LumiNola

Introduction

The dividend yield for WhiteHorse Finance (NASDAQ:WHF) proper now may be very excessive at over 11%. This comes from the truth that the corporate goals to maximise the shareholder returns because it operates as a closed-end administration enterprise. The payout ratio is at 81% and the dividend has climbed fairly somewhat through the years, however with 11% you’re getting a incredible return.

The share worth appears to be in an uptrend proper now because it bounced from the lows of $11.2 again in Could when the financials sector noticed a big quantity of volatility following the collapse of two important regional banks. Apart from this, WHF is buying and selling beneath the NAV worth of $14 which additional illustrates why the value is so honest proper now and deserves a purchase score in my view. Over the long run the excessive dividend yield goes to lead to a big market-beating return I believe.

Firm Construction

WHF is a enterprise improvement firm with a novel deal with originating senior secured loans within the decrease center market and progress capital industries. This non-diversified, closed-end administration firm makes a speciality of offering financing to a spread of sectors, together with broad-line retail, workplace companies, and provides, constructing merchandise, well being care companies, and well being care provides. By investing in these areas, WHF goals to help the expansion and growth of companies in numerous industries whereas producing returns for its buyers.

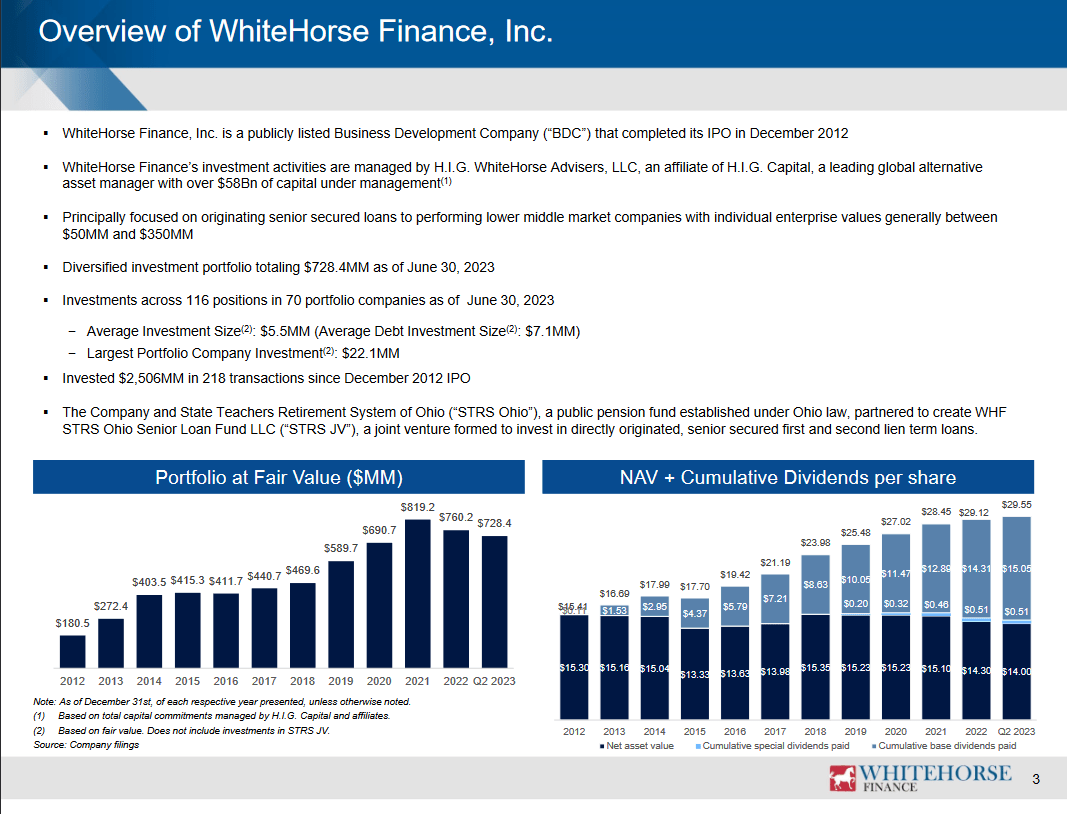

Firm Overview (Investor Presentation)

Over time the portfolio worth of WHF has been steadily climbing and is a number of occasions larger than a decade in the past. This has resulted in an asset progress of 8.28% yearly within the final 10 years. If that is one thing that may be stored up I believe that WHF appears to be like fairly undervalued proper now even.

The corporate goals to generate a big return based mostly on its investments after which have the ability to go that on to shareholders and due to this fact yield them a big return as nicely. Because the IPO of the corporate, they’ve invested simply over $2.5 billion in capital and have landed at an all-in yield of 13.4% which I discover very spectacular.

