Up to date on August 1st, 2023 by Eli Inkrot

The tip purpose of many dividend development buyers is to generate sufficient passive earnings to cowl their residing bills.

There are two fundamental options to succeed in this purpose:

Enhance the scale of your funding portfolio.

Generate extra yield out of your present portfolio.

Normally, the one modifications that you could make as we speak are to generate extra yield. Excessive dividend shares are helpful for this.

You possibly can obtain a free copy of our full listing of excessive dividend shares by clicking on the hyperlink under:

Excessive dividend shares can actually generate extra earnings, however so can dividend-focused possibility methods.

On this article, we are going to introduce the money secured put earnings technology technique, which is one possibility technique that you should utilize to spice up the passive earnings generated by your funding portfolio.

Desk of Contents

Video: How To Increase Your Dividend Revenue Utilizing Money Secured Places

For buyers preferring to study new methods by way of movies, we’ve created the next video companion to this information on the money secured put earnings technology technique:

What Is The Money Secured Put Revenue Technology Technique?

To grasp what a money secured put possibility technique is, you might want to have a basic understanding of inventory choices. Right here’s a proper definition of a inventory possibility.

“A inventory possibility is a contract between two events during which the inventory possibility purchaser purchases the correct (however not the duty) to purchase/promote 100 shares of an underlying inventory at a predetermined value (referred to as the strike value) from/to the choice vendor inside a hard and fast time frame.”

If the contract permits the choice holder to purchase the safety, it’s a name possibility.

If the contract permits the choice holder to promote the safety, it’s a put possibility.

Every inventory possibility corresponds to 100 shares of the related safety, which known as the “underlying.” This can be a crucial idea to grasp, and makes the money secured put technique unsuitable for buyers which have solely small quantities of capital to speculate.

In a money secured put possibility technique, you promote a put possibility for a safety that you simply want to buy, however at a lower cost than it’s at present buying and selling. This lets you obtain the choice premium upfront in alternate for the duty (if the choice is exercised) to buy the safety at a lower cost level.

A picture is useful in understanding the payoff profile of a money secured put possibility technique:

Right here, the underlying inventory value is on the horizontal axis and the technique’s payoff profile is on the vertical axis.

As you’ll be able to see, the upside of the technique is the same as the choice premium obtained, much less any relevant commissions.

As the value of the underlying inventory declines previous the strike value of the choice, the technique turns into much less worthwhile and, finally, the investor taking part within the money secured put possibility technique loses cash. Nonetheless, needless to say the purpose of this technique is 1) to generate upfront money movement and a pair of) to probably buy securities you’ll be pleased to personal anyway.

As with all funding technique, the money secured put earnings technology technique has professionals and cons. We’ll dive into these – starting with the advantages – earlier than concluding this information with a number of examples.

Advantages of The Money Secured Put Revenue Technology Technique

Put Choice Profit #1 = You Get Paid

Whenever you promote money secured places, you receives a commission the choice premium upfront. Relying on the safety and the value at which you’re keen to purchase, this money movement could be vital. Typically the choice premiums generated by this technique can truly dwarf the dividend earnings generated by the inventory itself.

Put Choice Profit #2 = You Can Reinvest Proper Away

Money secured places permit for instant reinvestment. Not solely can the money movement be vital, but it surely additionally occurs instantly. You make an settlement now and some seconds later that capital is offered to you to be deployed. There’s a time worth of cash facet right here that may make possibility earnings extra engaging than ready on different sources of money movement.

Put Choice Profit #3 = You’re Ready To Dictate A Decrease Worth

When a money secured put technique is applied, there are tons of of accessible strike costs and expiration dates. Should you can be pleased to personal a sure inventory at $50, then you’ll be able to construction that settlement and nonetheless receives a commission for doing so. Should you would solely be pleased to personal a inventory at $45, then you can also make that settlement as an alternative, though you’ll obtain a decrease possibility premium in alternate for a decrease potential buy value. Utilizing put choices provides you nice flexibility in that you simply’re not merely taking costs which might be obtainable on the open market.

Put Choice Profit #4 = Permits You To Personal Decrease Yielding Securities

You would possibly assume that say Visa (V) is a wonderful firm, however have by no means actually given it a lot consideration resulting from its low dividend yield. By promoting a money secured put you might receives a commission for agreeing to purchase at a lower cost and thus enhance your money movement stream. Choices are aptly named. They’ll open up potentialities that you could be not have beforehand thought-about.

