JHVEPhoto

Introduction

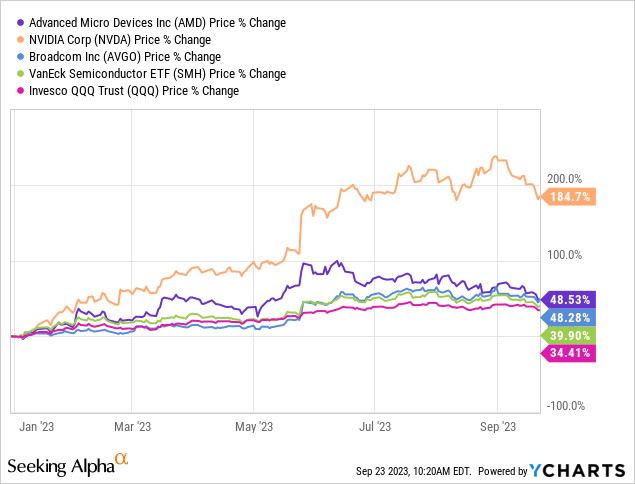

In 2023, a red-hot generative AI hype cycle has powered semiconductor shares like Superior Micro Units, Inc. (NASDAQ:AMD), Nvidia (NVDA), and Broadcom (AVGO) larger, with the VanEck Semiconductor ETF (SMH) handily outperforming the mega-cap tech-dominated Invesco QQQ ETF (QQQ).

Current breakthroughs in generative AI have triggered a rush for AI chips (primarily GPUs) this yr, and semiconductor giants are naturally benefitting because the “picks and shovels” suppliers of this AI rush. In Nvidia: The Magnificent One Delivers On Its AI Promise, we reviewed Nvidia’s newest blowout quarterly outcomes, which substantiated the AI rush and NVDA’s dominance within the knowledge heart AI chips market. Whereas Nvidia is the clear chief proper now, Superior Micro Units, Inc. [AMD] has a great shot at turning into the Pepsi (PEP) to Nvidia’s Coke (KO) in the humongous knowledge heart AI chips market, which is anticipated to develop at a 50% CAGR over the following 5 years to grow to be a $150B market!

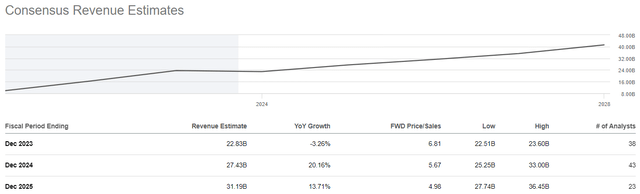

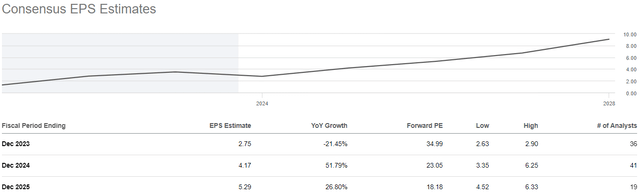

As it’s possible you’ll know, AMD is ready to launch its Mi300 AI chip within the close to future to stake its declare on this rising market. Whereas AMD’s share good points within the knowledge heart AI chips market are prone to be restricted to 10-20% over the long term, taking part in second fiddle to Nvidia should still symbolize an amazingly good final result for AMD shareholders. Based on consensus estimates, AMD’s income development is all set to re-accelerate again as much as 20% subsequent yr on the again of sturdy demand for its knowledge heart GPUs, with EPS projected to develop by 52%.

SeekingAlpha SeekingAlpha

Now, regardless of having a wholesome enterprise outlook, AMD’s inventory has tanked by greater than 25% from its latest peak of ~$129 over the past three months or so. And traders are naturally pondering if this can be a good shopping for alternative.

Google Finance

On this be aware, we are going to examine the dip in AMD inventory, after which re-assess the inventory utilizing our proprietary course of.

Why Is AMD Inventory Crashing So Exhausting?

