Javier_Art_Photography/iStock through Getty Pictures

2023 isn’t proving to be a very nice 12 months for shareholders of photo voltaic expertise firm Enphase Power (NASDAQ:ENPH). Over the previous 12 months, shares of the enterprise are down 74.5%. And 12 months up to now, they’re down 69.1%. Though the 12 months began off simply nice, the latest information offered by administration exhibits a significant slowdown for the corporate. Weak spot in demand for the trade, mixed with some regulatory points, are proving to be damaging for the agency. Despite the fact that the corporate is sure to develop in the long term, this near-term ache is plain and it is unclear how lengthy it’s going to final earlier than progress resumes. That is the issue with progress investing as a result of, when it would not go precisely proper, the tip consequence might be a substantial amount of ache. Within the occasion that monetary efficiency reverts again to what it was even final 12 months, shares may make for an honest prospect. However as a result of there’s ambiguity out there and extra ache is probably going across the nook, I’d argue that traders can be higher off trying elsewhere for alternatives presently. I would not go as far as to say that I’m bearish concerning the agency. However I do imagine that it’s going to doubtless underperform the broader marketplace for the foreseeable future. And as such, it deserves a delicate ‘promote’ ranking presently.

Latest weak spot is a matter

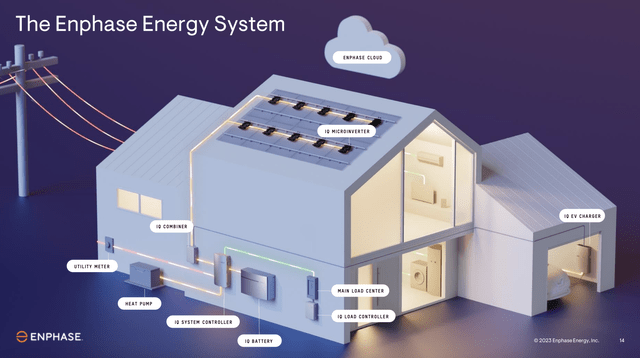

Earlier than I get into my ideas concerning the firm as an entire, it could be useful to dig a bit into the agency and its enterprise mannequin. Administration describes the corporate as a expertise agency that’s centered on offering good and simple to make use of options that assist to handle photo voltaic technology, and to interact within the storage of power. The first expertise utilized by the corporate is known as a microinverter. For many who are usually not terribly accustomed to solar energy, this doubtless means nothing. In brief, when you may have a photo voltaic panel, akin to one which is connected to a rooftop for residential functions, an inverter is required in an effort to take the direct present (referred to as DC) from the photo voltaic panel and switch it into an alternating present (or AC) to be used inside your own home or different property.

Historically, many inverters have been string inverters. That is the place a number of photo voltaic panels are linked as much as a system that transports the power to a central location for the aim of inverting it. However this has a number of issues related to it. For example, when you have shading over your own home, you possibly can find yourself with suboptimal power manufacturing as a result of the inverter can solely carry out on the highest degree of the bottom performing panel. And if there is a matter with the system, you would possibly want to exchange or restore all the string inverter. A microinverter is basically a small inverter that’s devoted to a single photo voltaic panel. It then takes the power from this decentralized location and transports it into your own home after it’s transformed. Within the occasion {that a} single panel turns into inoperable or operates suboptimally, a microinverter will nonetheless work as meant for the opposite photo voltaic panels. This ends in better effectivity, though it does typically come at a better value. Optimizers might be utilized to bridge the hole between the 2. However at that time, it could simply make extra sense to go for microinverters.

Enphase Power

The administration crew at Enphase Power has made certain to develop different applied sciences as effectively. For example, its Enphase IQ Gateway is a networking expertise that collects efficiency information for its methods. And there are many these methods, with an estimated 3.8 million unfold throughout 145 nations. The microinverters that the corporate sells, totaling 72 million in all in its lifetime, are only one piece of that system. Different facets of its system embrace batteries, load controllers, system controllers, and extra. The corporate additionally has its personal cloud-based power administration platform that provides analytics with the purpose of maximizing solar energy. One other providing put out by the corporate is the IQ EV Charger That integrates into its photo voltaic and battery system in order that householders with electrical automobiles can maximize electrical energy financial savings. It even has an EV Constitution that may be bidirectional, which means that it could actually cope with power flowing from automobile to residence, or residence to automobile, and from automobile to grid, or from grid to automobile. This gives prospects with extra flexibility. There are different choices as effectively, akin to its IQ Router household of units that may even work with warmth pumps and that makes use of AI for the aim of forecasting and optimizing electrical energy consumption.