This concludes our dialogue of the advantages to the money secured put earnings technology technique. Subsequent, let’s transfer on to some potential downsides.

Downsides of the Money Secured Put Revenue Technology Technique

Put Choice Draw back #1 = You Have To Work In Spherical Heaps

Choices commerce in “spherical heaps” of 100 shares. Normally share value doesn’t matter (in greenback phrases, not in worth phrases), however on this scenario it actually does due to the spherical lot requirement. This may restrict the feasibility of allocating capital on this method.

For instance, buying and selling choices on Kinder Morgan (KMI) – which has a present inventory value of round $18 – is possible for many buyers. Conversely, buying and selling choices on Chipotle (CMG) – which has a present inventory value over $1,900 – is out of the realm for all however essentially the most prosperous.

Put Choice Draw back #2 = You Could By no means Personal Shares

The money secured put earnings technology technique is just not appropriate for buyers that have to finally personal shares of the underlying firm. If the share value stays greater, you could by no means personal shares. Even when the value momentarily strikes down previous your settlement value this doesn’t imply that it will likely be robotically triggered.

By the way, that is one benefit of a restrict order. Though you don’t receives a commission for a restrict order, it’s going to transact if shares are buying and selling at or under your set value. With a put possibility, it’s on the possibility purchaser’s (the vendor of the underlying inventory) discretion.

Put Choice Draw back #3 = You Don’t Acquire The Dividends Whereas You Wait

With a lined name earnings technology technique, you continue to obtain the dividend funds, as you continue to personal the underlying safety. With a money secured put you don’t but personal the safety and thus you don’t gather the dividend funds.

You’re compensated for this with the upfront premium, but it surely stays that this can be your solely money movement till the choice is exercised or it expires.

Put Choice Draw back #4 = You May Have To Redeploy The Capital

Should you’re a “set it and neglect it” sort investor, a easy purchase and maintain technique is apt to be extra engaging to you. With the money secured put earnings technology technique, the choice doesn’t need to be exercised. With that mentioned, each time a put possibility expires with out being exercised, you will want to re-initiate the technique by promoting additional cash secured places. This makes the technique extra time-intensive than long-term possession of the underlying securities.

Put Choice Draw back #5 = There Are Separate Tax Implications To Suppose About

If the put possibility is just not exercised, the choice premium could be taxed as abnormal (short-term) earnings.

If the choice is exercised, the choice premium turns into a part of your price foundation and future tax issues rely upon how lengthy you maintain the underlying safety. There’s an added layer of complexity concerned that’s not current with shopping for, holding and accumulating certified dividend funds.

Money Secured Put Instance #1: Johnson & Johnson (JNJ)

The primary money secured put possibility technique that we’ll discover is Johnson & Johnson (JNJ), a widely known healthcare conglomerate.

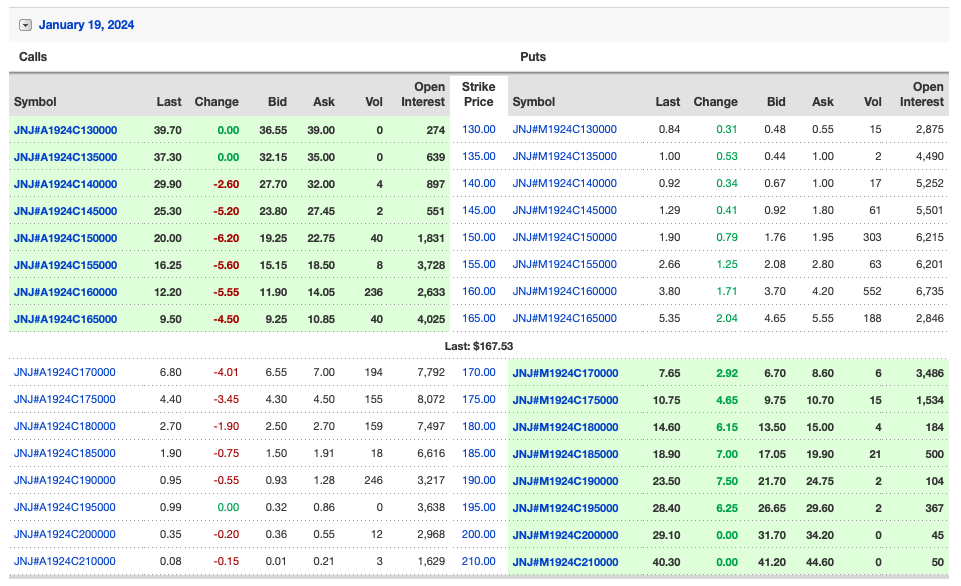

Whenever you search for inventory choices, you’ll often be offered with what known as an “possibility chain.” An possibility chain reveals the totally different strike costs for name and put choices at a sure expiration date. For instance, right here is the choice chain for Johnson & Johnson that expires on January nineteenth, 2024:

