RyanJLane/E+ by way of Getty Photos

ATN Worldwide, Inc. (NASDAQ:ATNI) reaffirmed its EBITDA steering for 2023, which I famous in a earlier article. Moreover, I count on {that a} additional mixture of inorganic development in new markets, financing obtained from Digital Rural Alternatives Fund, and joint ventures with giant telecom corporations might speed up FCF margin development. Even contemplating dangers from failed M&A or failed growth into new areas, beneath my totally different case eventualities, ATNI seems to be buying and selling undervalued.

ATN: Internationalization Will Most Doubtless Supply Working Margin Enlargement

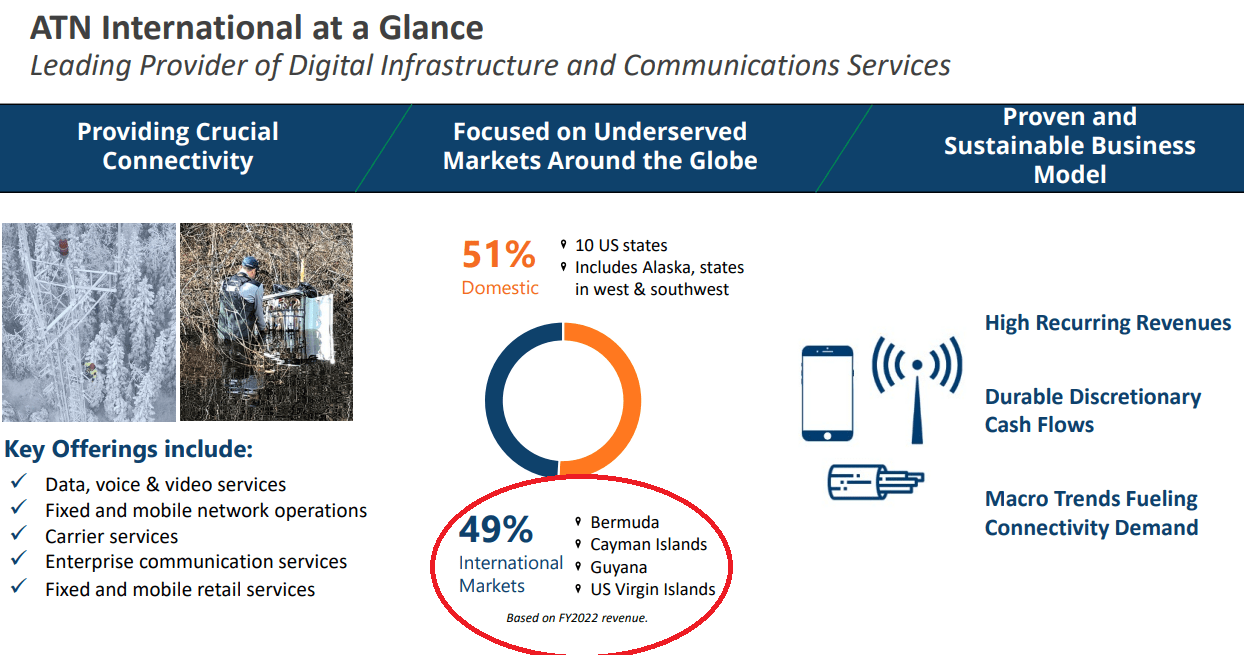

ATN is an organization that gives digital infrastructure and communication providers in america and internationally within the Caribbean. The corporate’s focus is on small rural or distant markets that provide nice infrastructure funding and improvement alternatives. ATN’s foremost providers are the set up of terrestrial and underwater fiber optic networks and communication towers for corporations and suppliers in addition to mounted and cell telecommunications providers for residences, companies, and authorities entities, with high-speed web and communication providers.

Supply: Presentation To Buyers

Operations are divided between native and worldwide providers within the Caribbean, particularly in Bermuda, Grand Cayman, and Guyana. ATN’s providers are the identical for each segments: providing of cell telephones and cell phone units, with possession of communication towers, mounted telephony for residences and companies.

