The article under is an excerpt from our Q2 2023 commentary.

Gold is not any completely different than every other asset class: it turns into standard, rises in value, is overvalued, and finally represents a poor funding. Different instances, it undergoes intervals of investor disinterest, suffers sustained value declines, turns into undervalued, and finally represents a wonderful funding.

We aren’t gold bugs. Over the long run, gold protects financial debasement; nonetheless, not like equities, gold will present little actual return. If an investor can determine intervals when gold turns into extraordinarily undervalued, it could actually supply distinctive extra returns, usually uncorrelated with different monetary property.

The secret’s determining when gold is undervalued and overvalued.

On this essay, we are going to describe the assorted valuation frameworks we’ve used over a few years to estimate gold value targets and decide when so as to add or scale back our gold publicity.

In Could 2000, I used to be profiled in Forbes (hyperlink) and mentioned gold’s radical undervaluation. I predicted gold would attain $2,500 per ounce earlier than the bull market ended. When the article was printed, gold was $275 per ounce, and steady central financial institution promoting had left buyers wildly bearish in the direction of the so-called “barbarous relic.” Our valuation framework pointed as an alternative to substantial potential returns. Though gold by no means hit our $2,500 goal, it reached $1,900 in 2011 and was the best-performing asset class of the 2000s.

Gold has been in a bull marketplace for practically a era, leaving many questioning if it nonetheless represents a pretty funding as within the late Sixties or Nineteen Nineties.

After bottoming at $251 per ounce in August 1999, gold surged to $1,900 in August 2011, pulled again to $1,050 by December 2015, and resumed its advance, making an all-time excessive triple-tops of $2,050 in August 2020, March 2022, and Could 2023. Nevertheless, gold is now as undervalued as in 1999 on a number of metrics.

Potential gold buyers should ask three questions.

First, is gold undervalued at the moment?

Second, if gold is undervalued, to what diploma?

And at last, how excessive might it go had been it to swing from undervalued to overvalued – one thing that has occurred twice in 100 years?

To assist reply the primary query, we examine the worth of gold to each the cash provide and the worth of economic property. We additionally discover it useful to think about the historic relationship between gold and different commodities.

Under are three charts that spotlight these relationships during the last 100 years. The primary chart reveals the connection between the scale of the US Treasury’s gold holdings and the Federal Reserve’s stability sheet.

Though considerably controversial, we consider the scale of the Fed’s stability is said to the greenback worth of the Treasury’s gold holdings over the long run. In line with this chart, there have been two distinct intervals over the previous 100 years throughout which gold was extremely overvalued and three intervals throughout which gold was considerably undervalued. Within the late Thirties, President Roosevelt devalued the greenback by 65%, elevating the gold value to $35 per ounce. On the identical time, clouds of conflict had been gathering throughout Europe. The mix of a better gold value within the US and rising hostilities in Europe led to an enormous quantity of gold inflows in America. On the peak, the greenback worth of the Treasury’s gold holdings exceeded the scale of the Fed’s stability sheet by an unbelievable 1.7 instances. The gold flows into the US had been so nice that the Treasury might have exchanged each greenback invoice in circulation for gold and retained half of its gold inventory.

The gold’s second interval of overvaluation occurred in January 1980. Gold spiked in a parabolic blow-off to $850 per ounce in January 1980, following 20 years of accelerating inflation. On the peak, the Treasury’s gold holdings (vastly diminished from the late-Thirties ranges) had been as soon as once more valued at 1.7 instances the scale of the Federal Reserve stability sheet.

Gold turned out to be a horrible funding after each intervals of radical overvaluation. Between 1937 and 1971, gold was flat whereas the inventory market superior tenfold. Between 1980 and 2000, gold fell 70% whereas the inventory market ran thirteen-fold.

Then again, gold was radically undervalued thrice. The primary interval occurred within the late Sixties. With gold fastened at $35 below the Bretton Wooden’s Gold Alternate Customary and inflationary pressures mounting within the US, gold flowed out of the Treasury. By 1971, the Fed’s financial base exceeded the Treasury’s gold holdings by seven instances. The three-decade reversal was spectacular: between 1938 and 1971, the Treasury’s gold holdings went from protecting the Fed’s financial base by 1.7 instances to lower than 15%.

