The reshaping of the world financial system and the worldwide (political) order is in full swing. It’s a lengthy course of, the concrete end result of which is unsure upfront and related to quite a few imponderables. However, there are highly effective elements, such because the shift in financial, demographic and navy weight, which are driving the readjustment within the (geo)political area. And this readjustment can be mirrored within the change in gold flows. They’re more and more shifting from West to East, since “Gold goes the place the cash is,” as James Metal pointedly put it.

The central banks of the states of the East are among the many strongest patrons of gold – additionally inside the West

That is additionally mirrored within the persevering with enthusiasm of central banks for gold, particularly in non-Western international locations. 2022 noticed the biggest purchases of gold by central banks since data started greater than 70 years in the past, at 1,136 tons. The primary half of 2023 noticed a continuation of this development. Regardless of a weaker second quarter, central financial institution purchases within the first half of the yr set a brand new half-year document. Central banks elevated their gold reserves by a complete of 378 tons from January to June. The earlier half-year document from 2019 was thus barely exceeded. China made the biggest purchases, adopted by Singapore, Poland, India and the Czech Republic. So even within the West, it was international locations within the East that made extra purchases.

The next chart exhibits the extent to which institutional demand for gold has shifted to the East. It compares the cumulative gold gross sales of Western central banks with the cumulative gold purchases of the Shanghai Cooperation Group (SCO or SOC) since 2001.

Wanting on the BRICS, we additionally see a hanging overlap, with central banks from 4 of the 5 BRICS international locations – Brazil, Russia, India and China – shopping for a cumulative 2,932 tonnes of gold over 2010–2022.

Holdings of US Treasuries are decreased

In flip, the BRICS proceed to cut back their share of the hovering US authorities debt. In different phrases, gold is turning into increasingly more fascinating as a reserve asset as a result of US Treasuries have been turning into much less and fewer fascinating as a forex reserve for greater than a decade. The militarization of cash by freezing Russia’s overseas change reserves simply days after Russia’s invasion of Ukraine in late February 2022 added emphasis to this course of, however didn’t kick it off.

The BRICS now maintain solely 4.1 p.c of all US authorities debt, in contrast with 10.4 p.c in January 2012. That could be a decline of greater than 60 p.c. The remainder of the world has decreased its publicity to US authorities debt by a lot much less. In January 2012, the remainder of the world held 22.0 p.c of all US authorities debt on their books; presently, they maintain 19.3 p.c. That could be a lower of greater than 12 p.c.

The East is increasing its infrastructure for gold buying and selling

Nonetheless, the East just isn’t solely stocking up on gold and mining gold itself on a big scale. China and Russia have ranked among the many prime 3 gold producing nations for years.

Nations reminiscent of China, the United Arab Emirates and even Russia are increasing their gold buying and selling infrastructure. That is to ascertain a everlasting infrastructure for the detour of gold buying and selling from gold buying and selling facilities within the West reminiscent of London, New York and Zurich. This testifies to the altering understanding of roles: The East more and more not sees itself as a buyer of Western infrastructures, however gives the infrastructure itself.

Key developments embrace:

SGE & SFO NRA: Cooperation between the Chinese language and Russian gold markets

For a while now, China and Russia have been working laborious to hyperlink their gold markets by cooperation between the Shanghai Gold Trade (SGE) and the Russian monetary authority, the Nationwide Monetary Affiliation (NFA). The NFA is a Russian skilled affiliation representing your complete Russian monetary sector, together with the Russian valuable metals market.

Within the face of Western sanctions, Russian gold exports to China have already surged since mid-2022. As three Russian banks – VTB, Sberbank and Otkritie – are already members of the SGE Worldwide Board of the SGE, which was based in 2014, this cooperation between the gold markets of Russia and China is prone to intensify sooner or later.

Memberships in gold-related establishments

As gold flows from west to east and the significance of jap gold markets will increase, these markets will even have larger illustration and affect within the international establishments that symbolize the gold market, such because the LBMA and the World Gold Council (WGC).

In 2009, solely six Chinese language refineries had been on the LBMA’s Good Supply Record, however now there are 13. Whereas simply 15 years in the past there was just one common (full) member of the LBMA from China, the Financial institution of China, there at the moment are seven. China’s rising affect can be mirrored within the World Gold Council. In February 2009, just one Chinese language gold producer was a member of the WGC; now there are 4.

India Worldwide Bullion Trade (IIBX)

Along with its subtle OTC gold buying and selling market, India has additionally established a buying and selling infrastructure for gold futures contracts on the Multi Commodity Trade of India Restricted (MCX). In July 2022, the India Worldwide Bullion Trade (IIBX), supported by the Indian authorities, was formally opened for buying and selling spot gold contracts backed by bodily metallic. IIBX is situated in a particular financial zone in GIFT Metropolis within the Indian state of Gujarat, and the gold underlying the contracts is saved there. One objective of IIBX is to permit certified patrons to import gold straight into India with out the necessity for banks or approved businesses. Thus far, nevertheless, buying and selling volumes have been minimal.

Institution of a Moscow World Commonplace

On the finish of February 2022, when sanctions towards Russia had been imposed by the West instantly after the beginning of the Ukraine warfare, the London Bullion Market Affiliation (LBMA) excluded the three Russian banks VTB, Sovkombank and Otkritie. Just a few days later, the LBMA eliminated all six Russian valuable metals refiners from the LBMA Good Supply Record and the CME Group adopted go well with, eradicating the identical refiners from the record of accredited COMEX refiners.

