David Gyung

Introduction

The final quarter showcased a major beat on the underside line for Erie Indemnity Firm (NASDAQ:ERIE), however the reality of the matter stays that the valuation is simply too excessive to justify a purchase case. The bounce in value significantly will increase the draw back threat if there’s a broader market correction.

Nevertheless, holding shares nonetheless looks as if an inexpensive method to take when the yield is over 1.6% proper now and it has been rising for the final 12 years consecutively. I just like the enterprise and the way it operates, the big quantity of retention they will have speaks volumes in regards to the high quality they supply. For the second although it stays to be a maintain.

Firm Construction

ERIE based in 1925 and based mostly in Pennsylvania, operates because the attorney-in-fact for policyholders on the Erie Insurance coverage Trade. The Erie Insurance coverage Trade, a Pennsylvania-based reciprocal insurer, focuses on underwriting property and casualty insurance coverage insurance policies. ERIE performs a vital function in managing coverage issuance and renewals for the subscribers on the Trade. Moreover, the corporate is liable for claims processing, and funding administration, and provides administrative companies to all declare holders, guaranteeing environment friendly and complete assist for its clientele.

ERIE safeguards the Trade’s monetary well-being, which is instrumental in propelling the prosperity of Indemnity. The dynamics of their partnership are delineated throughout the subscriber’s settlement, which additionally delineates the construction of administration charges. In adherence to this settlement, the administration price is topic to a cap, guaranteeing it doesn’t surpass 25% of the premiums written by the Trade.

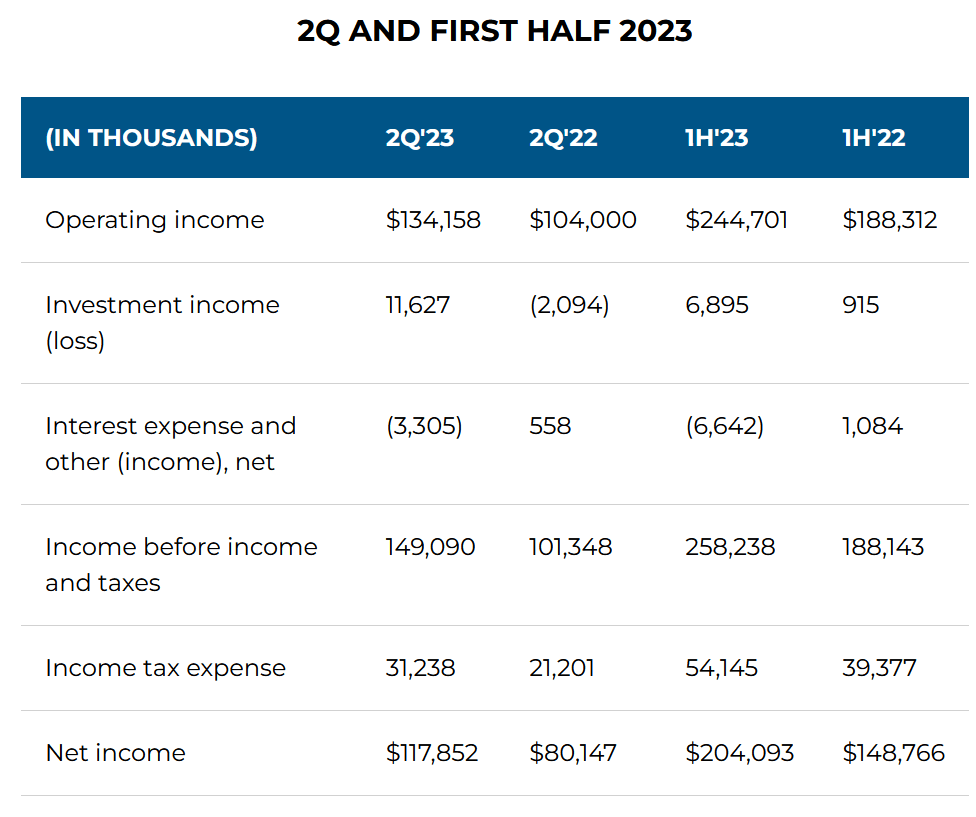

Earnings Assertion (Earnings Report)

Going off the final revenue assertion from the enterprise there was power throughout the board, I feel. The underside line managed to develop very properly as much as $117 million for the quarter, versus $80 million in Q2 FY2022. This has been largely doable because of the upper funding revenue the corporate can generate. Final 12 months they posted unfavorable funding incomes, however this 12 months round it was $11 million optimistic as an alternative.