The second interval of undervaluation occurred through the late Nineteen Nineties. Following twenty years of falling gold costs and a fast enlargement of the Fed’s stability sheet, the scale of the Fed’s financial base exceeded the Treasury’s gold holdings by 9 instances. In different phrases, the greenback’s unofficial (and unconvertible) gold protection reached an all-time low of 11%.

As we noticed, the intervals of overvaluation (the Thirties and 1980) had been nice alternatives to promote gold. Conversely, the intervals of undervaluation (1969 and 1999) had been wonderful shopping for alternatives. Gold was the best-performing asset class within the decade following every interval of most undervaluation.

Gold, relative to the scale of the Fed’s stability sheet, is extra undervalued at the moment than within the late Sixties or Nineteen Nineties. The explanation: despite the fact that gold superior over seven-fold during the last twenty-three years, the Federal Reserve’s stability sheet has grown even sooner. Following the worldwide monetary disaster of 2008, world central banks have undertaken radical financial insurance policies.

Since 2008, the Federal Reserve has undertaken 4 huge rounds of quantitative easing, leading to a financial base 9 instances bigger than in 1999. The Fed printed cash sooner than gold appreciated during the last twenty-three years. The Fed’s financial base presently stands at over 9 instances the Treasury’s gold holdings, in contrast with six instances in 1969 and 9 instances in 1999 – the opposite two wonderful shopping for alternatives. In line with our evaluation, gold is 30% extra undervalued than in 1969 and on par with 1999.