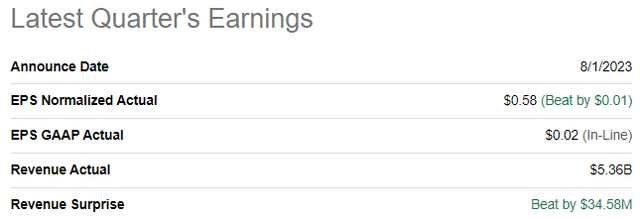

Regardless of beating its prime and backside line expectations for Q2 2023, AMD’s inventory has tanked by ~25% from its latest highs of ~$129 per share in simply over three months. Whereas this transfer could possibly be a corrective pullback, the speed and depth of this transfer resonate with a crash.

SeekingAlpha

AMD Q2 2023 Earnings Launch

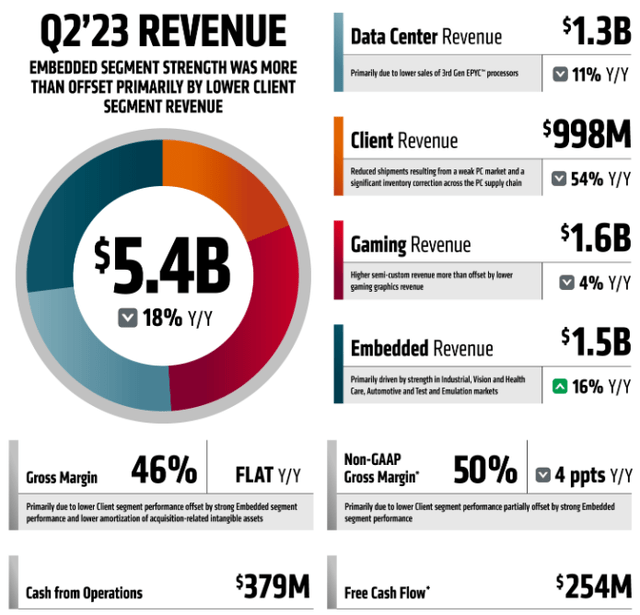

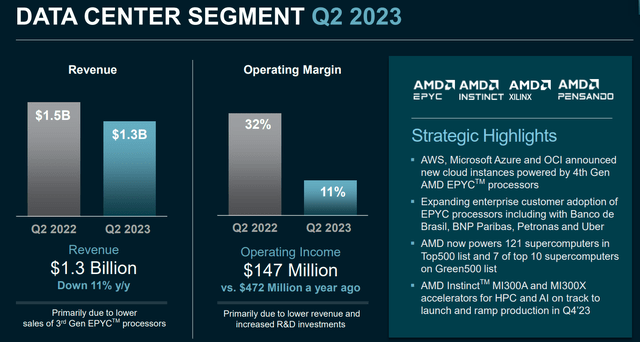

The frequent bearish narrative floating round within the media is that AMD shouldn’t be an actual beneficiary of the generative AI pattern, with its monetary efficiency (particularly knowledge heart income) nonetheless in decline. In Q2 2023, Nvidia’s knowledge heart income grew at +171% y/y to greater than $10.3B; whereas, AMD’s knowledge heart revenues declined by -11% y/y to $1.3B.

AMD Q2 2023 Earnings Presentation

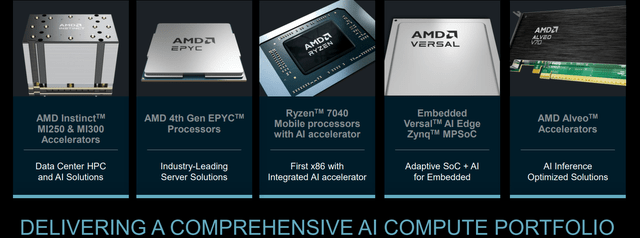

Whereas the numbers clearly present that AMD is nowhere near Nvidia, AMD has a complete AI compute portfolio that is set to drive wholesome development on the firm for a number of years to come back. Now, AMD’s monetary studies have not showcased an AI enhance simply but; nevertheless, the Mi300 AI GPU chip is on monitor to scale in This autumn 2023, and I believe AMD’s knowledge heart revenues are set to rebound sharply in 2024.