Shares of Johnson & Johnson are presently buying and selling round $168 on the time of this writing. If you wish to personal shares at this value, you’ll be able to merely purchase within the open market. Nonetheless, for those who would favor to attend for a lower cost you’ll be able to both 1) set a restrict order or 2) promote a money secured put and receives a commission upfront for making this willingness to purchase at a lower cost identified. For illustration, let’s suppose that you’re concerned about agreeing to purchase at $160.

The following step is figuring out how a lot money is required to safe the transaction. That is calculated by multiplying the strike value by the variety of shares which might be related to the choice, which is 100. On this case, an investor must $16,000 ($160*100) of their brokerage account to “money safe” the choice in case it’s exercised and 100 shares are “put” to you.

There are two nuances that make buying and selling choices totally different than buying and selling frequent shares. The primary is the relative illiquidity of inventory choices. As you’ll be able to see by inspecting Johnson & Johnson’s possibility chain, the quantity of transactions is low, creating a big bid-ask unfold for every strike value within the possibility chain. As an possibility vendor (which is what we’re doing in a money secured put technique), it is best to funds to obtain the “bid” value.

The second distinctive facet to pricing choices is that though choices contracts correspond to 100 shares of inventory, the quoted value is per share. Accordingly, multiply the quoted value by 100 to calculate your precise proceeds from promoting 1 money secured put.

In Johnson & Johnson’s case, this corresponds to $370 per possibility contract, or $3.70 per share for the $160 strike value expiring January nineteenth, 2024.

Final, we need to calculate the yield on the collateral we’ve put up towards these money secured places.

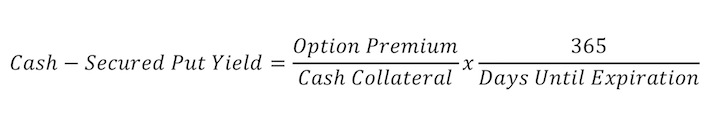

We are able to calculate the earnings from the money secured put technique utilizing the next system:

The system has two elements. The primary is possibility premium divided by the commerce’s money collateral. This issue provides you ways a lot absolute return you obtained expressed as a share of strike value.

The second is 365 divided by days till expiration, which turns your absolute return into an annualized return determine. That is essential as a result of virtually all charges of return in finance are expressed on an annualized foundation, so this improves the comparability of the money secured put possibility technique.

Within the case of Johnson & Johnson, right here’s what the precise math works out to:

Money-Secured Put Yield = ($370/$16,000)*(365/171) = 4.9%

The investor obtained $370 of possibility premium in alternate for posting collateral of $16,000. The choice had 171 days till expiration. This gives an annualized return of 4.9%.

The following two examples will cowl different well-known shares – Coca-Cola (KO) and Berkshire Hathaway (BRK.B) – whereas sparing a number of the element of this primary instance.

Money Secured Put Instance #2: The Coca-Cola Firm (KO)