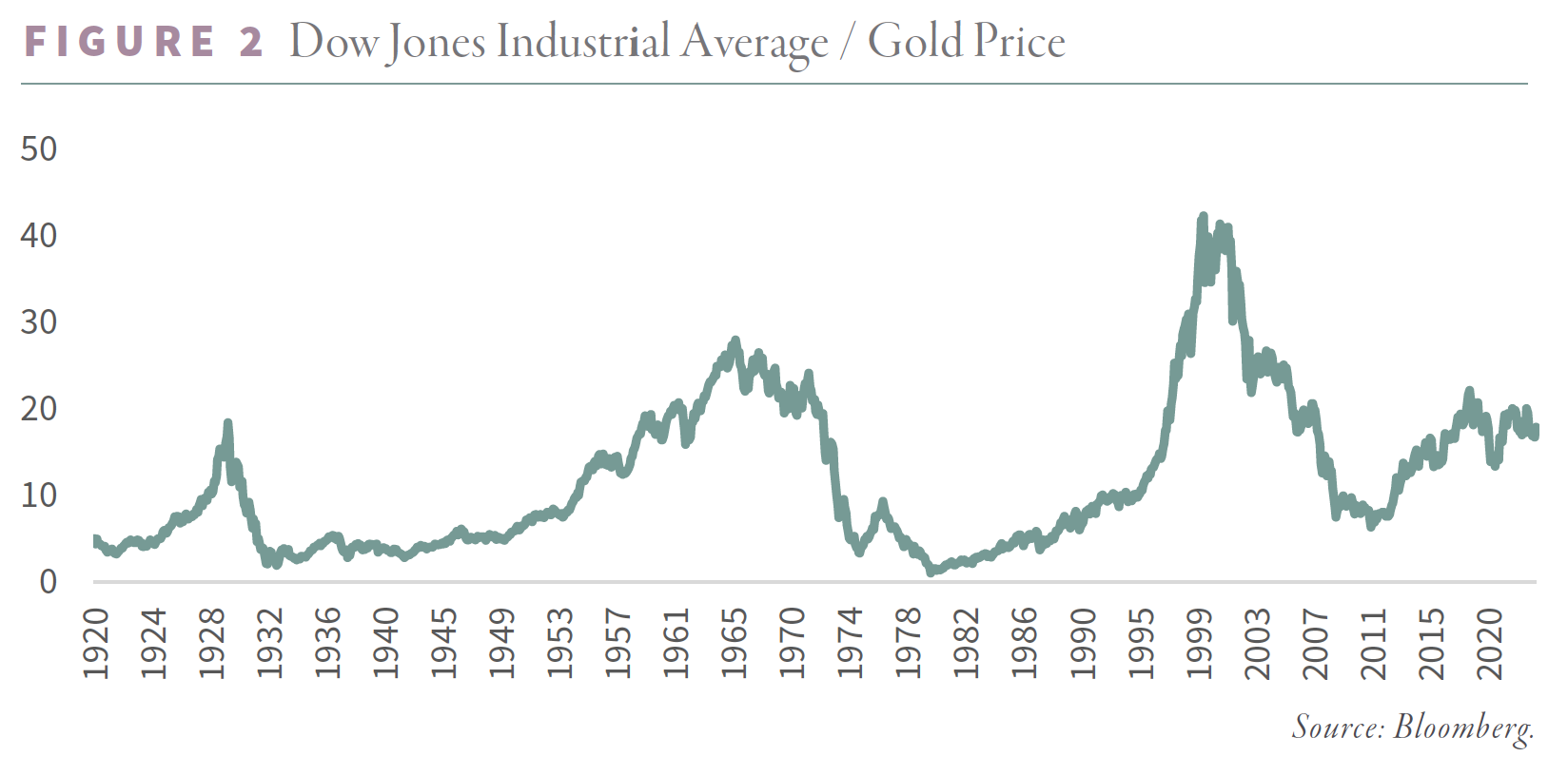

Valuing gold towards monetary property tells an analogous story. Chart 2 reveals the connection between gold and the Dow Jones Industrial Common. During the last 100 years, there have been three intervals throughout which gold was radically undervalued relative to monetary property.

The primary interval occurred within the late Twenties. In response to a decade of fast financial progress within the US (associated to Britain’s failed try to peg the pound to gold on the pre-World Struggle I charge), the US inventory market surged, pushed primarily by hypothesis funded by borrowed cash. From the 1921 lows, the Dow appreciated six-fold, hitting 380 in August 1929.

With gold fastened at $20.65 per ounce, the Dow, by the autumn of 1929, was equal to roughly eighteen ounces. On reflection, the inventory market was radically overvalued. Over the subsequent 4 years, the Dow fell 90%, bottoming at 42. On the lows, the Dow was equal to solely two ounces of gold – an excessive studying that might not be repeated for 50 years.

In January 1934, Roosevelt raised the gold value to $35 per ounce. The Dow and gold practically reached parity in 1932; nonetheless, they missed one another by $7 per ounce and eighteen months. Between 1929 and 1934, the Dow fell 80% whereas gold rose 70%. From 1929 to 1935 gold radically outperformed world fairness markets.

The following time monetary property had been radically overvalued relative to gold occurred within the late Sixties. The Dow first broke 1,000 in 1966 after which once more in 1969 and 1971. With gold nonetheless fastened at $35 per ounce, the Dow was equal to twenty-eight ounces– a brand new document. The Sixties skilled lengthy intervals of extra cash and credit score creation, leading to a speculative bull market once more funded by debt. On reflection, monetary property had been overvalued. Between the late Sixties and 1980, the Dow fell by 25% whereas gold superior twenty-four-fold. Lastly, by 1980, the Dow and gold each hit 850.

Gold entered a grinding bear market following its document overvaluation in 1980. Then again, monetary property spent the subsequent 20 years rallying. Following the 1929 episode, gold took fifty years to work off its overvaluation. Following the 1980 peak, gold solely took twenty years to grow to be low-cost relative to monetary property. Between 1980 and 1999, gold fell by 68% from $850 to $253 per ounce, whereas the Dow superior thirteen-fold from 850 to 11,000. A prudent investor should have been out of the gold market totally.

In 1999 the Dow surpassed 11,000 whereas gold had fallen to $253 per ounce. The Dow was equal to forty-three ounces of gold at these ranges – an all-time document. Given these excessive ranges, an investor should have anticipated a booming bull market in gold to develop. Certainly, that’s what I anticipated once I made my investments and gave my interview to Forbes in 2000.

We had been handsomely rewarded. Between 1999 and 2011, gold surged seven-fold, changing into the best-performing asset class of the last decade. World equities suffered two huge bear markets, ending the interval the place it began.

