Printed on September fifth, 2023 by Bob Ciura

The Dividend Aristocrats are among the many greatest dividend development shares to purchase and maintain for the long-run. Dividend Aristocrats have wonderful enterprise fashions which have produced annual dividend will increase, even throughout recessions.

With this in thoughts, we now have created a downloadable checklist of all of the Dividend Aristocrats.

There are at the moment 67 Dividend Aristocrats. You’ll be able to obtain an Excel spreadsheet of all 67 (with metrics that matter comparable to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

This text will focus on the ten greatest Dividend Aristocrats now, primarily based on 5-year anticipated annual returns in accordance with the Positive Evaluation Analysis Database.

Desk of Contents

You’ll be able to immediately leap to any particular part of the article through the use of the hyperlinks beneath:

Dividend Aristocrat #10: Lowe’s Corporations (LOW)

5-12 months Anticipated Annual Returns: 11.1%

Lowe’s Corporations is the second-largest residence enchancment retailer within the US (after Dwelling Depot). Lowe’s operates or providers greater than 1,700 residence enchancment and {hardware} shops within the U.S.

Lowe’s reported first quarter 2023 outcomes on Could twenty third, 2023. Complete gross sales for the primary quarter got here in at $22.3 billion in comparison with $23.7 billion in the identical quarter a 12 months in the past. Comparable gross sales decreased 4.3%. Adjusted web earnings, which excludes the acquire related to the 2022 sale of the Canadian retail enterprise, rose 5% year-over-year to $3.67 per share.

The corporate repurchased 10.6 million shares within the first quarter for $2.1 billion. Moreover, they paid out $633 million in dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on LOW (preview of web page 1 of three proven beneath):

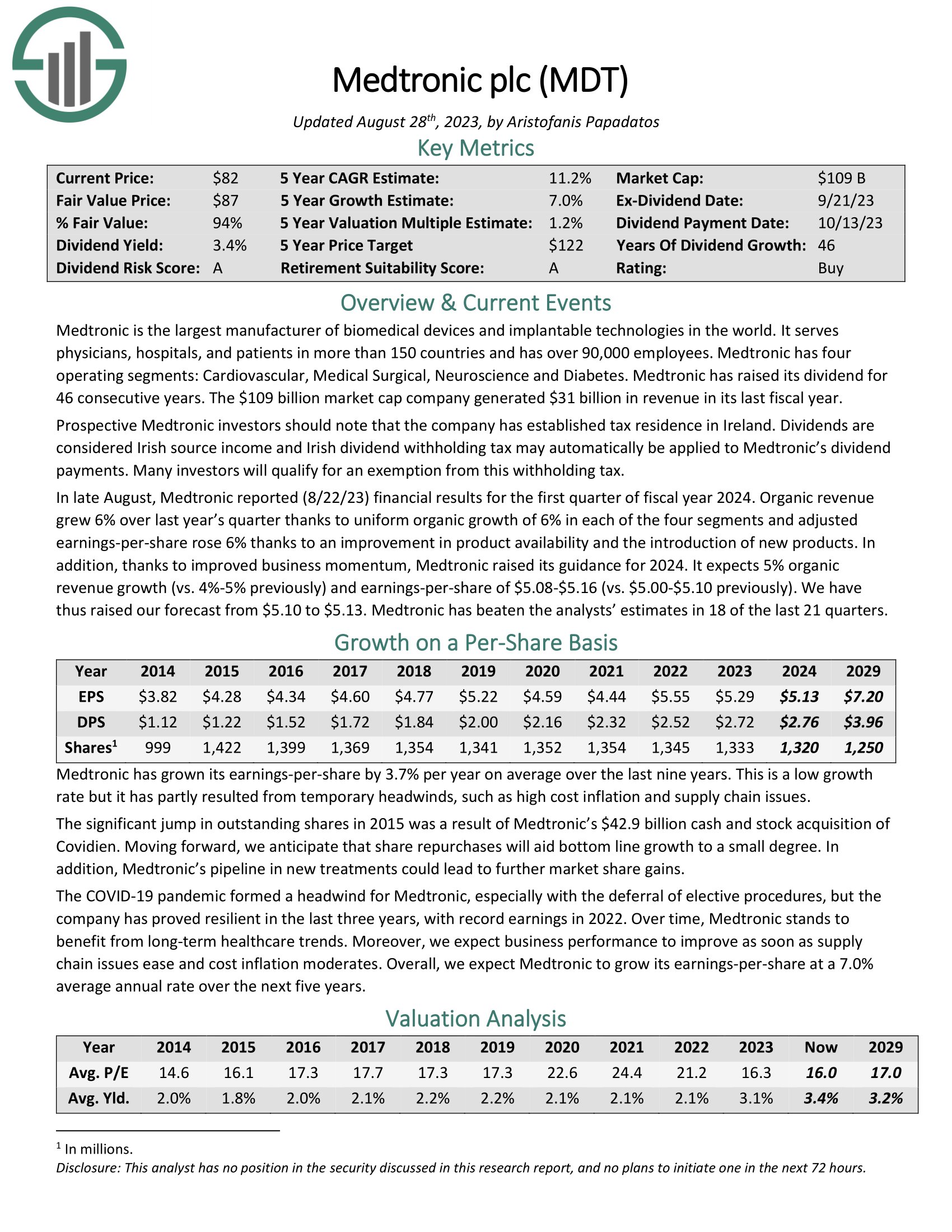

Dividend Aristocrat #9: Medtronic plc (MDT)

