Up to date on October fifth, 2023 by Aristofanis Papadatos

The Dividend Kings are a bunch of simply 50 shares which have elevated their dividends for no less than 50 years in a row. We imagine the Dividend Kings are among the many highest-quality dividend development shares to purchase and maintain for the long run.

With this in thoughts, we created a full record of all of the Dividend Kings.

You may obtain the complete record, together with vital monetary metrics reminiscent of dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

Every year, we individually evaluate all of the Dividend Kings. The subsequent within the sequence is Canadian Utilities (CDUAF).

Canadian Utilities has elevated its dividend for 50 consecutive years, which makes it the one Canadian firm on the record of Dividend Kings. This text will analyze the corporate in better element.

Enterprise Overview

Canadian Utilities is a utility inventory with roughly 5,000 workers. ATCO owns 53% of Canadian Utilities. Primarily based in Alberta, Canadian Utilities is a diversified world vitality infrastructure company that delivers options in electrical energy, pipelines & liquid, and retail vitality.

The corporate has an extended historical past of producing regular development and constant earnings by way of the financial cycle.

Supply: Investor Presentation

On July twenty seventh, 2023, Canadian Utilities reported its Q2-2023 outcomes for the interval ending June thirtieth, 2023. Income for the quarter amounted to $663 million, which was 6% decrease year-over-year, whereas adjusted earnings per share decreased 27.5%, from $0.51 to $0.37.

The lower in revenues resulted primarily from value efficiencies generated by Electrical energy Distribution and Pure Fuel Distribution over the second-generation Efficiency Base Regulation (PBR) time period now being handed onto prospects beneath the 2023 Value of Service rebasing framework, in addition to the choice of AUC (Alberta Utilities Fee) to maximise the gathering of 2021 deferred revenues in 2022 because of charge aid offered to prospects in 2021 (as a result of COVID-19 on the time).

The substantial decline in earnings was precipitated primarily by diminished revenues, which squeezed the corporate’s margins, coupled with the affect of inflation on the general prices of the corporate.

Through the quarter, Canadian Utilities invested C$332 million in capital tasks. Roughly 86% of this quantity was allotted on its regulated utilities enterprise, with the remaining 14% invested in its vitality infrastructure enterprise.

Progress Prospects

By benefiting from a steady enterprise mannequin, Canadian Utilities can slowly however progressively develop its earnings. The corporate persistently invests considerable quantities in new tasks and advantages from base charge will increase, which are inclined to hover between 3% and 4% per 12 months.

As development within the regulated utilities house stays quite restricted, Canadian Utilities is now looking for to develop its enterprise by way of the strategic acquisition of renewable technology property. The $730 million funding ought to present the corporate with rapid scale and future development by way of the event pipeline and benefit from the qualities of long-term buy energy agreements which are widespread in wind tasks. Additional, administration expects that this funding shall be accretive to money circulate and earnings in 2023.

Combining the corporate’s development tasks, the potential for modest margin enhancements, and – as voluntarily pursued – the postponed charge base will increase, we preserve our anticipated common annual development charge over the following 5 years at 4%. Our anticipated annual dividend development charge stays at 2.5%.

The corporate will seemingly enhance its payout ratio earlier than its new tasks begin producing sufficient money flows to re-accelerate dividend development. The inventory’s historic 10-year common annual dividend development charge of 4.0% is ample to compensate for the forex fluctuations, progressively rising buyers’ revenue.

Aggressive Benefits & Recession Efficiency

The corporate’s aggressive benefit lies within the moat surrounding regulated utilities. With no straightforward entry into the sector, regulated utilities get pleasure from an oligopolistic market with little competitors risk. The corporate’s resilience has been confirmed decade after decade.

One other aggressive benefit is the corporate’s sturdy monetary place. Canadian Utilities has investment-grade credit score rankings of BBB+ from Customary & Poor’s and A- from Fitch. This enables the corporate to boost capital at enticing rates of interest.

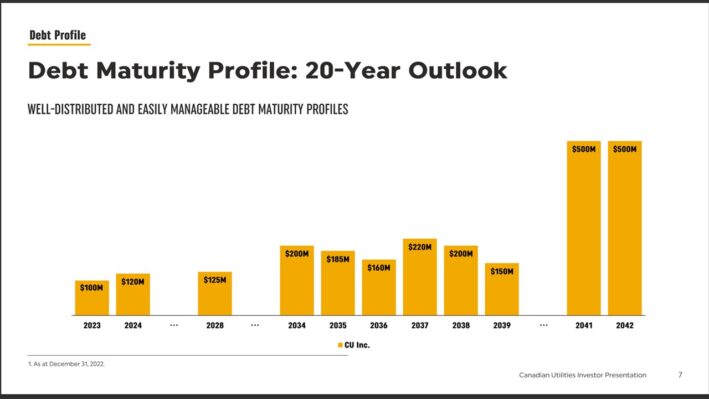

The corporate additionally has a powerful stability sheet with a well-laddered debt maturity profile, which can assist hold the dividend sustainable, even when rates of interest proceed to rise.

Supply: Investor Presentation

Regardless of a number of recessions and unsure environments over the previous 50 years, the corporate has withstood each considered one of them whereas elevating its dividend. Whereas Canadian Utilities’ payout ratio got here beneath stress throughout 2020 (although dividends have been in actuality coated from its working money flows if we’re to exclude depreciation and amortization,) by 2028, we count on it to have returned to far more comfy ranges of round 76% of its internet revenue.

The corporate held up extraordinarily nicely throughout earlier recessions and financial downturns, such because the coronavirus pandemic. We might count on Canadian Utilities to carry out comparatively nicely in future recessions, provided that the corporate operates in a just about recession-proof business.

Valuation & Anticipated Returns

Utilizing the present share value of ~$21 and anticipated earnings-per-share of US$1.66 for the operating fiscal 12 months, Canadian Utilities is buying and selling at a price-to-earnings ratio of 12.7. Our truthful earnings a number of for Canadian Utilities is 16.0.

Subsequently, the inventory appears to be undervalued at its present value degree. If the inventory trades at our assumed truthful valuation degree in 2028, it’s going to get pleasure from a 4.8% annualized valuation tailwind over the following 5 years.

Other than modifications within the price-to-earnings a number of, future returns shall be pushed by earnings development and dividends.

We count on 4% annual earnings development over the following 5 years, as utilities are usually slow-growth companies. As well as, Canadian Utilities presently pays a quarterly dividend of CAD $0.4486 per share. This works out to roughly CAD $1.79 per share on an annualized foundation. At present alternate charges, this interprets to an annualized dividend of $1.35 per share in U.S. {dollars} for a 6.4% dividend yield.

Complete returns may include the next:

0% earnings development

4.8% a number of enlargement

6.4% dividend yield

Given all of the above, Canadian Utilities is predicted to supply a median annual whole return of 13.5% over the following 5 tears. Consequently, we’ve a purchase suggestion on the inventory and stay assured within the firm’s means to boost dividends by way of a recessionary surroundings.

Closing Ideas

Canadian Utilities has an extended development document and a optimistic future outlook. We presently discover the inventory undervalued. Consequently, shares might provide a 13.5% common annual whole return over the following 5 years.

The inventory ought to proceed to boost its dividend for a lot of extra years, because the enterprise is prone to maintain up nicely throughout recessions. Canadian Utilities additionally has a excessive yield of above 6%, which is enticing to risk-averse revenue buyers, reminiscent of retirees. Subsequently, shares earn a purchase score.

Moreover, the next Certain Dividend databases include probably the most dependable dividend growers in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].