kritdarat Atsadayuttmetee/iStock by way of Getty Photos

Overview

ORLY stands as a distinguished participant within the automotive aftermarket trade in the USA. Famend for its wide selection of automotive elements, instruments, provides, tools, and equipment, the corporate caters to 2 distinct buyer segments: do-it-yourself [DIY] and Do-It-For-Myself [DIFM]. My advice for O’Reilly Automotive (NASDAQ:ORLY) is a maintain ranking as I imagine the market has excessive expectation for the inventory (ORLY is buying and selling at 23x ahead PE, the excessive finish of its buying and selling vary, and likewise a lot greater than friends). Regardless that ORLY continues to outperform friends, I don’t see sufficient margin of security for me to take a position at this valuation.

Sturdy Q223 comparable retailer gross sales however moderation for 2H23

Within the second quarter, ORLY as soon as once more exceeded expectations with a exceptional 9% improve in comparable retailer gross sales. This spectacular efficiency was pushed by a year-to-year acceleration in industrial gross sales, whereas the DIY section remained regular, even within the face of a broader trade pattern of a slower June. Moreover, retail tendencies surpassed inside forecasts, with ticket counts staying comparatively unchanged and mid-single-digit progress in ticket gross sales, resulting in constant optimistic month-to-month comparable gross sales.

Trying forward, I anticipate comparable retailer gross sales will reasonable within the second half of 2023, following the sturdy 9.8% progress seen within the first half. This moderation is predicted as the corporate faces comparisons with pricing will increase carried out within the earlier 12 months and stronger ticket counts. It is price noting that throughout the second quarter, there was a mid-single-digit improve in same-SKU inflation, however administration anticipates this measure will return to a extra typical low single-digit fee because the 12 months progresses. That stated, regardless of a softer June on account of clients buying and selling down or deferring providers, administration noticed some cases of shoppers selecting to “commerce up.” In addition they identified that extraordinarily sizzling summer season climate has led to preliminary outcomes which can be consistent with the second quarter’s efficiency. So there’s definitely room for ORLY to carry out than I anticipate.

Share beneficial properties in DIFM market

ORLY’s success within the DIFM market continues to be evident as the corporate constantly beneficial properties market share. Their spectacular DIFM gross sales progress relative to friends like AutoZone (AZO) helps the concept that ORLY is gaining share. That is particularly spectacular once we think about the sturdy progress within the prior 12 months, and ORLY is rising on prime of that. Nonetheless, I believe it’s unlikely that ORLY is gaining share from the large gamers like AZO as AZO is rising as effectively. I imagine it’s probably that these beneficial properties primarily come on the expense of subscale gamers that sometimes do not need the required scale to compete (lack of stock SKU, lack of geographical protection, and so on.). With ORLY market place and its sturdy provide chain, mixed with the profitable implementation of their skilled pricing initiative, I believe it should allow them to proceed capturing market share within the extremely fragmented DIFM sector in the long run. Administration remark throughout the name is very encouraging as regards to ORLY market place and share beneficial properties potential:

“I might say is that, particularly from operations and gross sales, the very first thing they level to once we talked to them about what we’re seeing available in the market, Simeon, is the place we’re in from a provide chain standpoint. As you already know, pretty much as good as anyone, our immediacy of want and non-discretionary enterprise, it is all about on each side of the enterprise, it is all about who has the precise half on the proper place on the proper time. And I simply could not be extra happy with the job that Brent, and the service provider group, the stock administration buying group, and our distribution groups are doing for our retailer operators, that they’ve simply bought us in a greater place than we have been in a very long time. And we really feel like, we’re taking part in from a place of energy from the group facet, from the provision chain facet, and all of the work we’re doing with our skilled clients out within the discipline each day making gross sales calls. After which, clearly, we nonetheless be ok with all the things we did with PPI.” from: 2Q2023 earnings name

SG&A investments are obligatory

SG&A bills per retailer noticed a major improve of round 10% in comparison with the earlier 12 months. Whereas this improve is kind of enormous, I see it as administration’s dedication to enhancing service high quality and positioning itself for long-term gross sales progress and market share enlargement. One of many main contributors to this improve was spending on retailer imaging and refreshing, which I see as important so as to repeatedly appeal to clients.

Valuation and threat

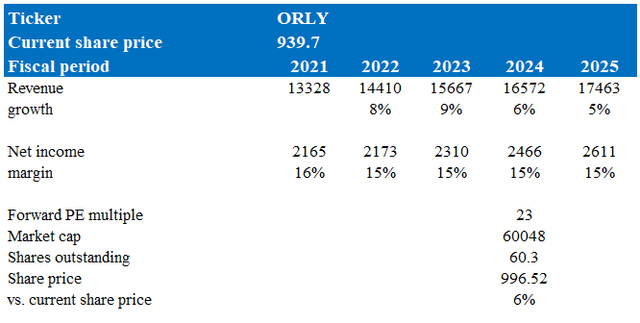

Writer’s valuation mannequin

In accordance with my mannequin, ORLY is valued $939.70 in FY24, representing a 6% improve, or in different phrases – pretty valued. This goal worth is predicated on my progress expectation that progress will progressively revert again to normalized stage of mid-single digits as per historic.

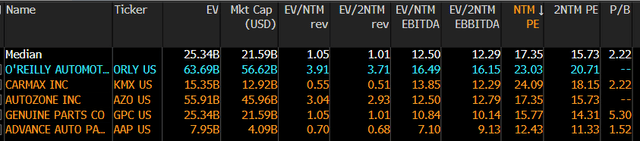

ORLY is now buying and selling at 23x ahead PE. Taking a look at historical past, that is on the excessive finish of the coaching vary which has sometimes reverted downwards when it touches this stage. Nonetheless, given the sturdy comparative progress vs friends, I believe this a number of may maintain for the near-term. Nonetheless, even at this stage, ORLY is barely honest valued. That is indicative (in my view) that the market has excessive expectation for the inventory, which is one thing that I are inclined to keep away from as lacking expectation could be unhealthy for the inventory worth within the near-term (consensus revised estimates + multiples revising downwards). When comp in opposition to friends, ORLY can also be buying and selling at a a lot greater a number of, which implies there’s fairly a room for ORLY multiples to revert downwards (the low finish of ORLY buying and selling vary traditionally was 18x, for what it is price).

Bloomberg

I might additionally be aware that whereas ORLY’s provide chain is described as best-in-class, any disruptions within the provide chain, akin to these brought on by exterior elements like international provide chain challenges or logistics points, may have an effect on the corporate’s potential to fulfill buyer demand and influence its monetary outcomes. Though the enter price setting has returned to a extra normalized sample, any surprising spikes in enter prices may squeeze ORLY’s revenue margins if the corporate is unable to move on these price will increase to clients.

Abstract

My advice for ORLY is a maintain ranking. ORLY’s sturdy efficiency in comparable retailer gross sales and DIFM market share beneficial properties are commendable, pushed by its provide chain energy {and professional} pricing initiatives. Nonetheless, the substantial improve in SG&A bills, notably for retailer enhancements, signifies a long-term dedication to enhancing customer support and progress. That stated, my valuation mannequin suggests a goal worth of $939.70 for FY24, indicating that ORLY is at present pretty valued. Whereas its premium a number of could possibly be sustained on account of sturdy progress relative to friends, the inventory’s excessive expectations pose a short-term threat, particularly if consensus estimates and multiples revise downward.