BlackJack3D

By Christopher Gannatti, CFA

Synthetic intelligence has taken up a big share of the world’s consciousness in 2023. Previous to ChatGPT, there have been many AI functions that have been “fairly good,” however only a few issues that have been sturdy sufficient to totally seize the world’s consideration. After ChatGPT, CEOs of public tech corporations raced to make AI bulletins on earnings calls.

What Does AI Look Like?

There’s a large distinction between “mentioning” and “implementing” AI initiatives, however let’s have a look at what AI means throughout paradigms:

AI is built-in into current software program. Digital assembly instruments like Microsoft Groups and Zoom improved transcription, summaries and even motion factors of conferences. Cybersecurity is one other essential space, with extra and several types of assaults and never sufficient workers to fill crucial cybersecurity positions. New AI modules are choices customers will pay for. Microsoft allowed customers of Workplace 365 to pay extra and entry a model of Copilot straight on its platform. Google Workspace can also be vying for customers in these productiveness enhancers. New instruments: ChatGPT was a “new instrument,” spawning plenty of extra functions that may take a immediate and create textual content to “fulfill” stated immediate. The identical precept was utilized to create movies and footage. Possibly it should turn out to be regular for future slide shows to be given totally by AI—which means programs create the slides, and the system can also be in a position to narrate the textual content to attract out the tales. We’re transitioning from feeling like “That is cool” to “Can this tech actually add worth?” As traders, we now have to have a look at rising revenues, after which money flows and, in the end, earnings.

Cloud Software program Firms Have Not Participated in 2023’s AI Rally

Thus far, 2023 has been outlined by such shares because the “Magnificent 7” and Nvidia.

Many of those AI functions require cloud-based computing platforms and providers. Nevertheless, rising cloud software program corporations haven’t participated just like the Magnificent 7 within the AI increase of 2023.

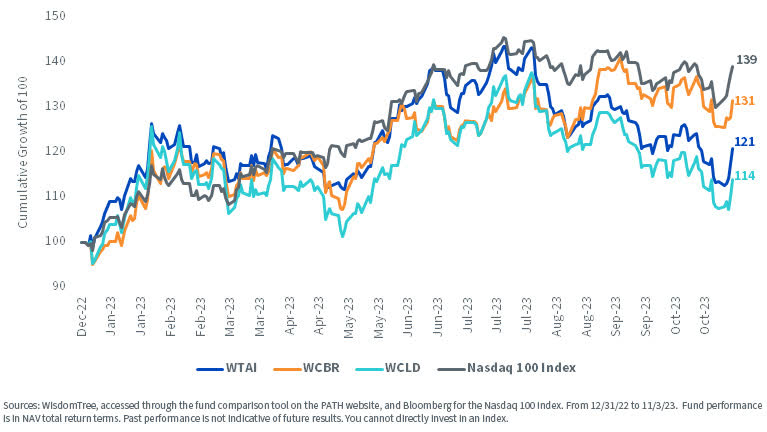

The Nasdaq 100 Index, with its huge weight within the Magnificent 7, has outlined 2023 as strongly delivering fairness market returns, however there are a variety of how to spend money on the rising tech area. WisdomTree has the WisdomTree Cybersecurity Fund (WCBR), the WisdomTree Cloud Computing Fund (WCLD) and the WisdomTree Synthetic Intelligence and Innovation Fund (WTAI). WCBR and WCLD are largely software-focused, whereas WTAI represents a mixture. WCBR has rallied of late. At any time when there’s a new know-how—this yr, generative AI—we consider it is very important additionally take into consideration the right way to safe it. WCLD has been the relative laggard. Many requested in the event that they “missed” 2023’s AI rally. If our thesis is right—that many customers of AI will use it by way of cloud software program—possibly this portends a response in WCLD’s returns as we glance ahead.

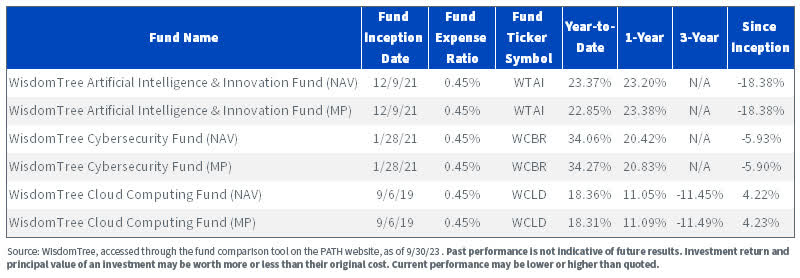

Determine 1a: Standardized Efficiency

For present holdings, 30-day SEC yield, SEC standardized return and most up-to-date month-end efficiency, click on the respective ticker: WTAI, WCBR, WCLD. Click on to enlarge

Determine 1b: Rising Cloud Firms Largely Lagged in 2023

For 30-day SEC yield, SEC standardized return and most up-to-date month-end efficiency, click on the respective ticker: WTAI, WCBR, WCLD. Click on to enlarge

WCLD Dropped beneath the Russell 1000 Progress Index on a Valuation Foundation

Most traders who converse to us always remember in regards to the fundamentals—and WisdomTree’s basis was constructed on such fundamentals as dividends and earnings.