AMD Q2 2023 Earnings Presentation

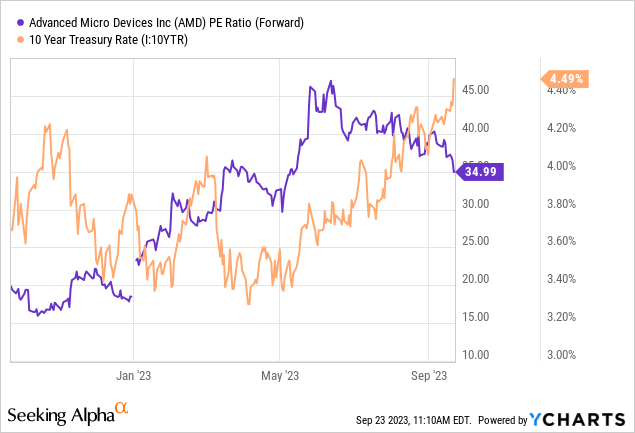

In my opinion, AMD’s latest inventory worth decline shouldn’t be all the way down to weak monetary efficiency in any respect. The large year-to-date leap in AMD’s inventory worth was pushed primarily by buying and selling a number of growth; nevertheless, with long-duration treasury yields climbing quickly in latest weeks, buying and selling multiples have been contracting decrease.

And unfavourable worth motion in Nvidia (regardless of its blowout quarter and steerage) and different mega-cap tech names assist my view that this transfer in AMD is pushed by a change within the rate of interest atmosphere [higher discount rate = lower asset prices].

Now, let’s run AMD via our course of to see if this ongoing sell-off is a shopping for alternative for traders.

Working AMD Via Our Evaluation Course of

As a long-term investor, I prefer to fine-comb each inventory thought utilizing a mixture of basic, quantitative, technical, and valuation evaluation so as to make knowledgeable investing selections. Let’s begin this train for AMD.

1. Basic Evaluation

After a number of years of fast development, AMD’s development story hit a painful snag in H1 2023, with income down -18% y/y in Q2 2023 primarily attributable to weak point in Shopper and Knowledge Middle companies.

AMD Q2 2023 Earnings Presentation

Through the years, AMD’s enterprise has been shifting towards the info heart phase; therefore, weaker gross sales of third Gen EPYC processors have been having an outsized unfavourable affect on AMD’s ends in Q2 2023. And within the Shopper phase, a drastic shift from provide constraints to a provide glut within the PC market has led to under-shipping from the likes of AMD and Intel (INTC) in latest quarters.

Whereas the PC market [and AMD’s Client business] is just prone to get better progressively over time, we’re possible previous the trough right here. And extra importantly, AMD’s knowledge heart enterprise is all set to return to constructive development this quarter on the again of stronger adoption of AMD’s 4th Gen EPYC processors from cloud hyperscalers akin to Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure.

AMD Q2 2023 Earnings Presentation

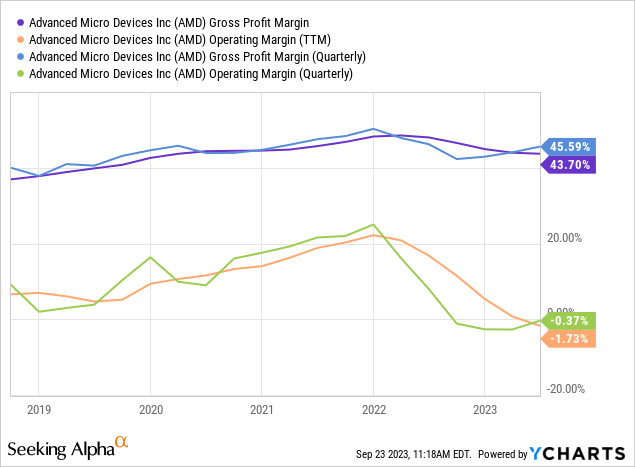

Along with an imminent restoration in income development, AMD is ready to expertise a margin growth in H2 2023 as channel stock will get again within the stability (worth discounting ends). And we have now already seen early indicators of margin enchancment at AMD in Q2 2023:

