HJBC

Funding Thesis

IBM (NYSE:IBM) has a wealthy historical past of being on the forefront of technological evolution prior to now. Based in 1911, IBM performed a pioneering function in creating and popularizing the punched card system, which revolutionized knowledge processing and computation through the early twentieth century.

Throughout World Battle II, IBM’s tabulating machines have been instrumental in aiding the conflict effort, serving to to course of huge quantities of knowledge and contributing to the event of early computing expertise.

Within the Nineteen Fifties and Sixties, IBM launched the IBM 700 sequence of mainframe computer systems, which turned a cornerstone of large-scale knowledge processing for companies and governments worldwide.

Within the Eighties, IBM was a pacesetter within the private laptop revolution, with the introduction of the IBM PC, which set business requirements and helped carry computing to the plenty.

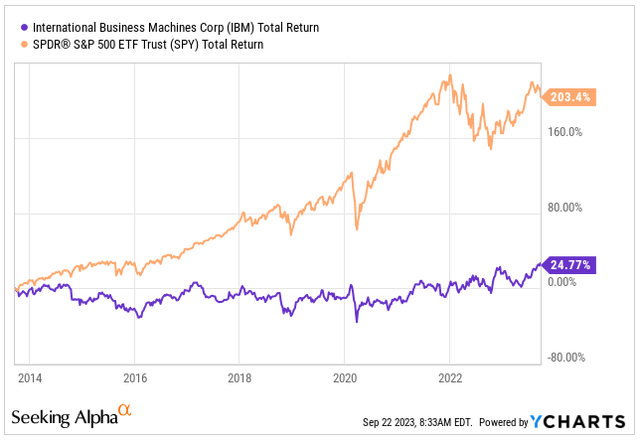

Regardless of its spectacular historic journey, the final decade has been fairly a difficult one for each IBM and its buyers. To be exact, the corporate has fallen considerably behind the market, trailing by a staggering 178% by way of whole return over the previous decade. Now, one would possibly argue that the S&P500 Index (SPY) has been disproportionately influenced by a handful of tech juggernauts which have powered its progress. Nevertheless, is not IBM working in the identical business? Should not it have discovered a option to thrive on this tech-driven panorama of final decade?

Whole Return (In search of Alpha / YCHARTS)

As we stand on the daybreak of the following technological revolution, characterised by Synthetic Intelligence, we’re poised to witness profound shifts in our interactions with expertise. These developments not solely promise to redefine our relationship with machines but additionally carry the potential to reinforce productiveness for generations to come back. The query that naturally arises is whether or not IBM, a longstanding technological innovator, can as soon as extra declare a pioneering function on this ongoing revolution.

Let’s take a look.

AI on the Forefront of IBM’s Agenda

To see how AI might have an effect on IBM’s progress, let’s begin by taking a look at how IBM makes cash in the present day.

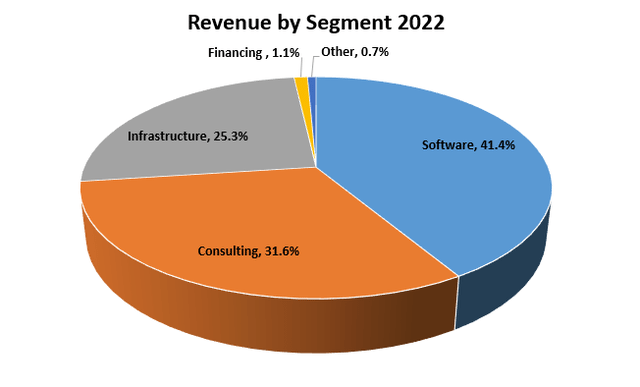

In 2022, IBM posted a complete income of $60.53 billion, marking a noteworthy 5.5% enhance in comparison with the earlier 12 months. The lion’s share of this income comes from the Software program phase, which raked in a considerable $25 billion, accounting for 41.4% of the general income. Notably, this occurs to be essentially the most worthwhile phase for the corporate, boasting a formidable gross margin of 79.6%. The second most important enterprise unit is Consulting, making up 31.6% of the entire income, whereas Infrastructure takes the third spot with 25.3% of the income pie.

Income by Phase (IBM IR)

It is thought by many who the AI revolution actually started with the debut of ChatGPT. This marked the second when AI expertise turned accessible to the general public and demonstrated its sensible purposes, catapulting it into the mainstream consciousness.

IBM’s enterprise into generative AI truly dates again to 2020, though it largely remained underneath the radar till the excitement surrounding ChatGPT emerged. IBM is distinctively positioned with its hybrid cloud and AI capabilities.

All of it started with a considerable funding in infrastructure, laying the muse for what would ultimately turn into a pioneering platform for coaching through the early phases of transformer experimentation, paving the way in which for generative AI and enormous language fashions.