During the last decade, the inventory market has once more entered one other big bull market, leaving the Dow equal to twenty ounces of gold. The query is whether or not this represents under- or overvaluation. Monetary bulls (i.e., gold bears) would possibly spotlight how the Dow has been equal to thirty ounces of gold within the late Sixties and forty ounces within the late Nineteen Nineties. On this context, 20:1 doesn’t seem radically undervalued. Maybe the fairness bull market will proceed. Sadly, for fairness markets, we firmly consider in any other case.

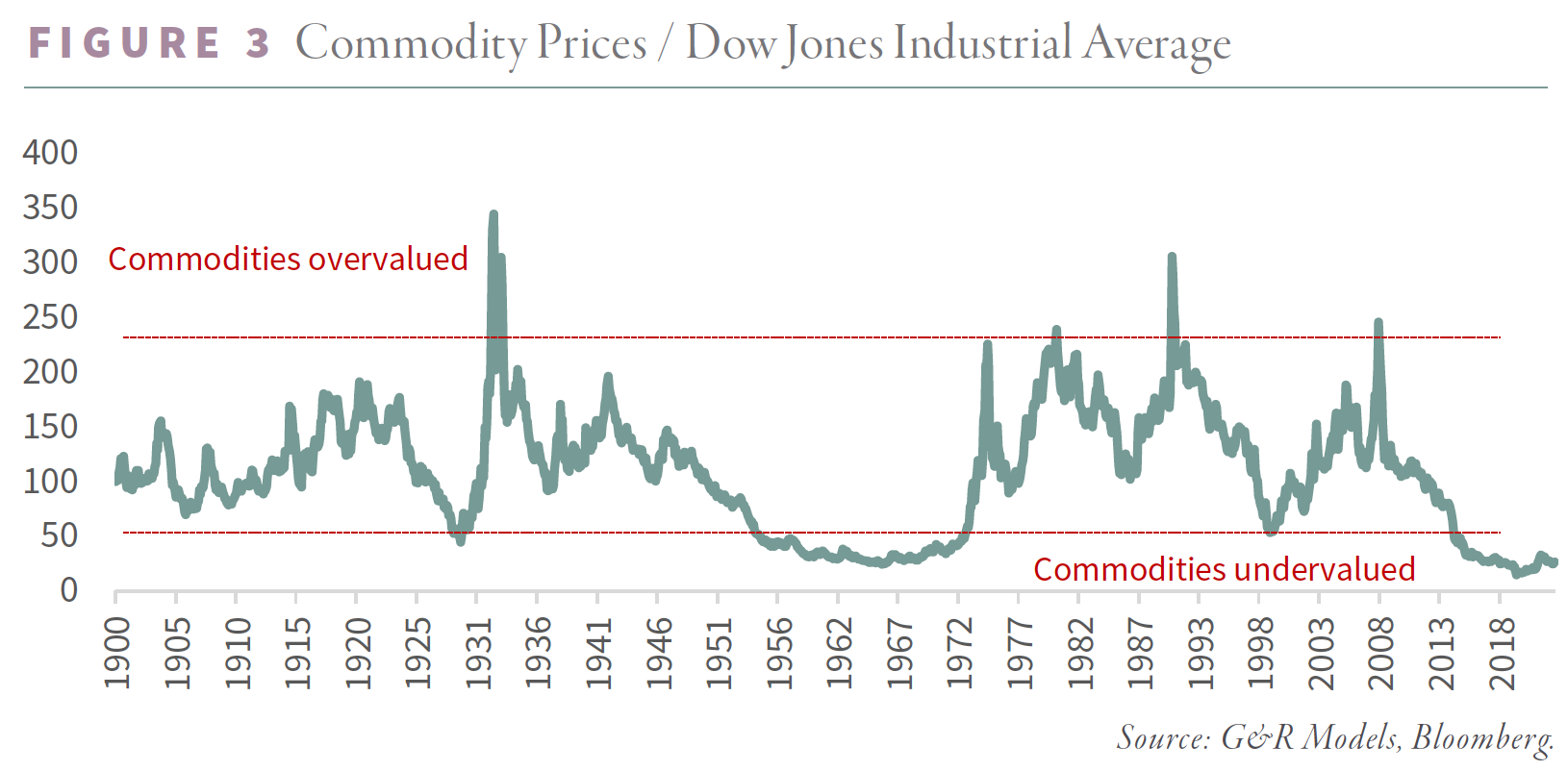

Chart 3 offers us nice confidence that at the moment’s 20:1 ratio will find yourself being the cycle peak and that over the subsequent a number of years, the Dow will probably be equal to fewer than 5 ounces of gold, the extent reached at gold’s peak in 2011. The Dow and gold might once more cross, just like what occurred in 1980 and virtually occurred in 1932-4.