Supply: Presentation To Buyers

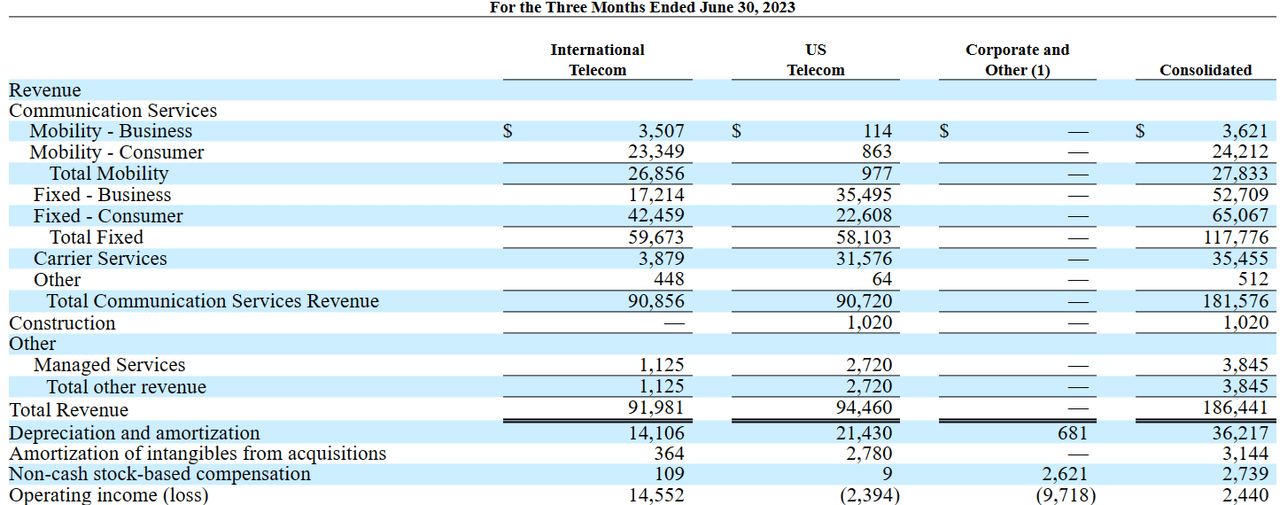

Income from each segments is shut, nonetheless the working revenue provided in worldwide markets seems to be fairly superior as in comparison with that from the US telecom. With this in thoughts, I proceed to imagine that internationalization will more than likely carry important FCF margin growth.

Supply: 10-Q

ATN’s present strategy has to do with the growth of its providers in rising markets, particularly within the Caribbean and the areas of america the place there’s nonetheless no expanded telecommunications community intervention. Examples of this are the acquisition of Alaska Communication Group, with 52% of the possession and management of the shares of this firm, a supplier of mounted and administration providers for purchasers within the area, and the acquisition of Sacred Wind Enterprises, a telecommunications firm current in rural areas of New Mexico.

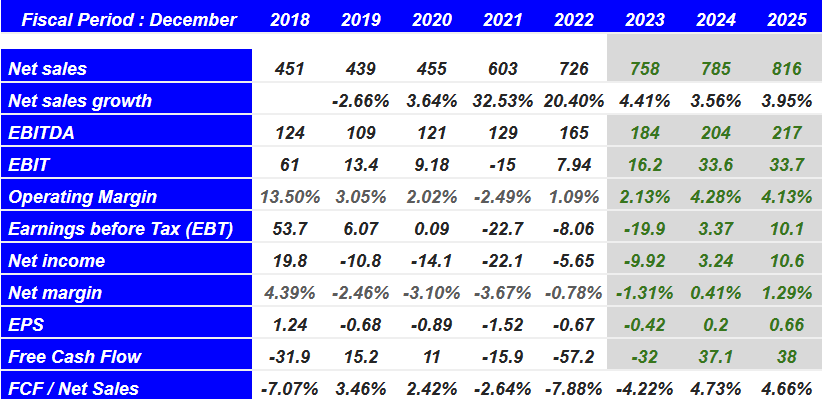

Market Expectations Embody Constructive FCF From 2024 And Constructive EPS In 2025

