SIphotography/iStock by way of Getty Pictures

Funding Thesis

PayPal (NASDAQ:PYPL) not too long ago launched a meek and lackluster earnings report. And but, this has led to my suggestion to purchase the inventory. Why, you ask?

In my expertise, international manufacturers often endure a worth drop, making them interesting at round 10x EPS.

Waiting for the following twelve months, I am not advocating for extraordinary measures, however quite a concentrate on the soundness of PayPal’s a number of, which I count on to stay regular, as defined under.

As I look out over the following twelve months, I am not arguing for heroics, as you may see.

My solely consideration is that PayPal’s a number of would not compress additional, which I imagine it will not, for causes talked about herein.

Fast Recap

As we headed into the earnings outcomes, that is what I wrote about PayPal,

PayPal’s inventory outlook is unappetizing. Grim. Unsure. Navigating a extremely aggressive panorama the place friends from all corners are encroaching on its turf. What can PayPal do?

Sure, PayPal inventory is wound tightly, like a coil, able to go larger. However considering in that method would not do anyone any good. Why?

As a result of once you say one thing is tightly coiled, you’re priming traders into the expectation that the inventory will pop. Quickly. And that is the flawed method to consider investing. The perfect kind of investing is boring and gradual.

The perfect kind of investing is when you find yourself shopping for as others are capitulating. When you don’t have any expectations. And you’re keen to place in what others cannot: persistence.

Therein lies the PayPal alternative. Accordingly, this is why I imagine that paying 10x subsequent yr’s EPS for PayPal is enticing.

Having adopted PayPal for a very long time, I now imagine is an effective time to extend my confidence on this identify and purchase shares on this inventory.

PayPal’s Close to-Time period Prospects

PayPal’s near-term prospects seem like targeted on driving worthwhile progress whereas managing the fee base effectively. The corporate’s management, notably Alex Chriss, emphasizes the necessity to prioritize investments in progress initiatives whereas additionally streamlining operations via automation and price administration. Regardless of acknowledging the challenges and areas that require additional consideration, the corporate appears decided to leverage its sturdy property, together with a globally acknowledged platform, the recognition of Venmo, and strong knowledge capabilities, to reinforce the shopper expertise and drive enterprise progress. The emphasis on enhancing transaction revenue greenback progress and increasing the acceptance of Venmo, means that PayPal is poised to navigate the near-term challenges and place itself for sustainable progress sooner or later.

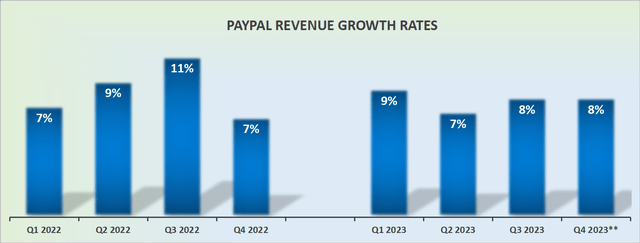

Income Development Charges Are Stabilizing Round Excessive Teenagers

PYPL income progress charges

PayPal faces a number of near-term challenges that require quick consideration. One of many key points highlighted is the necessity to focus the group on essentially the most impactful alternatives and prioritize important initiatives, as the corporate appears to be unfold too skinny, resulting in inefficiencies and doubtlessly hampering general efficiency. Moreover, the corporate acknowledges a decline in transaction revenue greenback progress and has lowered its income outlook for the upcoming quarter, indicating a cautious strategy in mild of the present enterprise surroundings. This cautious outlook means that PayPal could encounter hurdles in sustaining its worthwhile progress momentum, necessitating strategic changes to handle these challenges.

Extra particularly, the enterprise is more likely to proceed rising at across the high-single digits. So why must you spend money on PayPal now?

This is the factor, when new administration involves an organization, they’re going to wish to make modifications. They usually must put their stamp on the corporate sooner quite than later.

I don’t know whether or not or not these modifications will find yourself being optimistic or not, however I imagine you may agree with me that modifications are going to come back over the following twelve months. And given the place traders’ expectations are actually, I imagine it is a good time to purchase into PayPal.

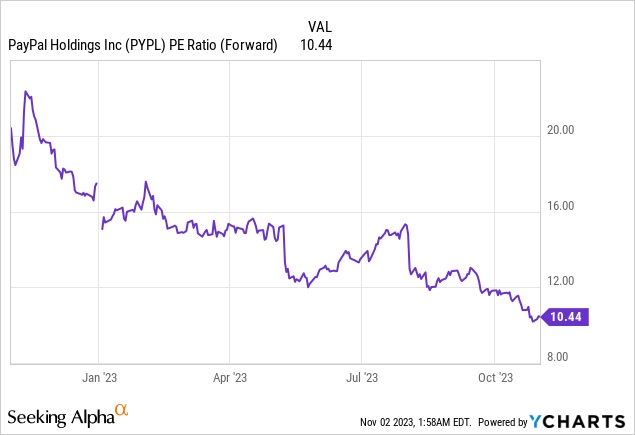

PYPL’s A number of Has Totally Compressed

PayPal is about to make near $5 of non-GAAP EPS. Moreover, PayPal has roughly $11 billion of money and equivalents, and simply over $15 billion, if we embody its funding portfolio. That is towards its $11 billion of debt.

Accordingly, PayPal shouldn’t be solely able to making about $5 billion of free money circulate per yr, nevertheless it additionally has a really strong steadiness sheet. Of that, there could be little denying.

So, the issues going through PayPal aren’t a few lack of market share. And even, that the enterprise hasn’t found out the way to make free money flows. No, the issue that PayPal faces is one among traders’ expectations.

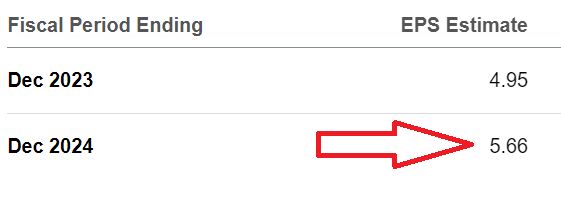

Nonetheless, I proceed to imagine that PayPal will make near $6 of EPS in 2024. Be aware, that is larger than analysts’ personal estimates proper now, see under.

SA Premium

However no matter me being proper or analysts being nearer to actuality, this inventory is now priced at 10x subsequent yr’s EPS.

For my thesis to work out positively, I’m not anticipating a re-rating of PayPal’s a number of. I am solely claiming that if PayPal’s a number of stays round 10x ahead free money circulate and would not compress additional, this inventory offers a optimistic risk-reward.

As additional proof that PayPal’s a number of has compressed loads already, think about the graphic that follows.

Simply twelve months in the past, traders have been keen to pay twice the a number of for PayPal than they pay at present.

If traders have been to re-rate the inventory larger, even barely, that may be icing on the cake, however that is not mandatory for my funding to ship a optimistic return.

The Backside Line

When contemplating PayPal’s present valuation, it turns into evident that the inventory is attractively priced, notably when factoring in its strong steadiness sheet and constant free money circulate technology.

With investor expectations low and the market already reflecting a compressed a number of, there’s ample room for optimistic sentiment to drive the inventory’s efficiency.

As the corporate units its sights on executing strategic modifications, PayPal seems well-positioned to exceed present market expectations and ship sturdy returns for traders within the subsequent twelve months.