Every peak within the Dow-gold ratio (1929, 1969, and 1999) coincided with intervals of commodity undervaluation. As every commodity bull market began, the Dow-gold ratio contracted massively. In 1929, commodities bottomed relative to monetary property precisely because the Dow reached a excessive of twenty ounces of gold equal. 4 brief years later, commodities had been overvalued relative to monetary property, and the Dow was equal to solely two ounces of gold after having rallied 70%.

In 1968 (the yr President Johnson eliminated the US greenback’s required 25% gold backing), commodities had been the most cost effective in historical past relative to monetary property. At that second, the Dow peaked at twenty-eight ounces of gold. Over the subsequent twelve years, commodities entered an enormous bull market and, by 1980, had grow to be radically overvalued. Gold led the bull market and soared twenty-four-fold from $35 to $800 per ounce. Like in 1929, the Dow-gold ratio peaked in 1968 at exactly the identical time commodities bottomed. By January 1980, the Dow was equal to at least one ounce of gold – the bottom studying because the Dow Jones Industrial Common was established in 1896.

In 1999, commodities had been virtually as radically undervalued as within the late Sixties. The Dow-gold ratio reached an all-time excessive of forty-two simply as commodities bottomed. As commodity costs rose, the Dow-gold ratio contracted, reaching eight in 2011.

Had been commodities overvalued at the moment, we’d agree that the growth in monetary property (and bear market in gold) nonetheless had years left to run. Beneath these circumstances, the Dow-gold ratio would proceed to maneuver considerably larger. As an alternative, commodities are as undervalued as they’ve ever been relative to monetary property. In line with our historic framework, a commodity bull market has doubtless began. As such, we consider the Dow, equal to twenty ounces of gold, in all probability represents a cycle-high and can fall all through the last decade, just like 1929, 1969, and 1999.

How excessive might costs go if we enter a brand new gold bull market?

In previous gold bull markets, the worth of the Treasury’s gold holdings has surpassed the financial base by over 1.5 instances – together with in 1980 after the US greenback was now not backed by gold.

Given the Fed’s stability sheet explosion since 2009, a projected goal value for gold appears outlandish. The Fed’s financial base at the moment stands at $5.6 tr. For the Treasury’s gold holdings to cowl the financial base by 1.5 instances, gold must attain $32,000 per ounce. Critics would possibly argue the financial base is distorted by extra reserves left on stability on the Fed. At current, extra reserves foot to $3.2 tr, and the Fed has talked of sometime draining them out of the system. If that had been to occur, the Fed’s financial base would fall to $2.4 trillion. Even below this conservative state of affairs, gold must attain $14,000 for the Treasury’s gold place to cowl the financial base by 1.5 instances. Though these numbers sound outlandish, they symbolize relationships which have emerged twice previously 100 years. The primary time (the late Thirties) was throughout huge deflation, whereas the second (1970) was throughout inflation. In each situations, gold had grow to be the “should personal” asset class that every one buyers clamored for, and the valuation of gold was pushed to the intense.

May the greenback worth of the Treasury’s gold holdings attain 1.5 instances the financial base– because it has twice within the final 100 years? We consider it’s extremely possible. As monetary turmoil surges this decade, buyers will aggressively purchase gold as an asset class that gives each wealth safety and the chance for big speculative revenue. In such a state of affairs, gold’s valuation might very nicely be pushed to extremes similar to it was within the late Thirties and 1980.

What about wanting on the Dow-Gold relationship?

Within the Thirties, the Fed aggressively shrunk its stability sheet by half, producing a deflation implosion that became the Nice Despair. On the worst level within the disaster, the Dow traded at half its $80 guide worth. By 1934, gold (now at $35 per ounce) practically reached parity with the Dow. Presently, the Dow’s guide worth is 8,000. Had been the Fed to undertake equally draconian hawkish measures as within the Thirties (one thing we consider to be unlikely), the Dow might conceivably commerce for half its guide worth, or 4,000. Had been gold to commerce at parity to the Dow, prefer it practically did in 1934, it might greater than double. In different phrases, in essentially the most excessive deflationary state of affairs, the Dow would fall virtually 90% whereas gold would double – just like between 1929 and 1934. Traders, with a considerable gold allocation, would do very nicely.