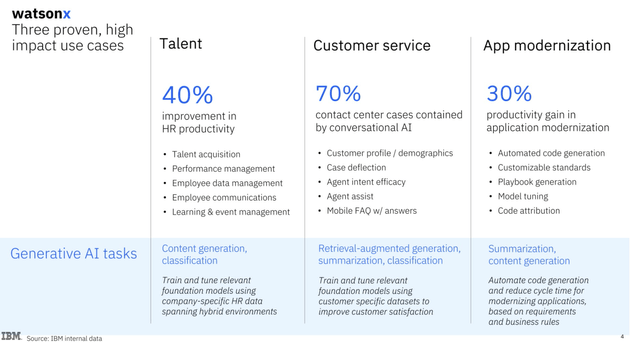

As an alternative of channeling its efforts towards a consumer-centric engine, IBM’s software program product, Watsonx, is resolutely dedicated to offering tailor-made generative AI options solely designed for enterprises. This strategic emphasis spans throughout key areas resembling HR options, customer support enhancement, and utility modernization.

IBM is concentrating its efforts on domains the place important repetitive duties exist, and the place firms are wanting to spend money on digitized options to reinforce their operational effectivity and drive productiveness.

Generative AI Use Circumstances (IBM IR)

I see the enterprise oriented strategy as fairly encouraging, as it seems that the corporate has lastly recognized a distinct segment market during which they’ll excel. The panorama for AI options aimed toward particular person shoppers appears already saturated and fiercely aggressive.

IBM is specializing in its core strengths, developing fashions grounded in datasets it is aware of intimately, encompassing code, pure language processing, IT knowledge, and extra.

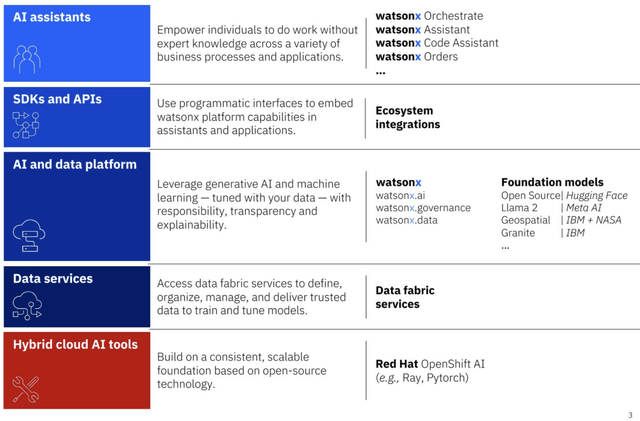

Moreover, their Software program and Consulting portfolios lengthen to AI assistants through WatsonX, a platform with the potential to considerably increase the productiveness and effectivity of their purchasers’ workforce.

As well as, IBM is dedicated to growing its funding and bolstering its presence within the Information Platform market, with a concentrate on enabling seamless interactions with their purchasers’ knowledge—a pivotal component for the profitable execution of AI initiatives.

Furthermore, they’re additionally offering knowledge companies and hybrid cloud AI instruments, successfully broadening their array of choices and enriching their core competencies. This growth finally offers their purchasers with a complete and well-rounded product bundle.

Product Providing (IBM IR)

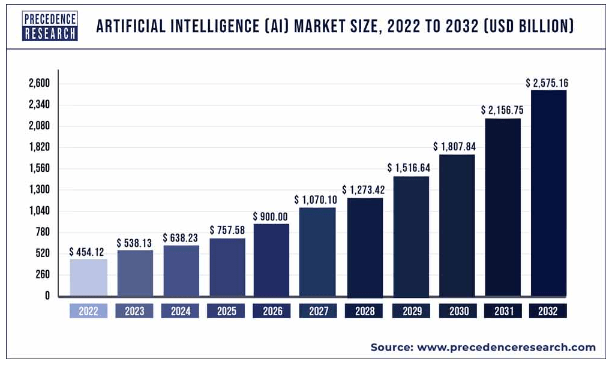

Once we think about the broader panorama of the AI market, it is projected to strategy a considerable dimension of roughly $2.6 trillion by 2032, with greater than half of this worth attributed to generative AI options—the very area during which IBM is actively competing. This suggests that we must always anticipate the generative AI market to exhibit a strong CAGR of roughly 42%.

This presents an immense alternative, one which’s sure to see fierce competitors from quite a few firms. However, I maintain an optimistic view that IBM is strongly positioned to grab this chance successfully inside each their Software program and Consulting segments.

AI Progress Forecast (Priority Analysis)

Whereas the market’s progress potential is undeniably substantial, the important query that also looms is the extent of the addressable market that IBM can successfully faucet into. Given the early stage of this rising business, pinpointing a precise determine stays difficult.

