On August 29, the US Courtroom of Appeals dominated in favor of Grayscale in its authorized battle towards the US Securities and Trade Fee (SEC). Following this, Grayscale’s GBTC shares buying and selling quantity considerably elevated, climbing to a 2-year excessive within the course of.

GBTC Shares See 17% Enhance

In accordance with knowledge from Yahoo Finance, GBTC’s share worth had opened at $17.66 on the day and closed at $20.56, rising by nearly 17% from the day prior to this. Moreover, the fund noticed its busiest day in over a 12 months, with over 19 million GBTC shares altering arms. This quantity soar marked the fund’s highest in over two years.

These figures aren’t stunning, contemplating that Grayscale’s victory presents a bullish outlook for the fund. Moreover, Grayscale’s GBTC is one step nearer to being transformed right into a Spot Bitcoin ETF, so many traders could need to get in on the fund at a reduced worth.

GBTC presently operates as a closed-end fund and has seen a reduction as excessive as 48.89% of its web asset worth (NAV) in December 2022. This low cost has been lowered to about 18% following the court docket’s ruling in favor of Grayscale. Nevertheless, some nonetheless consider this hole may shut additional, particularly if Grayscale’s ETF utility had been permitted.

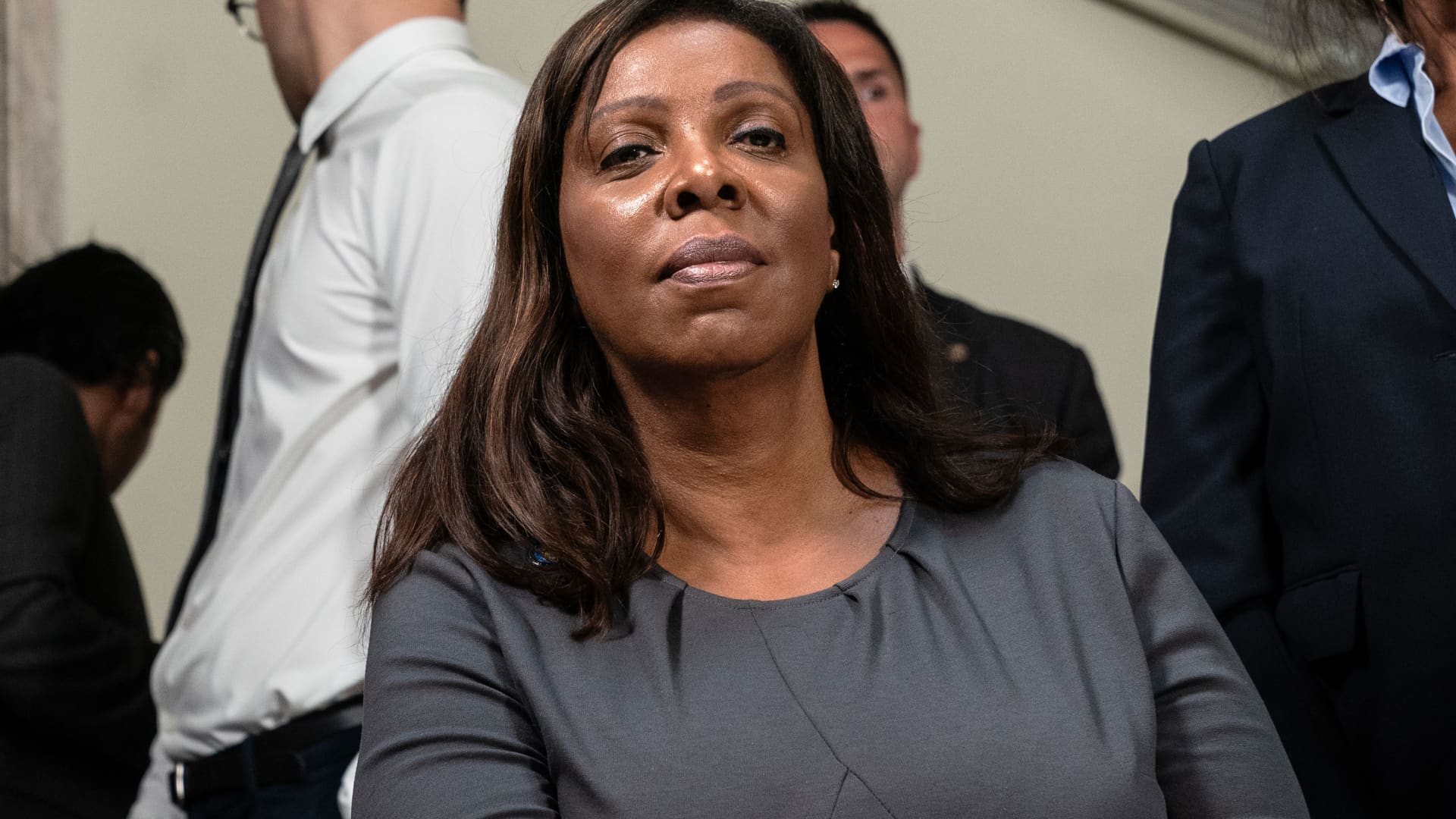

Share worth rises 17% in in the future | Supply: Grayscale Bitcoin Belief on Tradingview.com

Massive Win For The Crypto Group

Grayscale had filed a lawsuit following the SEC’s refusal to grant its utility to convert its GBTC fund right into a Spot Bitcoin ETF.

Grayscale argued that the SEC acted arbitrarily and capriciously by not giving it the identical regulatory remedy the Fee did to the Teucrium Bitcoin Futures Fund and the Valkyrie XBTO Bitcoin Futures Fund.

The fund acknowledged that it deserved the identical remedy because the Bitcoin futures fund as a result of the costs of each Spot and Futures Bitcoin ETFs had been “99.9%” correlated, so that they posed the identical threat relating to fraud and manipulation.

The court docket adopted Grayscale’s argument and agreed that the SEC had not supplied ample motive for denying Grayscale’s utility whereas approving the Bitcoin futures funds.

With this ruling, the SEC’s major motive for not approving a Spot Bitcoin not carries weight, because the Fee can not deny purposes solely as a result of the Spot Bitcoin market has no regulated market of serious measurement.

The court docket already discovered each funds (spot and futures) to be comparable, so these exchanges’ surveillance sharing agreements with the Chicago Mercantile Trade (CME) needs to be ample to discourage manipulation in both the spot or futures market.

Whereas it stays to be seen what step the SEC will take relating to the Courtroom of Attraction’s ruling, there’s an elevated probability that the Fee must approve the pending Spot Bitcoin ETF purposes besides if it may well discover one more reason to disclaim these proposals.

Featured picture from Bitcoinist, chart from Tradingview.com