David Tran

Introduction

Regardless of optimistic read-through from cloud hyperscalers, I handed on the chance to purchase Nvidia Company (NASDAQ:NVDA) inventory at ~$400 per share resulting from lingering valuation fears and a precarious technical setup amid heightened macroeconomic and geopolitical dangers:

In gentle of a -20% decline since my final replace on Nvidia, the long-term danger/reward for NVDA inventory has improved considerably, with the inventory transferring nearer to my truthful worth estimate of $390 and the 5-year anticipated return rising to almost 20%. As a picks & shovels play, Nvidia ought to proceed to profit from the continued AI CAPEX spending bonanza from different massive tech corporations. Therefore, I feel Nvidia’s monetary efficiency will proceed to stay sturdy, a minimum of within the close to time period.

That stated, the wild run-up in long-duration treasury yields has elevated the probability of a tough touchdown, which may negatively impression the demand for Nvidia’s AI chips. Additionally, the U.S. ban on the export of AI chips to China poses a recent problem for our long-term progress projections for Nvidia. Given our valuation mannequin for Nvidia is kind of beneficiant, I nonetheless do not suppose we’ve got a margin of security to deploy recent capital into Nvidia.

Technically, Nvidia’s inventory is buying and selling at a make-or-break stage. A breakdown right here may ship the inventory right into a tailspin down by ~25% to $300 per share. Regardless of sturdy beats from its massive tech friends for Q3, Nvidia and the “Magnificent 7” names are experiencing elevated promoting strain in current classes, with main market indices breaching key technical ranges.

current market motion, I imagine a “flight-to-safety” commerce into long-duration treasury bonds [real safe haven] is seemingly underway, and much more cash may come out of (beforehand high-flying) massive tech shares [perceived safe havens] within the subsequent few weeks and months.

Given the heightened macroeconomic, geopolitical, and technical headwinds, I can’t justify shopping for Nvidia at present ranges. If we do see a breakdown of the $400 stage (affirmation of the “H&S” sample), then I feel NVDA inventory will slide all the way down to $250-350 vary in a jiffy.

For daring buyers keen to climate volatility, Nvidia Company inventory could possibly be an honest guess proper right here. Nonetheless, contemplating the near-to-medium time period danger/reward, I might be staying on the sidelines for now, but when NVDA will get all the way down to $250-300, then depend on me to be a purchaser.

Supply: Nvidia Inventory At A Make-Or-Break Degree: Purchase, Promote, Or Maintain? (Technical Evaluation).

Whereas Nvidia inventory by no means confirmed a breakdown of the H&S sample, I clearly missed a shopping for alternative given Nvidia’s 25%+ run-up to all-time highs forward of its earnings! In at present’s word, we are going to analyze Nvidia’s Q3 FY2024 outcomes, and re-run it by way of our valuation mannequin to gauge the long-term danger/reward for Nvidia and to make an knowledgeable funding resolution.

What Have been Nvidia’s Anticipated Earnings?

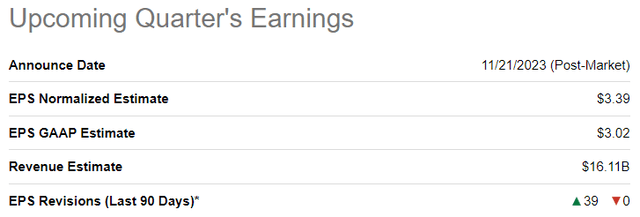

Heading into the Q3 FY2024 earnings report, Nvidia was projected to ship revenues and Normalized EPS of $16.11B [up +171% y/y, estimate range: $12.56B to $17.49B] and $3.39 [up +483% y/y, estimate range: $3.25 to $3.69], respectively.

SeekingAlpha

Did Nvidia Beat Earnings?