5-year Anticipated Annual Returns: 11.3%

Medtronic is the biggest producer of biomedical units and implantable applied sciences on this planet. It serves physicians, hospitals, and sufferers in additional than 150 nations and has over 90,000 workers.

It has 4 working segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. The corporate generated $31 billion in income in its final fiscal 12 months.

In late August, Medtronic reported (8/22/23) monetary outcomes for the primary quarter of fiscal 12 months 2024.

Supply: Investor Presentation

Natural income grew 6% over final 12 months’s quarter due to uniform natural development of 6% in every of the 4 segments and adjusted earnings-per-share rose 6% due to an enchancment in product availability and the introduction of recent merchandise.

Medtronic has raised its dividend for 46 consecutive years.

Click on right here to obtain our most up-to-date Positive Evaluation report on MDT (preview of web page 1 of three proven beneath):

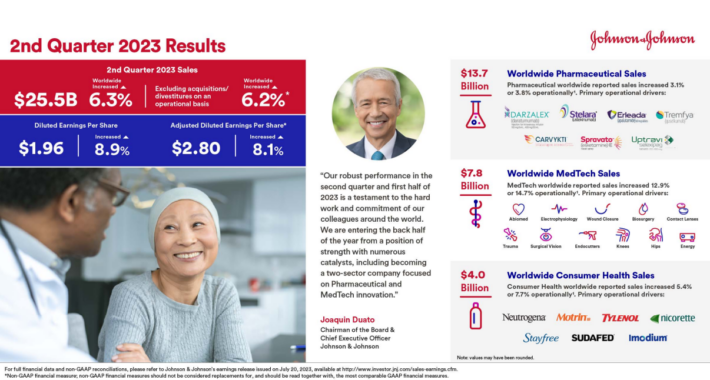

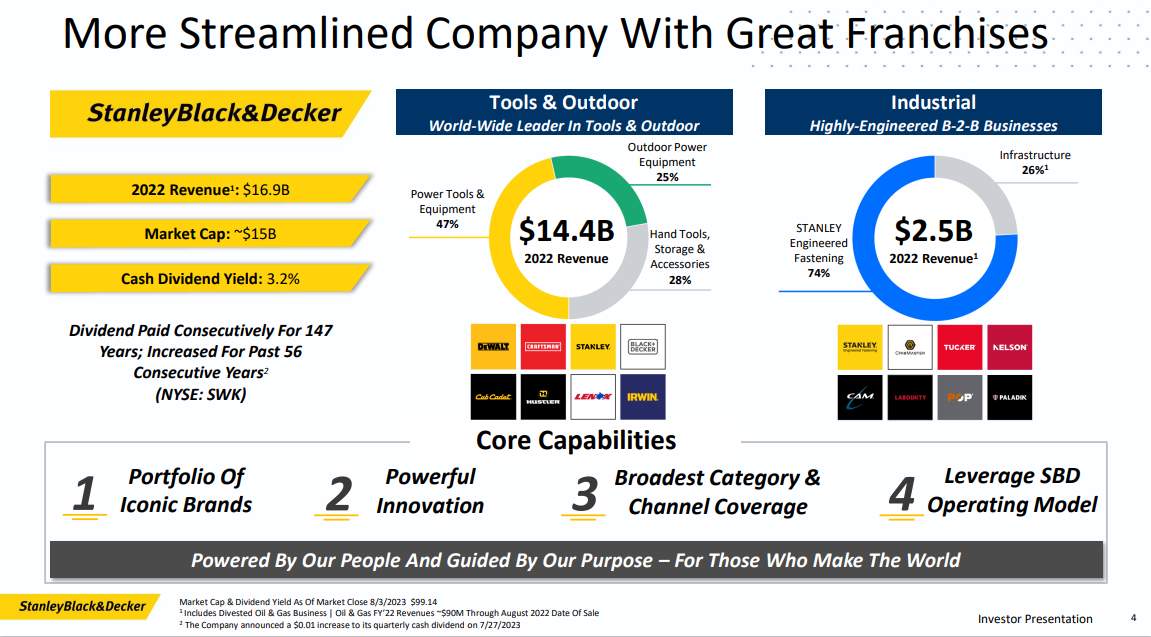

Dividend Aristocrat #8: Johnson & Johnson (JNJ)

5-year Anticipated Annual Returns: 11.2%

Johnson & Johnson is a world healthcare big. The corporate at the moment operates three segments: Client, Pharmaceutical, and Medical Units & Diagnostics. The company contains some 250 subsidiary firms with operations in 60 nations and merchandise offered in over 175 nations.