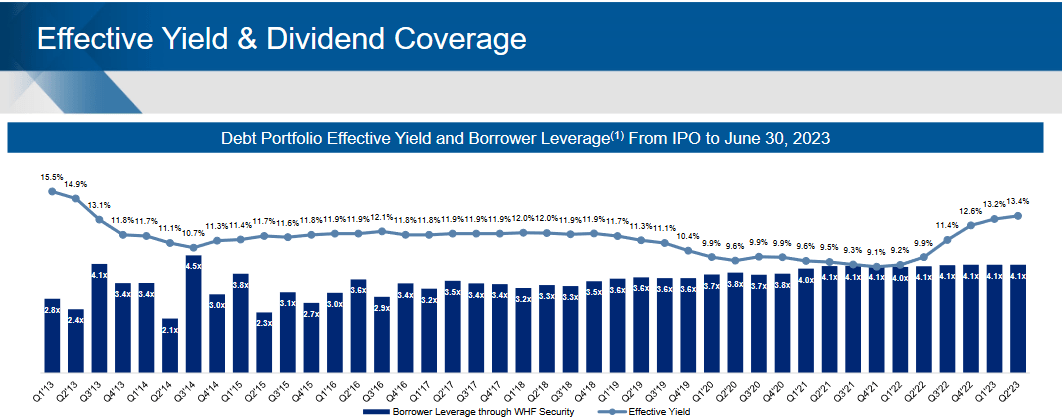

Firm Yield (Investor Presentation)

Trying nearer on the dividend yield of the corporate I believe that WHF has achieved an amazing job right here. The dividend yield has elevated during the last couple of quarters because of larger borrower leverage. The leverage proper now could be at 4.1x however has sat fairly secure at this degree over the previous couple of years. I believe that WHF is ready the place it could actually afford to tackle extra leverage to drive stronger returns. I would favor the verge ratio beneath 5 which nonetheless offers it loads of security to maneuver round with out making me fearful.

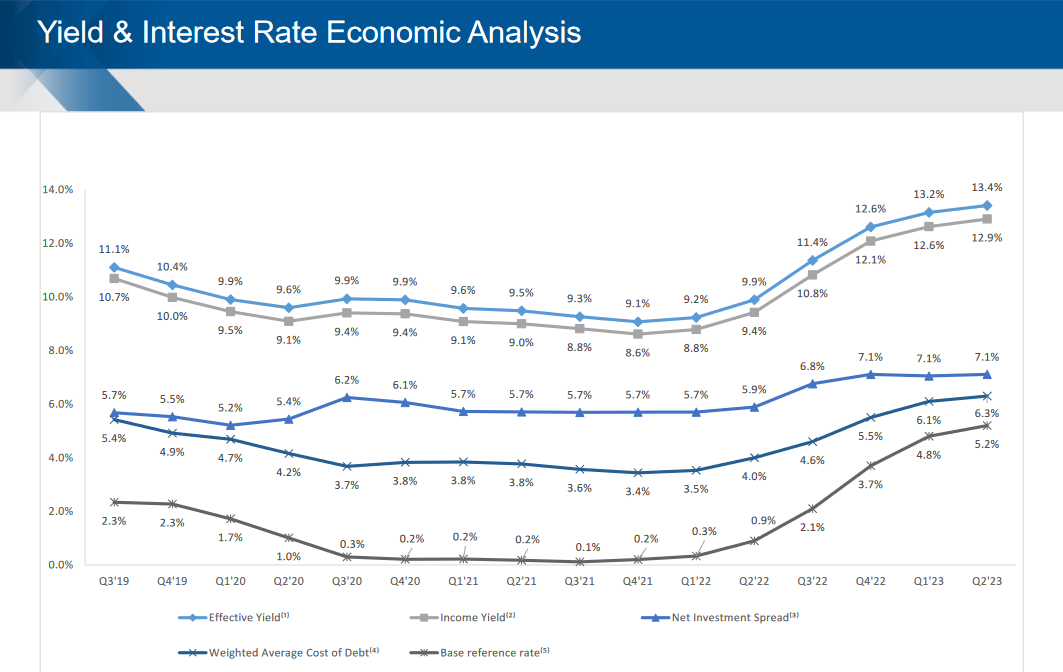

Yield And Curiosity (Investor Presentation)

Trying on the efficient yield for WHF it follows fairly nicely the bottom reference yield over the previous a number of years. What I believe is additional spectacular is the secure web funding unfold the corporate has had over this time as nicely, because it hasn’t reached a degree the place I believe it is showcasing indicators of weak spot. If it dips considerably I might assume that the share worth will do the identical.

Earnings Transcript

Going off the final earnings name the corporate had on August 8, the CEO of WHF Stuart Aronson had some very fascinating factors and feedback to share.

This morning I am happy to report robust efficiency for the second quarter of 2023, Q2 GAAP web funding earnings and core NII was $10.6 million, $45.06 per share, which greater than coated our quarterly base dividend of $0.37 per share. Whereas our core NII declined by $0.005 per share in contrast with Q1, Q2 core NII elevated by 34.5% improve over – year-over-year”.

