JHVEPhoto

Analysis Transient

Not too long ago, my deal with the “innovation” & “managed providers” sector turned in the direction of a selected area of interest: federal contractors specializing in aerospace, homeland safety, & cybersecurity.

After my protection of Normal Dynamics (GD), L3Harris Applied sciences (LHX), Leidos (LDOS), and Booz Allen Hamilton (BAH), immediately I’ll deep dive into the following one on this sequence and a well known identify on this area:

Northrop Grumman (NYSE:NOC), who lately had its 2023Q2 outcomes on July twenty seventh, will probably be immediately’s function inventory.

My private expertise with this sector began in 2001 as a Drew College pupil throughout my management semester in Washington DC, passing by amenities of Northrop & Lockheed on the prepare experience there, a reminiscence I vividly recall. Then, the limitless coverage discussions and panels throughout that semester, and analysis papers, and visits to Capitol Hill and lobbyist places of work. All of that is a part of the “ecosystem” wherein this agency operates, and a variety of federal public monies are at stake on this course of.

For readers new to this inventory, listed below are fast notable factors I feel needs to be related about this firm, from its web site: 95K workers, amenities in all 50 states & 25+ international locations worldwide, based mostly in Virginia US, majority of its enterprise comes from US federal authorities: protection & intelligence sector. 2022 gross sales had been $36.6B. Trades on NYSE.

Ranking Methodology

To get a “holistic” ranking rating of purchase, promote, or maintain, I break down my evaluation into 5 classes: dividends, share value, valuation, earnings progress, & capital energy.

If I like to recommend the inventory on no less than 3 of those classes it will get a maintain ranking, and no less than 4 will give it a purchase ranking. A rating of lower than 3 is a promote ranking.

Dividends: Advocate

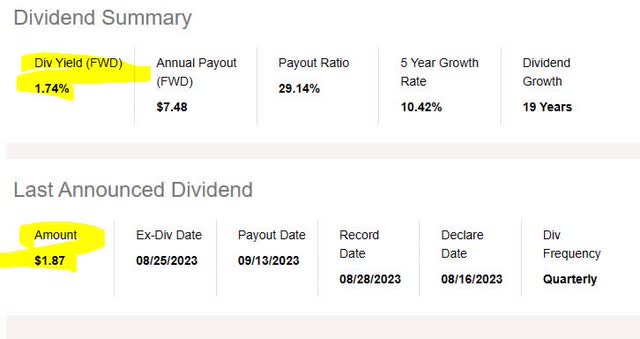

The primary class I’ll take a look at is dividends, and examine to the general sector. As of Aug. nineteenth, in keeping with dividend knowledge from In search of Alpha, Northrop has a dividend yield of 1.74%, not horrible or attention-grabbing both.

Worthy of point out is its dividend of $1.87 per share is quarterly and has an upcoming ex date this week on the twenty fifth, which might be value making the most of.

Northrop Grumman – dividend yield (In search of Alpha)

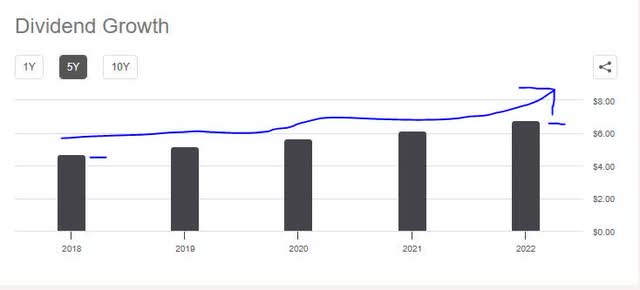

One other key knowledge level is a 5-year confirmed dividend progress charge, proven within the chart under. The inventory went from an annual dividend of $4.70 in 2018 to $6.76 in 2022, an virtually 44% achieve in 5 years, which is spectacular.

Although not a guarantor of future dividends, this does present proof of previous & present monetary energy to return capital again to shareholders.

Northrop – dividend 5 yr progress (In search of Alpha)

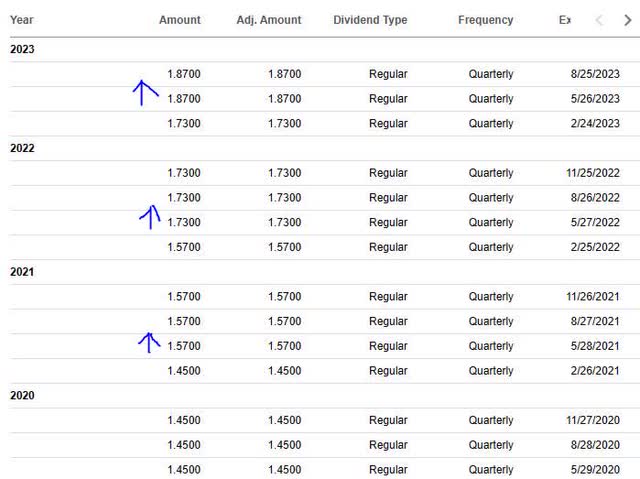

If you happen to take a look at the dividend payout historical past, it additionally reveals a dependable quarterly payout each quarter since 2020, and has been rising, one other good signal and it ought to present confidence to the dividend-income portfolio investor on this sector.

