JamesBrey

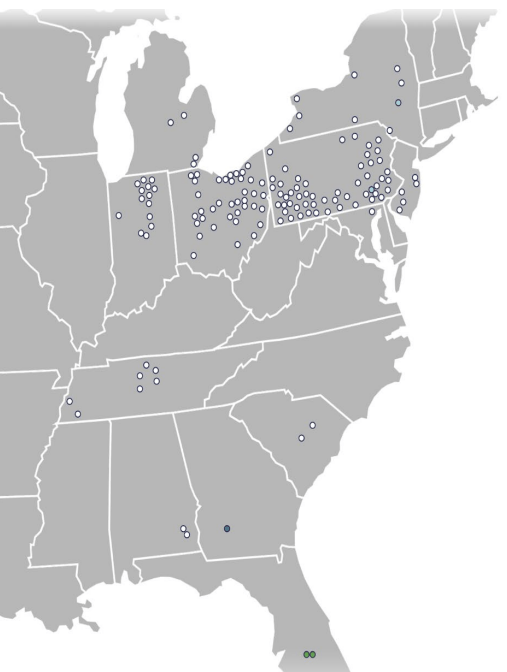

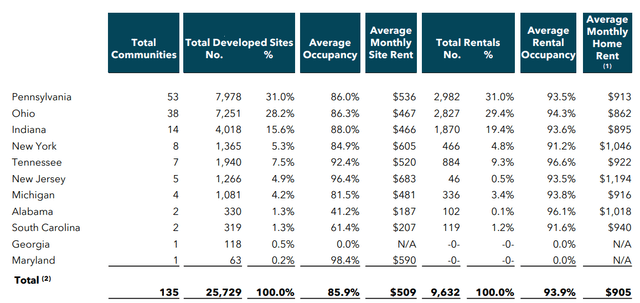

UMH Properties (NYSE:UMH) is a REIT that owns and operates numerous manufactured house communities within the jap half of the US. The corporate owns 135 properties in 11 states with a complete variety of 25,700 homesites.

UMH Property Places (UMH)

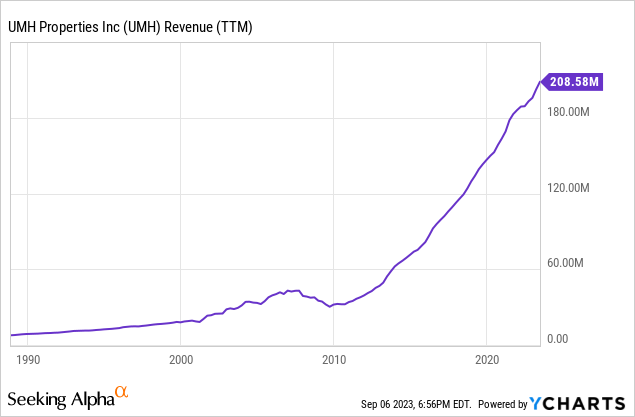

The corporate buys massive empty land and cuts them into heaps to organize them to accommodate manufactured or cellular houses. After getting needed permits from native governments, it builds up needed infrastructure in order that manufactured house homeowners can transfer in and begin residing in. Because the firm would not truly construct items, it collects hire on its land heaps and its margins are typically fairly wholesome.

As soon as a manufactured house is put in on so much, it’s extremely tough and costly to maneuver it to a different lot, so most individuals who personal these kinds of houses do not transfer round a lot except they promote their house and purchase one other one. This enables the corporate to generate secure and predictable ranges of revenue annually with only a few fluctuations. Along with amassing hire from its land heaps, UMH Properties additionally has a subsidiary that sells manufactured houses to folks which may add gas to the corporate’s future progress.

