seewhatmitchsee

Funding Thesis

I needed to try Groupon (NASDAQ:GRPN) after it rallied round 300% for the reason that backside in Could of this yr. I needed to have a look at the corporate’s historic financials to see why the corporate has misplaced 97% of its complete worth within the final decade and if there’s a turnaround in sight. Wanting on the financials and modeling fairly optimistic profitability, the corporate remains to be too costly and could be a pure hypothesis play on the brand new administration’s potential to show across the firm, subsequently, I give it a maintain ranking and new buyers should not threat their cash right here till we see outcomes.

Outlook

The inventory traded as little as $3 a share simply again in Could. It looks as if buyers are being very hopeful concerning the new administration that not too long ago took over, which can sign that the corporate will see a turnaround. The brand new CEO Dusan Senkypl is an entrepreneur who could be very excited to rework the corporate and has eight pillars outlined that may assist the corporate turn into extra environment friendly and worthwhile. The prices have been fluctuating dramatically over time, which led to destructive internet margins for 4 out of the final 5 years of the enterprise. The corporate is burning money to maintain on surviving, moving into debt to maintain operations going, which isn’t a super means of doing enterprise for certain.

The outlook, subsequently, could be very murky because the CEO and CFO only recently took over the reins of the corporate and could have so much to show to everybody. I want to see additional enhancements in working margins and get them to optimistic ranges for a few consecutive quarters earlier than I think about what they did a hit. One other factor that makes me somewhat anxious but additionally appreciative is that the CFO Jiří Ponrt mentioned within the newest earnings name that the transformation plan “could not alleviate substantial doubt about our potential to proceed as a going concern.” No less than the administration is being actual right here and never touting that the plan goes to achieve success, and every part goes to be alright now that they’re in cost.

The administration is just not the one one that’s optimistic as one advisory agency has not too long ago elevated its stake in GRPN to eight.6% as they consider the shares may rise to round $55 a share. That’s fairly the assertion to make, and naturally, they’d be bullish, it is of their curiosity.

Financials

As of Q2 ’23, the corporate had $118m in money, which is a lower of round 60% from FY22 reserves, towards $225m of long-term debt, that are convertible bonds. These notes carry round 1% curiosity and could be transformed into shares if the worth reaches above $68 a share, which could be very removed from present valuations, so I feel this debt will keep as debt and the corporate will preserve paying the curiosity. For a corporation like Groupon that isn’t making any earnings and is down $40.6m in internet revenue as of Q2 ’23, the debt is a critical concern for me. I don’t suppose the corporate could be very secure if it can’t flip the ship round rapidly sufficient.

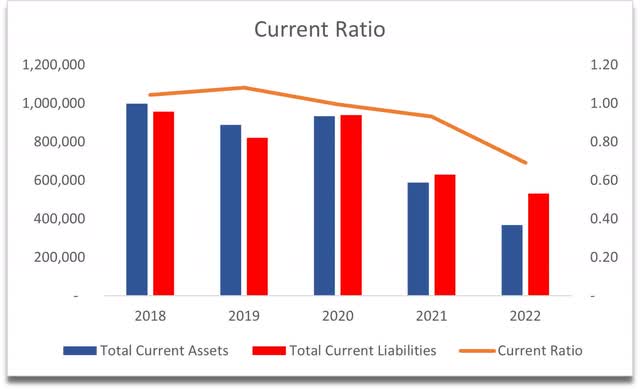

The present ratio has been beneath my minimal requirements of 1.5-2.0 and is effectively beneath 1 additionally as of the most recent quarter, which implies the corporate could also be having some liquidity points. The long-term development goes down with none rebound in sight as of but.

Present Ratio (Creator)

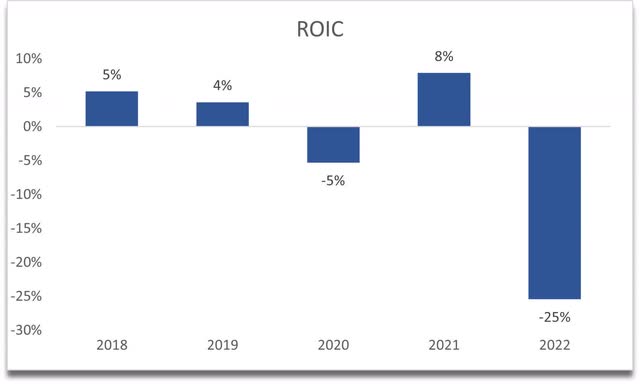

The corporate’s ROA and ROE have been destructive 4 years out of the final 5 and that isn’t a very good signal both and tells me that the corporate is just not being environment friendly with its property and shareholder capital.

Groupon has additionally misplaced any aggressive edge or moat that it could have had previously and I don’t see any turnaround on the horizon. I’m in search of at the least 10%.

