jetcityimage

Conventional Defensive Sectors Have Not Proved Defensive Just lately

The current market surroundings has proved particularly difficult for lots of shares sometimes seen as defensive comparable to Utilities (XLU) and Shopper Staples (XLP). Sometimes throughout market sell-offs, these are two sectors that are inclined to outperform as a result of their defensive nature. Nonetheless, in the newest sell-off that has not been the case because the sharp enhance in rates of interest has led to sell-off in rate of interest delicate shares comparable to Utilities. Moreover, Shopper Staple shares have offered off as a result of fears that the brand new weight reduction medicine comparable to Ozempic, Wegovy, and Mounjaro will result in modifications in client habits which can lead to much less demand for unhealthy merchandise offered by firms comparable to Coca-Cola (KO), Hershey (HSY), and plenty of others.

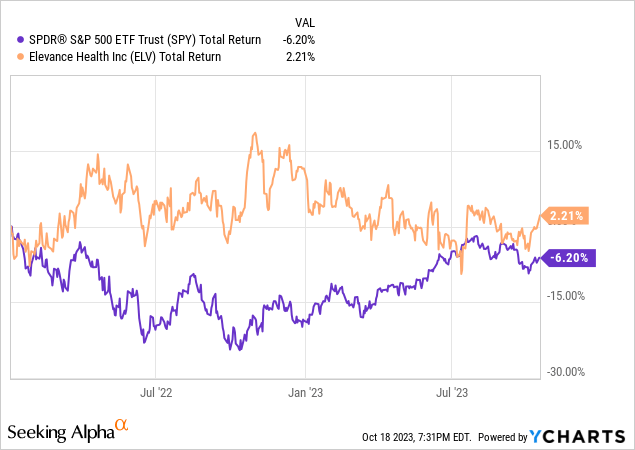

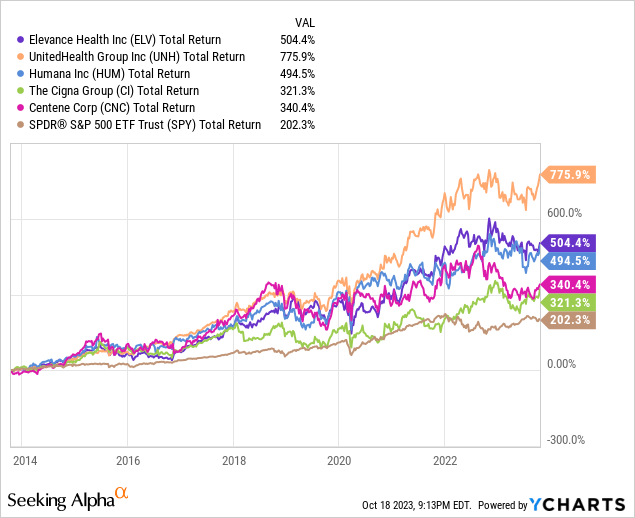

Given the challenges confronted by these conventional defensive sectors, traders with restricted threat tolerance ought to look to diversify into different defensive equities. Elevance Well being (NYSE:ELV), which has outperformed the S&P 500 by ~8.5% because the index reached an all-time excessive on January 3, 2022, represents a wonderful defensive funding alternative at present ranges.