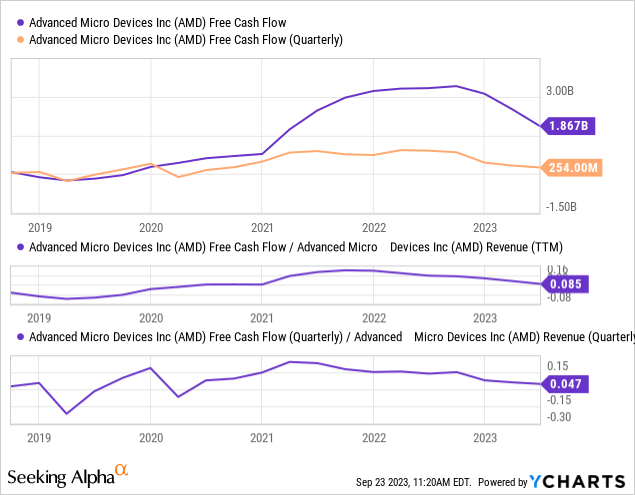

Now, as you possibly can see under, declining revenues and shrinking margins have pressured AMD’s money move era in latest quarters, with TTM and Quarterly FCF margins falling to eight.5% and 4.7% in Q2 2023.

In upcoming quarters, a return to constructive gross sales development coupled with margin growth ought to result in stronger free money move era at AMD. And with that, I’d anticipate the corporate to renew its inventory buyback program.

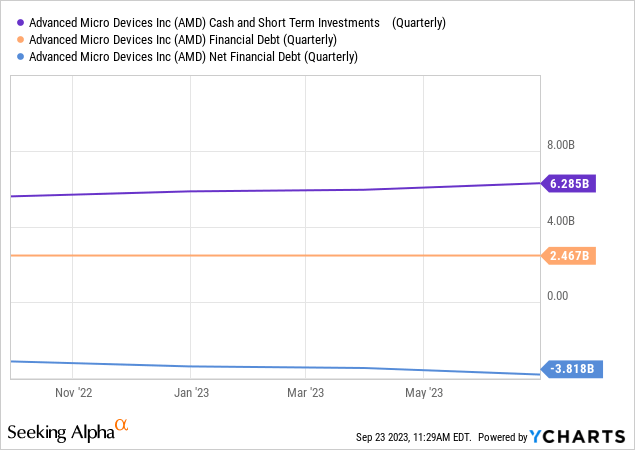

As of Q2 2023, AMD had a internet money stability of $3.8B on its stability sheet, giving the chip large a powerful monetary basis. With AMD prone to ship rising quantities of free money flows in upcoming quarters, I see no liquidity points for the foreseeable future.

From a basic perspective, AMD stays a sound enterprise. With a broad product portfolio, AMD is well-positioned to outlive and thrive within the period of AI, and monetary efficiency is probably going to enhance considerably within the quick time period as stock headwinds subside. A recession may throw a spanner within the works for AMD’s 2024 development story; nevertheless, as of now, AMD appears to be like all set to re-accelerate gross sales development and enhance profitability [earnings & free cash flows].

2. Valuation Evaluation

Usually, equities are valued on a relative and/or absolute foundation. On this train, we will worth AMD by way of each of those views.

From a relative valuation standpoint, AMD seems to be richly valued at ~35x ahead P/E (normalized EPS) and ~83x P/FCF particularly in a rising rate of interest atmosphere the place the long-duration treasury yields are >4%.

Now, let’s contemplate AMD’s absolute valuation.