Enphase Power

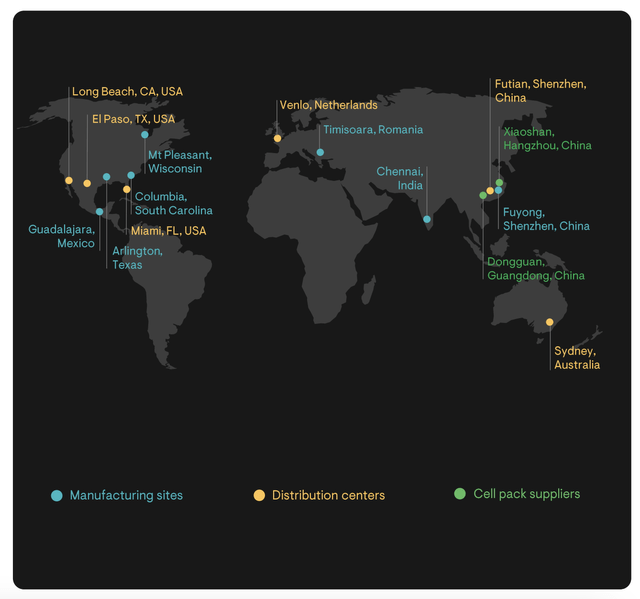

If this appears like an fascinating market, it is as a result of it’s. At current, solely about 3.2 million houses within the US function off of photo voltaic panels. That is 2.2% of the 144 million houses on the market. This presents an incredible progress alternative in the long term. It additionally helps that the corporate operates internationally. Europe, for example, is a really massive marketplace for photo voltaic. And the corporate is effectively suited to play on the worldwide scale. Its microinverters, for example, are at present produced at seven totally different manufacturing websites internationally, with 4 of these within the Americas, one in China, one in India, and one other in Romania. The corporate additionally works with two cell pack suppliers for its batteries and it’s working with a contract manufacturing facility in Mexico for the manufacturing of its EV chargers. The corporate ships to all kinds of nations, together with Germany, Greece, Denmark, Sweden, France, India, South Africa, Brazil, and extra. Whereas I’ve careworn the residential market as a key space of focus, a number of the agency’s merchandise may also be used within the business area. For example, the IQ8P microinverter is used within the small business market all through North America and Europe.

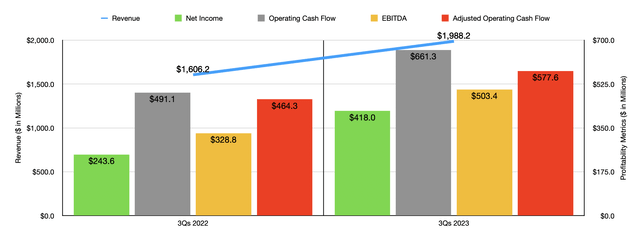

Creator – SEC EDGAR Knowledge

It is unclear precisely how massive this market is. Administration did say within the newest investor presentation, for example, that the corporate boasts over 390 patents globally. And the serviceable attainable market during which it performs in ought to develop to $23 billion by 2025. When you had been to have a look at the monetary information for the corporate overlaying the primary 9 months of its 2023 fiscal 12 months, you would possibly suppose that progress remains to be coming in sturdy. Gross sales throughout that window of time totaled $1.99 billion. That is a rise of 23.8% over the $1.61 billion generated one 12 months earlier. Profitability metrics for the corporate have additionally achieved fairly effectively throughout this window of time. Web earnings virtually doubled from $243.6 million to $418 million. Working money move expanded from $491.1 million to $661.3 million whereas the adjusted determine for it elevated from $464.3 million to $577.6 million. In the meantime, EBITDA for the corporate expanded from $328.8 million to $503.4 million.

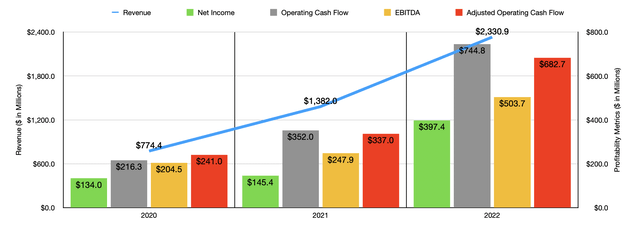

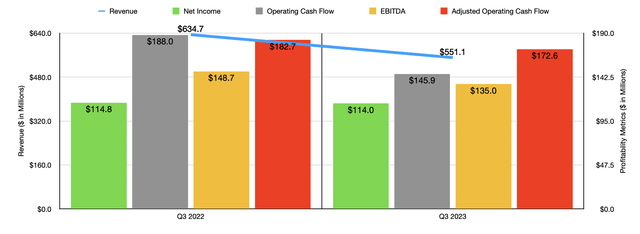

Creator – SEC EDGAR Knowledge

This isn’t the primary window of time during which progress has been spectacular. As you possibly can see within the chart above, income, income, and money flows all elevated properly over the previous three years. The actual ache, nonetheless, has come extra just lately. As you possibly can see within the chart under, income, income, and money flows, all fell within the third quarter of this 12 months in comparison with the identical time final 12 months. Income dropped from $634.7 million to $551.1 million. Whereas the decline in web earnings was modest, the entire firm’s money move metrics fell fairly a bit. However this pales compared to what administration is forecasting for the fourth quarter of this 12 months. Within the fourth quarter of final 12 months, income got here in at $724.7 million. Gross sales within the closing quarter must be solely between $300 million and a $350 million. Based mostly on administration’s personal steering, I imagine that web earnings shall be someplace round $29.2 million for that quarter. That is a large drop in comparison with the $153.8 million generated within the closing quarter of 2022.