Pennsylvania stands out as one of many states with comparatively excessive residence and automotive insurance coverage prices. Nevertheless, regardless of these elevated premiums, there continues to be a considerable demand for insurance coverage throughout the state. If ERIE can proceed to drive vital progress because of the big market alternative I feel that the market will proceed to reward the corporate with the big premium it at present trades at. With rising residence costs and automotive costs, the price of insurance coverage goes up and so does the revenues of ERIE in consequence.

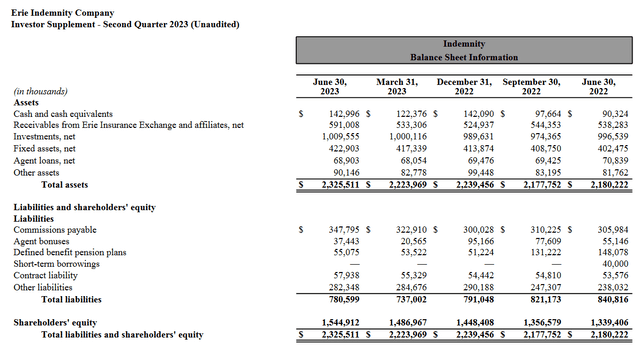

Stability Sheet (Earnings Report Q2)

Wanting on the monetary well being of the corporate I feel it seems fairly respectable proper now. The money place has risen very properly to over $142 million, up from $90 million a 12 months earlier. However what I’m extra taking a look at is the investments the corporate is making, proper now boasting over $1 billion. A gentle enhance right here ought to underscore the monetary place of ERIE and will allow the enterprise to keep up a equally excessive ROE because the 24% TTM has been.

This I feel is making traders extra bullish on the corporate and has been trigger for the speedy rise in share value the previous few months. The financials of the corporate are stable I feel however even with that, the valuation has considerably gotten uncontrolled, and a pullback may happen within the close to time period, which makes a maintain probably the most affordable ranking right here.

Taking a look at what the investments are composed of, the 2022 12 months report mentions each fixed-income securities, fairness securities, and restricted partnerships. The emphasis is totally on fixed-income securities which has helped drive regular and dependable earnings progress over the previous few years. The vast majority of the investments the corporate has sits in company debt securities proper now at $569 million as of their newest 10q. The second largest portion of investments are in residential mortgage-backed securities at $158 million. I discover these to be fairly steady sources of funding revenue for the corporate and the final quarter it netted them round $13 million. On an annual foundation that’s simply over $50 million. If this may be sustained it could actually show to be a steady spine for the corporate’s earnings and will allow ERIE to keep up an ROE of round 24%. Even now, the corporate is barely beneath its 5-year common ROE of 26%. Going ahead, I feel the comparatively protected and dependable areas that ERIE has invested in ought to yield them a robust quantity of internet funding revenue and in the end result in a sustainable 22 – 24% being achievable for ERIE.

Earnings Transcript

I’ve mentioned that the final report from ERIE showcased a robust beat on the highest line for the enterprise which in the end led to the rising share value within the following weeks afterwards. Let’s take a more in-depth take a look at the earnings name that was held and get some feedback from the administration, extra particularly the CEO of ERIE Tim NeCastro.

“A frequent matter of dialogue at these current gatherings has been the challenges the business continues to face. Inflation, provide chain points and a rise in extreme climate are among the many most urgent, and we’re definitely feeling the consequences of them to this point in 2023. That is mirrored in our mixed ratio, which now stands at 120.8% in comparison with 113.7% for the primary half of 2022”.

Going into the subsequent few quarters there actually must be enhancements on this entrance for the corporate. If the mixed ratio stays above 100% for too lengthy I feel that the market will flip bitter on the prospects of ERIE as bills are an excessive amount of and the effectivity of the enterprise is deteriorating.

“General, insurance policies in power are up 5.2% with private strains reaching its highest progress in 20 years at 5.5%. Retention can also be robust at 90.8% for private and industrial strains mixed, with retention for private auto, which stands at 92.3%, approaching an all-time excessive. This spectacular progress and the loyalty demonstrated by our policyholders is a testomony to the robust worth proposition we provide”.

Regardless of the challenges the corporate is dealing with the basics and core elements of the enterprise stay very robust. The rise in inflation and rates of interest is creating short-term difficulties for the corporate, however I don’t assume it is indicative that ERIE received’t have the ability to ship robust progress over the approaching many years. The truth that they’ve such a excessive retention fee I feel speaks volumes in regards to the base and shoppers they’re serving and the standard of the enterprise.