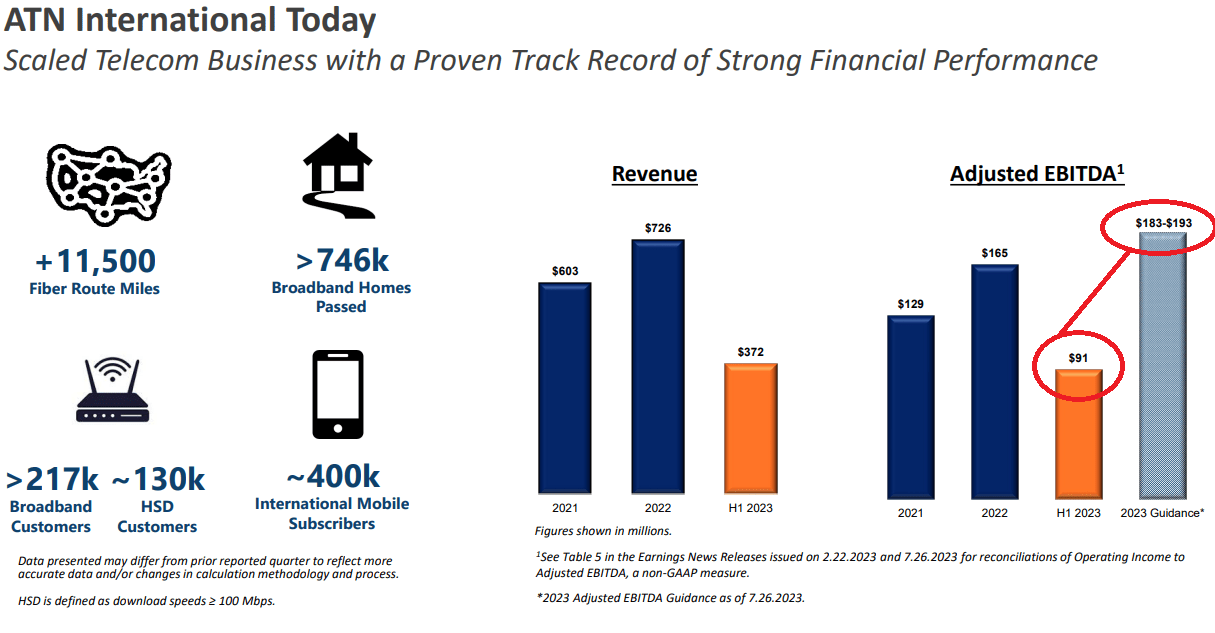

In a earlier article, we famous that 2023 Adjusted EBITDA was anticipated to be near $183-$193 million. For my part, it’s fairly helpful that the corporate continues to ship the identical expectations many months later.

Lastly, the corporate included Adjusted EBITDA within the vary of $183-$193 million and 2023 steering with additional development coming within the second semester. I imagine that the figures are near what different analysts have been anticipating, however they appear helpful. Supply: ATN This autumn Earnings: Helpful 2023 Steering And Double-Digit Cell Enterprise Progress

Supply: Presentation To Buyers

Skilled forecasters count on decrease internet gross sales development in 2024 and 2025. Nevertheless, additionally they imagine that ATN might ship constructive internet revenue in 2024 and 2023 in addition to FCF development. For my part, constructive EPS and constructive FCFs will more than likely have a constructive impact on the inventory valuation.

Extra specifically, traders predict 2025 internet gross sales near $816 million, with EBITDA of $217 million, 2025 EBIT near $33 million, and constructive FCF. For my part, as quickly as traders study concerning the new FCF/Internet Gross sales expectations for 2024, we might even see a rise in inventory demand.

Supply: Market Screener

Funding In New Areas, Additional Inorganic Progress, New Joint Ventures With Massive Telecom Corporations, And The Experience Collected Will Most Doubtless Improve FCF Progress

ATN’s foremost goal is to turn out to be a number one firm within the provision of telecommunications networks and providers within the markets through which it’s current, with a deal with areas the place there has traditionally been no funding. With know-how from america, I imagine that ATN might efficiently obtain some demand in new markets. Consequently, we might even see sure internet gross sales development and FCF margin enhancements because of economies of scale.

I additionally count on FCF margin growth from the implementation of the primary fiber program, which consists of the implementation of joint financing applications with regional governments and federal assets for the set up of optical fibers in communities and faculties.

Moreover, I imagine that ATN will more than likely ship additional internet gross sales development making use of the corporate’s historic expertise and information within the improvement and operation of telecommunications networks and infrastructure, in collaboration with native managers and directors. Let’s remember that ATN reviews a greater than 30-year historical past of investing in bandwidth infrastructure in traditionally underbuilt rural and distant markets.

