We’re very enthusiastic about what we’re seeing in small caps and consider the tide is popping after a tough 2022. Valuations are enticing, and there may be rising proof {that a} small-cap management regime is in its early innings.

And whereas we’re inspired about small caps as an asset class, we’re much more optimistic about small-cap development shares and the alternatives we see for Calamos Timpani Small-Cap Development Fund (CTSIX). We now have a time-tested, repeatable course of and consider we’re simply six months into what is probably going a multiyear upcycle for our funding type. Listed below are 5 vital takeaways:

When the S&P 500 Index has rallied above bear market lows, small caps have outperformed

Traditionally, small caps have posted robust efficiency after the S&P 500 Index rallied greater than 20% off bear market lows-both in absolute phrases (highlighted by the inexperienced containers within the desk under) and relative to massive caps (orange containers). Just some weeks in the past in June, the S&P 500 gained 20% above its bear market low in October 2022. We consider crossing this threshold is a optimistic for all shares, however particularly small caps relative to massive caps. In June and July, small caps outperformed massive caps by a complete of 467 foundation factors. Two months is not a very long time, however it’s nonetheless one thing we consider is value being attentive to, particularly as a part of the larger image that is coming collectively.

Small-cap efficiency after bear market bottoms and confirmations of recent bull markets

Since 1980

Previous efficiency is not any assure of future outcomes. Supply: Piper Sandler Technical Analysis and Bloomberg.

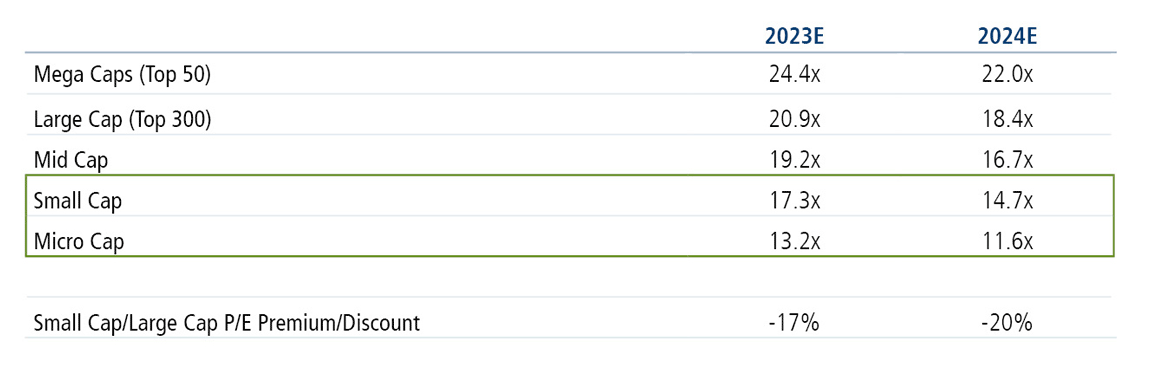

We consider small caps are low-cost on each an absolute and relative foundation

A variety of mega caps carry excessive value tags, however the chart under reveals how cheap small caps are. The smaller you go, the extra enticing the price-to-earnings ratios are for each 2023 and 2024 earnings estimates.

Small caps and micro caps: Enticing valuations

Previous efficiency is not any assure of future outcomes. Supply: The Leuthold Group. Knowledge as of seven/31/23.

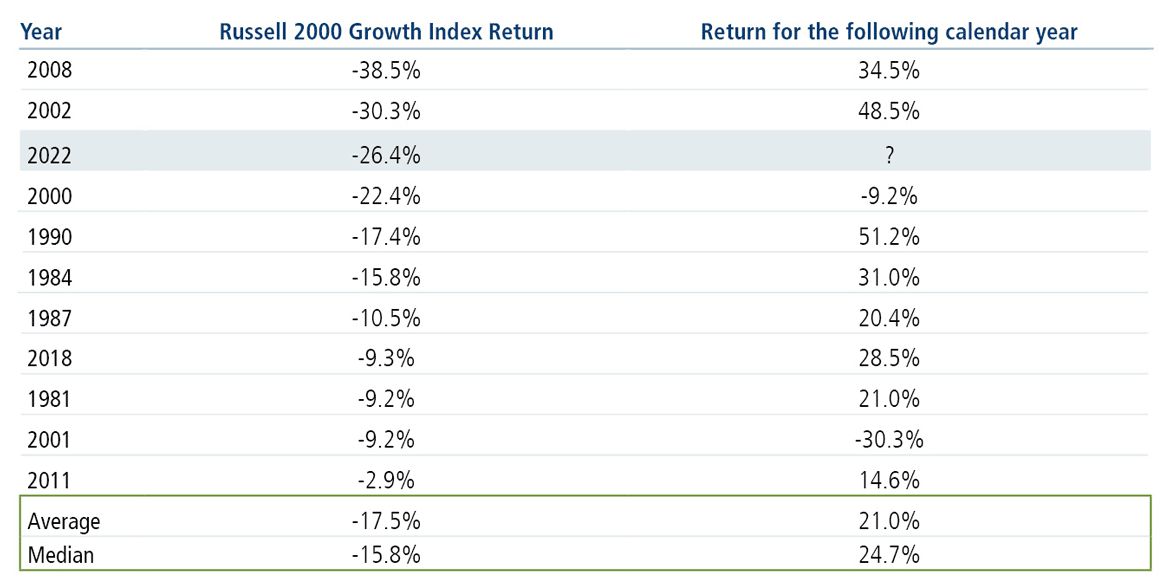

Traditionally, unhealthy years for small-cap development shares have been adopted by good ones

Previous efficiency does not assure future outcomes, however it may well present significant context. As a rule, small-cap development shares have rebounded strongly after down years.

