Up to date on November seventh, 2023

In 2022, The Gorman-Rupp Firm (GRC) introduced that it was rising its quarterly dividend for the fiftieth consecutive 12 months. Because of this, it joined the Dividend Kings.

The Dividend Kings are a bunch of simply 51 shares which have raised their dividends for at least 50 straight years.

This group is amongst our favorites for buyers to think about as we consider their high-quality enterprise fashions which have enabled dividend progress for many years are prone to proceed to take action sooner or later.

With this in thoughts, we created a full checklist of all 51 Dividend Kings. You possibly can obtain the total checklist, together with necessary monetary metrics similar to dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

This text will look at Gorman-Rupp’s enterprise overview, progress prospects, aggressive benefits, and anticipated returns for the subsequent 5 years.

Enterprise Overview

Gorman-Rupp has been in enterprise since 1933. The corporate started as a producer of pumps and pumping methods and has grown over time to turn into a number one provider of vital methods that industrial shoppers rely on to run their companies. The corporate generates income of greater than $500 million yearly and has a market capitalization of $800 million.

Regardless of its measurement, Gorman-Rupp is a key cog for a lot of industrial prospects. Its merchandise are utilized in all kinds of finish markets, together with agriculture, air con, building, fireplace safety, heating, industrial, liquid dealing with, army, authentic gear, petroleum, air flow, water, and wastewater.

Supply: Investor Presentation

The corporate’s water-related companies account for over half of annual income, non-water contributes roughly 30%, and restore components account for the rest.

Gorman-Rupp posted third quarter earnings on October twenty seventh, 2023, and outcomes have been largely in keeping with expectations. Adjusted earnings-per-share got here to 25 cents, whereas income rose 8.9% year-over-year to $168 million.

The rise in gross sales was on account of a rise in quantity, in addition to the optimistic affect of pricing will increase put into place final 12 months. Home gross sales rose 10.1%, or $11.7 million, and worldwide gross sales rose 5.2%, or $2 million.

Progress Prospects

Gorman-Rupp’s position in its business is essential as the corporate’s merchandise are crucial for these finish markets to carry out their fundamental features. This makes this reasonably small firm a reasonably very important piece of the commercial sector.

That stated, the corporate’s earnings progress over the long run is usually correlated to the well being of the economic system. Earnings volatility has been a problem as income can swing wildly from 12 months to 12 months.

The corporate has been superb at managing prices, which has allowed for secure margins over the past decade, however there are intervals of weak point.

One issue working in Gorman-Rupp’s favor is the growing old infrastructure that plagues its foremost market of the U.S. The America Society of Civil Engineers charges the nation’s infrastructure as poor. General, the growing old infrastructure system receives a C- from the group, with notably poor grades for consuming water, wastewater, and stormwater methods.

It’s estimated that $2.6 trillion will probably be required to be spent to repair and enhance water, wastewater, and flood management methods over the subsequent decade to fulfill the necessity for infrastructure enhancements. This could have Gorman-Rupp well-positioned for years to return.

One other means that Gorman-Rupp makes an attempt to enhance its natural progress is thru using strategic acquisitions.