Northrop – dividend historical past (In search of Alpha)

In evaluating Northrop’s dividend yield to some the friends I discussed, when you take into account that Booz Allen’s dividend yield is simply 1.64%, and Leidos has a yield of 1.50%, Northrop beats them each barely on dividend yield, an essential metric as a result of the next yield means a greater return on capital invested.

Primarily based on the proof, I can safely advocate this inventory within the class of dividends.

Share Value: Advocate

On this class, I’m taking a really simplified method to figuring out whether or not the present share value is a purchase alternative or not.

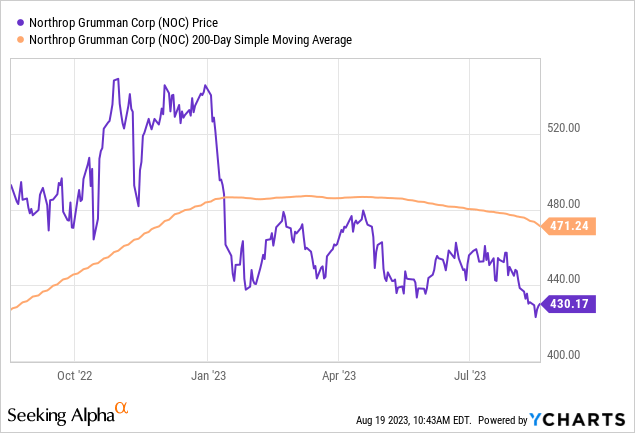

First, I pull the present chart as of Aug. nineteenth after yesterday’s market shut, exhibiting the closing value of $430.17 (blue line) vs the 200-day easy transferring common of $471.24 (orange line). Now, do not get startled in seeing a share value as gigantic as this, as it isn’t the worth itself that ought to determine a purchase determination.

Second, I set up a purpose for a way lengthy I wish to maintain the inventory, my purpose for return on capital, and my most danger tolerance for capital loss.

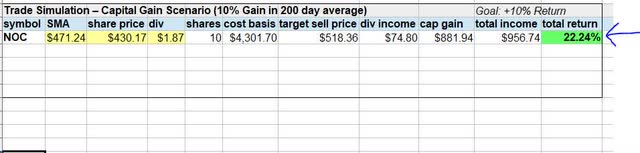

In my fictitious commerce, I’ll purchase 10 shares and maintain for 1 yr to earn the total yr dividend revenue, my purpose is no less than 10% return on capital after a yr, and my loss tolerance is destructive -10% return in a yr.

Assumptions: the transferring common I’m monitoring will transfer up by 10% in a yr, and that will probably be my promote value, or it should drop by 10% and that will probably be my promote value. This establishes a “vary” to consider long run.

Within the following simulation, I simply plug within the present share value, present 200-day SMA, and dividend quantity. My goal promote value of $518.36 is 10% above the present transferring common. On this simulation, I exceed my revenue purpose and obtain 22.24% return on capital invested. Revenue is from capital positive factors and dividends.

Northrop – commerce simulation 1 – achieve state of affairs (writer evaluation)

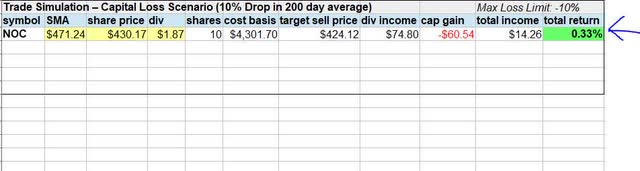

Within the 2nd simulation, testing a loss state of affairs, I plug in the identical knowledge and my promote value now could be 10% under the present SMA. Nonetheless, my capital loss is offset by dividend revenue, so I’m truly getting a optimistic return of +0.33%, therefore it’s inside my max loss restrict of destructive -10%.

Northrop – commerce simulation 2 – loss state of affairs (writer evaluation)

As a result of the present share value works out in each simulations, I’d advocate it as a shopping for value.

Valuation: Advocate

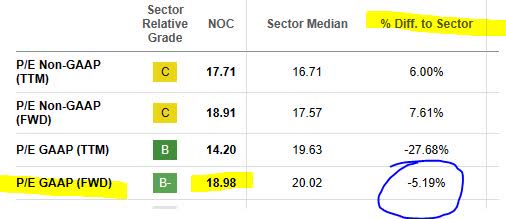

On this class, I’ll take a look at valuation from the viewpoint of the worth to earnings and value to ebook worth, utilizing valuation knowledge from In search of Alpha.