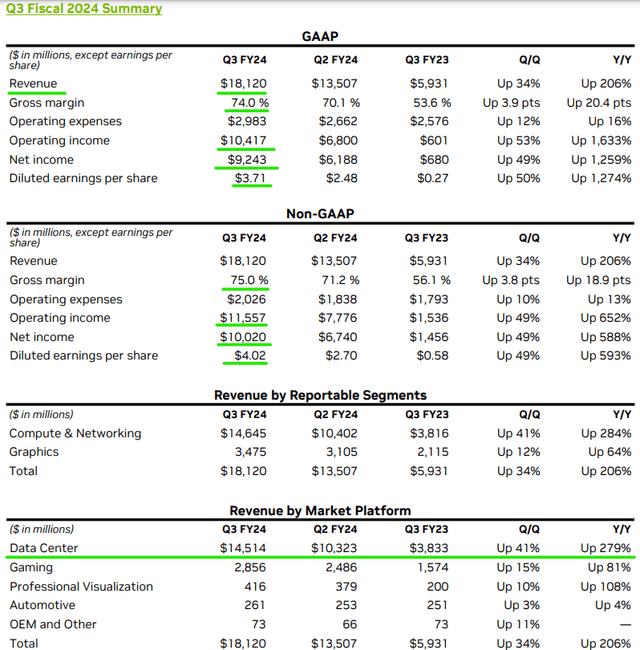

For Q3 FY2024, Nvidia sailed previous prime and backside traces expectations, with revenues and non-GAAP EPS coming in at $18.12B [up +206% y/y] (vs. est. $16.11B) and $4.02 [up +593% y/y] (vs. est. $3.39), respectively. As soon as once more, the top-line outperformance was pushed primarily by insatiable generative AI-induced demand for Nvidia’s Information Heart AI GPU chips:

Nvidia Q3 2023 CFO Commentary

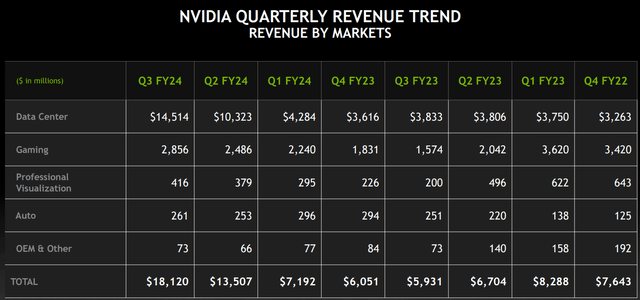

In Q3 FY2024, Nvidia’s Information Heart income reached a report excessive of $14.51B (+279% y/y and +41% q/q) amid an AI gold rush for NVDA’s GPUs as enterprises race to implement generative AI and huge language fashions [LLMs] throughout their companies. Here is what Jensen Huang, Nvidia’s CEO, needed to say in regards to the quarter:

Our sturdy progress displays the broad trade platform transition from general-purpose to accelerated computing and generative AI.

Massive language mannequin startups, shopper web corporations and international cloud service suppliers had been the primary movers, and the following waves are beginning to construct. Nations and regional CSPs are investing in AI clouds to serve native demand, enterprise software program corporations are including AI copilots and assistants to their platforms, and enterprises are creating customized AI to automate the world’s largest industries.

NVIDIA GPUs, CPUs, networking, AI foundry companies and NVIDIA AI Enterprise software program are all progress engines in full throttle. The period of generative AI is taking off.

Given the optimistic read-through from cloud hyperscalers, I’m not in any respect shocked by the outperformance in Nvidia’s knowledge heart phase. Whereas Nvidia is primarily a data-centric enterprise now, sturdy gross sales efficiency in Gaming (+81% y/y) is a optimistic shock [especially due to rival AMD’s lukewarm gaming performance].

Nvidia Investor Relations

In Q3, Nvidia’s Skilled Visualization and Auto enterprise segments returned to optimistic y/y progress; and I feel it’s truthful to say that Nvidia is firing on all cylinders!

On the margin entrance, Nvidia’s non-GAAP gross margin expanded to 75%, up 380 bps over Q2 FY2024 and up 1,890 bps over Q3 FY2023. With its huge first-mover benefit in AI, Nvidia is having fun with great pricing energy, and in impact, getting an enormous AI windfall.