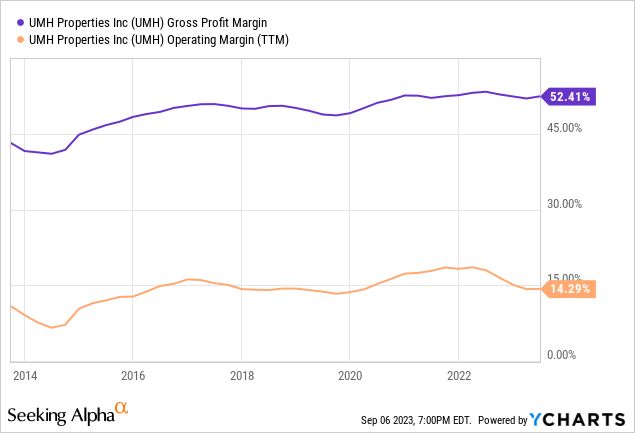

A few of UMH’s communities have additional facilities that you just would possibly count on to see in flats resembling a neighborhood pool and neighborhood fitness center. These communities are additionally a part of an HOA managed by the corporate. Other than these facilities and fundamental upkeep of the infrastructure (resembling water pipes and electrical traces), managing land heaps is so much cheaper than managing complete properties and if carried out appropriately, this sort of enterprise can typically get pleasure from larger margins than managing condo items. Through the years, UMH’s margins have been fairly secure with gross margins being round 50% and working margins being round 15%.

On the subject of manufactured house communities, traders may be apprehensive about stability as a result of individuals who stay in these communities are inclined to have decrease revenue on common. Individuals even have the notion that crime charges are larger in these communities though this isn’t essentially true since many manufactured house communities are 55+ communities which are typically quiet and clear. As UMH manages its personal properties the corporate has quite a lot of management over who it lets to stay in its properties. The corporate usually conducts adequate background checks to make sure that individuals who stay in its properties aren’t going to trigger any hassle and almost definitely care for their property and pay their hire on time. It actually takes a particular form of expertise and skillset to handle manufactured house communities and the corporate appears to have the fitting skillset since it has been round since 1968 and surviving and thriving since then.

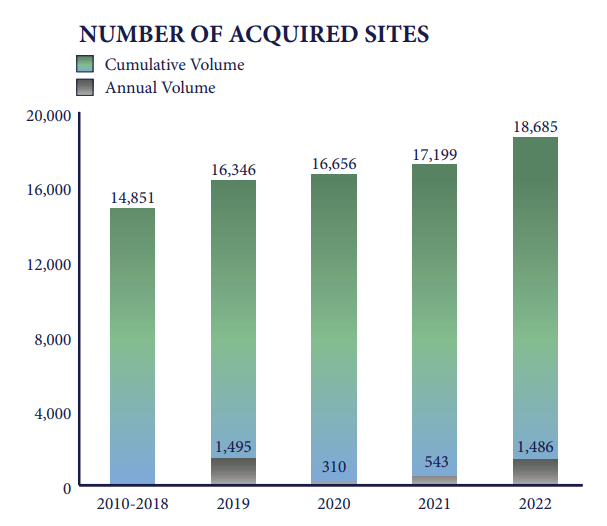

The corporate appears to have the ability to obtain progress via each acquisition of latest property in addition to hire worth hikes in its current properties. Because the collapse of the true property market in 2009, the corporate has been aggressively shopping for up properties as quick as its money circulate and liquidity would enable it to take action. Through the years, the corporate has acquired mixture of developed properties in addition to unbuilt land and it was in a position to triple the quantity of websites it owns and manages since 2010 via these acquisitions. There’s little motive to count on this development to vary anytime quickly because the firm’s money circulate ranges stay wholesome and its liquidity ranges are robust. Maybe its acquisitions could be a bit slower for the following couple years as a consequence of excessive inflation charges however they need to return to accelerating after charges are again to regular ranges particularly if it might probably come throughout some discounted offers.

UMH Website Acquisitions (UMH)

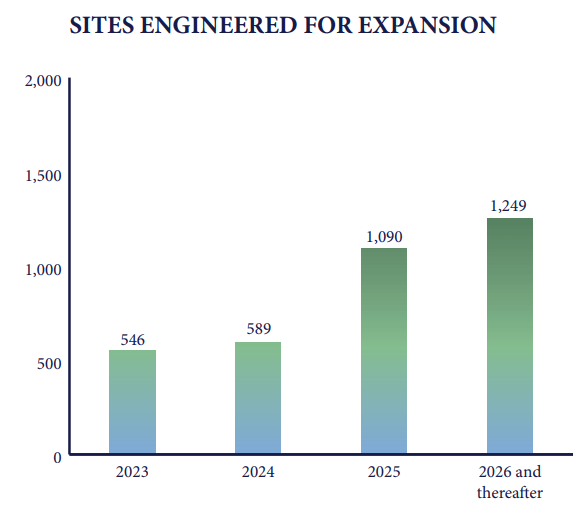

The corporate owns loads of empty land appropriate to construct new properties so that is the place portion of its near-term progress may come from at a comparatively low price as in comparison with buying developed properties. The corporate has engineered 546 websites for growth this 12 months, one other 589 in 2024 and greater than a thousand per 12 months beginning in 2025. So long as demand for housing stays robust, these websites ought to refill quickly after growth.