First, as of Aug. nineteenth the ahead P/E of 18.98 is impressively over 5% under the sector common which is hovering nearer to 20x earnings, as seen under. This earned it a “B-” grade from In search of Alpha, and this can be a key metric to comply with, exhibiting that the market is prepared to pay virtually 19x earnings for this inventory.

Northrop – P/E ratio (In search of Alpha)

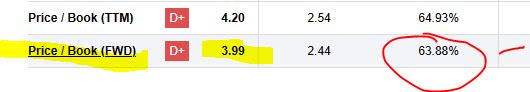

When it comes to price-to-book, the market is paying 4x ebook worth when the sector common is nearer to 2.4x ebook, making this inventory virtually 64% greater than its sector.

Northrop – P/B ratio (In search of Alpha)

In weighing the 2 metrics, though its value to ebook appears overvalued, the worth to earnings remains to be very engaging.

By the way, in evaluating to one in all its friends, Northrop’s value to ebook remains to be much better than that of Booz Allen, whose trailing P/B ratio is over 486% above the sector common, incomes an “F” grade. Additionally, one other peer I’ve not coated but, Lockheed Martin (LMT), has a ahead P/B ratio that’s 439% above the sector common. If this sector, that Lockheed can also be a significant competitor of Northrop Grumman, as is Boeing (BA).

So, my outlook is that the valuation will be really useful based mostly on the proof proven.

Earnings Development: Not Really useful

At first look, the highest line figures YoY look nice, with a soar in complete revenues in addition to gross revenue, because the desk reveals:

Northrop – prime line income YoY (In search of Alpha)

Nonetheless, the underside line not so good, with internet revenue exhibiting a YoY drop:

Northrop – internet revenue YoY (In search of Alpha)

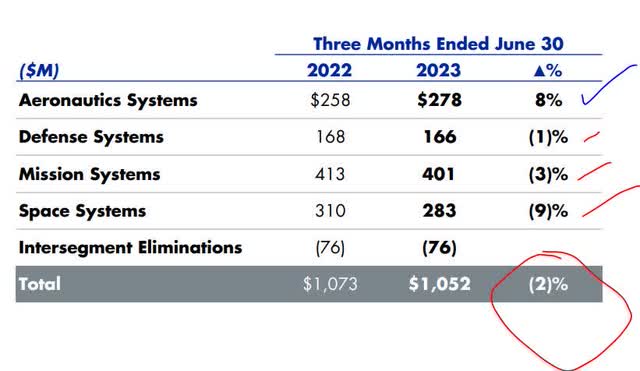

On nearer look, their working revenue YoY fell throughout a number of enterprise segments:

Northrop – working revenue YoY (firm q2 presentation)

In line with the corporate earnings launch commentary:

Second quarter 2023 internet earnings decreased $134 million, or 14 %, primarily as a result of a $244 million discount within the non-operating FAS pension profit.

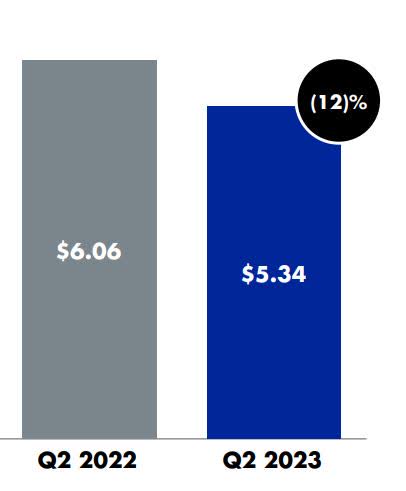

This affect will be seen within the earnings per share YoY comparability too:

Northrop – diluted EPS YoY (firm Q2 presentation)

On this case, I’ve to ding the corporate on this class and never advocate on earnings progress, regardless of sturdy prime line numbers. I do anticipate an enchancment in Q3.

Capital Power: Advocate

I’d advocate this firm within the class of capital energy and right here some key knowledge factors to strengthen that thesis:

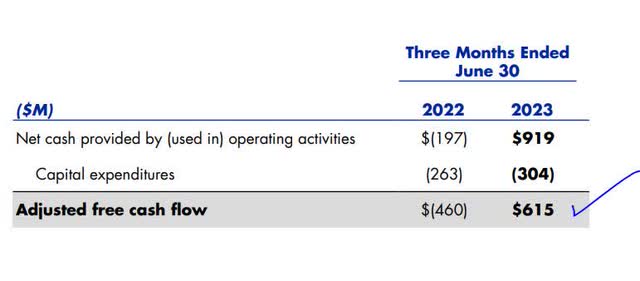

In line with the Q2 presentation, the corporate will “proceed to anticipate to return over 100% of adjusted free money circulation this yr to shareholders, together with ~$1.5 billion in share repurchases.”