Moreover, I assumed additional profitable inorganic development and disciplined allocation of capital with a deal with long-term sustainable companies, akin to latest acquisitions within the growth of its subsidiaries in underdeveloped areas within the area of telecommunications. Along with the aforementioned acquisitions, ATN might carry additional internet gross sales development because of at present growing joint applications with necessary service supplier corporations inside america, such because the mission with Verizon (VZ) for the event and modernization of wi-fi networks or the infrastructure development mission for AT&T Mobility (T) within the west of the nation.

Digital Rural Alternatives Fund And Different Investments In Public Infrastructure Will Most Doubtless Speed up Capital Expenditures, And Enlarge The Implied Valuation Of ATN

Likewise, the corporate is a part of totally different federal applications of america authorities that put money into the event of infrastructure via the capabilities of ATN, particularly the Digital Rural Alternatives Fund, via which the corporate expects to obtain financing within the subsequent ten years for the set up of networks in additional than 10k houses. Normally phrases, we will say that the corporate’s positioning technique is supported by nice relationships with non-public and public funding funds.

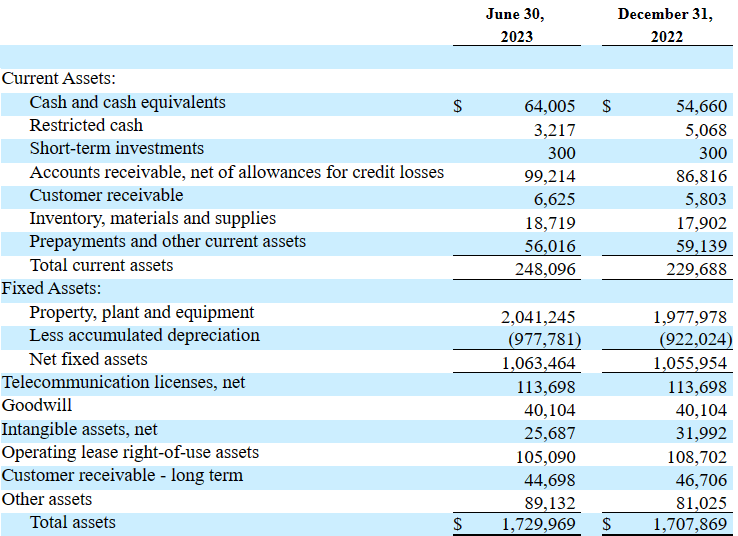

Steadiness Sheet

As of June 30, 2023, ATN reported money and money equivalents price $64 million, restricted money over $3 million, and accounts receivable price $99 million. Complete present property are equal to $248 million, simply above the overall quantity of present liabilities. With this in thoughts, I don’t assume that liquidity is a matter right here.

Fastened property embrace property, internet mounted property of about $1.063 billion, with telecommunication licenses price $113 million, goodwill near $40 million, and whole property over $1.729 billion. The asset/legal responsibility ratio is near 2x, so I imagine that the stability sheet stands in place.

Supply: 10-Q

I’m not involved concerning the whole quantity of liabilities as a result of the corporate reviews a substantial quantity of mounted property. Nevertheless, the overall quantity of debt doesn’t appear small as in comparison with the present FCF and EBITDA ranges. The present portion of long-term debt is the same as $18 million, and the long-term debt, excluding the present portion, is the same as $464 million. If we assume ahead EBITDA near $170 million, the online debt/EBITDA shouldn’t be removed from 3x. I really feel comfy concerning the stage of debt due to the properties and the steadiness of the enterprise mannequin, nonetheless I’d perceive that fairly conservative traders might not recognize it.

Accounts payable and accrued liabilities stand at near $145 million, with whole present liabilities near $240 million, lease liabilities excluding present portion near $80 million, and whole liabilities price $980 million.

Supply: 10-Q

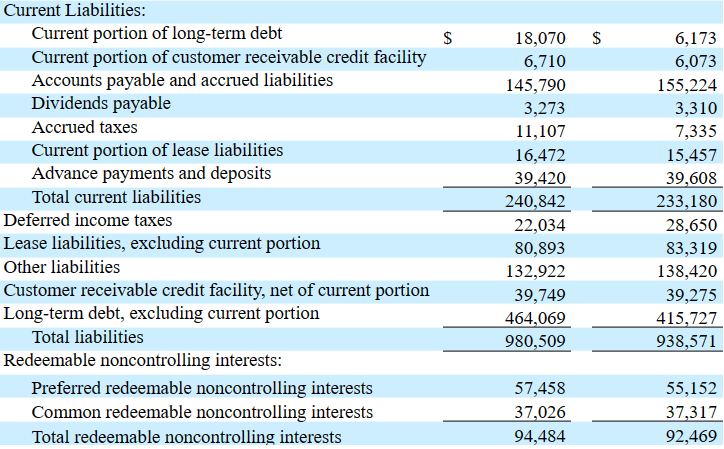

DCF Fashions

My monetary mannequin contains fairly conservative assumptions together with long run internet revenue development, D&A development, rising capital expenditures, and rising FCF. The free money movement ranges that I count on from now to 2030 don’t exceed earlier FCFs reported by ATN previously.