AMD’s Truthful Worth And Anticipated Returns

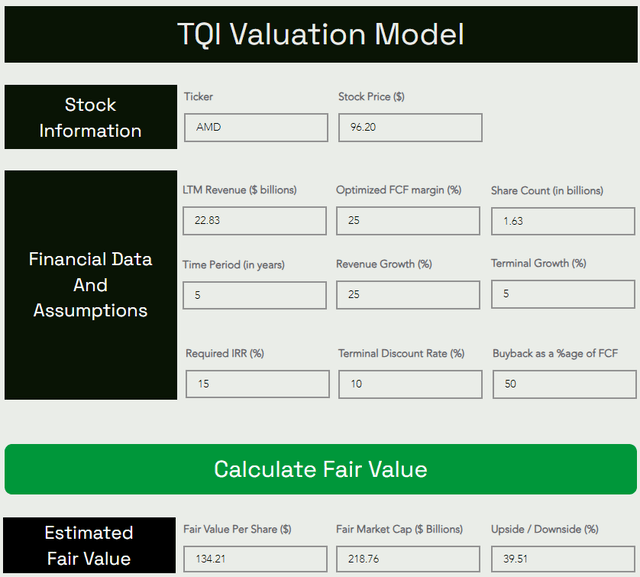

In gentle of Nvidia’s blowout quarter (and excessive demand for AI chips), I’ve upgraded AMD’s 5-year CAGR gross sales development expectations from 15% to 25% in our mannequin. As I see it, AMD’s knowledge heart enterprise is all set to return to fast development in upcoming quarters, with demand for AI GPUs set to drive revenues larger. With $1T value of cloud & knowledge heart infrastructure set to get replaced over the following 10 years, AMD has a protracted runway for development.

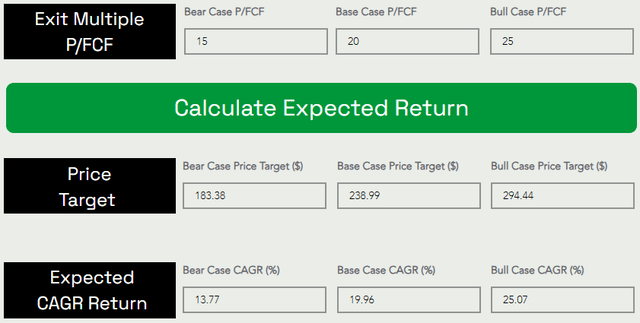

This is my up to date valuation mannequin for AMD:

TQI Valuation Mannequin (TQIG.org)

As you possibly can see above, AMD inventory is at present buying and selling at a major low cost to its truthful worth of ~$134 per share.

Assuming a base case P/FCF exit a number of of ~20x, we get to a 5-year worth goal of ~$239 per share, which means a CAGR return of ~20%.

TQI Valuation Mannequin (TQIG.org)

Since its anticipated CAGR return handily beats my funding hurdle charge of 15%, I like AMD from a long-term threat/reward standpoint.

Now, let’s consider AMD’s near-term threat/reward utilizing technical evaluation.

3. Technical Evaluation

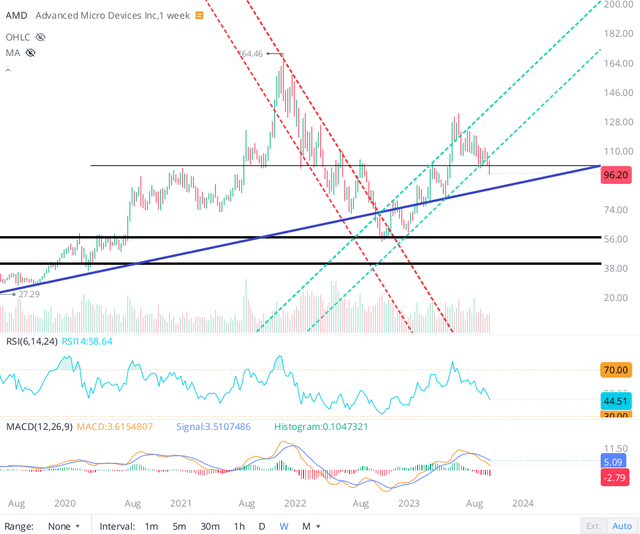

After placing a backside on the prime finish of its multi-year assist zone within the $40-60 vary again in late 2022, AMD’s inventory has rallied larger in a large channel marked in dotted inexperienced strains on the chart under. With RSI and MACD indicators rolling over on the weekly chart, the continued sell-off in AMD inventory may fairly simply lengthen to the multi-year assist trendline at ~$80-85 and a re-test of the $40-60 vary can’t be dominated out both (given the rising chance of an financial recession).