In consequence, Moscow introduced in July 2022 {that a} new infrastructure for valuable metals buying and selling unbiased of the LBMA and COMEX could be established. In response to Moscow, that is supposed to interrupt the supremacy of London and New York in international valuable metals pricing. This proposal requires the introduction of a Moscow World Commonplace (MWS) for valuable metals buying and selling, just like the LBMA’s Good Supply Record, the institution of a brand new worldwide valuable metals change in Moscow based mostly on the MWS, the Moscow Worldwide Treasured Metals Trade, and the creation of a brand new gold value fixing based mostly on the MWS in order to ascertain gold costs and reference costs completely different from these of the LBMA and COMEX.

Personal gold demand shifts to the east

EAST’S elevated curiosity in gold can be evident within the non-governmental sector. Chinese language shopper demand, for instance, elevated from 292.6 tons to 824.9 tons (2022) for the reason that flip of the millennium. This is a rise of 181%. Annual shopper demand in India has additionally elevated for the reason that flip of the millennium, albeit from an already excessive degree in 2000. China and India, which collectively accounted for less than 28.7% of shopper demand in 2000, account for nearly half of world shopper demand (48.4%) in 2022 and collectively acquired 1,600 tons of gold final yr.

Shopper Demand for Gold – 2000 vs. 2022

2000% of World Demand2022% of World Demand2022 vs. 2000in Tonnes2022 vs.2000 in %India723.020.4percent774.023.4percent50.07.0percentChina292.68.3percent824.925percent532.3181.9percentJapan105.13.0percent4.30.1%-100.8-95.9percentMiddle East457.912.9percent268.28.1%-189.7-41.4percentTürkiye177.45.0percent121.53.7%-55.9-31.5percentUnited States368.510.4percent256.67.8%-111.9-30.4percentFrance19.00.5percent19.90.6percent0.94.5percentGermany15.60.4percent196.45.9percent180.81,159percentItaly92.12.6percent17.80.5%-74.3-80.6percentUK75.02.1percent35.61.1%-39.4-52.5percentRemainder of Europe142.44.0percent115.13.5%-27.3-19.2percentOther1,076.030.4percent669.120.3%-406.9-37.8% World Demand3,544.6100.0percent3,303.3100.0%-241.3-6.8%

Supply: World Gold Council, Incrementum AG

Current developments level in the identical path. Within the first eight months of the present yr, Asian gold ETFs elevated their holdings by 7.7%, whereas North America and Europe recorded outflows of two.3% and 6.1%, respectively. Considerably, within the bars and cash demand phase, Turkey and Iran changed Germany and Switzerland within the prime 5 within the first half of the yr. China now leads this sub-segment of gold demand – within the first half of 2022, Germany was nonetheless within the lead – adopted by Turkey, the US, India and Iran. It is because whereas demand for bars and cash in Turkey shot up from 9.5 tons to 47.6 tons within the second quarter of 2023, it fell by round three quarters in Germany.

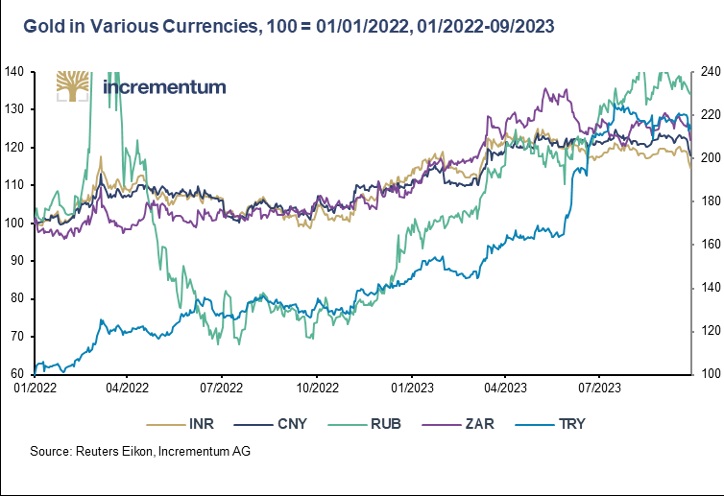

The worth of gold in currencies of the East has elevated considerably

As of the top of September, gold was 14.6% greater in Indian rupees than in the beginning of 2022, 18.0% greater in Chinese language renminbi, 34.3% greater in Russian rubles, 22.1% greater in South African rand (all left-hand aspect) and 114.0% greater in Turkish lira (right-hand aspect). Gold thus impressively demonstrates its value-preserving properties in tough (geo)political and macroeconomic conditions in these international locations.

The considerably elevated premium on the gold value in China since July is an unmistakable signal that there’s a structural scarcity of gold within the Chinese language market and thus an expression of the sturdy demand for gold within the Center Kingdom, which is battling profound financial issues.

Conclusion

This shift in demand from West to East might be noticed not solely amongst governments or government-related entities, but in addition amongst institutional and personal buyers. Gold is flowing to the place it’s most valued and the place financial prosperity and financial savings charges have elevated. Within the medium time period, the shift in demand ought to subsequently discover assist from the upper development prospects in Asia and the Center East. “Ohne Geld, ka Musi” (“With out cash, no music”) – that is how the vernacular formulates this financial truism in German. And because the IMF’s most up-to-date financial development forecast signifies, the sub-region of rising and creating Asia will develop at a projected 5.2% this yr and 4.8% subsequent yr, whereas the West will develop a lot much less strongly. This will even result in a shift in affect on pricing from West to East.

Gold Switzerland

**********