Small-cap development shares: A historical past of bounce backs

Previous efficiency is not any assure of future outcomes. Supply: Factset, FTSE Russell, Jefferies.

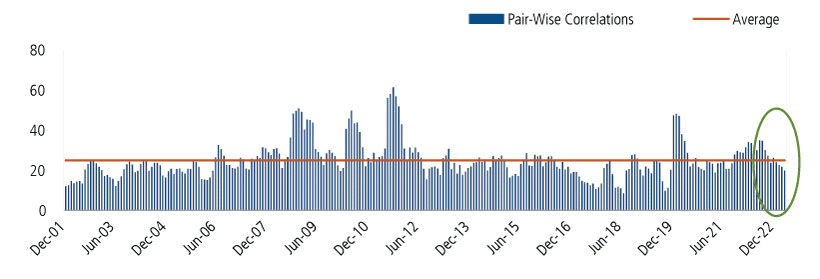

The present atmosphere is an effective backdrop for our bottom-up method

We comply with a time-tested, repeatable, fundamentally-driven course of to establish fast-growing corporations poised to exceed earnings expectations for the subsequent a number of quarters. For the previous 20 months, markets have been pushed by macro elements that favored massive caps relative to small caps, and small-cap shares with robust development fundamentals have usually been missed and underappreciated. This created headwinds for our method, however we’re beginning to see a shift again to a market the place company-specific basic momentum issues extra.

Under, we present correlations since December 2001. Because the graph reveals, correlations in latest months are falling amongst small caps. Falling correlations are an indication that the market is keen to embrace firm specifics – in different phrases, it is extra of a stock-picker’s market. We anticipate that corporations with good earnings and development traits will probably be rewarded, and the unhealthy will probably be punished. That is an atmosphere we consider units up nicely for our method as a result of we consider historical past has proven that we’re good at figuring out corporations with robust basic profiles.

Firm specifics matter extra when correlations are decrease

Russell 2000 Index, pair-wise correlations in small caps, primarily based on quarterly rolling durations

Previous efficiency is not any assure of future outcomes. Supply: FactSet, Lipper Analytical Providers, FTSE Russell, Jefferies.

AI development alternatives within the small-cap and mid-cap world

If we’re in a inventory picker’s market, the subsequent logical query is “the place are these alternatives?” In our view, the reply is everywhere in the market – well being care, industrials, client performs and naturally, know-how, together with AI. Though the mega cap AI names within the headlines are out of bounds for us, there are a variety of different methods to play AI within the small and mid-cap world. By and huge, our participation at this level is thru periphery performs associated to AI-enabled information middle buildouts and reconfigurations.

The semiconductors made by sure massive cap corporations want to enter high-performance computing servers. These servers are positioned inside server racks and should be related to different gear. These AI-enabled servers require considerably extra energy. Extra energy means extra warmth is generated, which implies extra cooling instruments are required. Small-cap and mid-cap corporations are taking part in an vital function in all of those areas. The desk under reveals some examples of corporations that meet our standards.

Small-cap and mid-cap corporations: Key to the AI information middle buildout

INDUSTRIES EXAMPLES IN CTSIX Servers Tremendous Micro Laptop (SMCI) Energy and Thermal Administration(information facilities run sizzling!) Vertiv (VRT) Semiconductors/Connectivity Credo Know-how (CRDO), Good International (SGH), Arteris (AIP) Knowledge Networking Excessive Networks (EXTR) Knowledge Engineering Innodata (INOD) Knowledge Middle Operations Utilized Digital (APLD) Knowledge Middle Development Sterling Infrastructure (STRL) Click on to enlarge

The fund is actively managed and holdings are topic to vary each day and with out discover The holdings listed above are included within the portfolio of Calamos Timpani Small-Cap Fund as of 6/30/23. Please see the disclosures for extra info.

A closing notice: Calamos Timpani Small-Cap Development Fund has substantial tax-loss carryforwards of $146.2 million (as of the semiannual report dated April 30, 2023), representing almost 50% of fund belongings. These tax-loss carryforwards might be used sooner or later to offset realized good points, and though the tax tail should not wag the asset allocation canine, we consider it is a compelling level for a lot of buyers.

Editor’s Word: The abstract bullets for this text have been chosen by In search of Alpha editors.