same time as their rents stored on rising and their property values remained kind of secure.

I strongly consider that the market has overreacted to fears of rising rates of interest, not understanding that REITs use little debt, get pleasure from lengthy debt maturities, and the rising rents greater than make up for the rising curiosity expense.

So I’m very bullish on most REITs.

However even I am goal sufficient to acknowledge that not all REITs are enticing. In actual fact, there are fairly a number of kinds of REITs that I count on to do very poorly over the long term, and the aim of this text is to warn you in opposition to these REITs:

#1 – Externally Managed REITs

Most REITs are at the moment internally managed.

What this implies is that the administration is employed as workers of the REIT and their sole focus needs to be the REIT itself and never another automobiles.

Furthermore, this additionally signifies that the managers will not earn “charges” which might be primarily based on the quantity of property beneath administration. As an alternative, they may earn salaries, that are sometimes primarily based on key efficiency indicators. For example, the compensation of executives at VICI Properties (VICI) will depend on two issues: (1) their skill to develop their funds from operations (“FFO”) per share by a minimum of 6% per yr over a 2-year rolling interval; and (2) reaching a minimum of 10% compounded annual whole returns for shareholders over a 3-year interval.

This does a fantastic job of aligning the pursuits of the shareholders and managers, and this is the reason most REITs are at the moment internally managed.

Nonetheless, there are nonetheless many REITs which might be externally managed, which basically signifies that the administration is outsourced to an exterior asset administration firm that is employed to deal with the administration.

This results in a lot better conflicts of curiosity as a result of:

For one, the supervisor will sometimes additionally handle different automobiles with competing pursuits. For example, they might deal with the REIT but in addition handle 3 completely different personal funds that concentrate on the identical property sector. Which automobile then will get the most effective offers? For 2, the compensation of the supervisor will sometimes be a charge that is primarily based on the quantity of property beneath administration and never the efficiency of the REIT itself. This can then result in a “development in any respect prices” mentality. The REIT will subject as many shares as it could possibly to purchase extra property even when the offers are dilutive simply because it could result in better compensation for the supervisor. It would additionally push the supervisor to take extra debt as a result of larger leverage would result in extra property and better charges.

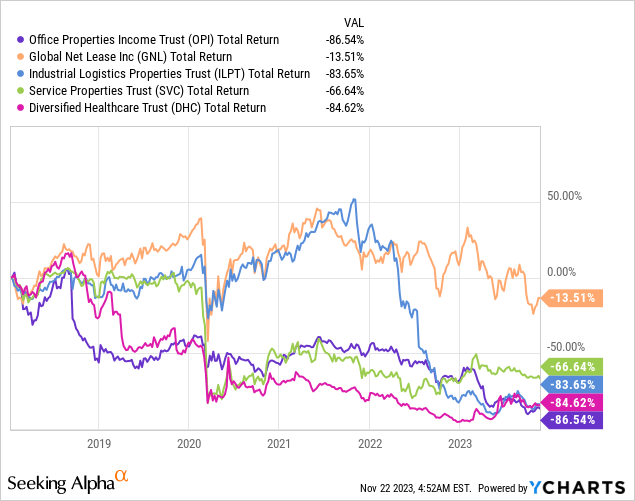

Because of these conflicts, the efficiency of externally managed REITs has been so much worse than that of internally managed REITs.

Listed here are some examples of externally managed REITs that I might keep away from in any respect prices. They at all times appear to be low-cost, however low-cost usually will get cheaper…

Workplace Properties Earnings Belief (OPI) World Internet Lease (GNL) Industrial Logistics Properties Belief (ILPT) Service Properties Belief (SVC) Diversified Healthcare Belief (DHC).

And there are lots of others.

If a REIT has an exterior administration construction, in all probability avoid it. There are a number of exceptions, however typically talking, they aren’t well worth the danger.

#2 – Mortgage REITs

A whole lot of traders are lured into mortgage REITs, or mREITs, as a result of they provide very excessive dividend yields.

Simply to provide you a number of examples, AGNC Funding Corp. (AGNC) affords an 16.4% dividend yield, Arbor Realty Belief (ABR) yields 14%, and Annaly Capital Administration (NLY) yields 14.6%.

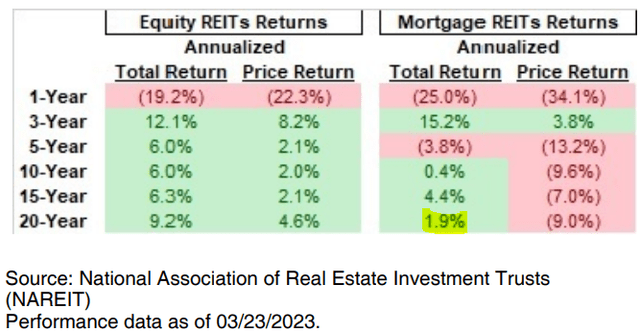

However regardless of providing these excessive dividend yields, most mortgage REITs have been very poor investments over the long term. In actual fact, their observe document is amongst the worst in your complete monetary market:

NAREIT

They solely earned a ~2% whole return over the previous 20-year interval, which reveals you that the excessive dividends have been actually only a mirage as they got here at the price of declining share costs.

