Andrii Dodonov

Market overview

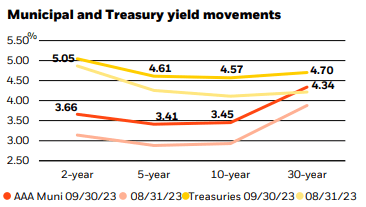

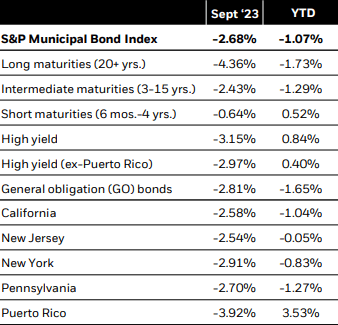

Municipal bonds posted sharply unfavorable complete returns in September amid heightened volatility. Rates of interest rose quickly and pressured fastened earnings belongings because the market navigated a reasonable rise in inflation, continued power within the labor market, surging oil costs, and extra hawkish-than-expected message from the Federal Reserve (Fed). The asset class, dragged down by wealthy valuations and fewer favorable supply-and-demand dynamics, lagged versus comparable Treasuries. The S&P Municipal Bond Index returned -2.68%, bringing the year-to-date complete return to – 1.07%. Shorter-duration (i.e., much less delicate to rate of interest adjustments), AA-rated bonds and the corporate-backed, utility, and transportation sectors carried out finest.

Issuance was gentle at simply $28 billion, 23% under the five-year common, bringing the year-to-date complete to $263 billion, down 8% year-over-year. Nevertheless, issuance nonetheless outpaced reinvestment earnings from maturities, calls, and coupons by almost $6 billion, weighing closely in the marketplace as seasonal internet unfavorable provide throughout the summer season months yielded to internet constructive provide. Consequently, offers have been oversubscribed simply 3.2 occasions on common, the bottom complete since February. On the similar time, traders displayed warning as rates of interest rose, and mutual fund flows have been more and more unfavorable, exacerbated by a pickup in tax loss promoting late within the month.

Whereas the current sell-off was considerably bigger and extra unstable than anticipated, seasonal efficiency weak spot within the autumn was broadly anticipated. With the Fed nearing the top of its tightening cycle, we view the reset in yields and valuations as a sexy long-term shopping for alternative. We foresee utilizing any materials pickup in issuance so as to add some length and lock in sturdy yields.

Technique insights

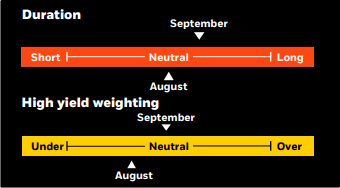

We preserve a neutral-duration posture general, albeit barely longer than final month. We favor an up-in-quality bias and stay each cautious and selective in noninvestment grade. We advocate a barbell yield curve technique, pairing front-end publicity with an elevated however modest allocation to the 15-20-year a part of the curve.

Chubby

Important-service income bonds Choose highest-quality state and native issuers with broadest tax help Flagship universities Choose issuers within the excessive yield house

Underweight

Speculative initiatives with weak sponsorship, unproven expertise, or unsound feasibility research Senior residing and long-term care services in saturated markets Decrease-rated non-public universities Stand-alone and rural well being suppliers

Credit score headlines

Final month, Moody’s revised its credit score outlook to ‘constructive’ from ‘steady’ for the New York Metropolitan Transportation Authority’s (MTA) $20.6 billion in excellent transportation income bonds. Moody’s additionally affirmed the MTA’s ‘A3’ score. S&P adopted with a score improve to ‘A-‘ from ‘BBB+’ and revised its outlook to ‘constructive’ from ‘steady’ on October 4th. Extra state help has offset post-COVID-19 ridership losses and has enabled the MTA to almost shut forecasted price range gaps and stabilize liquidity. Weekday subway ridership on the nation’s largest mass-transit system has slowly risen however stays at about 70% of 2019 ranges. To offset fare losses, a state-approved 0.6% enhance in New York Metropolis payroll taxes will present an estimated $5 billion of income over the following 5 years. Continued help from the state, a full restoration of ridership, and the implementation of operational financial savings are key components in any future score upgrades.

A current score downgrade of a small issuer highlights the significance of credit score analysis and the necessity to analyze an issuer’s whole debt construction prior to buy. For instance, S&P downgraded Maryland Heights, MO from ‘BBB’ to ‘BB+’ final month based mostly on the town’s refusal to help its nonrated 2018B Industrial Improvement Authority income bonds. Town was rated ‘AA+’ as just lately as November 2020. The 2018B bonds have been secured by revenues from a multipurpose ice enviornment that by no means grew to become totally operational as a result of COVID-19 pandemic. The ice facility has confronted working imbalances since its opening in 2019, having relied on common fund transfers from the town to make debt funds on three separate events. Given the town’s current choice to not present extra help for the ice complicated bonds, S&P has turn out to be cautious of the town’s willingness to pay its excellent debt backed by annual appropriations. This technical default by a beforehand extremely rated metropolis underscores the necessity for in-depth credit score evaluation.

BlackRock, Bloomberg.

Municipal efficiency

S&P Indexes.

Funding includes threat. The 2 important dangers associated to fastened earnings investing are rate of interest threat and credit score threat. Sometimes, when rates of interest rise, there’s a corresponding decline out there worth of bonds. Credit score threat refers back to the risk that the issuer of the bond will be unable to make principal and curiosity funds. There could also be much less info out there on the monetary situation of issuers of municipal securities than for public firms. The marketplace for municipal bonds could also be much less liquid than for taxable bonds. A portion of the earnings from tax-exempt bonds could also be taxable. Some traders could also be topic to Various Minimal Tax (AMT). Capital positive aspects distributions, if any, are taxable. Index efficiency is proven for illustrative functions solely. You can’t make investments straight in an index. Previous efficiency is not any assure of future outcomes.

This materials is just not supposed to be relied upon as a forecast, analysis or funding recommendation, and isn’t a suggestion, provide or solicitation to purchase or promote any securities or to undertake any funding technique. The opinions expressed are as of October 6, 2023, and should change as subsequent circumstances fluctuate. The data and opinions contained on this materials are derived from proprietary and nonproprietary sources deemed by BlackRock to be dependable, will not be essentially all-inclusive and will not be assured as to accuracy. There isn’t any assure that any forecasts made will come to cross. Any investments named inside this materials could not essentially be held in any accounts managed by BlackRock. Reliance upon info on this materials is on the sole discretion of the reader.

©2023 BlackRock, Inc or its associates. All Rights Reserved. BlackRock is a trademark of BlackRock, Inc or its associates. All different emblems are these of their respective house owners.

Ready by BlackRock Investments, LLC, member FINRA

Not FDIC Insured • Could Lose Worth • No Financial institution Assure

This publish initially appeared on the iShares Market Insights.