Huber & Starke

California regulators voted on Thursday to permit Cruise (NYSE: GM) and Waymo (GOOG)(GOOGL) to start out working a 24/7 paid taxi service in San Francisco. Anybody who’s been to town of San Francisco just lately, particularly within the night, has seen the vehicles driving round, eerily with nobody within the driver seat. Many of those have been working as taxis, resulting in some distinctive outcomes.

As we’ll see all through this text, self-driving is a brand new funding alternative, nonetheless, we count on there to be substantial winners and losers on this dangerous new trade.

The Self Driving Downside

The self-driving drawback is enormously advanced. As a result of no matter what some within the media would possibly make you afraid of, normal AI has but to exist. Computer systems observe a algorithm. Trendy statistics, mixed with terribly advanced guidelines, results in the AI that appears to look terribly advanced, like Chat GPT.

The truth is the impacts on coaching information from the rising variety of generative AI fashions has made present generative AI worse. Self-driving is a posh algorithm and when it hits an sudden situation it fails. Because of this, we count on AI to proceed the best way Cruise and Waymo are constructing it up, metropolis degree robotaxis that earn earnings and collect information.

Market Alternative

The market alternative is big.

Taxi Income

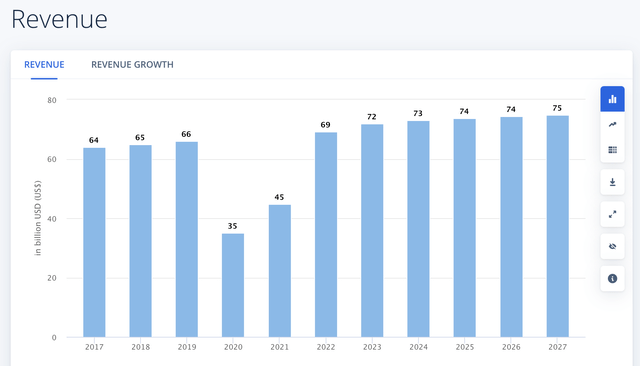

The income earned from journey hailing and taxi companies is clearly huge. Regardless of a large dip throughout COVID-19, the earnings from the trade are set to surpass $70 billion this calendar yr. The town mannequin allows these corporations to make the most of main markets to start out which can be accountable for a considerable % of the market like NYC or SF.

With Waymo and Cruise already profiting from the market, incomes chilly onerous money as they enhance, they’re already profiting from the market.

Take Benefit

So what’s one of the simplest ways to make the most of this. Cruise has 2x the fleet measurement of Waymo at the moment with Cruise having roughly 400 autos and Waymo having about half of that. Nonetheless, Waymo is healthier at working 24/7 whereas Cruise primarily runs at night time exhibiting a possible worry across the depth of daytime operations.

The reply is it relies upon.

Normal Motors (NYSE: GM) has a $46 billion market capitalization with its 80% possession of Cruise. Waymo was as soon as value virtually $200 billion however is now value $30 billion. Cruise is estimated to be value about $30 billion. Which means it makes up simply over half of Normal Motor’s valuation. Clearly, any success there can be very worthwhile for Normal Motors.

Alternatively, Google is gigantic. It is value virtually $1.7 trillion. Which means even when Waymo turns into value a number of hundred $ billion the upside for Google might be a lot smaller. In fact if Waymo by no means goes anyplace, Google’s core enterprise and present worth is way much less essential than that of Cruises.

The funding you make the most of is predicated in your private threat profile and the quantity of publicity you wish to that firm’s self-driving outcomes.

Tesla’s Draw back

Let’s get to our ideas on one of the crucial talked about corporations within the self-driving world, Tesla (NASDAQ: TSLA).

Tesla’s method, increasingly, appears to give attention to driver help slightly than full self-driving. The corporate has quite a few miles on its programs however it hasn’t began rolling out full self-driving with out a driver like Cruise and Waymo. They could have statistics on human interventions required, however they don’t hit all of the distinctive alternatives that occur when human drivers aren’t utilizing the system as a lot, like short-distance advanced metropolis driving.

Cruise and Waymo have hit constant interventions however every time they study one thing from it. They’re already incomes income from the enterprise and gathering information. We predict Tesla is behind Cruise and Waymo by a major margin when it comes to incomes income from full self-driving. Proper now Tesla hasn’t indicated any form of path to hitting the place Cruise and Waymo are, that’s greater than a long-term objective.

There’s one thing else value noting right here that’s coming more and more into view. Regulatory burden. Full 24/7 self-driving was allowed in San Francisco after years of testing and regardless of sturdy protests. Some would argue if it had been San Francisco’s resolution and never California’s regulatory resolution it wouldn’t have been authorised in any respect. Every metropolis is a ache staking course of that requires years of effort and planning.

The trail to self-driving income appears to be taxi-replacement in main cities that may be painstakingly investigated and mapped. They’ve the dimensions to make such an effort value it. Extra importantly Waymo and Zoox are backed by corporations that may spend $10s of billions to make it a actuality. Cruise is already a pacesetter and Normal Motors is robust. Tesla is behind and at the same time as a automotive firm isn’t worthwhile sufficient to proceed these investments at a better scale.

On condition that self-driving is a key a part of Tesla’s extremely excessive valuation versus different automotive makers we count on it to underperform because it continues to fall behind within the race.

Our View

Humanity is nice and fixing issues and the amount of cash being invested right here together with the beginning of regulatory approval coming implies that they suppose there is a path ahead.

Nonetheless, there’s winners and losers and threat ranges. Google is the traditional selection. Its tech appears to be main, in on the street points, versus Cruise. It has the monetary backing to proceed investing closely, and even when the enterprise finally ends up nugatory it isn’t in a very powerful spot with its funding.

Normal Motors is a higher-risk higher-reward. Cruise is doing extremely nicely with its increasing circulate of robotaxis. The corporate makes up a large a part of Normal Motor’s valuation, which means the potential for a lot stronger shareholder rewards if it succeeds. Nonetheless, Normal Motors core enterprise nonetheless helps to supply some useful isolation.

Then there’s Tesla. The corporate is dramatically overvalued and one option to meet that will be an extremely profitable self-driving enterprise, however it’s not main there. We count on Tesla to proceed to wrestle to justify its valuation and because it drops down it will increase the prospect that traders will see that, punishing it additional.

Thesis Threat

The most important threat to the thesis in our view is an sudden technological breakeven, a “golden nugget” that occurs every now and then. Tesla might have one, some second of technical genius, that adjustments the sphere. It’s occurred earlier than in AI with the creation of generative AI fashions and extra. Tesla is actively investing and will see such a breakthrough that allows it to catch as much as its rivals.