On July twentieth, 2023, Johnson & Johnson introduced outcomes for the second quarter for the interval ending June thirtieth, 2023.

Supply: Investor Presentation

For the quarter, income grew 6.4% to $25.5 billion, which was $860 million greater than anticipated. Adjusted earnings-pershare of $2.80 in contrast favorably to $2.59 within the prior 12 months and was $0.18 greater than anticipated. Excluding unfavorable foreign money alternate, income grew 7.5%. Pharmaceutical revenues grew 3.1% on a reported foundation (up 7.2% excluding foreign money alternate).

The corporate has elevated its dividend for over 60 consecutive years, making it a Dividend King.

Click on right here to obtain our most up-to-date Positive Evaluation report on JNJ (preview of web page 1 of three proven beneath):

Dividend Aristocrat #7: NextEra Power (NEE)

5-year Anticipated Annual Returns: 11.3%

NextEra Power is an electrical utility with two working segments, Florida Energy & Mild (“FPL”) and NextEra Power Sources (“NEER”). FPL is the biggest U.S. electrical utility by retail megawatt hour gross sales and buyer numbers.

The speed-regulated electrical utility serves about 5.8 million buyer accounts in Florida. NEER is the biggest generator of wind and photo voltaic power on this planet. NEE generates roughly 80% of its revenues from FPL.

NextEra Power reported its Q2 2023 monetary outcomes on 7/25/23.

Supply: Investor Presentation

On a per-share foundation, adjusted earnings climbed 8.6% to $0.88. Notably, FPL continued to execute on capital investments in photo voltaic and transmission and distribution infrastructure, whereas NEER positioned ~1.8 GW into service. Moreover, NEER added ~1.7 GW of recent renewables and storage initiatives to its backlog that totals ~20 GW.

Click on right here to obtain our most up-to-date Positive Evaluation report on NEE (preview of web page 1 of three proven beneath):

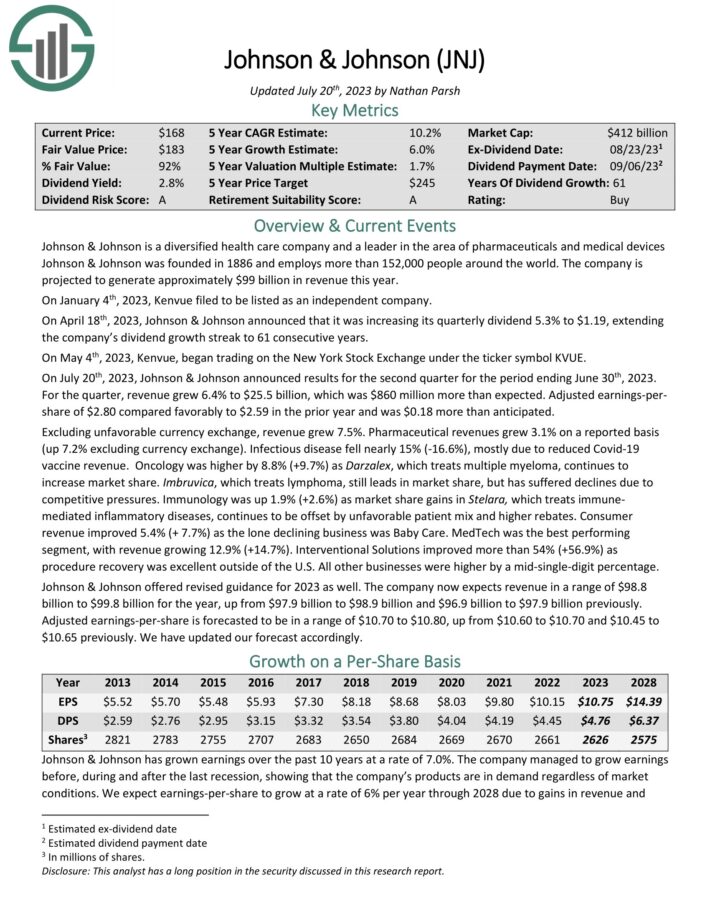

Dividend Aristocrat #6: Stanley Black & Decker (SWK)

5-year Anticipated Annual Returns: 11.9%

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated objects. The corporate holds the highest world place in instruments and storage gross sales. Stanley Black & Decker is second on this planet within the areas of economic digital safety and engineered fastening.

Supply: Investor Presentation

Stanley Works and Black & Decker merged in 2010 to type the present firm, thought the corporate can hint its historical past again to 1843. Black & Decker was based in Baltimore, MD in 1910 and manufactured the world’s first transportable energy device.