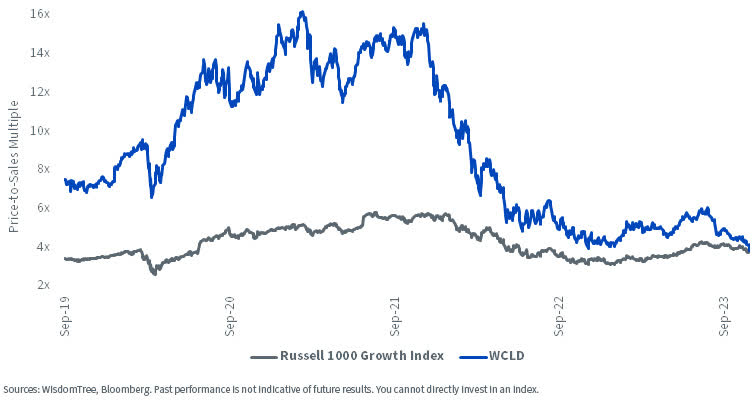

Nevertheless, once we shift the main focus to WCLD and the underlying corporations outlined by the BVP Nasdaq Rising Cloud Index, it’s clear that these ready for an “cheap valuation” is likely to be sitting on the sidelines for fairly a very long time. It’s attainable that “rising cloud software program” corporations by no means look cheap by conventional measures, given their above-average progress charges over the approaching years.

Not less than based mostly on what we now have seen since 2021, rising cloud software program shares like these in WCLD have been very rate of interest delicate. After we see the U.S. 10-Yr Treasury observe rate of interest going up, we are likely to see valuations dropping…and efficiency doing the identical. Equally, when charges fall, efficiency picks up.

In determine 2a, possibly because of the latest rise within the U.S. 10-Yr Treasury observe rate of interest, we see one thing new over the reside historical past of WCLD since its inception.

Often, the rising corporations inside WCLD are outlined by their “potential,” and at instances, that potential doesn’t but have constructive earnings behind it. When corporations are outlined by potential, it tends to push up valuations. However rising charges have pushed down the multiples. WCLD’s price-to-sales a number of really dropped beneath that of the Russell 1000 Progress Index for the primary time.

Determine 2a: Valuation Alternative?

Keep in mind the Seesaw: Valuation AND Progress, Not Simply Valuation

In our view the true query is definitely not whether or not the businesses represented inside WCLD are costly or cheap however somewhat whether or not these corporations are exhibiting sturdy sufficient progress to justify their valuations. After we see the upper valuations in determine 2a, traders have been pushing these costs up as a result of the demand for software program in the course of the peak of the pandemic was extraordinarily excessive.

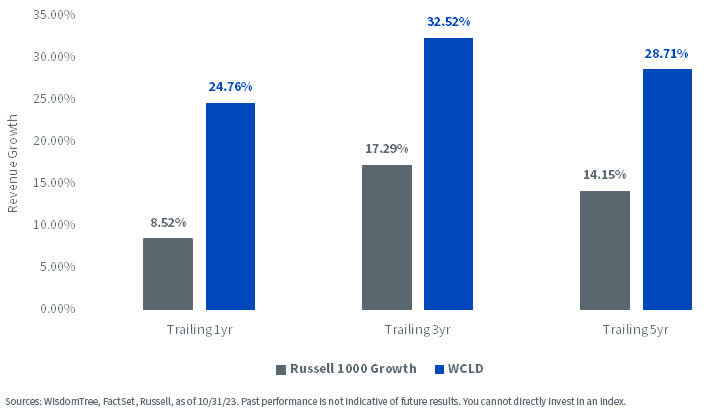

In determine 2b, we present the historic income progress in addition to the longer term income progress expectations. As with all estimates or expectations, there are by no means any ensures, however one factor we’re enthusiastic about is that the businesses inside WCLD are persevering with to exhibit quicker progress than that of the Russell 1000 Progress Index.

One other large image level to take note of—the vast majority of the businesses in WCLD are Software program-as-a-Service (SAAS) corporations, and the shopper is selecting to, after due diligence, subscribe to the software program to resolve a selected enterprise want. In at the moment’s world, these software program packages are typically extra related to effectivity beneficial properties than spending extra total. Whereas nothing is “recession-proof,” you may, subsequently, say that these subscriptions would not often be the primary issues minimize in a interval of stress.

Determine 2b: The Income Progress Aspect of the Ledger

Conclusion: Did Cloud Computing Firms Turn into Extra Fascinating in 2023?

Whereas we will by no means know future efficiency with certainty, we do know two issues in regards to the shares represented inside WCLD on account of 2023’s expertise.