UMH Website Growth Potential (UMH)

Presently the corporate’s properties get pleasure from a mean occupancy fee of 86% which can not sound like a excessive quantity in comparison with condo REITs that get pleasure from occupancy charges in mid 90s however remember the fact that these are long-term leases. The typical condo dweller would possibly keep in the identical condo for 2-4 years however folks with manufactured houses will keep in the identical spot for a decade or longer as a result of it is vitally expensive for them to maneuver their property (nearly like a “captive viewers”). The typical month-to-month website hire throughout all of UMH’s properties is $509 whereas the common month-to-month house hire is $905. Within the first quantity, the renters convey their very own manufactured house and solely pay hire for the land whereas within the second quantity the hire for the unit itself is included as properly.

UMH Rental Traits (UMH)

Final 12 months the corporate raised its rents throughout the board by anyplace from 6% to 10% and its occupancy charges did not drop which implies its worth hikes had been well-received for probably the most half. After all we will not count on the corporate to have the ability to hike charges at that fee without end. As inflation fee returns again to long run common of two%, the corporate’s hire hikes are more likely to stabilize round 3-4% as we see in most residential REITs. There are additionally circumstances the place the corporate may purchase a website that’s in lower than good form, repair up the place, add extra facilities and hike rents because of bettering the property considerably. These actions can drive additional income progress for the corporate so long as it is carried out strategically.

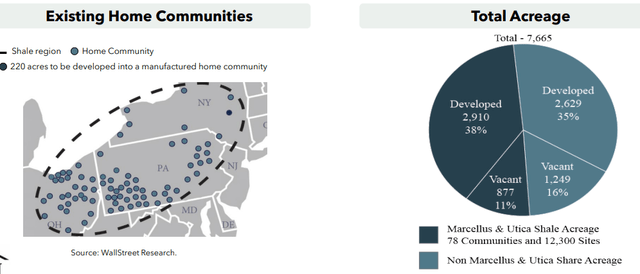

The corporate owns quite a lot of websites in Pennsylvania, Ohio and western New York. This space is called Marcellus & Utica Shale Area which is without doubt one of the largest and doubtlessly most efficient pure fuel fields. There’s quite a lot of growth on this space with extra to return. The corporate’s administration appears to consider that UMH will profit drastically from this growth since it should present 1000’s of excessive paying jobs the place lots of its websites are situated. This might enhance the general financial exercise within the space which may end in larger general demand for housing and better hire costs general however we must wait and see if it truly materializes. It is very tough to quantify precisely how a lot it might probably profit from this growth although so at the very least some warning is warranted earlier than getting too excited.

UMH Websites close to Marcellus & Utica Shale (UMH)

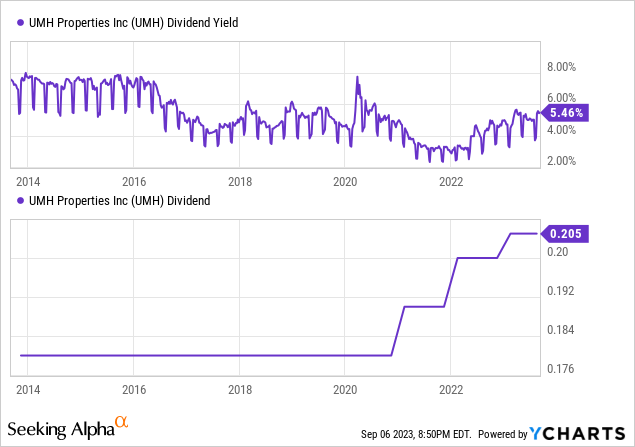

Since this can be a REIT, one essential part of this inventory is its dividends. In any case, REITs are anticipated to cross nearly all of their earnings to shareholders in form of dividends and many individuals make investments into REITs for dividends. The inventory’s present dividend yield of 5.46% is fairly first rate and considerably above what it was only a 12 months in the past (about 3%) but it surely’s nonetheless barely beneath its long-term common of 6%. In the meantime, after shying away from elevating its dividends for a number of years, the corporate lastly began to hike its dividends once more a pair years in the past. UMH’s dividend per share had been flat for 11 years from 2009 to 2020 as the corporate was spending most of its liquidity on aggressively buying new property and rising its enterprise however now there could be extra room to hike dividends within the subsequent few years as the corporate’s earnings develop.

