US Treasury yields rose final week regardless of a comparatively tame CPI report. Mortgage charges rose as properly. What’s happening?

30-12 months Mortgage Chart Notes

On Friday, August 11, 2023, mortgage charges jumped to 7.19 p.c and strategy the October 20, 2022 excessive of seven.37 p.c as famous by Mortgage Information Each day.

The 7.37 p.c fee was the best since October of 2000, practically 23 years in the past.

Ominous Chart Technically

Technically talking, the chart is ominous. Rising triangle formations have a tendency to interrupt increased.

That’s actually not a assure, and even shut. Nevertheless it suits in with US treasury motion in response to CPI information.

US Treasury Yields Since 1998

Since 1998 there have been three main inversions the place short-term yields soared above long-term yields throughout the board.

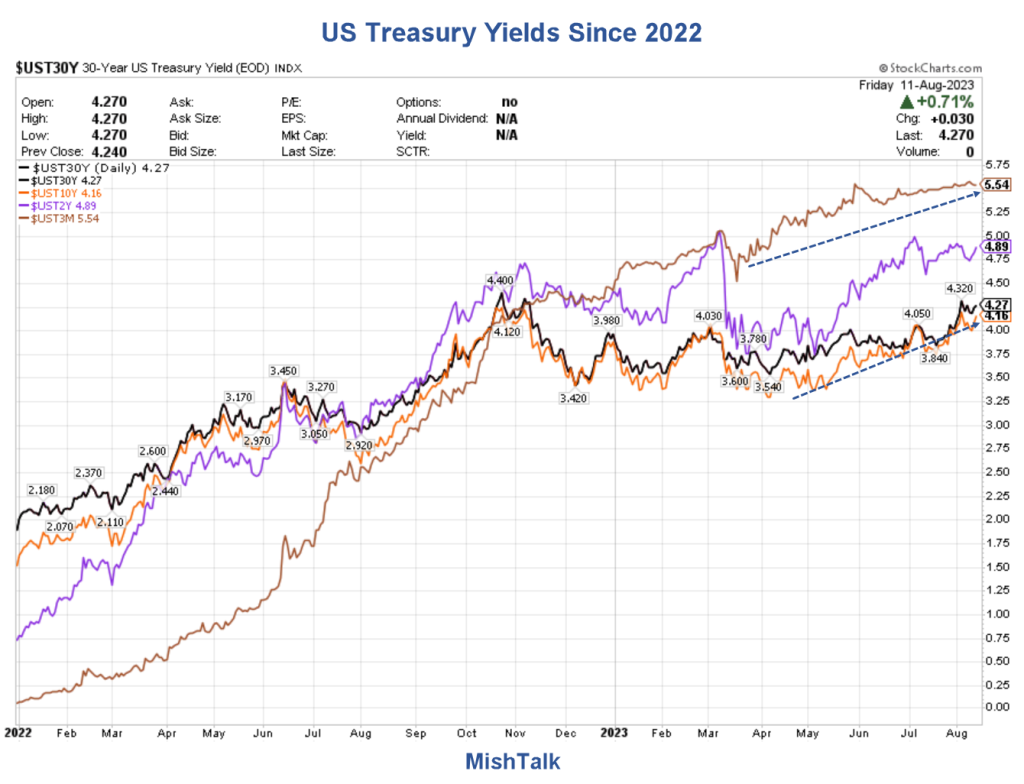

Presently we’re in one of many steepest inversion in historical past with the 3-month yield at 5.54 p.c and the 10-year yield at 4.16 p.c.

Nevertheless it’s the current motion that’s extra telling particularly vs the CPI.

US Treasury Yields Since 2022

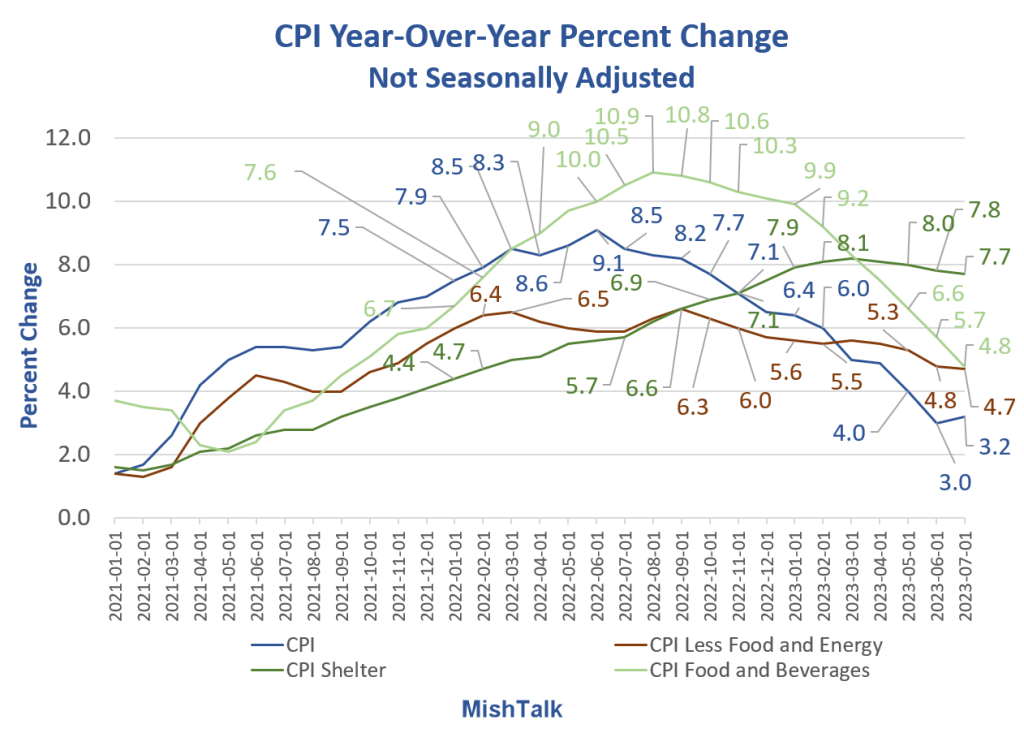

CPI 12 months-Over-12 months

12 months-over-year the CPI peaked at 9.1 p.c in June of 2022. Since then, it has plunged to three.2 p.c.