Extra specifically, I assumed 2030 internet revenue of about $9 million, with depreciation near $340 million, however no amortization of acquisition intangibles or provision for uncertain accounts.

Moreover, with 2030 stock-based compensation of about $13 million, deferred revenue taxes of about -$9 million, and goodwill impairment price -$27 million, I included modifications in accounts receivable of $7 million and modifications in buyer receivable near -$5 million. Moreover, with modifications in supplies and provides and prepayments of -$19 million, 2030 CFO could be near $270 million. If we additionally assume 2030 capital expenditures of -$185 million, the implied 2030 FCF would stand at $86 million.

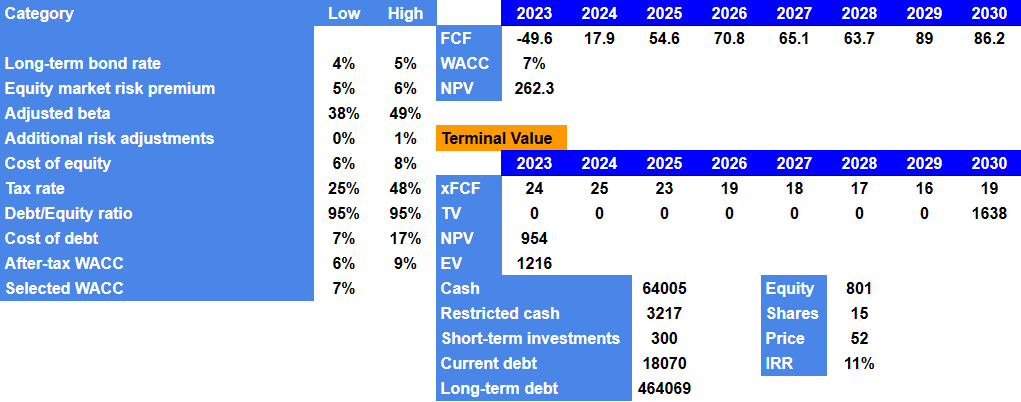

Supply: My Money Circulate Expectations

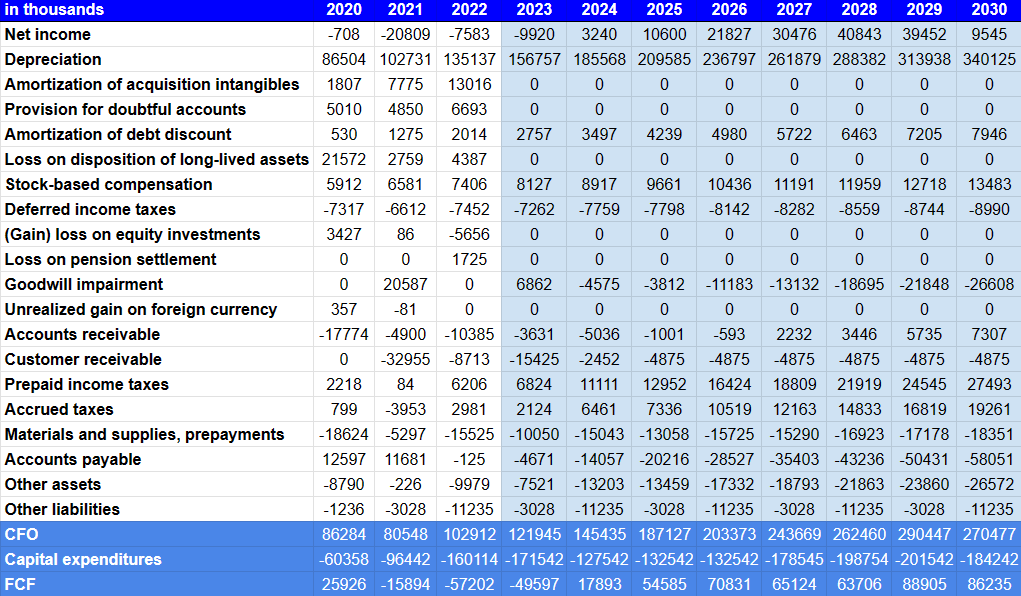

My CAPM mannequin beneath my conservative case situation contains an fairness market danger premium shut to five% with adjusted beta of 0.38, value of fairness of 6.1%, a tax charge of near 24%, value of debt of 6.8%, and a WACC of seven.1%. With these figures, the NPV of future FCF could be near $262 million. Moreover, assuming an EV/FCF a number of of 19x, the implied enterprise worth could be near $1.216 billion. Including money and subtracting debt, I obtained an fairness valuation of $52 per share and an IRR of 11%.

Supply: My Money Circulate Expectations

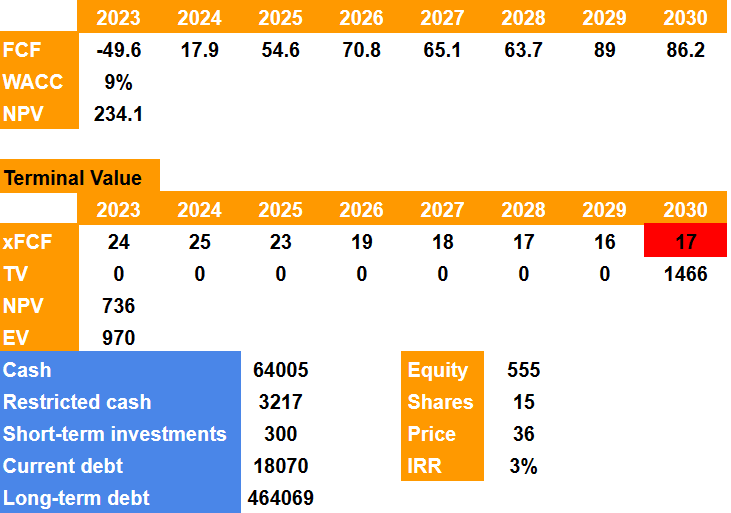

Considering precisely the identical money movement expectations, beneath a CAPM a bit extra conservative, I used a WACC of 9%, which might indicate a NPV of future FCFs of $234 million.

Now, with an EV/FCF of 17x, the implied enterprise worth could be $970 million, and the fairness valuation wouldn’t be removed from $555 million. Lastly, we might be speaking a couple of valuation of $36 per share and an IRR of three%. I imagine that the earlier mannequin is a little more possible, nonetheless I needed to run a bearish situation for these traders who dislike the overall quantity of debt.

Supply: My Money Circulate Expectations

Rivals And Dangers