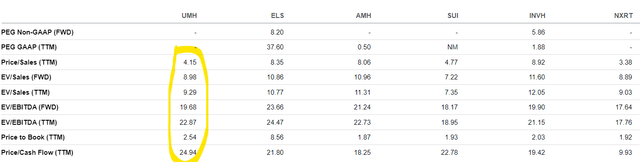

Valuation-wise, we will take a look at a couple of metrics to worth a REIT. Considered one of them is dividend yield which I discussed above. After we take a look at different metrics to match UMH towards its friends resembling Fairness LifeStyle Properties (ELS), American Properties 4 Lease (AMH) and Solar Communities (SUI) we see that UMH’s valuation is healthier in some metrics and blended in others as in comparison with its friends. For instance the corporate is doing higher than most of its friends in Value to Gross sales metric but it surely’s larger than its friends in Value to Money Circulate. UMH can also be larger than all however one among its friends in Value to Ebook ratio which is a crucial metric when valuing a REIT as a result of it tells us how a lot traders are paying for an organization for every $1 it has in belongings. The present worth to e-book worth of two.54 is not precisely low cost but it surely’s on the decrease finish of the corporate’s 5-year P/B vary of two.5 to 7.5. So I would not precisely name this inventory exceptionally low cost but it surely’s not excessively costly both. I’d name the corporate pretty priced.

UMH vs Friends valuation comparisons (Searching for Alpha)

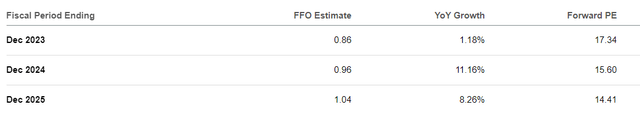

Analysts count on the corporate to generate $0.86 per share this 12 months, $0.96 in 2024 and $1.04 in 2025 in FFO (funds from operations). This may give the corporate a ahead P/FFO ratio of 17.3 for this 12 months, 15.6 for 2024 and 14.4 for 2025 which makes the corporate’s valuation much more affordable if it might probably meet or beat these estimates. Because the firm’s present dividend is round 82 cents per share, this might additionally imply additional dividend hikes if the corporate is ready to meet these estimates.

UMH Analyst ahead estimates (Searching for Alpha)

Danger elements

There are a couple of danger elements with this firm since there is no such thing as a such factor as risk-free funding. First, REITs are capital intensive companies they usually want quite a lot of liquidity to maintain working. As rates of interest rise and liquidity turns into costlier and tough to acquire, this may in all probability put a headwind into the corporate’s progress at the very least within the quick time period. Second, because the firm’s clients are typically folks with decrease revenue typically, they’re those that might endure probably the most from a doable recession that might occur sooner or later. Individuals who stay in manufactured house parks are inclined to have much less sources and fewer monetary stability in order that they could be unable to pay their hire if the economic system had been to enter a extreme recession. This considerably occurred in 2008 and the corporate needed to lower its dividend considerably again then. Third, there could possibly be new regional or native legal guidelines and rules altering how land is getting used and what could possibly be constructed on what sort of land and this might restrict what the corporate may do with huge quantities of empty land it owns. Fourth, there could possibly be shift in folks’s preferences and notion the place manufactured houses won’t be seen as possibility and we’d see folks making other forms of residing preparations. Additionally, since quite a lot of manufactured house communities are for older residents, they must rely on social safety funds to make hire. In the long run this could possibly be a danger issue.

Conclusion

UMH Properties is an honest REIT play with an above common dividend yield and potential for future progress in a distinct segment space of the residential market. UMH’s administration appears to be good at what they’re doing contemplating their successes within the final 50 years. This inventory has the potential to be an amazing play if it might probably proceed climbing dividends after that lengthy pause and if the corporate’s strategically focused progress continues. The corporate has a number of instruments in its device field for future progress resembling acquisition of latest properties, growing current land, fixing up or upgrading properties to enhance their worth and climbing its rents. Whereas the inventory is not exceptionally low cost, it is not dangerously costly both. I’d name it “totally priced” in the mean time.

The corporate additionally has a most popular inventory (UMH.PR.D) which yields 7.5% and appears to be extra secure when it comes to share worth fluctuations however on the damaging aspect it will not get pleasure from potential upside in both the inventory worth or dividend hikes that you just would possibly get from common shares.