WeBull Desktop

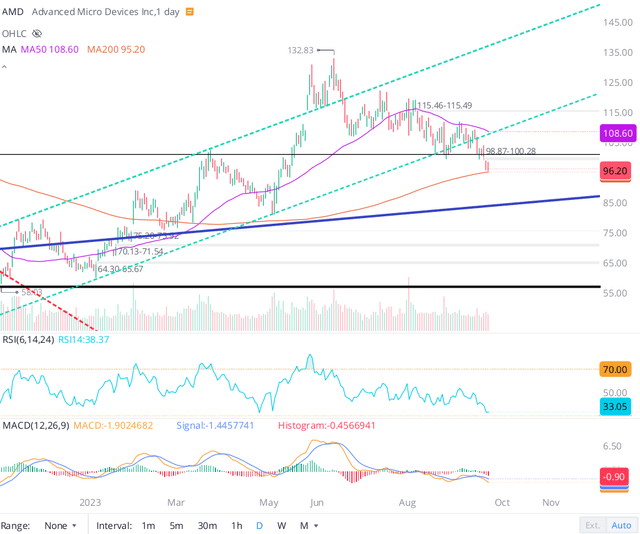

That stated, AMD is at present sitting on the 200-DMA assist degree and may be very near oversold territory (RSI: 33) on the day by day chart. A technical bounce right here may materialize within the upcoming session; nevertheless, if the broad market sell-off intensifies, I can see AMD sliding all the way down to the low $80s.

WeBull Desktop

Total, AMD’s technical setup is wanting bearish, with the inventory dropping momentum in latest weeks and breaking under the decrease finish of the upward channel it has been buying and selling in since hitting a backside in October 2022. If we do find yourself in an financial recession, AMD’s anticipated gross sales development and earnings rebound might fail to materialize in 2024. And in that state of affairs, I believe a re-test of the October lows is feasible.

Technically, AMD inventory appears to be like primed for additional draw back in upcoming weeks, and so, I view the near-term threat/reward in AMD inventory as unfavorable.

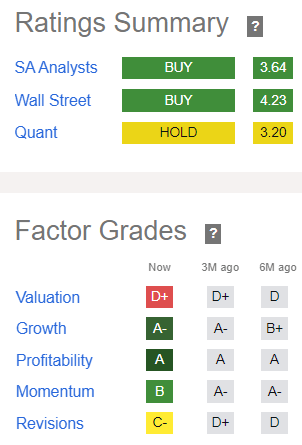

4. Quant Issue Grade Evaluation

Along with its ominous technical setup, AMD’s quant issue grades are at present unsupportive for recent shopping for. Based on SA’s Quant score system, AMD is rated a “Maintain” with a rating of three.20/5. Whereas its “Profitability” and “Development” grades have held up at “A” and “A-” over the past three months, AMD’s (technical) “Momentum” grade has deteriorated from “A-” to “B” offsetting the development in (earnings) “Revisions” grades from “D+” to “C-“.

AMD’s Quant Issue Grades (SeekingAlpha)

As we noticed earlier on this be aware, AMD appears to be like costly on a relative valuation foundation, and that is what is mirrored in its quant issue grade of “D+” for “Valuation”. Nevertheless, from an absolute valuation standpoint, AMD is considerably undervalued, and because of this, I believe traders can select to disregard the quant issue grades on this occasion and purchase AMD right here if they’re placing capital to work for the long term [3-5+ years].

Concluding Ideas: Is AMD Inventory A Purchase, Promote, or Maintain?

Superior Micro Units, Inc. has had a spectacular turnaround over the previous decade, and regardless of hitting a snag in 2023, the expansion story is ready to renew subsequent yr, with income development set to rebound to twenty%+ on the again of sturdy demand for AI GPU chips and a stabilization within the PC markets. AMD has a powerful stability sheet (strong monetary basis) and its enterprise stays a free money move producing machine.

AMD’s transition to a data-center-centric enterprise ought to allow it to stay way more resilient via an financial downturn in comparison with earlier cycles. And demand for AMD’s merchandise is prone to develop quickly over the approaching years as ground-breaking, compute-intensive applied sciences akin to generative AI come to markets.

Whereas AMD’s technical charts and quant elements grades don’t assist a near-term lengthy place within the inventory, the long-term threat/reward [~20% expected CAGR return] and enterprise fundamentals stay wholesome. Therefore, I charge AMD inventory a purchase at present ranges, with a choice for greenback price averaging.

Key Takeaway: I charge Superior Micro Units, Inc. inventory a “Purchase” at ~$96 per share, with a powerful choice for sluggish, staggered accumulation.

Thanks for studying, and blissful investing! Please share any questions, ideas, and/or considerations within the feedback part under or DM me.