oatintro/iStock through Getty Photographs

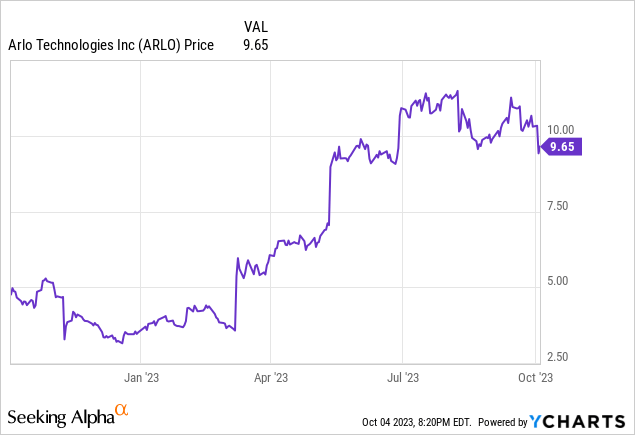

With rate of interest fears hitting a fever pitch, it is usually not a good time to purchase into the shares of small-cap tech firms which have already greater than doubled 12 months thus far. The place the rise has been accompanied by an enormous elementary enchancment, nonetheless, we will make exceptions on a case by case foundation.

Enter Arlo (NYSE:ARLO), the safety digicam vendor. This small-cap inventory has seen its inventory skyrocket by greater than 150% 12 months thus far, buoyed by an enormous enhance in companies income and an accompanying raise in gross margins. And because of this shift towards promoting subscriptions, the corporate has entered right into a section of unimaginable profitability.

As a reminder for buyers who’re newer to Arlo, the corporate’s large transfer this 12 months was to cut back {hardware} pricing so as to stimulate family adoption and companies progress. And whereas {hardware} income did decline y/y (doubtlessly suggesting that demand is comparatively inelastic, as worth drops outweighed quantity beneficial properties), companies income is hovering – which is the important thing to the long run future for Arlo. I commented on this favorable shift in my earlier article on Arlo, and regardless of continued power within the inventory, I additionally proceed to be bullish on this title because it achieves outsized companies progress and notches spectacular scaling on its margin profile.

{Hardware} substitute cycles are tough to foretell. That is very true of gadgets like safety cameras – objects that we do not sometimes work together with on a everyday foundation. It is higher for Arlo to make use of the system to seize an set up base, and generate lifetime income from its storage choices.

Right here is my full long-term bull case on Arlo:

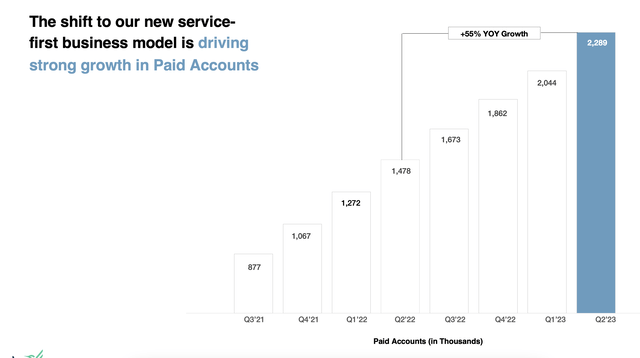

Extremely rated product and model. Arlo has been extremely reviewed by main tech publications like CNET and PCMag and is taken into account one of many high residence good cameras. Along with this, Arlo is among the most distinguished safety firms to advertise DIY set up, vs. different cameras that required costly technicians for set up. Massive addressable market. Arlo estimates the marketplace for residence safety to at present stand at $53 billion, and it additionally expects this chance to develop to $78 billion by 2025. With lower than ~$500 million in annual income, Arlo has loads of room to increase and innovate on this house. Given as effectively that there is no such thing as a clear chief within the residence safety digicam market, Arlo has an opportunity to take the crown. Partnerships with a few of the largest retailers within the nation. Arlo merchandise are bought by means of resellers like Finest Purchase (BBY), Costco (COST), Amazon (AMZN), and others. Arlo’s visibility to customers is unmatched, and the corporate is well-positioned for retail gross sales progress forward of the vacation season. Constructing a subscription base. Arlo is transferring away from being a pure {hardware} merchandise firm. Paid subscriber accounts, now above 2 million clients, are rising at a >50% y/y clip. Arlo additionally notes that ~65% of latest {hardware} clients join Arlo Safe inside six months. Profitability. In contrast to many small-caps of its measurement, Arlo has hit professional forma working profitability, or hovered very near it, for a number of quarters in a row.

Keep lengthy right here: there’s loads of upside left to go.