Enterprise Overview

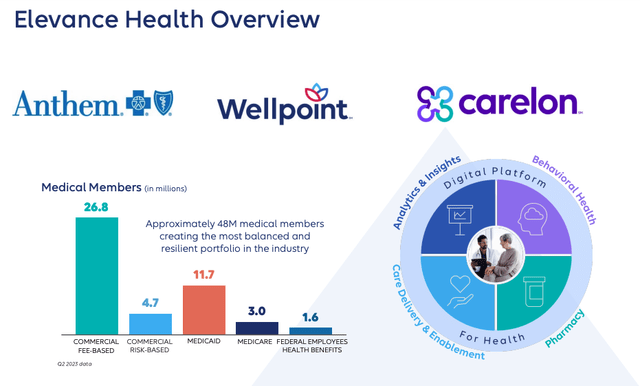

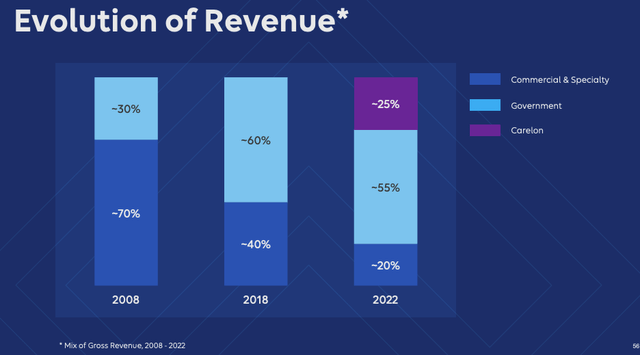

ELV is a number one medical insurance supplier serving greater than 47 million members within the U.S. and is the biggest single supplier of Blue Cross Blue Protect Plans having licenses in 14 states. ELV operates in three segments: Well being Advantages, Carelon, and Company & Different. The well being advantages enterprise is comprised of economic and authorities segments. The federal government enterprise makes up 55% of FY22 income and industrial markets make up 20% of FY22 income. The remaining 25% of income comes from Carelon which consists of Carelon Companies and CarelonRx. CarelonRx is a main profit supervisor and contributes ~70% of your complete Carelon section income.

Elevance Well being Presentation Elevance Well being Presentation

Recession Resilient Enterprise

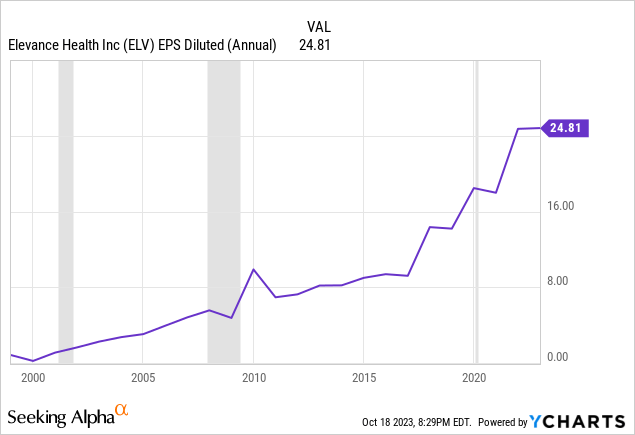

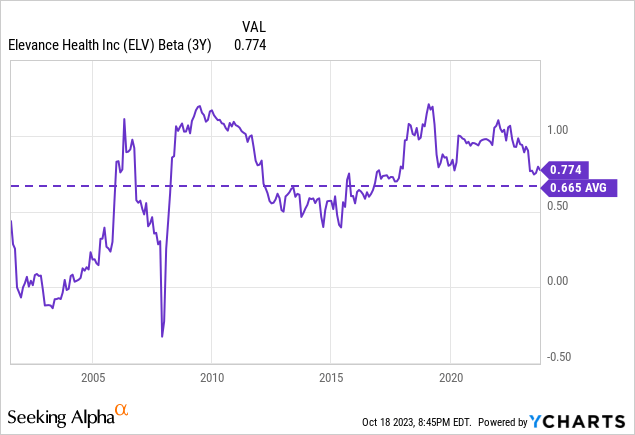

ELV’s enterprise is recession resilient as most individuals would require medical insurance no matter financial situations. Whereas the industrial enterprise might expertise a decline in a recession, the federal government enterprise tends to be extra steady. As proven by the chart beneath, the recession resilient nature of the enterprise might be seen within the comparatively robust EPS efficiency throughout the three most up-to-date recessions. Moreover, the realized common beta of 0.66 serves as further affirmation that ELV is much less economically delicate than most firms.