This can be a optimistic signal, I feel.

Additional, I just like the optimistic money circulation they achieved within the final quarter as properly of round $0.6B

Northrop – free money circulation (firm Q2 presentation)

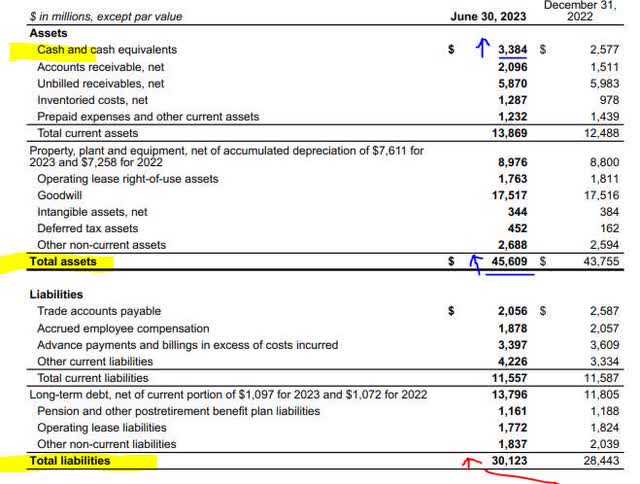

In looking on the firm steadiness sheet, it has drastically expanded each on the asset and legal responsibility facet, for the reason that finish of 2022, with a money & money equal place of $3.3B, complete property of $45.6B, complete liabilities of $30B.

Northrop – steadiness sheet (firm q2 earnings launch)

The one factor I’d point out, although, is that we’re in a really excessive rate of interest setting since final yr, after Fed charge hikes, so the query can be what’s the affect of charges on this firm’s long-term debt, and curiosity expense.

The next desk provides some perception into this subject, exhibiting a YoY improve within the curiosity expense, with curiosity expense at $147MM. In Q3 commentary I wish to see extra about how they’re decreasing their long-term debt load successfully.

Northrop – curiosity expense (In search of Alpha)

Ranking Rating: Purchase

At this time, this inventory received 4 of my 5 ranking classes, incomes a “purchase” ranking from me, which is definitely in keeping with the consensus from analysts and Wall Road who I agree with this time, however it’s extra bullish than the SA quant system, as proven under.

Northrop – ranking consensus (In search of Alpha)

Once more, what prevented it from being a “sturdy purchase” was the poor exhibiting on YoY internet revenue progress.

Danger to my Outlook: Sector Competitors

A danger to my modestly bullish outlook is the truth that Northrop has to compete for contracts with some massive gamers on this area like Lockheed and Boeing, amongst others. A couple of massive contract losses to these rivals, particularly media publicized ones, could trigger buyers to be bearish on this inventory, making my outlook too rosy.

Nonetheless, the benchmark I take a look at is the present pipeline of contracts or packages already awarded and in progress. Think about all of the work coming this firm’s method, in keeping with their Q2 earnings launch:

Q2 and YTD 2023 internet awards totaled $10.9B and $18.9B, respectively, and backlog totaled $78.8B. Important Q2 new awards embody $5.4B for restricted packages (primarily at House Programs, Aeronautics Programs and Mission Programs), $0.6B for F-35 (primarily at Aeronautics Programs and Mission Programs), $0.3B for the Missile Protection Company’s Ballistic Missile Protection System Overhead Persistent Infrared Structure (BOA) and $0.3B for Virginia-Class submarines.

I’m of the opinion that these awards and different will greater than maintain them busy and the income coming, regardless of competitors from massive gamers, and thereby lessening the danger of a bearish Wall Road, although not eliminating that danger fully. In any case, federal contracts can get cancelled, delayed, renewed or not renewed, and so forth.

Evaluation Wrap-up

Listed here are the factors we went over immediately.

This inventory obtained a purchase ranking immediately, in keeping with the consensus from Wall Road analysts, however extra bullish than the quant system.

Positives: dividends, share value, valuation, capital energy.

Headwinds: earnings progress YoY.

Concluding ideas:

This wraps up this month’s sequence on the innovation sector in terms of federal contractors, with a deal with aerospace & homeland safety.

The sector will stay on my watchlist, and this inventory specifically, as a result of its seemingly unending pipeline of tasks & work, and federal {dollars} flowing its method. Therefore, my forward-looking sentiment on each this inventory and sector is usually optimistic, anticipating continued sturdy monetary fundamentals within the subsequent a number of years.