mbbirdy/iStock by way of Getty Pictures

The Firm

Accel Leisure, Inc. (NYSE:ACEL) is a $1-billion market cap distributed gaming operator in the US, concerned within the set up, upkeep, and operation of gaming terminals, redemption units with ATM performance, and different amusement units in licensed non-casino places like eating places, bars, comfort shops, and extra. Additionally they supply gaming options to location companions to reinforce participant engagement. Moreover, the corporate operates stand-alone ATMs and gives numerous amusement units, equivalent to jukeboxes, dartboards, and pool tables, for leisure functions. Headquartered in Burr Ridge, Illinois, the corporate goals to be a most well-liked associate for native enterprise homeowners within the markets they serve.

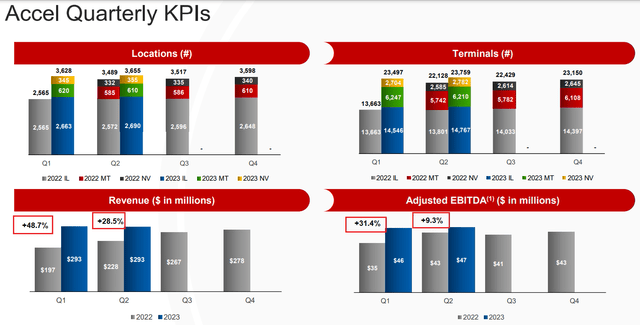

Final 12 months they expanded their operations via the acquisition of Century Gaming, Inc., which is now absolutely built-in [according to the management’s words during the latest earnings call] and drives the top-line development we noticed in Q2 FY2023:

ACEL’s IR supplies, creator’s notes

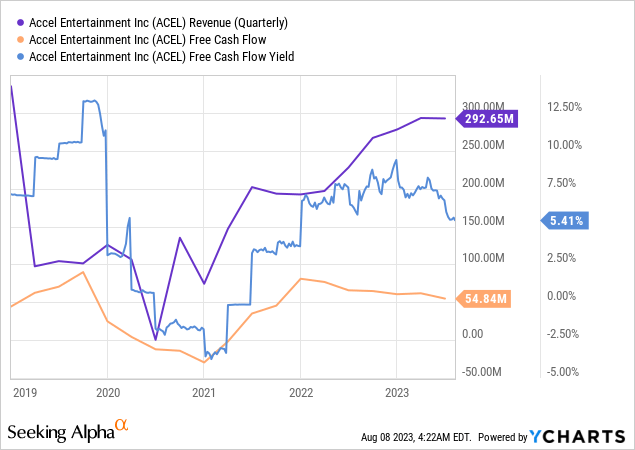

In Q2 FY2023, ACEL had a record-breaking second quarter with income of $293 million, a YoY improve of 28%, and adjusted EBITDA of $47 million, a YoY improve of 9%. The corporate had 23,759 terminals and three,655 places, with YoY will increase of seven% and 5%, respectively. CapEx for the quarter was $20 million [+212% YoY], primarily resulting from accelerating purchases in Illinois and funding in growing markets like Nebraska and Georgia. So the FCF dropped QoQ barely, however by way of the FCF yield of [~5.4%] we see nothing dramatic right here:

The executives imagine that the mixing of Century has been profitable, and whereas the corporate has extracted some synergies, they see extra alternatives for development and enchancment sooner or later.

Proper now, inflation [especially labor costs] is placing strain on the corporate’s gross margin, and macroeconomic uncertainty is stopping administration from offering clear steerage on future development. What additionally confuses me is the truth that gross sales development – regardless that it appears to be like fairly spectacular now towards the backdrop of a low 2022 baseline – is dealing with headwinds within the type of declining location attrition [primarily due to the closure of low-performing locations] and unfavorable climate circumstances.

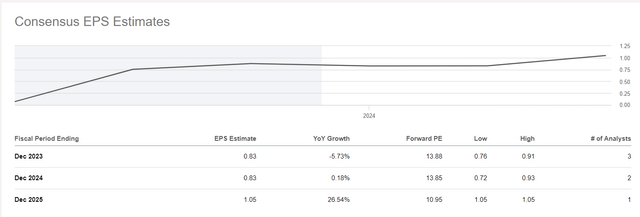

On a TTM-by-quarter foundation, ACEL’s web earnings decreased by 1.52% YoY, and Wall Avenue analysts anticipate it to maintain on shrinking, racing a full-year YoY decline of -5.73% by the tip of fiscal 2023:

Searching for Alpha, ACEL’s Earnings Estimates

The corporate is predicted to have flat earnings per share momentum in 2024, however I’ve doubts about how lifelike these forecasts are.

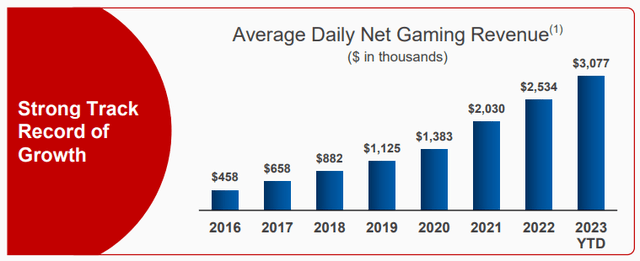

First, FCF technology appears to be like fairly secure, even after the CAPEX development of >200% YoY in Q2. It is smart for the corporate to speculate because the gaming enterprise continues to get well. An attention-grabbing truth: the coronavirus didn’t have a lot affect on ACEL’s common every day web gaming income, which grew in 2020-2021 and continues to develop within the present 12 months. The denominator in calculating this metric is the variety of buying and selling days, so the quantity of income didn’t depend upon this metric when casinos had been below quarantine.