On August 1st, 2023, Stanley Black & Decker introduced second quarter outcomes for the interval ending June thirtieth, 2023. For the quarter, income fell 5.3% to $4.2 billion, however this was $70 million greater than anticipated. Adjusted earnings-per-share of -$0.11 in contrast very unfavorably to $1.77 within the prior 12 months, however was $0.25 above expectations.

Click on right here to obtain our most up-to-date Positive Evaluation report on SWK (preview of web page 1 of three proven beneath):

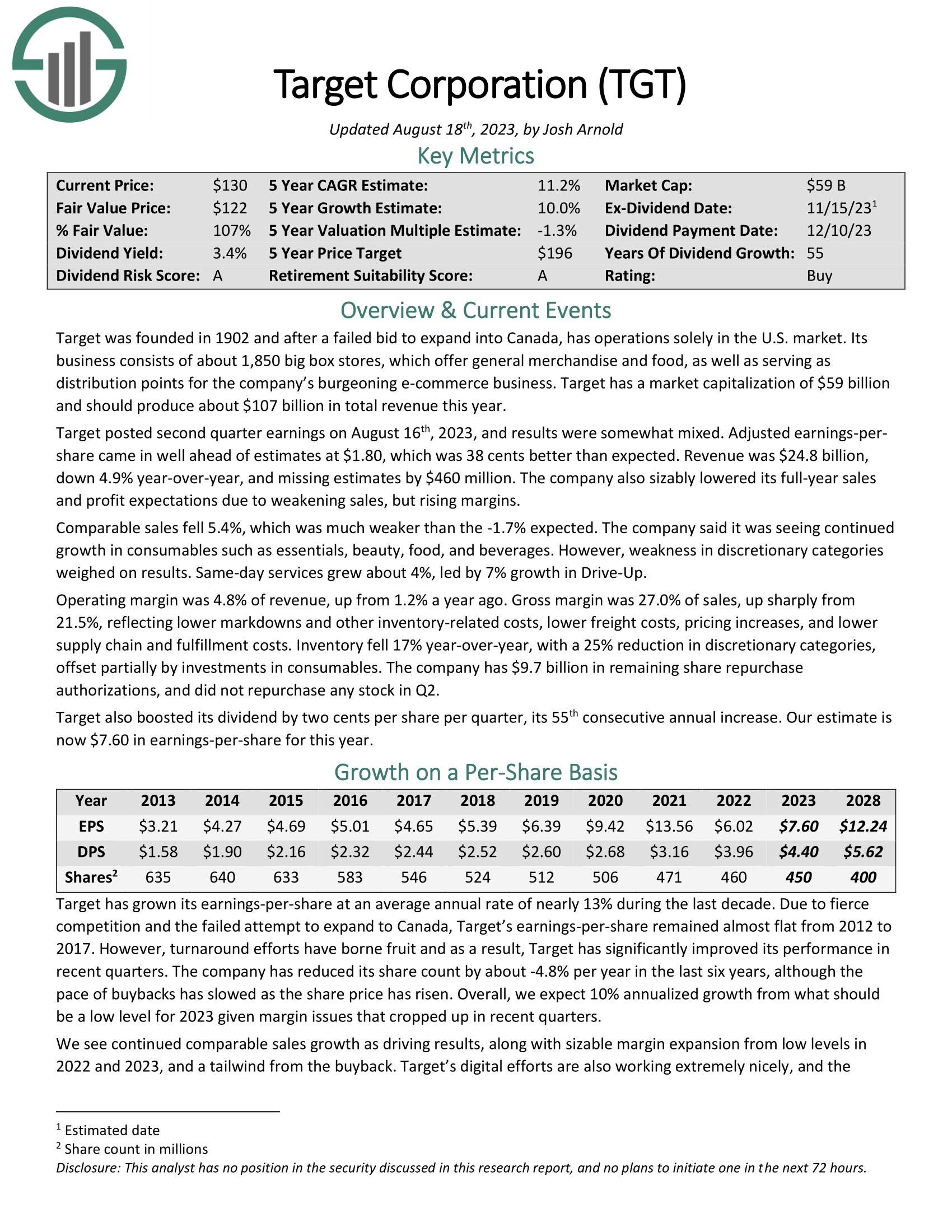

5-year Anticipated Annual Returns: 12.1%

Goal is a reduction retail operations solely within the U.S. market. Its enterprise consists of about 2,000 massive field shops providing normal merchandise and meals and serving as distribution factors for its burgeoning e-commerce enterprise. Goal ought to produce about $110 billion in complete income this 12 months.

Goal posted second quarter earnings on August sixteenth, 2023, and outcomes have been considerably blended. Adjusted earnings-per-share got here in effectively forward of estimates at $1.80, which was 38 cents higher than anticipated. Income was $24.8 billion, down 4.9% year-over-year, and lacking estimates by $460 million. The corporate additionally sizably lowered its full-year gross sales and revenue expectations as a result of weakening gross sales, however rising margins.

