Up to date on October third, 2023 by Bob Ciura

The Dividend Kings are a gaggle of simply 50 shares which have elevated their dividends for a minimum of 50 years in a row. We imagine the Dividend Kings are among the many highest-quality dividend progress shares to purchase and maintain for the long run.

With this in thoughts, we created a full checklist of all 50 Dividend Kings. You’ll be able to obtain the complete checklist, together with vital monetary metrics comparable to dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

Every year, we individually evaluate all of the Dividend Kings. The following within the sequence is Illinois Device Works (ITW).

Illinois Device Works has elevated its dividend for 59 consecutive years, which is very spectacular because it operates in a extremely cyclical sector (industrials). This text will focus on the main causes for Illinois Device Works’ lengthy dividend historical past.

Enterprise Overview

Illinois Device Works has been in enterprise for greater than 100 years. It began all the best way again in 1902 when a financier named Byron Smith positioned an advert within the Economist. On the time, Smith was seeking to put money into a “high-class enterprise (manufacturing most well-liked) in or close to Chicago.” A gaggle of inventors approached Smith with an concept to enhance gear grinding, and Illinois Device Works was born.

Illinois Device Works presently generates annual income of practically $16 billion. Illinois Device Works consists of seven segments: automotive, meals tools, check & measurement, welding, polymers & fluids, development merchandise, and specialty merchandise.

Supply: Investor Presentation

These segments have carried out very properly in opposition to their friends and allowed Illinois Device Works to attain industry-leading margins.

Illinois Device Works’ portfolio is concentrated in product segments that every maintain above-average progress potential of their respective markets. The overarching strategic progress plan for Illinois Device Works is to repeatedly reshape its enterprise mannequin, when mandatory. The corporate ceaselessly makes use of bolt-on acquisitions to develop its attain.

Progress Prospects

The macro-environment for world industrial producers is challenged by inflation and rising rates of interest. Nevertheless, Illinois Device Works continues to generate regular progress in 2023.

Within the 2023 second quarter, income got here in at $4.1 billion, up 2% year-over-year. Gross sales have been up 16.2% within the Automotive OEM phase, the biggest out of the corporate’s seven segments. Meals Gear, Welding, and Take a look at & Measurement and Electronics segments grew income by 6.3%, 0.7% and 0.7%, respectively. In the meantime, Polymers & Fluids, Building Merchandise, and Specialty Merchandise noticed income decline by 7.6%, 6.8% and 5.4%.

Earnings-per-share of $2.48 represented 4.6% year-over-year progress. Illinois Device Works additionally raised its 2023 steering and sees full-year GAAP EPS in a variety of $9.55 to $9.95 (up from $9.45 to $9.85 beforehand).

Lastly, share buybacks will likely be a part of EPS progress. The corporate expects to repurchase roughly $1.5 billion of its personal shares this 12 months. General, we count on 8% annual EPS progress over the following 5 years, comprised primarily of income progress and share buybacks.

Aggressive Benefits & Recession Efficiency

Illinois Device Works has a big aggressive benefit. It possesses a large financial “moat,” which refers to its means to maintain competitors at bay. It does this with a large mental property portfolio. Illinois Device Works holds greater than 17,000 granted and pending patents.

On the similar time, Illinois Device Works has a decentralized, entrepreneurial company tradition. This additionally units the corporate other than the competitors. Illinois Device Works empowers its numerous companies with important flexibility to customise their very own approaches to serving prospects in one of the best ways doable.

One potential draw back of Illinois Device Works’ enterprise mannequin is that it’s susceptible to recessions. As an industrial producer, Illinois Device Works is reliant on a wholesome world economic system for progress.

Earnings-per-share efficiency through the Nice Recession is under:

2007 earnings-per-share of $3.36

2008 earnings-per-share of $3.05 (9% decline)

2009 earnings-per-share of $1.93 (37% decline)

2010 earnings-per-share of $3.03 (57% improve)

That stated, the corporate remained extremely worthwhile through the Nice Recession. This allowed it to proceed rising its dividend every year through the recession, even when earnings declined. The corporate additionally recovered shortly. Earnings-per-share soared 57% in 2010. By 2011, earnings-per-share surpassed 2007 ranges.