I consider that it’s because most mREITs are too closely depending on exterior macro components which might be out of their management. Small adjustments in rates of interest or spreads can have a big influence on their companies, and predicting these components may be very difficult.

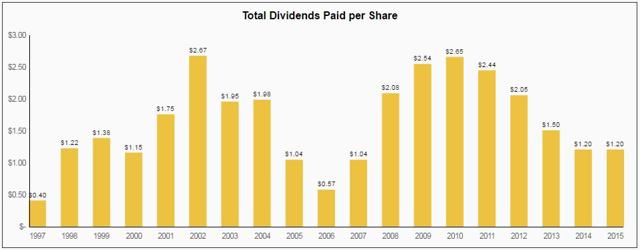

An excellent chart as an example this level is the dividend observe document of Annaly Capital Administration, which is without doubt one of the hottest mREITs:

Annaly Capital Administration

You possibly can clearly see that their enterprise mannequin is on the mercy of macro components that they are not in a position to predict.

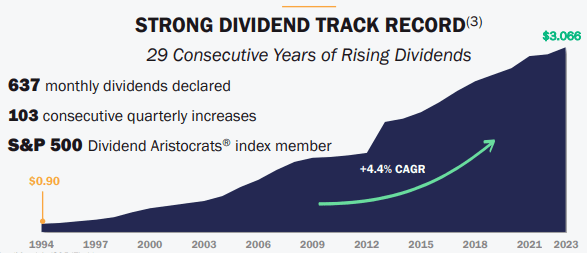

I might a lot moderately put money into a lower-yielding fairness REIT like Realty Earnings (O) that grows slowly however steadily. The chance-to-reward is much more compelling for my part as a result of the enterprise mannequin of an actual landlord is much less depending on these macro components:

Realty Earnings

#3 – Sure Particular Property Sectors

This may increasingly appear apparent, however not all actual property is created equal and there are lots of property sectors that I might keep away from.

The most effective instance is the workplace sector.

Workplace REITs are at the moment closely discounted and they’re attracting numerous worth traders, however I believe that if you happen to regulate for the excessive capex wants, the leverage, some cap charge growth, and the chance of additional declines in occupancy/rents, then at the moment’s costs aren’t that low-cost.

I run a small funding boutique and my complete crew is absolutely distant and issues are simply nice. I do not count on everybody to go this route, however hybrid is right here to remain and it’ll have a profound and long-lasting influence on the workplace sector.

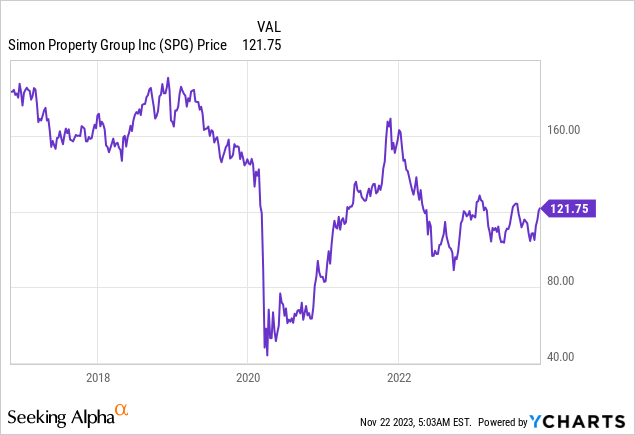

Subsequently, I concern that REITs like Boston Properties (BXP) will flip into worth traps. Investing at the moment in BXP could possibly be much like investing in a mall REIT like Simon Property Group (SPG) again in 2017. It appeared low-cost again then, however it nonetheless ended up turning into a worth entice.

However there are different property sectors to keep away from as properly.

I typically do not like lodges. They require an excessive amount of capex, they’re too cyclical, and they’re going through rising competitors from Airbnb (ABNB) and different related platforms.

I additionally concern that self-storage is overbuilt within the U.S. The share costs of Public Storage (PSA) and Additional Area Storage (EXR) have come down, however they’re nonetheless priced at a premium relative to better-performing property sectors.

#4 – Some Worldwide Markets

Usually talking, REITs are well-managed within the U.S. There are, after all, some exceptions, however REITs have existed for a lot of a long time, they’re scrutinized by numerous analysts, regulated by the SEC, and managers are sometimes well-aligned with shareholders.

