koto_feja

Thesis

That is an replace of my earlier protection on BIVI. BioVie Pharma (NASDAQ:BIVI) is creating NE3107 for Alzheimer’s Illness (AD) and Parkinson’s Illness and BIV201 for ascites. Briefly, in my earlier protection I expressed my issues on the upcoming topline outcomes of the section 3 trial as a consequence of very restricted scientific information previous the section 3 trial. Particularly, the previous section 2 examine was too small (n=23 sufferers) and too brief (3 months). Moreover, section 2 examine sufferers had a lot milder cognitive impairment in comparison with the section 3 examine (MCI/delicate AD in section 2 vs mild-to-moderate AD in section 3) and sufferers with greater baseline cognitive impairment didn’t do as properly within the section 2 examine. Contemplating the excessive uncertainty and binary upcoming occasion (section 3 topline) I gave a “maintain” suggestion (worth at publication $3.66, closing worth on the time of penning this replace $3.15).

Nevertheless, yesterday BIVI introduced blinded end result information from its section 3 trial which I imagine are bullish, considerably cut back the uncertainty and improve possibilities of a constructive end result.

Up to date timelines

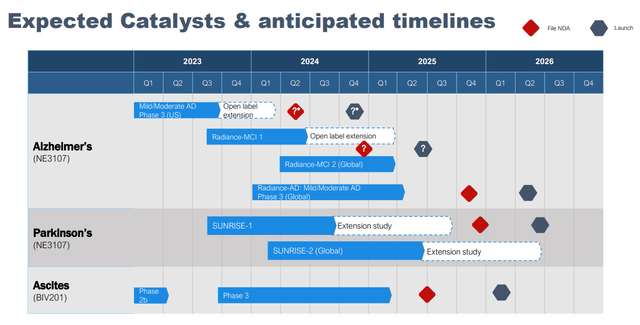

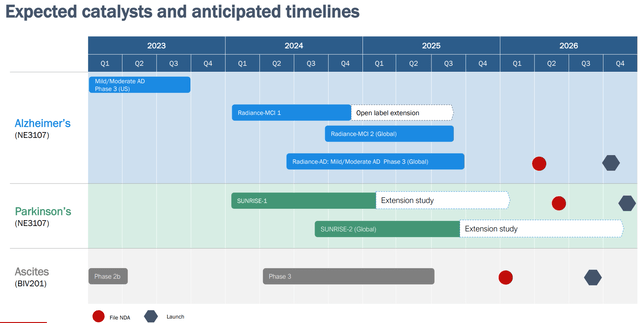

Within the newest firm presentation BIVI has altered its slide on anticipated catalysts and timelines. Notable are the next modifications;

Open label extension half from the section 3 AD trial was eliminated, in all probability as a consequence of monetary constraints. Earlier speculative timing for NDA submitting was eliminated. That is affordable in my view. Until outcomes of the section 3 trial are spectacular, displaying a big and simple impact dimension, I imagine FDA would need a second supportive trial in a extra well-defined affected person inhabitants and with longer follow-up. Timeline for initiating further section 3 trials has been delayed, additionally probably as a consequence of monetary constraints. However, I feel the up to date timeline is way more affordable. Beginning one other section 3 trials a pair months earlier than topline outcomes of the primary section 3 trial can be irrational in my view (not to mention the truth that BIVI would not have the money to take action).

Authentic slide (BIVI presentation) Up to date timeline (BIVI firm presentation)

Overview of the blinded information

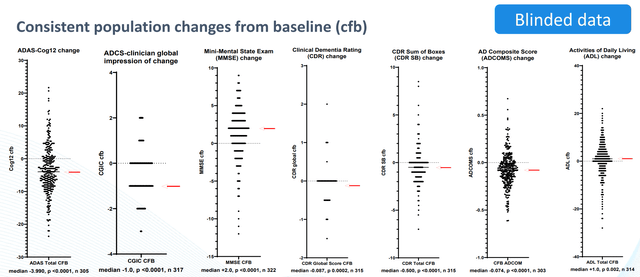

This is a abstract of the outcomes and why I imagine these outcomes are bullish;

