jax10289/iStock through Getty Photos

By Fawad Razaqzada

The Financial institution of England stays firmly centered on companies inflation and wage development. We may have knowledge on each fronts within the week forward, which ought to impression the GBP/USD outlook within the course of the shock.

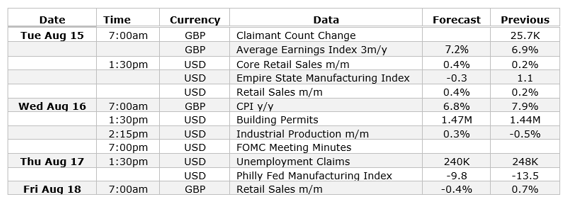

Key Information Releases to Look ahead to the Cable This Week

The next knowledge releases have the potential to maneuver the GBP/USD this week:

From the UK, we may have wages knowledge on Tuesday, forward of the more-important client inflation knowledge a day in a while Wednesday and the not-so-important retail gross sales figures on Friday.

From the US, we may even have retail gross sales on Tuesday, in addition to the FOMC assembly minutes on Wednesday amongst a number of different second-tier knowledge releases all through the week.

The UK inflation numbers in mid-week might decide what number of additional rate of interest hikes the Financial institution of England has left within the tank, one thing which can in flip impression the GBP/USD outlook within the course of the shock.

How Will This Week’s Inflation and Wage Information Impression BoE Considering?

The pound has been primarily pushed this 12 months by inflation overshooting to the upside, boosting expectations that the BoE might – because it has – tighten its coverage additional into the contractionary territory.

Nonetheless, the market’s odds of a future BoE hike weakened considerably from its lofty ranges, following the final inflation report which got here in considerably sharply under expectations, albeit at a nonetheless very excessive 7.9%, from 8.7% within the earlier month.

Whereas there’s now hope that inflation has peaked, the market will need to see additional proof of a disinflationary pattern earlier than it’s satisfied that the BoE is finished with tightening.

Wednesday’s inflation report is once more anticipated to indicate additional proof of cooling costs, with a headline of 6.7% year-on-year anticipated in comparison with 7.9% within the month prior. The drop is prone to be pushed by vitality and meals.

One huge challenge for the BoE is inflation within the companies sector, and robust wage development. On the latter entrance, we are going to get to see precisely how strongly wages grew within the three months to June, on Tuesday. Economists count on the typical earnings index to have climbed to +7.2%, accelerating from the earlier month’s stronger-than-expected +6.9% print.

A 25 foundation level price hike on September 21 is predicted by markets, though not 100%. So, if this week’s wages and inflation knowledge are available in surprisingly robust, then this can cement expectations of a hike whereas additionally boosting hypothesis that the BoE might tighten its coverage once more in November.

Conversely, a weaker-than-expected set of knowledge might imply September might be a coin flip or at greatest the final price hike within the cycle. This could weigh on the pound.

UK Economic system Defying Expectations

Heading into this week’s key knowledge releases, we had some constructive knowledge surprises from the UK on Friday of final week, which prevented the GBP/USD to fall deeper within the 1.26 vary, whereas different currencies struggled in opposition to the greenback.

Traders had been relieved to search out out that the UK financial system unexpectedly rebounded by 0.5% in June, serving to to gasoline a 0.2% development on a quarter-over-quarter foundation, and defying expectations for no development.

Progress was boosted by manufacturing whereas enterprise funding and development had been additionally stronger, regardless of the BoE’s aggressive price will increase.

Nonetheless, one key danger dealing with GBP buyers is the UK housing market, which has been slowing extra quickly than anticipated of late because of excessive mortgage charges. That is one thing that might weigh on the pound sooner or later.

Why Hasn’t the Greenback Bought off But?

The US Greenback Index has began the brand new week on the entrance foot, having momentum behind it with 4 consecutive weeks of good points.

We have now had pockets of weak spot in US knowledge, which ought to have undermined the greenback. However the reality it hasn’t means it’s most likely boosted by the risk-off tone within the markets, most notably in China.

Right here, equities and renminbi each proceed to wrestle, placing strain on the positively correlating markets such because the Aussie and kiwi, and thus not directly boosting the US greenback.

Considerations surrounding the perilous monetary state of a few of China’s largest property builders and the nation’s put up pandemic financial struggles have dented investor sentiment.

Additionally protecting the greenback supported is the financial struggles elsewhere around the globe, discouraging buyers from constructing lengthy positions in foreign currency echange – though we’re beginning to see indicators of resilience in some economies, for instance the UK.

Maybe buyers are ready to see extra proof that the US financial system is on a transparent downward trajectory, earlier than shunning the greenback once more. So, you will need to search for indicators of a slowing financial system, and never simply inflation figures, in case you are a greenback bear.

So, watch this week’s knowledge releases intently from China and the US as they’ve the potential to maneuver the markets, together with the GBP/USD.The Fed itself wants extra conviction that it’s profitable the battle in opposition to inflation, as some members proceed to warn that the central financial institution nonetheless has “extra work to do” on costs.

Final week noticed core inflation ease a tad additional to 4.7% whereas the headline price edged greater due to base results to three.2%, albeit this was higher than anticipated.

Value pressures abated almost throughout all elements, besides the housing market. With rates of interest being excessive, this isn’t going to final very lengthy – we expect. And the market agrees, because the chance of one other price hike fell even additional.

GBP/USD Technical Evaluation

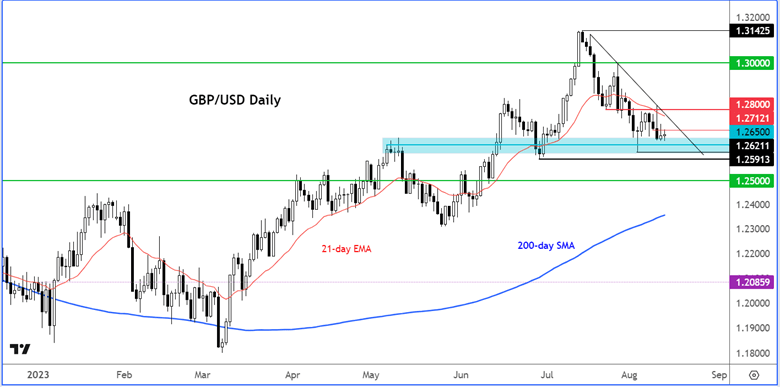

The GBP/USD’s short-term pattern stays bearish on condition that it has created some decrease highs of late. But, the downtrend is just not very robust, but. Certainly, the massive, inverted hammer candle from Thursday has to this point did not convey out contemporary sellers within the cable. As an alternative, the bulls have managed to defend help within the 1.2650-1.2700 vary for now.

The bulls will need to see a each day shut north of the 1.28 deal with to offer the sign that the GBP/USD goes greater once more.

The bears are blissful for now however shall be extra so if we get a break under 1.3591 – the final swing low – for then we may have a decrease low in place.

Supply: TradingView.com

Initially revealed on MoneyShow.com

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.

Editor’s Observe: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.