Seeing this robust progress within the NII of the enterprise makes me very assured that the excessive dividend yield could be maintained from right here on out. The core NII could have proven some lower it nonetheless exhibited a big double-digit YoY progress fee that I believe has despatched the share worth up for the corporate. Going into the subsequent couple of quarters I believe that it is a key level to be watching in my view. If WHF can elevate the NII much more then I see it possible that the share worth accumulates shortly in worth.

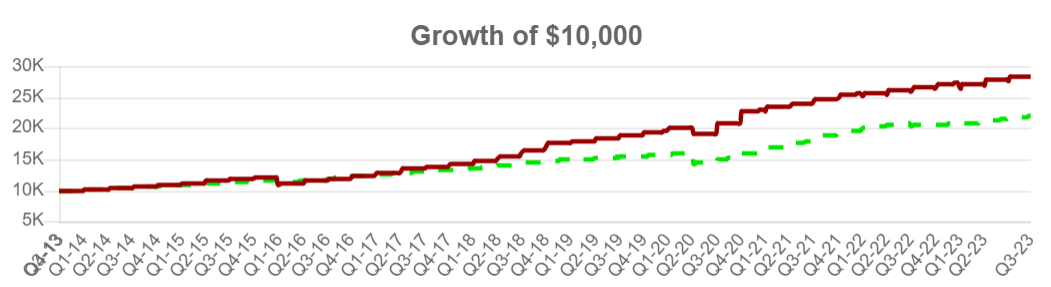

Firm NAV (CEFData)

Trying above we will see that the NAV worth of WHF has considerably managed to outgrow friends within the trade and this additional underscores why I consider that WHF might be such a powerful long-term addition. The value is below the NAV which is $14 per share.

Danger Related

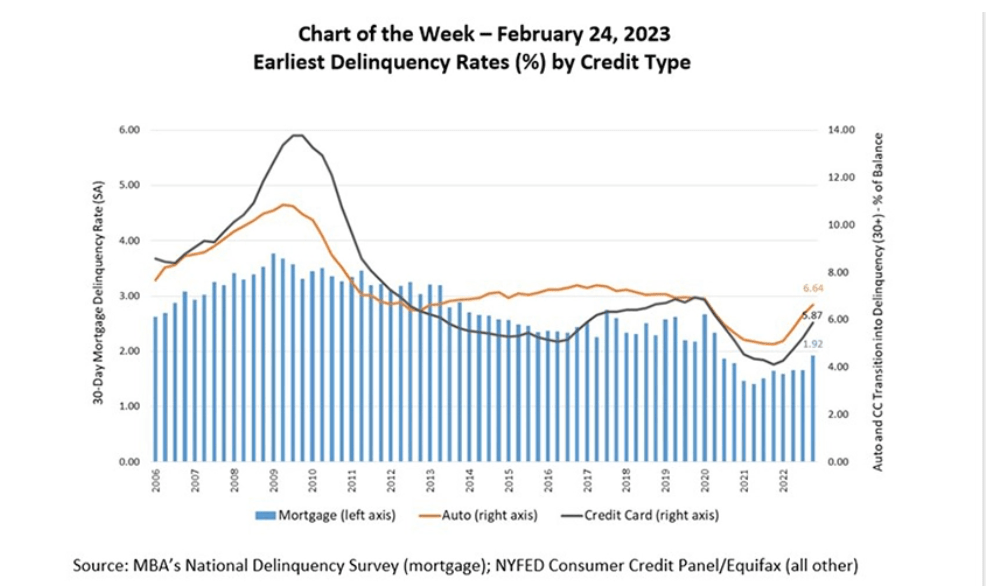

Given WHF’s involvement in offering loans, it is important to think about the influence of upper rates of interest on the corporate. When rates of interest rise, there’s a potential threat that delinquency charges may begin to improve as people and companies face larger borrowing prices. If this development turns into evident in one of many firm’s earnings experiences, it would put downward strain on the share worth as buyers grow to be extra involved concerning the heightened dangers related to the WHF mortgage portfolio.

Delinquency Charges (MBA)

In some remarks, it might be argued that WHF is overvalued proper now as nicely. When wanting on the p/s for instance it sits at 2.8 on an FWD foundation which displays a premium to the sector median of 27%. If there’s a valuation metric to say that WHF is overvalued based mostly on it will be this.

Apart from this, I believe there’s a threat of extended rates of interest that might mitigate a few of the earnings potential of the corporate seeing as they’re an asset and funding firm and driving earnings from these sources is the explanation for his or her excessive dividend yield proper now. If they’re pressured to chop it I believe the value would plummet as a lot of the enchantment of WHF is the dividend yield.

Investor Takeaway

The enchantment of WHF comes from the numerous dividend yield it presently has and may present buyers with a really robust ROI over the long run. As seen within the image above, the NAV of WHF has been climbing steadily through the years and displays why WHF is a sound addition. The earnings a number of sits beneath the remainder of the sector and the final quarter introduced a powerful progress within the NII of the enterprise. It is a development I believe can proceed and underlines the purchase thesis I’ve for WHF presently.