Click on right here to obtain our most up-to-date Positive Evaluation report on Goal Company (preview of web page 1 of three proven beneath):

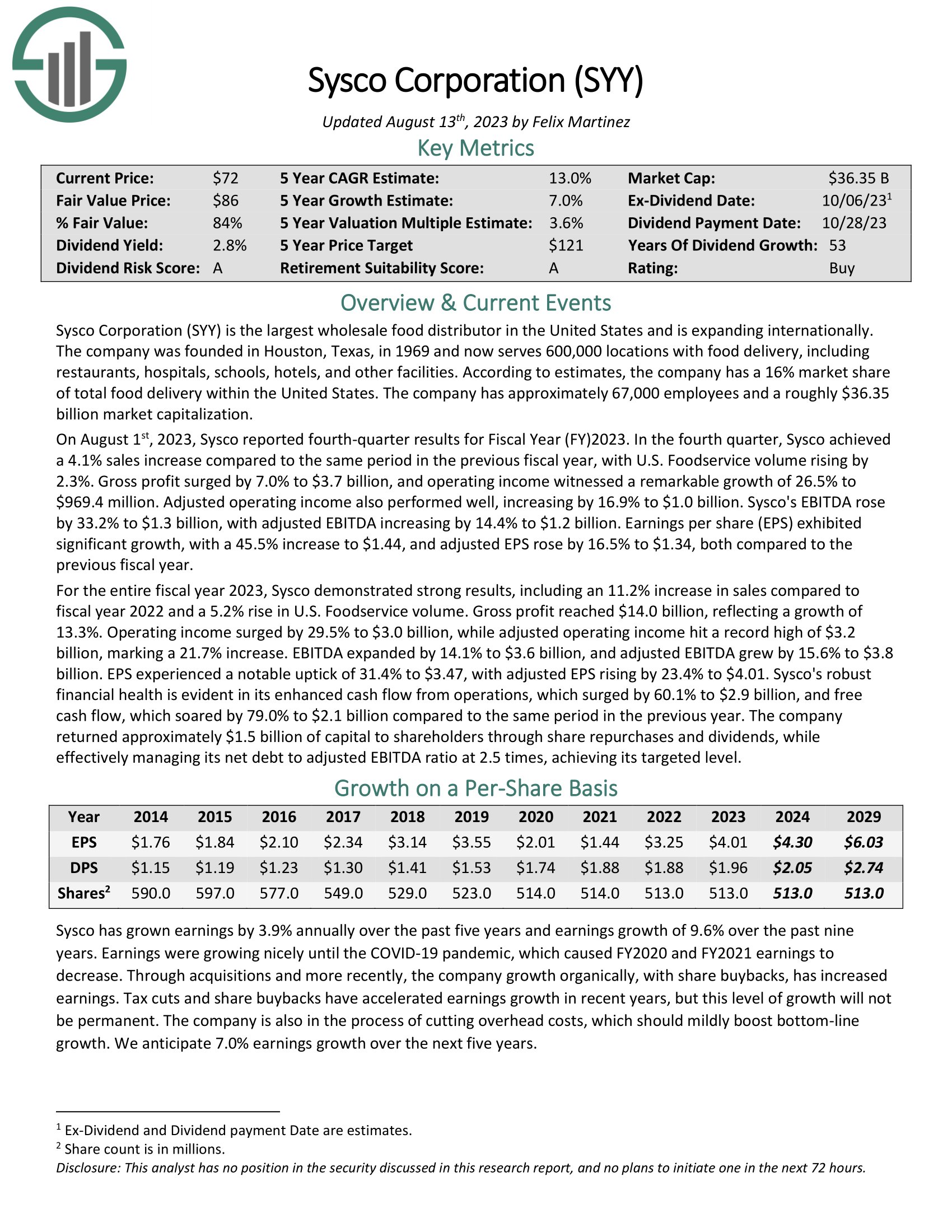

Dividend Aristocrat #4: Sysco Company (SYY)

5-year Anticipated Annual Returns: 13.6%

Sysco Company is the biggest wholesale meals distributor in america. The corporate serves 600,000 places with meals supply, together with eating places, hospitals, colleges, accommodations, and different amenities. In response to estimates, the corporate has a 16% market share of complete meals supply inside america.

On August 1st, 2023, Sysco reported fourth-quarter outcomes for Fiscal 12 months (FY) 2023. Within the fourth quarter, Sysco achieved a 4.1% gross sales enhance in comparison with the identical interval within the earlier fiscal 12 months, with U.S. Foodservice quantity rising by 2.3%. Adjusted EPS rose by 16.5% to $1.34, in comparison with the earlier fiscal 12 months.

For the whole fiscal 12 months 2023, Sysco grew income by 11% with a 5.2% rise in U.S. Foodservice quantity. Adjusted earnings-per-share elevated 23% to $4.01.