ACEL’s IR presentation

That’s, on common, the corporate’s terminals deliver extra per 1 working day from 12 months to 12 months. And the variety of ACEL’s terminals, as we recall, continues to develop. Towards the background of the persevering with return of individuals to the playing halls, I assume that this could play into the palms of an additional restoration of the corporate’s revenues and, consequently, the quantity of web revenue.

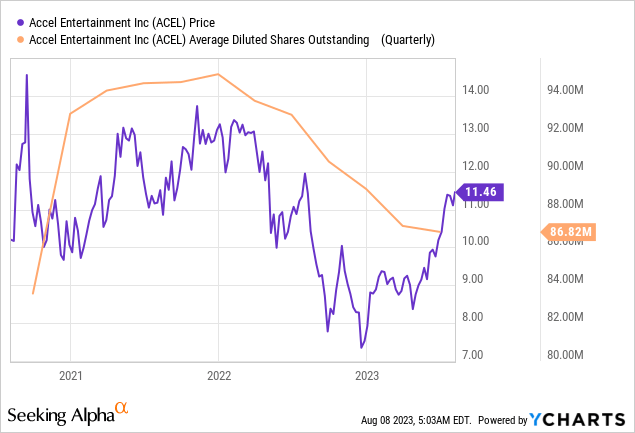

Second, the variety of shares excellent is more likely to decline additional, leaving room for development in EPS. The corporate lately introduced a $200 million share repurchase program [~20% of the total amount] and has repurchased $8.1 million value of inventory as of the newest quarter.

As of June 30, Accel had ~$285 million of web debt and $575 million of liquidity, consisting of money and out there credit score. I feel that the sturdy monetary place in addition to the FCF technology energy ought to permit ACEL to efficiently implement its share buyback plan this and subsequent 12 months. Due to this fact, the entire lack of EPS development in FY2024 appears to be too pessimistic an assumption.

However how does ACEL’s valuation help my bullish arguments?

The Valuation

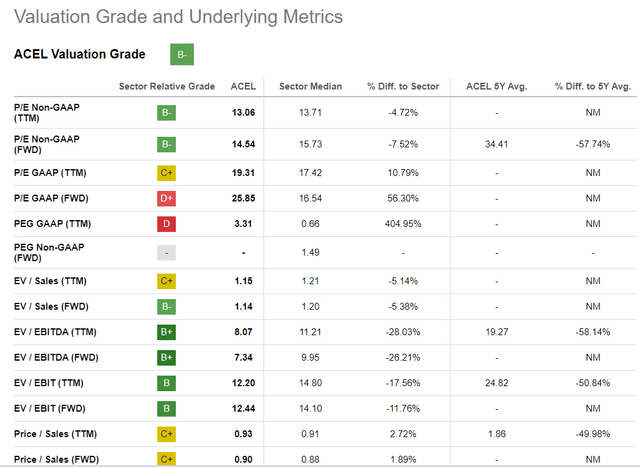

Searching for Alpha assigns a “B-” Valuation grade to ACEL inventory as a result of it has a whole lot of low EBITDA- and Gross sales-related multiples in comparison with the whole Client Discretionary sector, however there are additionally some regarding indicators concerning GAAP P/E and PEG ratios:

Searching for Alpha, ACEL, Valuation

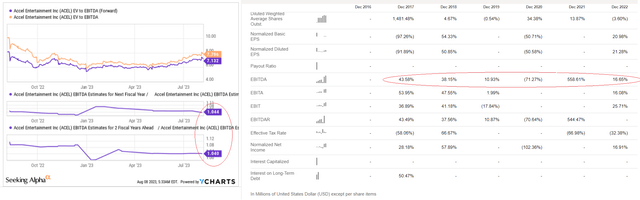

Specializing in the EBITDA-related multiples and EBITDA development charges, we discover a lot the identical as with the EPS forecast: analysts are estimating meager EBITDA development for FY2024 and FY2025, whereas the corporate has traditionally grown a lot sooner:

YCharts, Searching for Alpha, creator’s notes

I feel that if the corporate’s restoration continues, the market might assign it the next valuation a number of. So an EV/EBITDA of ~10x would look applicable [that’s about the industry’s median value], leading to an enterprise worth of ~$1,853M subsequent 12 months at a projected EBITDA of $185.31 [YCharts data], which is ~60% above right this moment’s market cap when adjusted for ACEL’s web debt determine.

The Backside Line

Generally, ACEL has clearly had some difficulties in current quarters, because the variety of working days has fluctuated continually, leading to inadequate income to keep up margins. Because of the many macroeconomic dangers and the truth that administration has not offered clear steerage for the close to future, ACEL inventory carries many dangers that any potential investor ought to contemplate. Maybe the Wall Avenue analysts are proper: earnings per share might really keep in the identical place subsequent 12 months (and even fall additional). If that’s the case, ACEL inventory will most probably present declining momentum from right here.

Nevertheless, wanting on the newest working numbers, ACEL’s enterprise appears to be like comparatively good. FCF technology continues to be sturdy, which ought to be sufficient for brand spanking new accretive M&A offers and buybacks. The operational metrics look promising – I am speaking about ACEL’s common every day web gaming income, which is steadily rising. I anticipate ACEL’s enterprise enlargement to proceed as gaming site visitors strengthens and recovers. So I personally do not suppose EPS ought to keep the identical. It can seemingly improve subsequent 12 months, which ought to give the inventory value a lift when/if a number of enlargement happens.

Due to this fact, I fee ACEL inventory as a “Purchase” this time.

Thanks for studying!