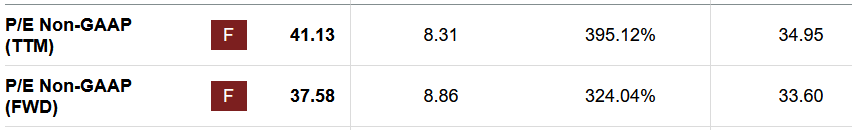

p/e (Searching for Alpha)

However when wanting on the valuation of the corporate I feel it turns into fairly absurd proper now. There could also be a major quantity of progress occurring, nevertheless it’s not being showcased properly sufficient to justify an FWD p/e of 37. Despite the fact that it is lowering, the present share value should keep stagnant for the valuation to catch up. With increased climate and catastrophe-related occasions occurring the losses of ERIE may enhance. This threat greater than diminishes the purchase case proper now I feel.

As for what I feel will likely be a fairer valuation of the enterprise, properly it comes all the way down to related numbers as the remainder of the sector. ERIE has been rising however I do not essentially see any qualities to counsel {that a} close to 350% premium based mostly on p/e needs to be utilized right here. The corporate has grown, that’s true, however even with double-digit EPS progress within the coming a number of years, I feel traders are caught with little appreciation for his or her place. I discover a honest worth to be round 1 for the p/b and 10 – 12 for p/e, which leaves various draw back threat right here nonetheless.

Threat Related

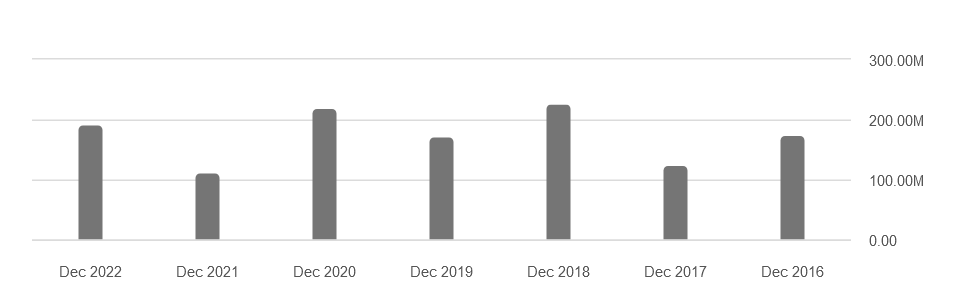

ERIE’s monetary efficiency is intrinsically linked to the fortunes of the Erie Insurance coverage Trade. Any developments that hinder the Trade’s capability to increase or preserve its monetary stability will inevitably influence ERIE as properly. It is value noting that the Trade has demonstrated strong premium progress over the previous six years, which serves as a optimistic indicator and helps mitigate some related dangers. Nonetheless, it stays vital to carefully monitor this key efficiency indicator to make sure the continued well being of ERIE’s operations. The important thing determine I’m watching although with ERIE is the underside line and the retention of margins. The final quarter provided a major beat on the underside line and this despatched the share value upwards considerably. Wanting on the backside line of ERIE it sits at 11.66% proper now, simply according to the historic 5-year common of the enterprise. I feel that going ahead we’re more likely to see enhancements on this entrance.

Web Earnings (Searching for Alpha)

ERIE’s CEO has emphasised the corporate’s strategic aim of enhancing profitability by harnessing the facility of knowledge. Nonetheless, any delays in reaching these enhancements carry substantial dangers for the corporate. Failure to display tangible enhancements in margins over time may result in investor dissatisfaction and probably end in a stagnant share value. Thus, the profitable implementation of data-driven methods stays vital for ERIE’s prospects. Moreover, the valuation of ERIE is sort of excessive proper now following the numerous bounce in value after the final report was launched. This places ERIE at an FWD p/e of 37, a quantity I’m not snug paying for nearly any firm. Even when there may be double-digit progress for a chronic interval there may be nonetheless a large premium it’s a must to overcome. This leaves in my view an excessive amount of speedy draw back threat for the corporate and traders in the end making the purchase case nonexistent and the one affordable ranking is a maintain proper now.

Investor Takeaway

The insurance coverage area might be troublesome to navigate however plainly ERIE has performed a good job as far as the underside line is up over 30% YoY. If that is one thing that may be maintained then maybe the excessive premium might be justified on some foundation. Nevertheless, I’m fearful that the current enhance in climate and disaster occasions is elevating the losses of the corporate and suppressing among the incomes potential. This extra threat together with a considerable amount of regularity impacts is weighing on the funding thesis and in the end resulting in a maintain being probably the most affordable proper now in my view.