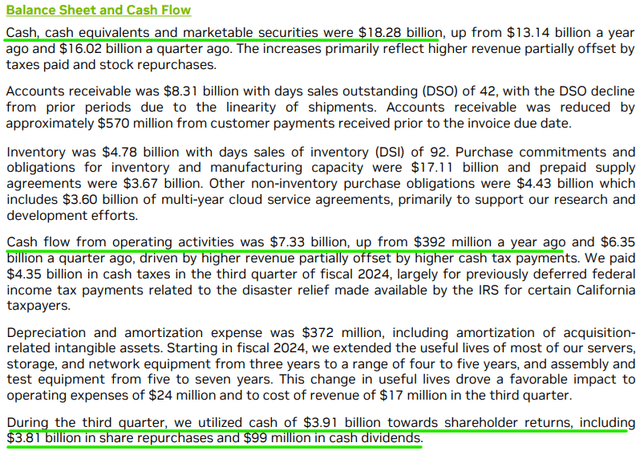

Additional, this ongoing margin growth is powering Nvidia’s quarterly free money move technology greater. In Q3 FY2024, Nvidia’s free money move elevated from +$6.05B in Q2 2023 to +$7.04B in Q3 2023. Regardless of Nvidia returning $3.9B to shareholders through buybacks and dividends throughout Q3, the semiconductor large’s fortress-like steadiness sheet obtained even stronger, with money and short-term investments place rising to $18.3B.

Nvidia Investor Relations

What Is The Outlook For NVDA Inventory?

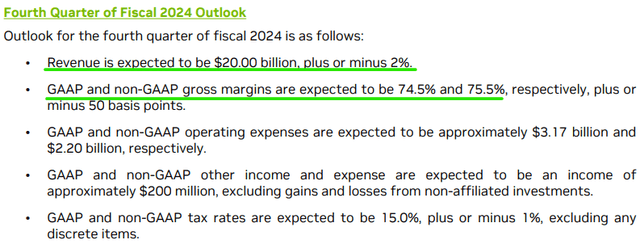

For This autumn FY2024, Nvidia’s administration is guiding for revenues of $20B forward of consensus road estimates of ~$17.80B. This guided income determine implies y/y progress of +230%, which in my opinion, is solely astounding!

Nvidia Investor Relations

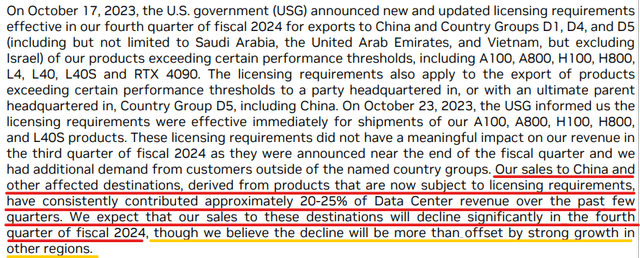

The AI chip export restrictions didn’t impression Nvidia materially in Q3 2023, however the firm now expects a major decline in exports to China and different extra areas in This autumn:

Nvidia Q3 FY2024 CFO Commentary

Whereas demand in different geographies is predicted to make up for this lack of income within the close to time period, doubts in regards to the sustainability of this AI chip demand spike (and subsequent provide crunch) are more likely to persist within the upcoming weeks, months, and quarters.

In line with Jensen Huang (emphasis added):

The pc trade goes by way of two simultaneous transitions – accelerated computing and generative AI. A trillion {dollars} of put in international knowledge heart infrastructure will transition from common function to accelerated computing as corporations race to use generative AI into each product, service and enterprise course of.

SeekingAlpha

The long-term alternative for Nvidia is huge [TAM: >$300B], and given CUDA’s dominance, Nvidia is more likely to preserve having fun with the lion’s share of the info heart marketplace for years to return. Nonetheless, almost all of its main prospects (cloud hyper scalers, i.e., Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL)) are growing in-house customized AI chips, which is a major potential danger to Nvidia’s future revenues and margins! Nvidia is miles forward of the competitors and the one clearly clear beneficiary of the breakthroughs in generative AI; nevertheless, income progress visibility continues to be low.