Q2 obtain

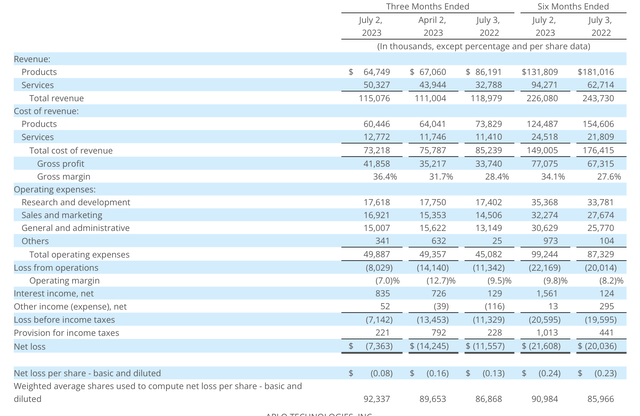

Let’s now undergo Arlo’s newest quarterly ends in larger element. The Q2 earnings abstract is proven under:

Arlo Q2 outcomes (Arlo Q2 earnings launch)

Arlo’s income declined -3% y/y to $115.1 million, forward of Road expectations of $110.9 million (-7% y/y). Once more as beforehand talked about, the largest drivers of income had been the worth cuts to {hardware} that resulted in larger adoption of companies. Product income fell -25% y/y to $64.9 million (underlying models fell -11% y/y, whereas worth cuts made up the steadiness of the distinction), whereas companies income jumped 53% y/y to $50.3 million.

For sure, the cheaper {hardware} entry costs drove substantial account adoption. Paid accounts grew 55% y/y to 2.29 million, including 245k net-new accounts within the quarter: stronger than 182k internet provides in Q1. ARR, in the meantime, jumped 66% y/y to $193.6 million. This serves to underline the purpose that the brand new accounts that Arlo is bringing on this quarter will carry advantages throughout many quarters and years. Administration additionally famous that ARPU per subscriber is growing as effectively, as households pattern towards deciding on higher-priced plans.

Arlo Q2 paid account progress (Arlo Q2 earnings launch)

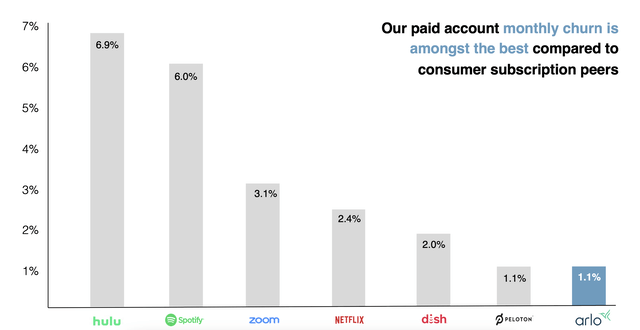

It is also value noting that churn charges for Arlo stay extremely low. The chart under reveals that Arlo’s ~1% churn compares very favorably in opposition to a few of the most notable subscription manufacturers:

Arlo churn charges (Arlo Q2 earnings launch)

Administration famous that demand has remained sturdy despite a troublesome macro surroundings, with efficiency carrying all through Prime Day. Per CEO Matthew McRae’s ready remarks on the Q2 earnings name:

Our technique and execution are driving these outcomes and producing vital shareholder worth. Regardless of the macroeconomic situations, we’re seeing sturdy demand as is evidenced by our key metrics and our stock ranges. Most lately, we noticed that demand carried by means of to a profitable Prime Day, which supplies us a glimpse into the present shopper mindset forward of the second half.

This upcoming vacation season, Arlo will lean additional into our profitable pricing technique by launching a completely new low-cost safety digicam platform, and we have now secured substantial placement in promotional autos throughout our main channels. Buyer acquisition drives paid accounts, which drives the enlargement of Arlo’s profitability. With this backdrop, we anticipate full 12 months service income to develop practically 50% year-over-year and now exceed our $200 million goal.”

From a margin perspective: not solely are firm gross margins enhancing because of the favorable combine shift towards companies (36.4% in Q2, up 470bps y/y), however the underlying companies margin can be hitting an all-time excessive pushed by economies of scale. Providers gross margins scaled to 75.2%, up 170bps sequentially and up roughly ten factors y/y.

Professional forma working margins, in the meantime, hit 4.7% within the quarter – up 390bps y/y. On high of gross margin beneficial properties, headcount fell barely y/y – all the way down to 345 whole staff, versus 354 on the similar time final 12 months.

Key takeaways

With a speedy buildup in paid subscription accounts, rising subscription ARPUs, gross margin enhancements and bottom-line enlargement, there’s loads to love about Arlo regardless of the sharp YTD rise. Maintain driving the upward pattern right here.