Aggressive Benefit

ELV’s aggressive benefit is available in half as a result of its massive scale. ELV controls an estimated 10% of the medical insurance market within the U.S. and is the second largest medical insurance firm within the U.S. after UnitedHealth (UNH). Aggressive benefits as a result of scale embrace each elevated bargaining energy with healthcare suppliers in addition to bigger supplier networks for members. Furthermore, ELV advantages from its main place within the Blue Cross Blue Protect Affiliation (“BCBSA”). The BCBSA community insures 1 in 3 Individuals which is greater than every other insurer. 1.7 million docs and hospitals contract with BCBSA which can be greater than every other insurer. The BCBSA has operations in all 50 states and every member is ready to make the most of different BCBS supplier networks and reductions when any BCBSA member travels outdoors of the state their coverage is written in. ELV’s robust place in BCBSA provides it a aggressive benefit when competing for very massive multi-state mandates.

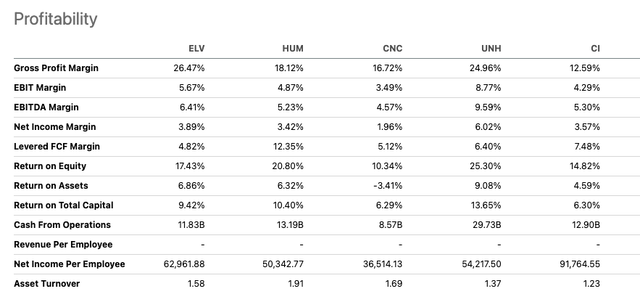

As proven by the desk beneath ELV scores favorably relative to friends on various key margin metrics together with gross revenue margin (highest among the many group), EBITDA margin (second solely to UNH), and internet revenue margin (second solely to UNH).

In search of Alpha

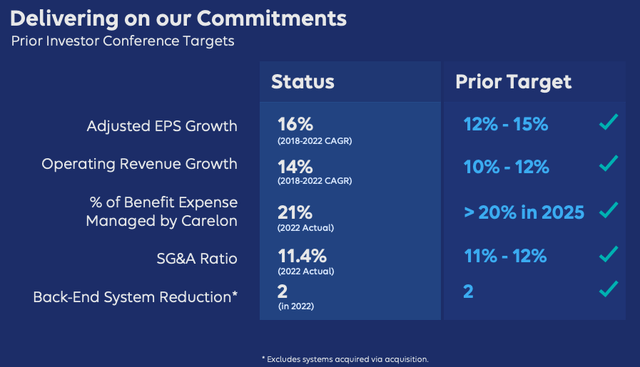

Historical past of Delivering Sturdy Outcomes

ELV has a protracted historical past of delivering robust monetary outcomes together with a 16% EPS progress CAGR (2018-2022) which has resulted in robust returns for fairness holders. Over the previous 10 years, ELV inventory has returned 504% in comparison with simply 202% for the S&P 500. The one peer that ELV has underperformed over the previous 10 years is UNH. This efficiency is especially spectacular given the mature nature of the business and excessive diploma of presidency regulation.

Elevance Investor Presentation Elevance Investor Presentation

Sturdy Q3 2023 Outcomes

On October 18, 2023 ELV reported robust Q3 outcomes which simply surpassed analyst expectations. ELV earned $8.99 per share in comparison with analyst estimates of $8.46 per share. The excellent news didn’t cease there as ELV additionally raised FY2023 steerage for EPS to be better than $33 per share vs a earlier outlook of better than $32.85. In response to the robust report, ELV shares initially traded increased as much as $482.5 per share earlier than closing at $469.31 (up lower than 1% on the day.)