For the transfer, the 10-year treasury yield slid to three.54 p.c in April of 2023. Mortgage charges additionally declined, main the way in which, in actual fact.

30 yr Mounted Mortgage Charges Element

What’s the Message?

One other uptick in inflation is on the way in which.

The Fed just isn’t accomplished mountain climbing.

The goldilocks view by the Fed any broadly touted in mainstream media isn’t going to occur.

Take your decide from these decisions and add another views you want.

In the meantime, the already crippled housing market is certain to take one other hit transaction-wise.

CPI Rises 0.2 P.c, Shelter Once more Accounts for Many of the Enhance

On August 10, I famous CPI Rises 0.2 P.c, Shelter Once more Accounts for Many of the Enhance

For the 18th straight month, the value of shelter has risen no less than 0.4 p.c. For a yr, analysts have predicted not only a slowing tempo of will increase, however falling costs. They’ve been fallacious.

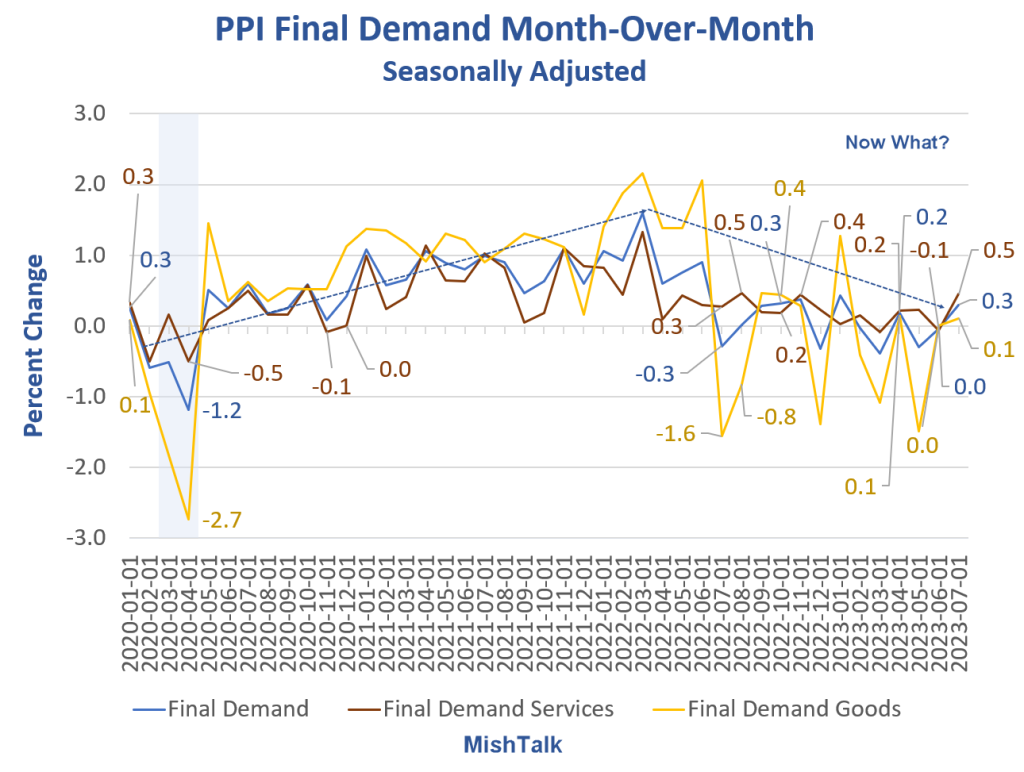

Producer Value Index Rises 0.3 P.c Led by a 0.5% bounce in Providers

On Friday, I famous Producer Value Index Rises 0.3 P.c Led by a 0.5% bounce in Providers

I feel it was the PPI that spooked the bond market. The index for crude petroleum rose 8.4 p.c in July.

That can spill over into gasoline costs. Except the value of shelter stabilizes, the August CPI report goes to come back in on the recent aspect.

Does Fed Coverage Assist?

It’s debatable if fee hikes will do a lot for shelter, no less than the way in which the BLS and Fed view issues, as a result of dwelling costs are usually not straight within the CPI.

Larger charges will gradual the tempo of recent development, and its completed development that may add to provide and probably strain lease costs.

The value of a brand new leases are falling due to the added provide, however current leases are cussed. In the meantime, landlords have each motive and incentive to maintain mountain climbing rents and have accomplished so, regardless of reported claims on the contrary for months on finish.

The provision of current properties is extraordinarily tight as a result of folks don’t need to commerce a a 3.0 p.c mortgage for a 7.0 p.c mortgage. And doubtlessly thousands and thousands of individuals need to purchase a brand new dwelling however can not as a result of they can not afford these excessive curiosity funds.

The Fed created this housing mess by not factoring in dwelling costs into its inflation mannequin.

Like householders who need to transfer however can’t, the Fed can be trapped into an issue of its personal making. The Fed desires to cut back demand, and has accomplished so, however concurrently, the Fed is lowering provide of recent homes. The latter acts to agency lease costs.