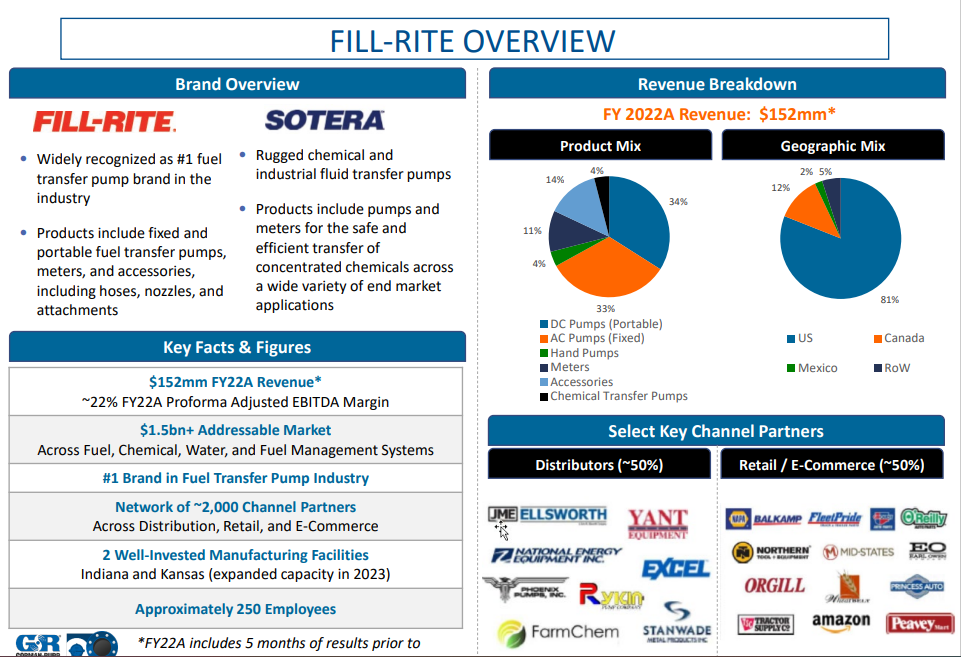

A great instance of this was the beforehand mentioned Fill-Ceremony buy. Utilizing money readily available and new debt, Gorman-Rupp paid $525 million for Fill-Ceremony, which was previously a division of Tuthill Company.

Supply: Investor Presentation

Fill-Ceremony’s portfolio contains high-performance liquid switch pumps, mechanical and digital meters, precision weights, hoses, nozzles, and equipment.

The addition of Fill-Ceremony was made doable as a result of Gorman-Rupp’s steadiness sheet is in remarkably good condition even after issuing new debt to fund the acquisition. Earlier than this acquisition, the corporate had zero long-term debt on its steadiness sheet. Debt has elevated, however stays manageable given how significant Fill-Ceremony has already been to outcomes.

Aggressive Benefits and Recession Efficiency

Gorman-Rupp has turn into an business chief due largely to its potential to supply quite a lot of finish markets the merchandise that it wants. The corporate’s diversified portfolio helps to guard in opposition to declines in anyone space of its enterprise.

Fireplace Suppression is the biggest contributor to gross sales, however that is nonetheless simply round 1 / 4 of the full that Gorman-Rupp’s generates annually.

Supply: Investor Presentation

This diversification can assist to alleviate declines in a sure space.

Nonetheless, Gorman-Rupp isn’t proof against the impacts of a recession. Listed under are the corporate’s earnings-per-share totals throughout, and after the Nice Recession:

2008 earnings-per-share: $1.04 (24% lower)

2009 earnings-per-share: $0.70 (33% lower)

2010 earnings-per-share: $0.93 (33% improve)

2011 earnings-per-share: $1.10 (18% improve)

Gorman-Rupp suffered important declines in the course of the Nice Recession. The corporate noticed a rebound shortly after this era because the economic system started recovering and demand improved. The corporate established a brand new excessive for earnings-per-share shortly after the downturn.

On the identical time, the corporate continued to extend its dividend, simply because it had for many years.

Whereas enterprise outcomes will doubtless undergo in the course of the subsequent financial downturn, we consider that the tailwinds to the corporate’s enterprise mannequin will permit for continued dividend progress.

Valuation and Anticipated Returns

Shares of Gorman-Rupp are buying and selling at 23.2 instances our anticipated earnings-per-share of $1.30 for 2023. We consider truthful worth lies nearer to 23 instances earnings, which suggests a declining P/E may scale back annual returns by roughly 0.3% per 12 months.

Between natural progress and the power so as to add key companies to its portfolio, we forecast that Gorman-Rupp can obtain earnings-per-share progress of 10% yearly via 2028.

The dividend may even add to the inventory efficiency. Presently, Gorman-Rupp is yielding 2.4%, which tops the typical yield of the S&P 500 Index.

Due to this fact, Gorman-Rupp is projected to return 12.1% yearly via 2028. This makes the inventory a purchase in our view.

Closing Ideas

The Dividend Kings are an unique checklist of firms which have established extraordinarily lengthy histories of dividend progress. This feat is so uncommon that there are simply 51 firms assembly the lone requirement of at the very least 5 a long time of dividend progress.

Gorman-Rupp is a comparatively new addition to this checklist. The corporate’s spectacular enterprise mannequin, potential to make strategic acquisitions and business tailwinds ought to place the corporate to proceed to develop its dividend.

The inventory can also be moderately priced and has double-digit complete return potential over the subsequent 5 years, incomes Gorman-Rupp a purchase advice.

If you’re excited about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The most important home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].