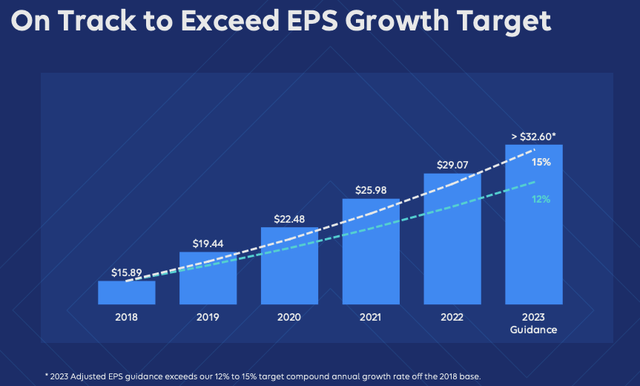

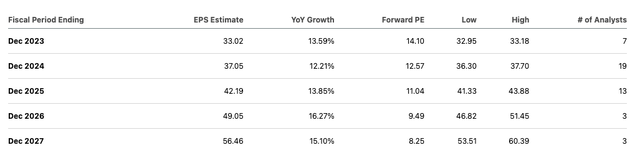

Lengthy-Time period Development Forecast

ELV believes it is going to be capable of develop earnings at a 12-15% CAGR by 2027. Given the corporate’s robust historic efficiency (i.e., 16% EPS CAGR from 2018-2022) I imagine this can be a progress charge that will likely be achieved. As proven beneath, this can be a view that’s shared by Wall Avenue with analysts anticipating mid double digit EPS progress by 2027.

In search of Alpha

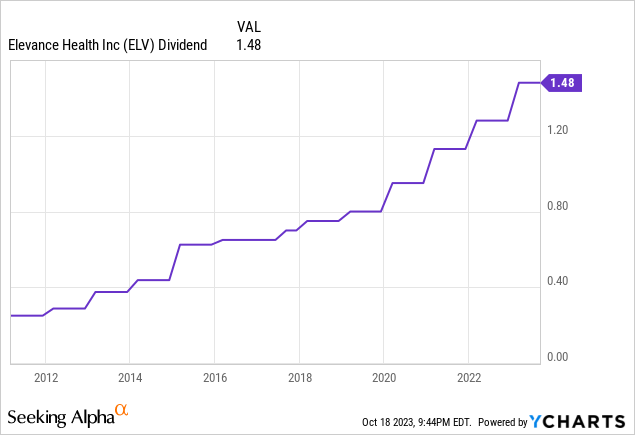

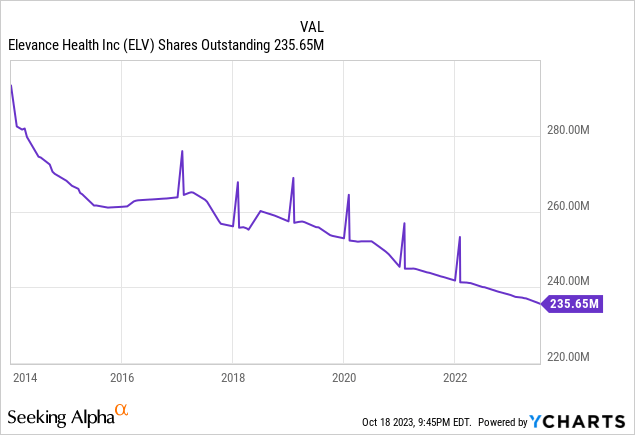

Shareholder Pleasant Capital Allocation

ELV has returned vital quantities of capital to shareholders through growing dividends and share repurchases. Going ahead, ELV expects to spend roughly 20% of Free Money Circulation on dividends, 30% on share repurchases, and the remaining 50% on reinvestment and M&A.