Nonetheless, the identical just isn’t true for a lot of international REIT markets.

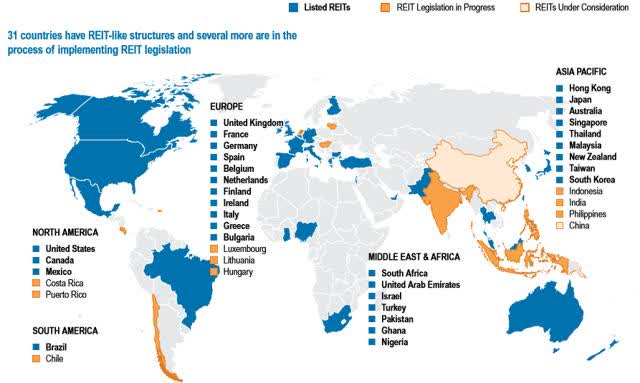

NAREIT

I’m presently in Asia to search for Asian REIT alternatives for our worldwide REIT portfolio, and the principle purpose why 90%+ of REITs are uninvestable is as a result of their administration is poorly aligned with shareholders.

Exterior administration constructions are nonetheless quite common and REITs get away with associated get together transactions that will be unacceptable within the U.S. For example, there’s a widespread “asset dumping” follow by which a supervisor will develop properties with a separate entity after which promote them to the REIT at a excessive worth.

Keep away from such conditions.

#5 – REIT CEFs

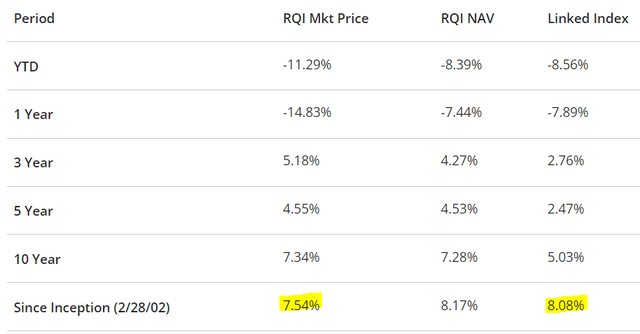

Lastly, I’m not an enormous fan of REIT closed-end funds (CEFs). Many traders are attracted by funds just like the Cohen&Steers High quality Earnings Realty Fund (RQI) as a result of it affords a a lot larger dividend yield than the Vanguard Actual Property Index Fund ETF Shares (VNQ), however listed below are the problems:

They use excessive leverage to create this yield. Additionally they make investments closely in most well-liked shares to bump up the yield, however most well-liked shares have much less upside potential in a future restoration. They cost excessive charges. They do “closet indexing” with a lot of their prime holdings being similar to these of passive benchmarks, lowering the probabilities of incomes alpha. Their observe information are poor typically.

Take the instance of Cohen&Steers High quality Earnings Realty Fund, which is often perceived to be the most effective REIT CEF. It has truly underperformed its passive benchmark since its inception:

Cohen & Steers

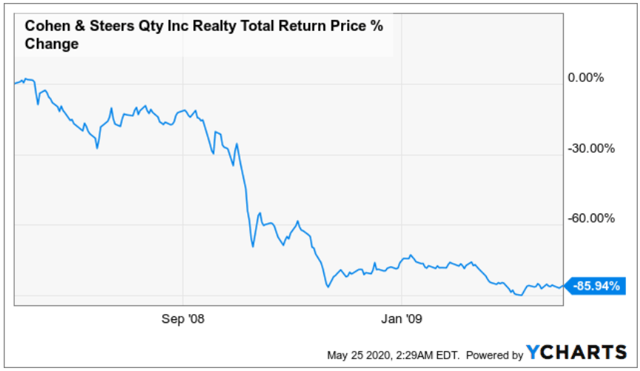

And that is regardless of taking a lot better danger as a result of it’s leveraged. In actual fact, it virtually went bankrupt through the nice monetary disaster:

YCHARTS

So the risk-to-reward of those CEFs is usually very poor. An excessive amount of leverage, excessive charges, and closet-indexing will not earn you alpha.

If you wish to be passive, you higher follow a low-cost ETF typically.

Backside Line

It’s not all sunshine and rainbows within the REIT world.

I’ve the majority of my internet price invested in REITs, however it is vitally essential to be selective as a result of not all REITs are price shopping for.

Some could possibly be exceptionally rewarding whereas others might flip into actual disasters. I’m speaking from expertise, having realized this the laborious manner at instances.

My portfolio at the moment consists of simply ~25 REITs in a universe of practically 1,000 corporations worldwide.