Nvidia’s Honest Worth And Anticipated Returns

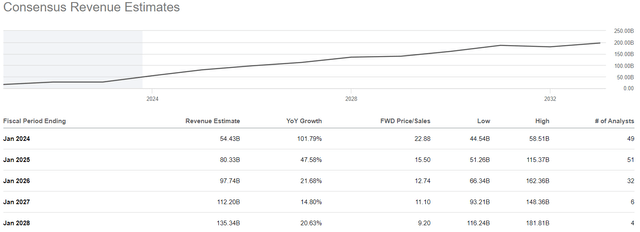

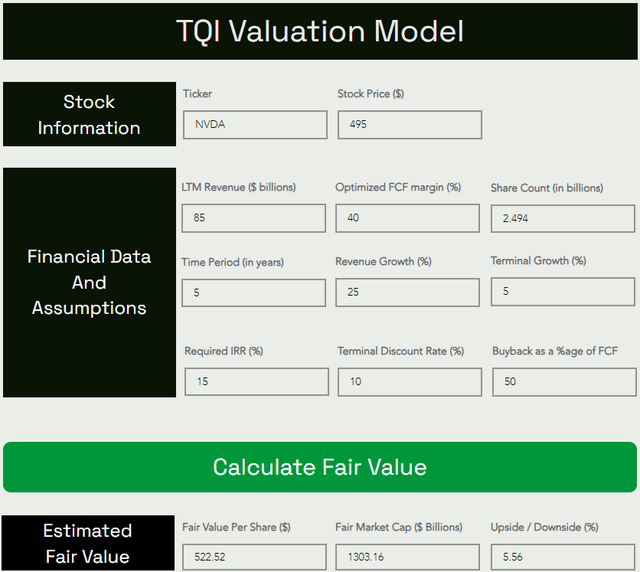

In gentle of yet one more blowout quarter and optimistic administration commentary for FY2025, I feel Nvidia Company may now clock $80-90B (up from $75-80B) in income over the following twelve months. Given the seismic leap in near-term gross sales progress, we might be constructing the mannequin based mostly on a ahead income estimate after which discounting the truthful worth output from the mannequin to get a present truthful worth estimate. In contrast to crypto, I imagine AI is the true deal, which is why I feel a 20-30% CAGR progress for Nvidia is believable (aggressive however actually believable).

Given Nvidia’s unbelievable pricing energy and looming shift to a high-margin software program enterprise, I imagine that steady-state free money move (“FCF”) margins for NVDA could possibly be as excessive as 40-50%. All different assumptions are comparatively simple. Please let me know when you’ve got any questions through the feedback part.

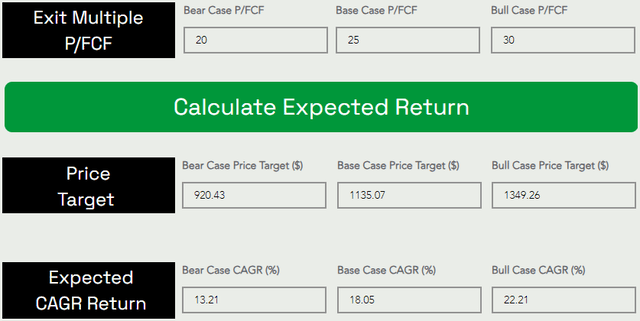

Here is my up to date valuation mannequin for Nvidia:

TQI Valuation Mannequin (TQIG.org)

Making use of a 15% low cost to this 2024 truthful worth estimate, we get a present truthful worth estimate of ~$444 per share for NVDA inventory. With Nvidia inventory buying and selling at ~$495 per share (on the time of writing), I proceed to imagine that the inventory worth is forward of its skis at this second in time.

Final quarter, my truthful worth estimate was at $390 at a time when the inventory was at $500. The inventory has nearly gone nowhere within the final three months, i.e., we’ve got seen a time correction. Whereas the hole between our truthful worth estimate and Nvidia’s market worth is closing (now at simply ~10%), I nonetheless do not suppose we’ve got an ample margin of security right here resulting from considerably beneficiant assumptions for long-term margins and gross sales progress.

Assuming a base case exit a number of of 25x P/FCF, I can see Nvidia rising to $1,135 per share by 2029. This worth goal interprets to a 6-yr CAGR return of 14.83% from present ranges.