Valuation

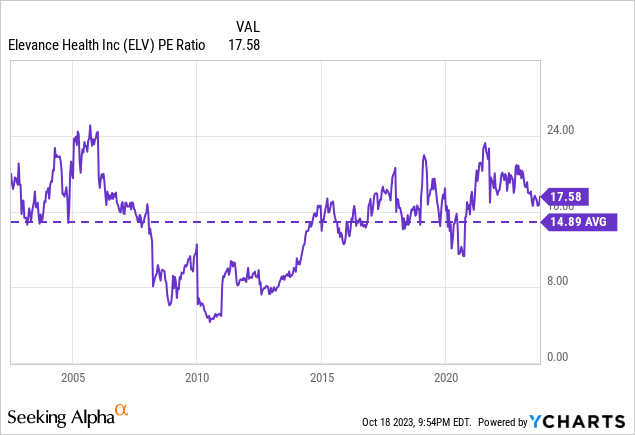

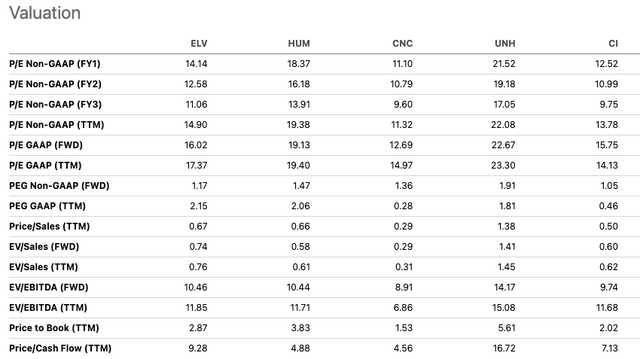

In case you have gotten to this a part of the article it’s possible you’ll suppose that ELV have to be buying and selling at a premium valuation because of the mixture of a powerful aggressive benefit, recession resilient enterprise, robust historic progress, and powerful progress forecast. Nonetheless, this isn’t the case as ELV trades at a ahead pe ratio of simply 12.5x in comparison with 17.9x for the S&P 500. Given ELV’s anticipated progress charge of ~13% this implies ELV is buying and selling at a ahead PEG ratio of simply 0.96x in comparison with 1.49x for the S&P 500 assuming a 12% progress charge. On a trailing foundation, ELV trades at ~17.5x which is simply barely above the historic common of 14.9x. Whereas some may argue that ELV is at present buying and selling at a excessive valuation relative to its historic common, that view fails to contemplate the truth that ELV has vastly outperformed the S&P 500 traditionally and thus the inventory was considerably undervalued throughout most earlier time durations. Moreover, as proven by the desk beneath, ELV is buying and selling at a lovely valuation relative to friends with a ahead PE ratio of 12.5x in comparison with 19x for UNH and 16x for HUM.

In search of Alpha

Dangers To Think about

The most important threat that ELV faces is a few type of authorities reform that disrupts the great enterprise than ELV at present has. Healthcare reform can take many alternative kinds however arguably essentially the most vital change can be a nationalization of the medical insurance system. Whereas this threat of radical change is all the time there sooner or later, this threat may be very low proper now given the present political local weather. A better likelihood, although much less catastrophic threat for ELV, can be authorities reform that results in elevated ranges of competitors and permits smaller gamers to compete with the likes of ELV and UNH. One other necessary threat to contemplate concerning ELV is the potential for the disruption of the PBM enterprise. This threat seems considerably elevated given the current information that CVS Well being misplaced a significant PBM contract with Blue Cross Blue Protect of California to Amazon and Mark Cuban Price Plus Drug Firm. Nonetheless, there has not been vital comply with by and, for now, that main contract loss seems to be an remoted scenario.

Conclusion

The funding setup round ELV is characterised by the uncommon mixture of robust aggressive benefits, restricted sensitivity to financial weak point, excessive progress, and beneath market valuations. ELV additionally confirmed a powerful working surroundings with its Q3 beat and lift earnings launch but the inventory didn’t transfer up as a lot as I’d have anticipated.

Whereas authorities regulatory modifications stays a threat, I imagine this threat is considerably mitigated within the near-term given political deal with different points such because the wars in Ukraine and Israel in addition to relations with China. Moreover, given the present fiscal scenario the U.S. is dealing with I imagine the potential for a major enhance in authorities run healthcare plans is the bottom it has been in a very long time.

For these causes, I imagine ELV represents a excessive conviction shopping for alternative at present ranges. I imagine ELV has the potential to serve an necessary position in portfolios as a key defensive holding given the truth that different conventional defensive shares comparable to Utilities and Shopper Staples have misplaced their defensive properties within the present market.