Within the late Seventies, the Fed finally raised rates of interest to document ranges in a ultimate profitable try to interrupt the inflationary forces of the previous twenty years. File actual charges put extreme downward stress on world equities. By 1980, the Dow traded at its guide worth of 850. Gold reached parity with the Dow in January 1980.

If we repeat the Seventies and the Fed raised rates of interest considerably due to persistent acceleration in inflation, we must always see an enormous bear market within the Dow with a draw back goal of its 8000 guide worth. If historical past had been to repeat the Seventies expertise, the Dow to enter an enormous bear market and probably commerce down 75% to its guide worth, and gold costs would rise 4–fold Once more, buyers with important gold allocations could be the winners.

Lastly, allow us to take into account a 3rd state of affairs that has by no means occurred in 230 years of US monetary historical past. What would possibly occur if the US immediately monetized its debt?

Given the large quantity of sovereign debt held by governments worldwide and the inherent refinancing dangers that it creates, international locations (together with the US) might try to immediately monetize their debt in response to a possible failure of a authorities debt public sale. Had been this to occur, inflationary pressures would surge, and hyperinflation might ensue. Our hunch is that equities markets might rise, however gold would enter an enormous bull market as buyers sought property to guard towards foreign money debasement and the ensuing inflation. In such a state of affairs, gold might simply surpass $35,000 per ounce – 1.5 instances at the moment’s $5.6 tr financial base. As soon as once more, the winners could be gold buyers.

In our view, gold will emerge because the asset class with essentially the most potential this decade, irrespective of the monetary or geopolitical backdrop. Beneath essentially the most excessive situations (a repeat of the deflationary implosion that produced the Nice Despair or a interval of inflation that verges on hyperinflation), gold would be the profitable asset class.

Intrigued? We invite you to obtain or revisit our complete Q2 2023 analysis letter, accessible under.

Registration with the SEC shouldn’t be construed as an endorsement or an indicator of funding talent, acumen or expertise. Investments in securities aren’t insured, protected or assured and should end in lack of earnings and/or principal. Historic efficiency just isn’t indicative of any particular funding or future outcomes. Funding course of, methods, philosophies, portfolio composition and allocations, safety choice standards and different parameters are present as of the date indicated and are topic to vary with out prior discover. This communication is distributed for informational functions, and it isn’t to be construed as a proposal, solicitation, advice, or endorsement of any specific safety, merchandise, or companies. Nothing on this communication is meant to be or needs to be construed as individualized funding recommendation. All content material is of a normal nature and solely for instructional, informational and illustrative functions. This communication might embody opinions and forward-looking statements. All statements aside from statements of historic truth are opinions and/or forward-looking statements (together with phrases resembling “consider,” “estimate,” “anticipate,” “might,” “will,” “ought to,” and “count on”). Though we consider that the beliefs and expectations mirrored in such forward-looking statements are affordable, we may give no assurance that such beliefs and expectations will show to be appropriate. Numerous elements might trigger precise outcomes or efficiency to vary materially from these mentioned in such forward-looking statements. All expressions of opinion are topic to vary. You might be cautioned to not place undue reliance on these forward-looking statements. Any dated info is printed as of its date solely. Dated and forward-looking statements communicate solely as of the date on which they’re made. We undertake no obligation to replace publicly or revise any dated or forward-looking statements. Any references to exterior information, opinions or content material are listed for informational functions solely and haven’t been independently verified for accuracy by the Adviser. Third-party views, opinions or forecasts don’t essentially replicate these of the Adviser or its staff. Until acknowledged in any other case, any point out of particular securities or investments is for illustrative functions solely. Adviser’s purchasers might or might not maintain the securities mentioned of their portfolios. Adviser makes no representations that any of the securities mentioned have been or will probably be worthwhile. Indices aren’t accessible for direct funding. Their efficiency doesn’t replicate the bills related to the administration of an precise portfolio.