Creator – SEC EDGAR Knowledge

This sudden plunge in gross sales has up to now been pushed largely by a ten% lower in microinverter items quantity shipped. The corporate went from transport 4.3 million items within the third quarter of 2022 to solely 3.9 million the identical time this 12 months. Though administration did additionally report a 35.5% decline within the Megawatt-hours value of IQ Batteries shipped throughout that very same window of time. Weak spot in each the US and Europe has triggered elevated stock ranges with distributors and installers and the issues concerned right here appeared to be multifaceted. Right here at residence, excessive rates of interest are a difficulty. It is because not solely does financing for these initiatives improve, but in addition customers have turn out to be extra cash strapped in any case. Much more problematic although appears to be one thing known as NEM 3.0. This refers to California’s web power metering program.

Underneath the prior NEM 2.0 program, customers who invested in photo voltaic panels for his or her properties would have the flexibility to promote extra energy created by these panels again to the grid at a value normally between $0.25/kWh and $0.35/kWh. However for anyone not grandfathered in to NEM 2.0, NEM 3.0 will apply. This may minimize the quantity of compensation right down to between $0.05/kWh and $0.08/kWh the excellent news is that anyone who positioned an order for a system previous to earlier this 12 months and that may have that system put in and operating no later than early 2026 can nonetheless get locked in beneath the previous program for 20 years. That exact program helped to incentivize 1.3 million prospects to put in a mixed 106GW of buyer cited residential power capability since its inception. Actually, that aided considerably in California changing into accountable for roughly 50% of all the US residential photo voltaic market. However now, by making this swap, the federal government in California is hoping to incentivize batteries that customers can use to retailer power on their properties versus promoting it again to the grid.

It is really unclear what the tip consequence shall be right here. Again in 2017 when Nevada made comparable cuts to their program, the tip consequence was a 90% decline in residential photo voltaic adoption. Nevertheless it’s additionally vital to keep in mind that photo voltaic adoption was dearer again then than it’s at present. One forecast offered by ROTH Capital Companions estimates that this shift for California will trigger a 30% drop in demand for residential photo voltaic panels. And given how a lot the trade depends on California for demand, that would trigger a fairly important quantity of ache for an organization like Enphase Power for some time. The identical macroeconomic points are additionally denting demand in Europe. However there’s additionally the truth that photo voltaic export penalties and an preliminary surge in gross sales attributable to the Russia/Ukraine struggle may now be coming to chew the corporate as effectively.

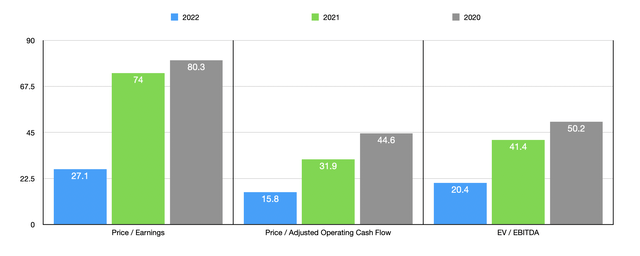

Creator – SEC EDGAR Knowledge

Within the occasion that shares of the corporate had been low cost, then I’d argue that it’d nonetheless make sense to purchase into. In the long term, I absolutely anticipate that the agency will do effectively for itself. And that is as a result of I do imagine firmly within the potential of not solely photo voltaic, however residential photo voltaic. Add on prime of this different areas of progress like with the EV Charger applied sciences that the corporate has, and I see no motive why traders must be anxious concerning the firm’s potential to outlive. This doesn’t suggest, nonetheless, that issues are going to go effectively at present. The very fact of the matter is that shares are awfully expensive. As you possibly can see within the chart above, the inventory appears a bit lofty even when we use the bloated numbers from 2022. However in the event you begin assuming that monetary efficiency will revert again to what it was in 2021 and even 2020, then it isn’t unthinkable that the inventory may fall even additional than it has already.

Takeaway

Based mostly on the info offered, I have to say that I’m not terribly keen about Enphase Power proper now. I do imagine that a number of the finest funding prospects might be bought when these corporations are feeling ache. However we have now a substantial amount of uncertainty right here, notably in the case of home demand. If the inventory had been low cost, I’d have a greater opinion of it. However I do not see any practical state of affairs the place the inventory appears enticing from a pricing perspective, not less than not whereas shares are buying and selling the place they’re at present. Due to this, I do suppose that the following 12 months or so will open up different doorways for traders, doorways that may make them higher upside with much less volatility than what Enphase Power affords now.