ROIC (Creator)

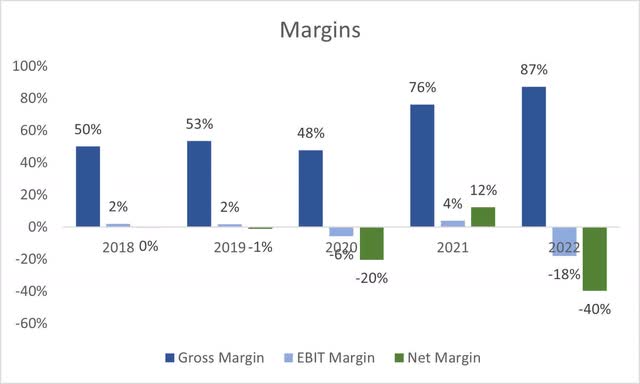

When it comes to margins, gross margins improved significantly in FY22 and as of Q2 ’23 stayed at about the identical degree, which is sweet. Working margins additionally improved fairly a bit; nonetheless, these are nonetheless destructive, which implies there may be plenty of work to be carried out earlier than the corporate turns into worthwhile as soon as once more. Working margins went from -32% in Q2 ’22 to -14% in Q2 ’23.

Margins (Creator)

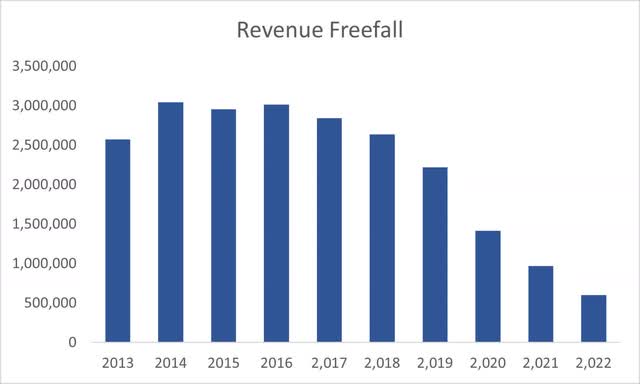

Revenues have plummeted within the final decade which may clarify the efficiency of the inventory worth alone, however coupled with different metrics it’s straightforward to see why it misplaced most of its worth.

Income decline (Creator)

I don’t see a lot optimistic in historic metrics, with slight enhancements within the final 2 quarters, nonetheless, it’s too early to inform that the corporate goes to show optimistic anytime quickly so a big margin of security is required.

Valuation

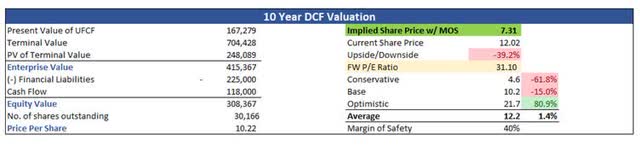

I’ve to take a hypothetical strategy to the corporate’s income progress. Analysts’ estimates predict -15% in FY23 and round 1% going ahead. I’ll be conservative and say the corporate stopped bleeding income and after FY23, revenues will develop at round 3% till FY32. For my optimistic case, I went with a 5% CAGR, whereas for the conservative case, I went with 1% after FY23 till FY32.

I don’t suppose I can speculate on greater progress for the reason that administration hasn’t supplied any optimism in that regard.

For margins, I needed to assume the cost-cutting measures of the brand new administration have labored out and went with a optimistic working margin of 17% in FY23 that improves to 23% by FY32, bringing internet margins from -40% in FY22 to +9% by FY32. Is it too conservative or too optimistic, I’m unsure, nonetheless, I do know that it’s higher than what the corporate has been doing not too long ago.

On prime of those estimates, I’ll add a considerable margin of security attributable to how dangerous the financials are and the speculative nature of the entire scenario. I went with a 40% margin of security which I feel is sufficient of a cushion. With that mentioned, Groupon’s intrinsic worth is $7.31 a share, which means that the present valuation remains to be too excessive.

Intrinsic Worth (Creator)

Closing Feedback

There may very well be a possibility for a good bounce if the administration goes to achieve success in turning the ship round. The advisory agency appears to place confidence in a turnaround that would rocket the shares as much as $55 a share by the tip of the yr, which I feel is sort of optimistic.

If I used to be to tackle such a threat, I would want the corporate to return down at the least one other 40% earlier than I bounce in with a small place as a result of it is rather speculative. My mannequin assumes that the corporate begins to supply optimistic unlevered free money movement, which within the final 2 years, was deep within the negatives, so, take the valuation with a grain of salt and a place to begin on your additional investigation into the corporate.

I am not going to counsel promoting your shares proper now as a result of I might be very to see what the brand new administration goes to do with the corporate and hope that they’ll flip the ship round and be extra streamlined and worthwhile as soon as once more.