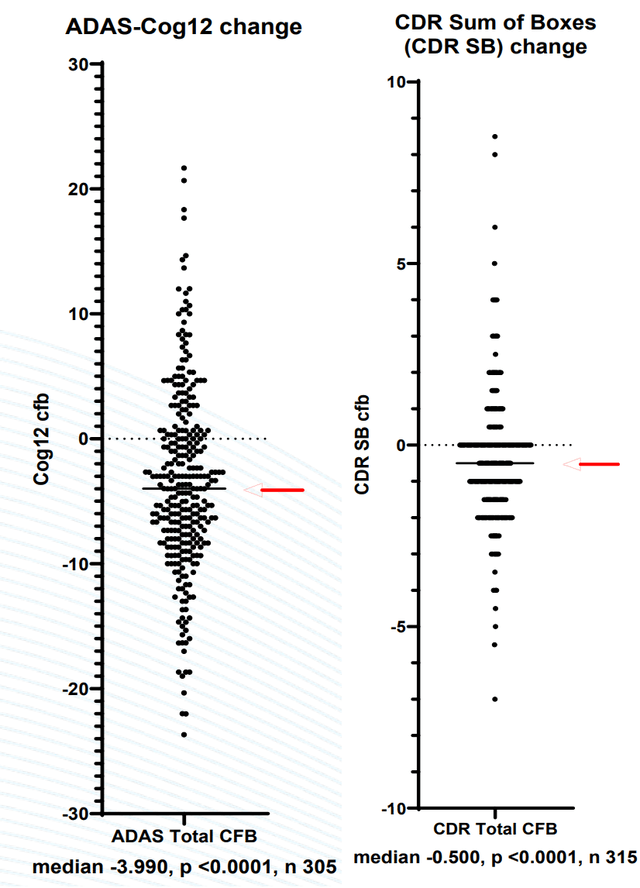

There was constant enchancment in a number of cognitive measures. Notably, a big share of sufferers had main enhancements in cognition, whereas many others worsened (as would usually be anticipated with out remedy). The magnitude of noticed enhancements can be sudden with no remedy impact. Usually, sufferers with AD can be anticipated to worsen. A major discount in amyloid burden from baseline was noticed. Notably, 36.5% of sufferers with constructive PrecivityAD® scores (a predictor of presence of amyloid plaques within the mind) at baseline reverted to having destructive outcomes after 30 weeks. Moreover, FDG-PET recommended discount in amyloid burden in 10 of 21 evaluated sufferers. These findings are goal and can be sudden with no remedy impact. Median volumes elevated in hippocampus and amygdala (information from n=23 sufferers). Constant findings by a number of cognitive measures, biomarker and imaging information help a remedy impact. The examine general had a really low charge of hostile occasions (AEs) and solely 10 topics discontinued as a consequence of a reported AE (2.3%, blinded)

Cognitive measures (BIVI presentation)

So why is the market not reacting positively?

I can consider the next elementary causes;

It is nonetheless simply blinded information and the result after unblinding stays unsure. Some have argued that if there have been large variations between remedy and placebo teams there needs to be 2 totally different distribution observable in every of the above-presented figures. It is a affordable argument. Personally, I do suppose there appear to be 2 totally different (however overlapping) distributions in ADAS-Cog12 determine (I see a cluster of datapoints round and above zero and one other cluster round -5 to -7). Equally, for CDR SB determine. As acknowledged by BIVI “a plurality of topics confirmed proof of enchancment and should have demonstrated results unrelated to the administration of the examine drug”. Examine contributors would sometimes be anticipated to worsen or expertise no change. Due to this fact, the noticed enchancment in majority of sufferers is inconsistent and suggests some impact unrelated to NE3107. Some explanations might be; placebo impact (mentioned in prior protection), “observe impact” (i.e. sufferers getting higher at repetitions of the identical cognitive exams), or constructive impact from different normal observe interventions. BIVI nonetheless wants lots of money. BIVI will doubtless nonetheless have to do one other section 3 trial earlier than approval.

Until I’m lacking one thing else, above causes should not be sufficient to maintain BIVI’s inventory worth so low going ahead in direction of section 3 outcomes.

Nearer view of figures on ADAS-Cog12 and CDR-SB (BIVI presentation)

Financials

No replace since my final protection. BIVI must increase money, in all probability following section 3 topline outcomes, to help deliberate scientific trials.

Dangers

The foremost danger is destructive/suboptimal outcomes of the section 3 trial. One other danger is that BIVI will nonetheless want a variety of money to help deliberate scientific trials. However with constructive section 3 outcomes this should not matter a lot (assuming that the market will react positively to constructive outcomes). Even with constructive section 3 outcomes BIVI will most definitely nonetheless must conduct one other trial, with doubtless an extended (no less than 12-18 months) follow-up. Competitors by different biotechs creating AD remedies. Primarily based on its up to date timeline, BIVI anticipates BLA submission for AD in 2026, which suggests opponents may attain the market earlier.

Conclusion

Contemplating bullish indicators from the blinded end result presentation the danger/reward steadiness has turn out to be extra favorable, prompting my to vary my ranking to “Purchase”. Nevertheless, market’s response to the info (as much as the time of writing) is regarding and there may be nonetheless excessive uncertainty concerning the end result. Part 3 topline outcomes stays a dangerous binary occasion and you need to solely make investments what you possibly can afford to lose. Ready for topline outcomes is safer and there needs to be loads upside potential following constructive outcomes (i.e. it’s safer to take a position following topline outcomes).

Your suggestions is appreciated

Please remark beneath in case you have any suggestions (constructive or destructive), for those who spot any errors, or for those who imagine I missed one thing vital in my evaluation.