Click on right here to obtain our most up-to-date Positive Evaluation report on SYY (preview of web page 1 of three proven beneath):

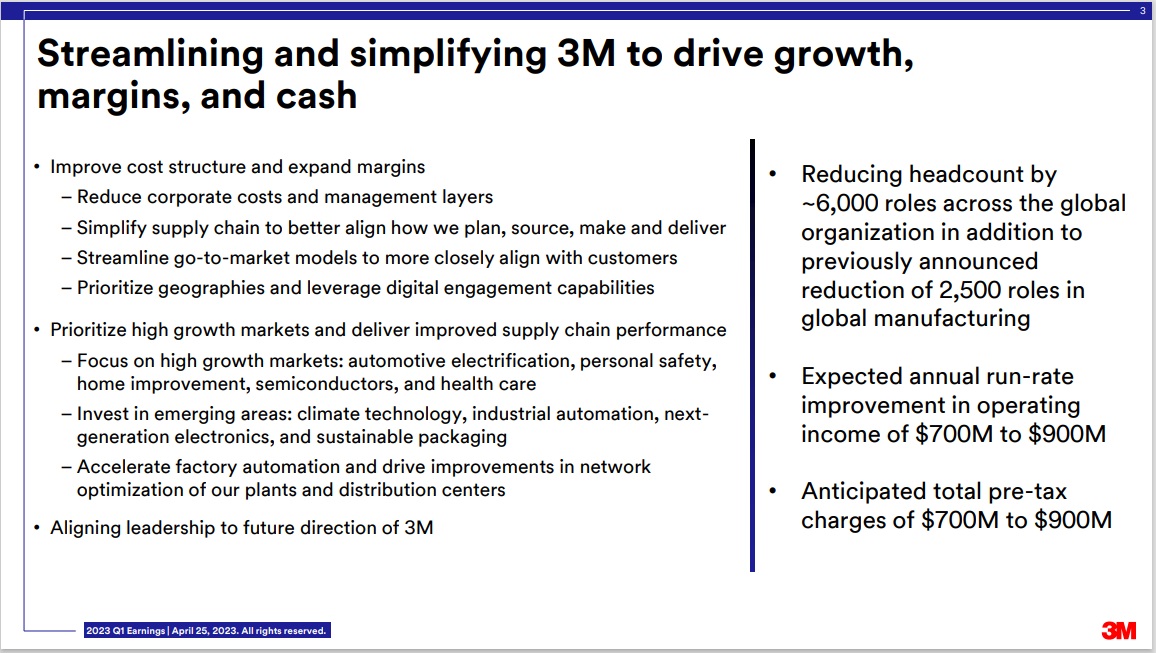

Dividend Aristocrat #3: 3M Firm (MMM)

5-year Anticipated Annual Returns: 15.9%

3M sells greater than 60,000 merchandise which can be used daily in properties, hospitals, workplace buildings and colleges across the world. It has about 95,000 workers and serves prospects in additional than 200 nations.

3M is now composed of 4 separate divisions: Security & Industrial, Healthcare, Transportation & Electronics, and Client.

The corporate additionally introduced that it could be spinning off its Well being Care section right into a standalone entity.

Supply: Investor Presentation

3M’s innovation is likely one of the firm’s biggest aggressive benefits. The corporate targets R&D spending equal to six% of gross sales (~$2 billion yearly) so as to create new merchandise to fulfill client demand.

This spending has confirmed to be very useful to the corporate as 30% of gross sales over the last fiscal 12 months have been from merchandise that didn’t exist 5 years in the past. 3M’s dedication to creating progressive merchandise has led to a portfolio of greater than 100,000 patents.

Click on right here to obtain our most up-to-date Positive Evaluation report on 3M (preview of web page 1 of three proven beneath):