An identical sample was seen in 2020 because the coronavirus pandemic triggered an financial recession. Illinois Device Works’ earnings-per-share declined in 2020, however the decline was manageable, and the corporate continued to boost its dividend.

Valuation & Anticipated Returns

Utilizing the present share worth of ~$230 and the midpoint for 2023 earnings steering of $9.75 for the 12 months, Illinois Device Works trades for a price-to-earnings ratio of 23.6. Given the corporate’s cyclical nature, we really feel {that a} goal price-to-earnings ratio of 19-20 is suitable. That is roughly in keeping with the corporate’s 10-year historic common.

Consequently, Illinois Device Works could possibly be overvalued. If the P/E a number of contracts from 23.6 to 19.5 over the following 5 years, it might scale back annual returns by 3.7% over this time period.

Future returns will likely be additionally pushed by earnings progress and dividends. We count on 8% annual earnings progress over the following 5 years. As well as, Illinois Device Works inventory has a present dividend yield of two.4%.

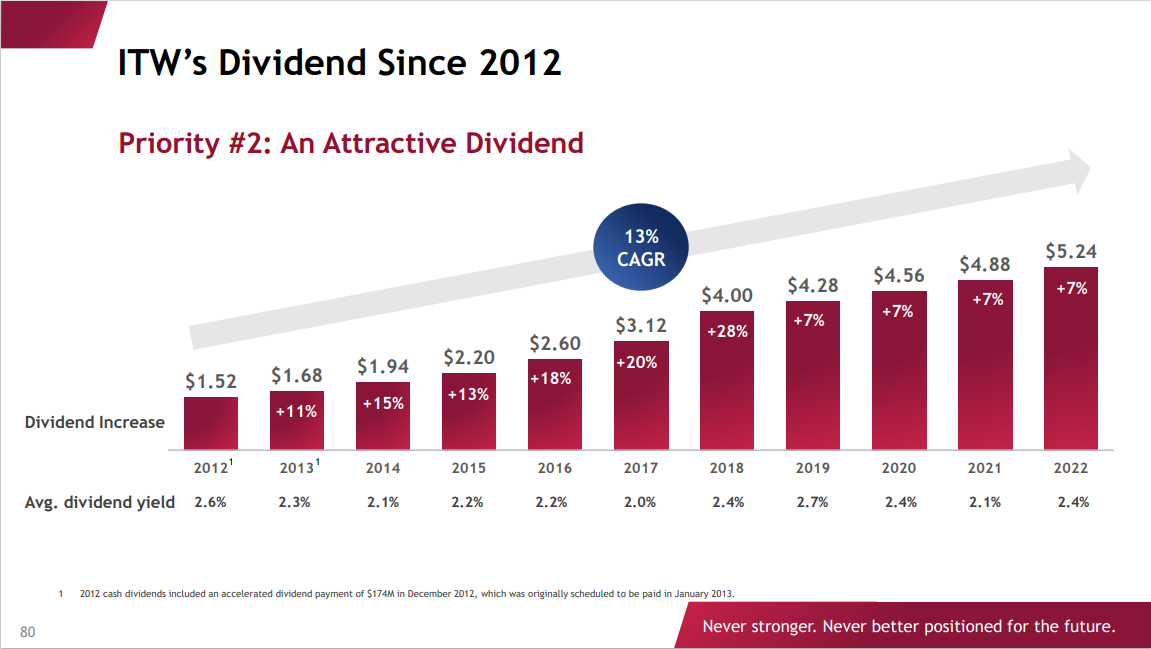

The corporate has elevated its dividend at a excessive fee previously decade.

Supply: Investor Presentation

Placing all of it collectively, Illinois Device Works is anticipated to return 6.7% per 12 months via 2028. Consequently, we’ve a maintain advice on Illinois Device Works, although the corporate’s means to boost dividends via a number of recessions is spectacular.

Closing Ideas

Illinois Device Works is a high-quality firm and a fair higher dividend progress inventory. It has a strategic progress plan that’s working properly, and shareholders have been rewarded with rising dividends for over 50 years.

The inventory additionally has a good 2.4% dividend yield, which may make it an interesting alternative for long-term dividend progress buyers. However the overvaluation of the inventory on the present worth means whole returns should not excessive sufficient for a purchase advice from Positive Dividend.

The next articles comprise lists of excessive yield shares and shares with lengthy histories of dividends:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].