Giving us a style of what we could anticipate, as of Q2 2023, IBM has reported promising YoY progress of their Software program division, at a formidable charge of 8%, with Information & AI experiencing an much more sturdy progress of 11%. In distinction, Consulting has witnessed a extra average progress charge of 6%.

Primarily based on this info, I envision that IBM’s potential lies in attaining a constant annual income progress charge of roughly 5-7% in each Software program and Consulting within the subsequent 10 years pushed by the AI initiatives, if executed nicely.

Considerably Undervalued with Sturdy Progress Prospects

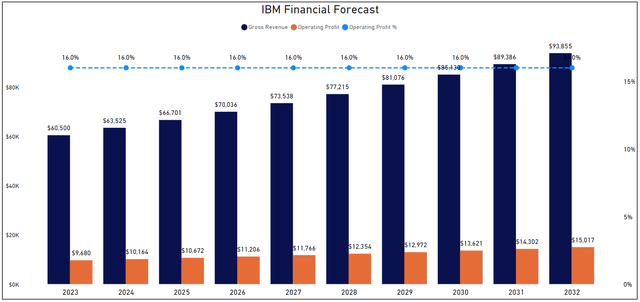

Given the inherent dangers related to the early phases of the AI revolution, which undoubtedly holds the potential to enhance the lives of many, as beforehand talked about, it stays difficult to exactly quantify the extent to which IBM can seize this chance. Taking a cautious strategy, I am assuming a modest progress charge of 5% yearly for the following decade, with out factoring in any enhancements in IBM’s working margin.

However, it is price noting that IBM, with its huge workforce of 288,000 staff, stands to profit considerably from AI by automating quite a few processes, thereby enhancing effectivity and probably enhancing working margins.

In a “bear case” state of affairs for AI adoption, I anticipate the corporate might obtain practically $94 billion in income by the top of 2032. This is able to signify a 55% progress from the present income ranges. Concurrently, the working margin is anticipated to exceed $15 billion.

IBM Monetary Forecast (Creator’s Graph)

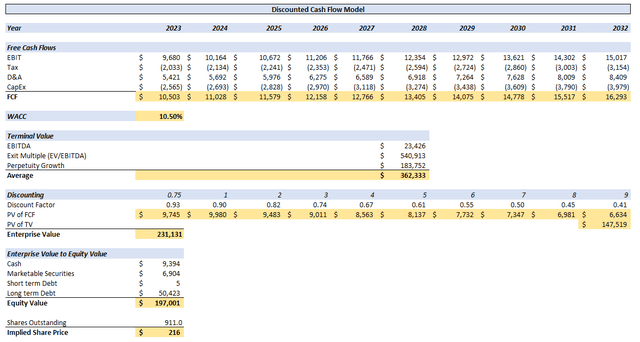

In an effort to calculate the Honest Worth of IBM I’m utilizing the DCF Mannequin.

Further assumptions for the DCF evaluation are:

A tax charge of 21.0%.

D&A and CAPEX amounting to 56% and 26% of EBIT, respectively.

WACC of 10.5%.

EV/EBITDA a number of of 23.09.

A Terminal Progress Fee set at 1.5%.

After discounting these values over the following 10 years, the PV of FCF quantities to roughly $83.6 billion, whereas the PV of TV reaches $147.5 billion. Consequently, the entire Enterprise Worth is estimated at $231.1 billion. Following changes for Money, Marketable Securities, Brief & Lengthy-term debt, the ensuing Fairness Worth is assessed at $197 billion.

DCF Mannequin (Creator’s Graph)

In response to my calculations, the estimated Honest Worth for the corporate in the present day is $216, suggesting a major undervaluation of roughly 47% in comparison with in the present day’s value of $148.

Conclusion

IBM has a outstanding historical past of staying on the forefront of technological evolution since its inception.

Nevertheless, it is important to acknowledge that the previous decade has posed challenges for the corporate, marked by declining revenues and a considerable underperformance compared to the broader market, trailing by a major 178%.

Nonetheless, we discover ourselves on the preliminary phases of a brand new AI revolution, one which guarantees to reinforce productiveness and the standard of life for a lot of people.

IBM has been deeply immersed in AI since 2020 and has recognized its area of interest within the enterprise sector, providing knowledge companies and hybrid cloud AI instruments. These instruments maintain the potential to considerably increase the effectivity of quite a few firms.

Anticipating sturdy demand for AI options within the coming decade, pushed by the compelling prospect of value financial savings and heightened productiveness, we will foresee enterprises rising sooner and changing into extra worthwhile, whereas in search of higher and sooner AI options.

Contemplating a conservative progress charge of round 5% in my “bear case state of affairs” for AI adoption, I imagine IBM is poised for distinctive efficiency. Coupled with its present important undervaluation, estimated at greater than 47% under its honest worth, I confidently charge the corporate as a STRONG BUY for these in search of to capitalize on the AI increase.