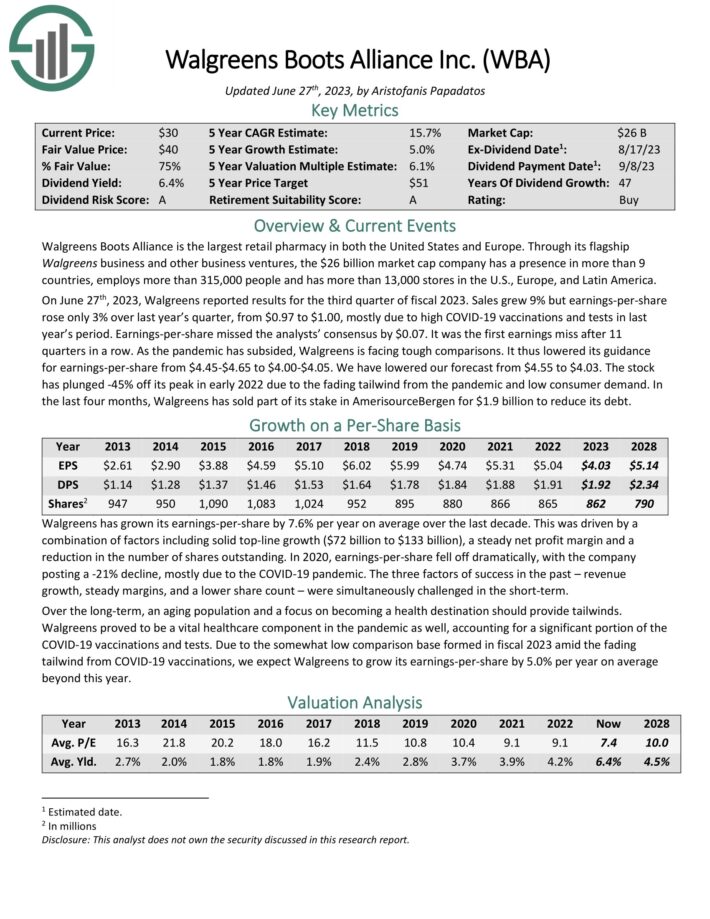

Dividend Aristocrat #2: Walgreens Boots Alliance (WBA)

5-year Anticipated Annual Returns: 19.6%

Walgreens Boots Alliance is the biggest retail pharmacy in america and Europe. The corporate has a presence in additional than 9 nations by means of its flagship Walgreens enterprise and different enterprise ventures.

Supply: Investor Presentation

On June twenty seventh, 2023, Walgreens reported outcomes for the third quarter of fiscal 2023. Gross sales grew 9% however earnings-per-share rose solely 3% over final 12 months’s quarter, from $0.97 to $1.00, principally as a result of excessive COVID-19 vaccinations and exams in final 12 months’s interval. Earnings-per-share missed the analysts’ consensus by $0.07.

It was the primary earnings miss after 11 quarters in a row. Because the pandemic has subsided, Walgreens is going through powerful comparisons. It lowered its steering for earnings-per-share from $4.45-$4.65 to $4.00-$4.05.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walgreens Boots Alliance (preview of web page 1 of three proven beneath):

Dividend Aristocrat #1: Albemarle Company (ALB)