Valuations have come down additional over the course of the yr, even amidst some volatility. AI represents a attainable catalyst to get extra customers in that if the cloud computing software program corporations can supply AI options, it would improve the general adoption and get corporations spending extra as a result of they consider there are probably higher advantages available.

We’d additionally observe—most corporations will in all probability by no means purchase an Nvidia H100 (or comparable) AI-accelerating chip, however they’re more likely to choose and subscribe to software program. We consider Cloud computing represents a really favorable mannequin of software program supply, the place corporations will pay virtually function by function and operation by operation in sure circumstances. AI may result in extra subscriptions over time.

Necessary Dangers Associated to this Article

For present Fund holdings, please click on the respective ticker: WTAI, WCBR, WCLD. Holdings are topic to danger and alter.

There are dangers related to investing, together with the attainable lack of principal.

WTAI: The Fund invests in corporations primarily concerned within the funding theme of synthetic intelligence (AI) and innovation. Firms engaged in AI sometimes face intense competitors and doubtlessly speedy product obsolescence. These corporations are additionally closely depending on mental property rights and could also be adversely affected by loss or impairment of these rights. Moreover, AI corporations sometimes make investments vital quantities of spending on analysis and improvement, and there’s no assure that the services or products produced by these corporations shall be profitable. Firms which are capitalizing on innovation and growing applied sciences to displace older applied sciences or create new markets is probably not profitable. The Fund invests within the securities included in, or consultant of, its Index no matter their funding advantage, and the Fund doesn’t try and outperform its Index or take defensive positions in declining markets. The composition of the Index is ruled by an Index Committee, and the Index might not carry out as meant.

WCBR: The Fund invests in cybersecurity corporations, which generate a significant a part of their income from safety protocols that stop intrusion and assaults to programs, networks, functions, computer systems and cellular units. Cybersecurity corporations are notably weak to speedy adjustments in know-how, speedy obsolescence of services and products, the lack of patent, copyright and trademark protections, authorities regulation and competitors, each domestically and internationally. Cybersecurity firm shares, particularly these that are web associated, have skilled excessive value and quantity fluctuations prior to now which have typically been unrelated to their working efficiency. These corporations can also be smaller and fewer skilled corporations, with restricted services or products traces, markets or monetary sources and fewer skilled administration or advertising personnel. The Fund invests within the securities included in, or consultant of, its Index no matter their funding advantage, and the Fund doesn’t try and outperform its Index or take defensive positions in declining markets. The composition of the Index is closely depending on quantitative and qualitative data and information from a number of third events, and the Index might not carry out as meant.

WCLD: There are dangers related to investing, together with the attainable lack of principal. The Fund invests in cloud computing corporations, that are closely dependent on the web and using a distributed community of servers over the Web. Cloud computing corporations might have restricted product traces, markets, monetary sources or personnel and are topic to the dangers of adjustments in enterprise cycles, world financial progress, technological progress and authorities regulation. These corporations sometimes face intense competitors and doubtlessly speedy product obsolescence. Moreover, many cloud computing corporations retailer delicate shopper data and may very well be the goal of cybersecurity assaults and different varieties of theft, which might have a unfavourable impression on these corporations and the Fund. Securities of cloud computing corporations are typically extra risky than securities of corporations that rely much less closely on know-how and, particularly, on the web. Cloud computing corporations can sometimes interact in vital quantities of spending on analysis and improvement, and speedy adjustments to the sector might have a fabric opposed impact on an organization’s working outcomes. The composition of the Index is closely depending on quantitative and qualitative data and information from a number of third events, and the Index might not carry out as meant.

All funds are managed in a different way and don’t react the identical to financial or market occasions. The funding targets, methods, insurance policies or restrictions of different funds might differ and extra data may be discovered of their respective prospectuses. Subsequently, we usually don’t consider it’s attainable to make direct fund to fund comparisons in an effort to focus on the advantages of a fund versus one other equally managed fund. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

Christopher Gannatti, CFA, International Head of Analysis

Christopher Gannatti started at WisdomTree as a Analysis Analyst in December 2010, working straight with Jeremy Schwartz, CFA®, Director of Analysis. In January of 2014, he was promoted to Affiliate Director of Analysis the place he was accountable to steer completely different teams of analysts and strategists inside the broader Analysis staff at WisdomTree. In February of 2018, Christopher was promoted to Head of Analysis, Europe, the place he was based mostly out of WisdomTree’s London workplace and was accountable for the total WisdomTree analysis effort inside the European market, in addition to supporting the UCITs platform globally. In November 2021, Christopher was promoted to International Head of Analysis, now accountable for quite a few communications on funding technique globally, notably within the thematic fairness area. Christopher got here to WisdomTree from Lord Abbett, the place he labored for 4 and a half years as a Regional Advisor. He obtained his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern College of Enterprise in 2010, and he obtained his bachelor’s diploma from Colgate College in Economics in 2006. Christopher is a holder of the Chartered Monetary Analyst Designation.

Unique Submit

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.