TQI Valuation Mannequin (TQIG.org)

Regardless of utilizing beneficiant assumptions, NVDA’s anticipated 5-year CAGR returns are in line or somewhat in need of my funding hurdle charge of 15%. Therefore, I’m nonetheless not a purchaser right here.

Please word: Nvidia is clearly profitable massive within the period of Gen AI; nevertheless, this initial-stage demand progress leap may but show to be non permanent in nature. Sure, Nvidia is buying and selling at simply ~25x ahead P/E, however margins could possibly be peaking right here too (a minimum of for the brief time period). With all of its main prospects constructing AI chips in-house (potential danger to revenues and margins), I see a real lack of a margin of security right here.

Concluding Ideas: Is NVDA Inventory A Purchase, Promote, Or Maintain After Q2 Earnings?

Buyers and analysts have been chasing NVDA inventory greater and better to be able to stake their declare within the “Gen AI rush,” and as of Q3, Nvidia Company stays the obvious “picks and shovels” play available in the market.

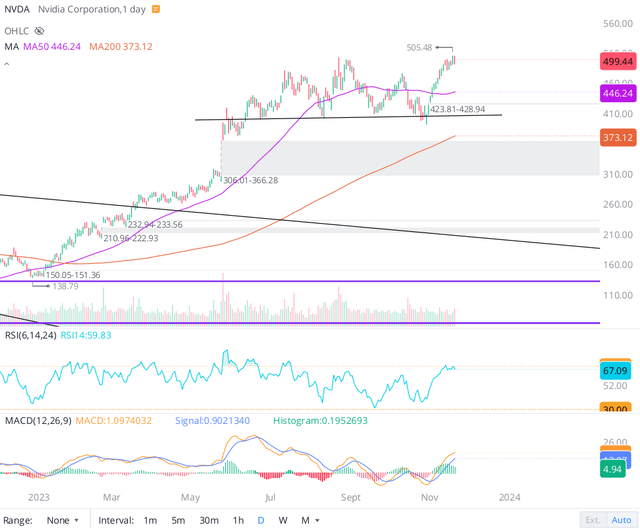

Whereas NVDA inventory managed to carry the important thing $400 psychological stage (i.e., keep away from a bearish “H&S” sample breakdown), it’s as soon as once more failing on the $500 stage regardless of reporting better-than-expected numbers for prime and backside traces in Q3 FY2024.

WeBull Desktop

Technically, Nvidia’s inventory is near overbought territory (RSI ~70); nevertheless, we all know that it may possibly keep in overbought territory for lengthy intervals of time, and momentum can carry NVDA inventory to unimaginable ranges. Given Nvidia’s sturdy monetary efficiency and administration’s optimistic outlook, I do not suppose buyers (institutional or retail) are going to be in any hurry to race towards the exit doorways right here.

Sure, I’ll sound like a damaged report, however I’ll say this once more –

Nvidia Company is a good firm with market-leading merchandise and arguably one of the best CEO within the semiconductor trade. Nonetheless, the worth we’re being requested to pay for Nvidia (~$1.2T) is simply too steep, in my view. In a zero-interest charge world, buyers can afford to be valuation agnostic; nevertheless, we’re now not working in such an atmosphere, with the FED nonetheless pulling liquidity out of economic markets and a financial institution credit score tightening cycle in impact after a number of financial institution failures.

Regardless of working the chance of lacking out on additional features in NVDA inventory, I select to stay on the sidelines right here. FYI, I’ve been mistaken about NVDA inventory prior to now, and I could possibly be mistaken once more. Whereas Nvidia is performing exceptionally proper now, the present price ticket leaves little to no margin of security for a long-term investor. Given the shortage of income progress and margin visibility going into a possible financial recession (exhausting touchdown), I stay “Impartial” on Nvidia Company inventory at these elevated ranges. The post-ER cool-off in Nvidia’s inventory is gentle, but when the inventory will get all the way down to the low $400s once more, I’ll provoke a brand new lengthy place, and begin accumulating slowly with a 12-24 month DCA plan.

Key Takeaway: I proceed to charge Nvidia Company inventory “Impartial/Maintain” at $495 per share.

Thanks for studying, and comfortable investing! Please share your ideas, questions, or issues within the feedback part beneath.