5-year Anticipated Annual Returns: 26.0%

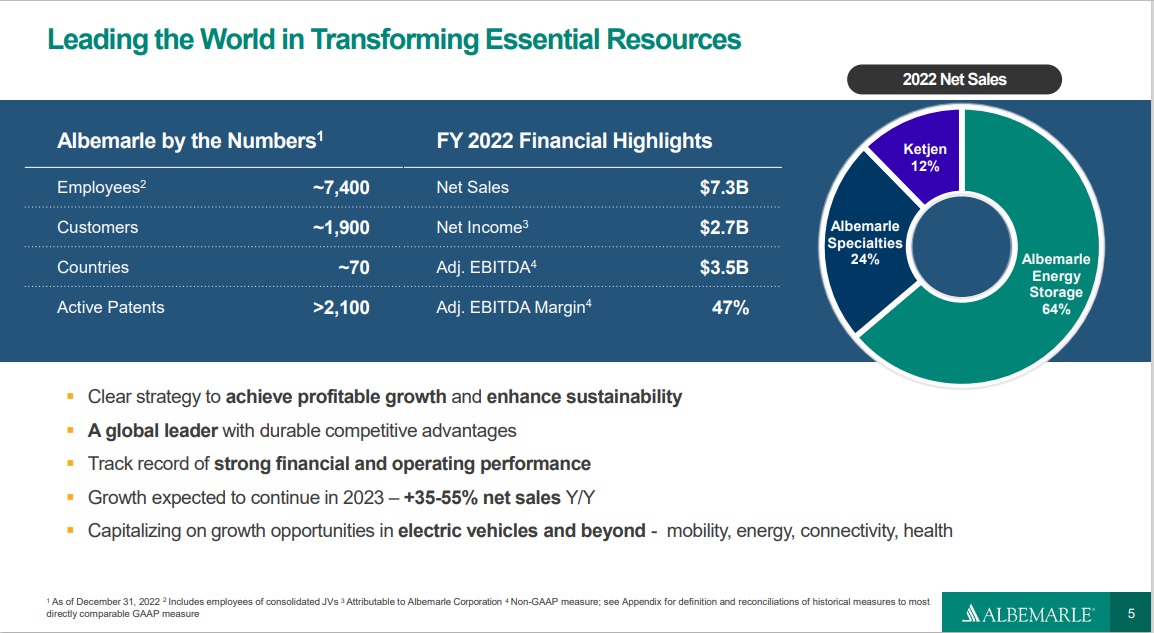

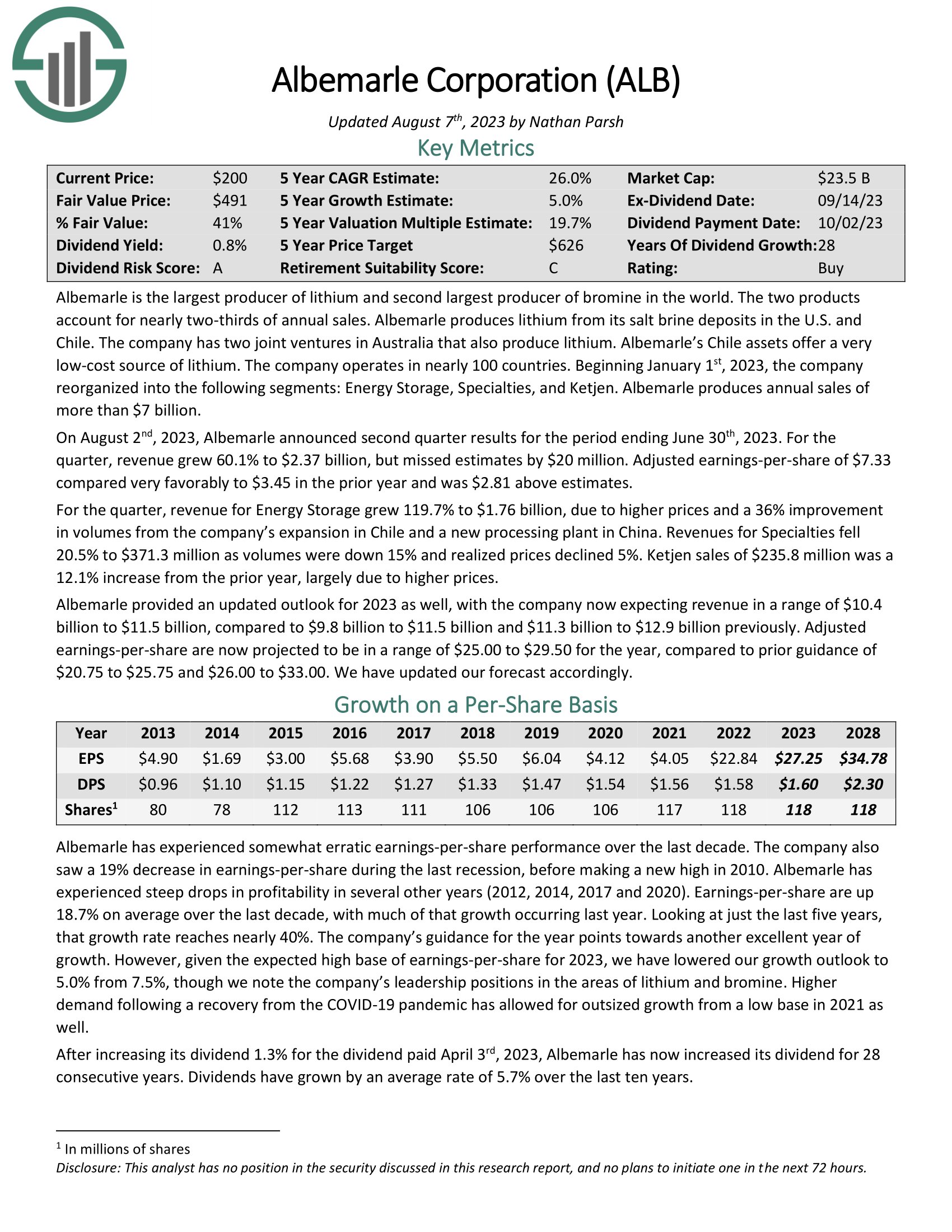

Albemarle is the biggest producer of lithium and second largest producer of bromine on this planet. The 2 merchandise account for almost two-thirds of annual gross sales. Albemarle produces lithium from its salt brine deposits within the U.S. and Chile. The corporate has two joint ventures in Australia that additionally produce lithium.

Associated: 2023 Lithium Shares Checklist

Supply: Investor Presentation

Within the second quarter, income grew 60.1% to $2.37 billion, however missed estimates by $20 million. Adjusted earnings-per-share of $7.33 in contrast very favorably to $3.45 within the prior 12 months and was $2.81 above estimates.

For the quarter, income for Power Storage grew 119.7% to $1.76 billion, as a result of larger costs and a 36% enchancment in volumes from the corporate’s growth in Chile and a brand new processing plant in China.

Click on right here to obtain our most up-to-date Positive Evaluation report on Albemarle (preview of web page 1 of three proven beneath):

Ultimate Ideas

The Dividend Aristocrats are wonderful choices for buyers on the lookout for a constant revenue stream, together with annual dividend will increase.

Our checklist of the ten greatest Dividend Aristocrats contains firms from quite a lot of industries that rank extremely primarily based on our 5-year anticipated complete return forecasts.

If you’re involved in discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend assets will likely be helpful:

Month-to-month Dividend Inventory Particular person Safety Analysis

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].