The Convention Board’s Main Financial Indicators (LEI) continued its decline in July, dropping 0.4% MoM (as anticipated).

That is the sixteenth straight month-to-month decline within the LEI (and seventeenth month of 18) – the longest streak of declines since ‘Lehman’ (22 straight months of declines from June 2007 to April 2008)

“The US LEI – which tracks the place the economic system is heading – fell for the sixteenth consecutive month in July, signaling the outlook stays extremely unsure” stated Justyna Zabinska-La Monica, Senior Supervisor, Enterprise Cycle Indicators, at The Convention Board.

“Alternatively, the coincident index (CEI) – which tracks the place financial exercise stands proper now – has continued to develop slowly however inconsistently, with three of the previous six months not altering and the remaining growing. As such, the CEI is signaling that we’re at the moment nonetheless in a good progress setting.

Nonetheless, in July, weak new orders, excessive rates of interest, a dip in client perceptions of the outlook for enterprise circumstances, and lowering hours labored in manufacturing fueled the main indicator’s 0.4 % decline.

The main index continues to recommend that financial exercise is prone to decelerate and descend into gentle contraction within the months forward.”

Regardless of ‘comfortable touchdown’ hype, the LEI is exhibiting no indicators in any respect of ‘recovering’, hitting its lowest since Sept 2017 (outdoors of COVID)

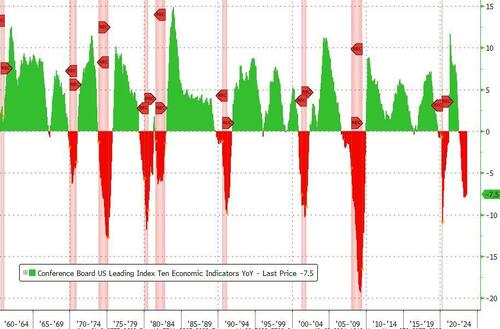

And on a year-over-year foundation, the LEI is down 7.5% – near its greatest YoY drop since 2008 (Lehman) outdoors of the COVID lockdown-enforced collapse…

Not a great signal for Actual GDP. (The annual progress fee of the LEI remained unfavourable, confirming weaker financial exercise forward)…

The trajectory of the US LEI continues to sign a recession over the subsequent 12 months

The Convention Board now forecasts a brief and shallow recession within the This autumn 2023 to Q1 2024 timespan.

Is that this the cleanest view of The Fed’s tightening affect on the US economic system? Definitely would not seem like a ‘comfortable’ touchdown.

Loading…