To research the competitors for this firm, it’s essential to section the competitors that exists for every kind of service it affords. In lots of circumstances, opponents have an identical service, and in others, they provide particular providers. Within the case of mounted providers, the contributors are restricted throughout the market, and people who stand out are Digicel and Liberty Latin America. In mobility providers, competitors is extra assorted relying on the area, though the 2 foremost contributors in ATN’s markets of curiosity are Digicel (DCEL) and Liberty Latin America (LILA).

There are dangers within the operational sense, in compliance with contractual obligations with authorities funds, Verizon, and AT&T. Concerning the settlement with AT&T, obligations rely upon exterior components akin to the availability or provision of third-party providers for compliance. The dependence on third events additionally expands to sure areas of the corporate’s operations, on the sale of cell units, equipment and components for the restore, or development of communication infrastructures.

When it comes to the market normally, the acceleration of change developments with digital improvements and set up of 5G networks pose a problem for the corporate within the integration and renewal of its networks. In the identical sense, concerning transformations, ATN expects to realize income development within the native markets of the Caribbean above the historic information of the working section in america. If ATN delivers decrease FCF development than anticipated outdoors america, for my part, sure traders might promote their stakes, which might decrease the inventory value.

My Takeaway

ATN didn’t decrease its 2023 EBITDA steering, and lots of analysts on the market predict constructive FCF and internet revenue in 2024. For my part, additional investments in new areas, inorganic development, and financing obtained from the Digital Rural Alternatives Fund will more than likely carry FCF margin development. I do see dangers from failed internet gross sales development within the worldwide markets, failed M&A development, or points with provide chain. With that, beneath my two case eventualities, I obtained a good value that’s considerably increased than the present inventory value.