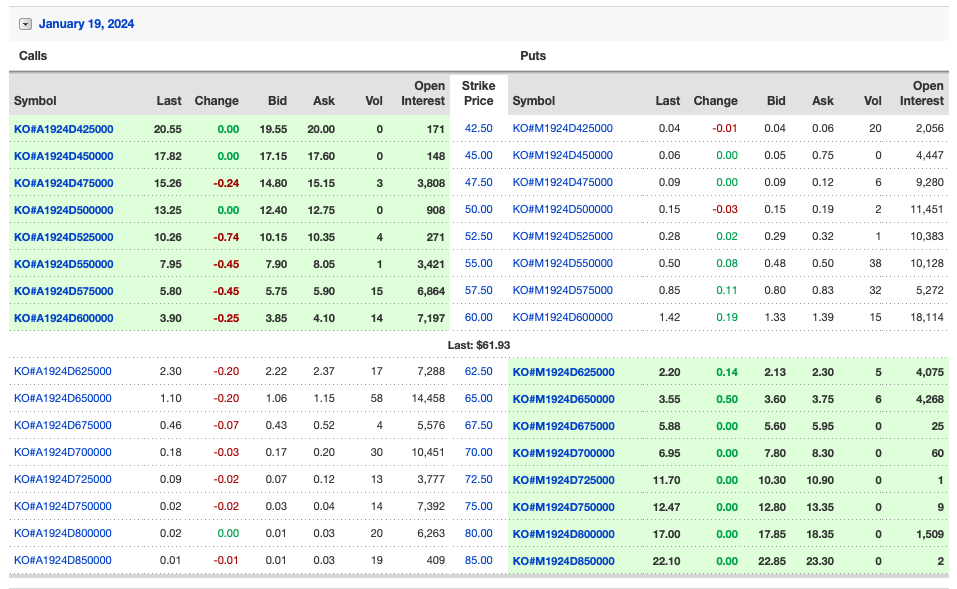

You possibly can see Coca-Cola’s choices chain right here:

Shares of Coca-Cola are at present buying and selling just below $62. Should you have been as an alternative concerned about shopping for at say $57.50, you might promote a money secured put at this value and obtain $0.80 per share or $80 per possibility contract.

Right here’s how we’d calculate the extra yield that we will generate from money ready to purchase Coca-Cola by promoting these money secured places:

Money-Secured Put Yield = ($80/$5,750)*(365/171) = 3.0%

The $57.50 possibility dated January nineteenth, 2024 is promoting for $80 per contract. $5,750 of collateral would should be posted to safe this settlement. This money secured put gives an annualized yield of three.0%.

Money Secured Put Instance #3: Berkshire Hathaway (BRK.B)

The following instance of a money secured put technique that we’re going to discover is for Berkshire Hathaway’s class B shares.

This instance is exclusive as a result of Berkshire Hathaway is the primary firm on this article that doesn’t pay a dividend. Due to this, Berkshire Hathaway is a superb instance of how one can generate passive earnings from firms that don’t at present pay dividends.

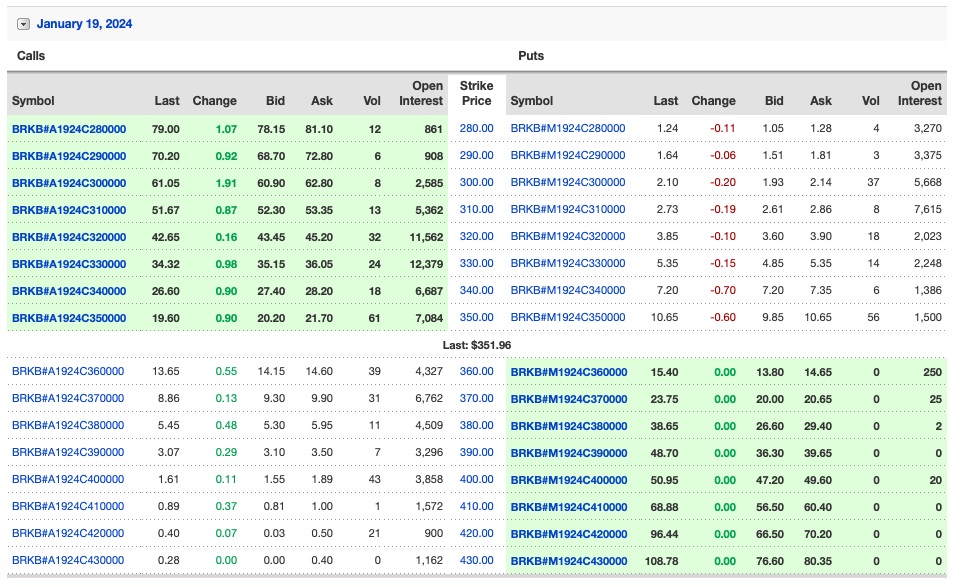

Right here is Berkshire Hathaway’s January nineteenth, 2024 possibility chain:

Shares of Berkshire Hathaway are presently buying and selling at $352. Suppose you’re keen to purchase at $340. At this strike value, the premium is $7.20 or $720 per contract.

Right here’s how we will calculate the yield obtainable for this selection:

Money-Secured Put Yield = ($720/$34,000)*(365/171) = 4.5%

The $340 possibility dated January nineteenth, 2024 is promoting for $720 per contract. $34,000 of collateral would should be posted to safe this settlement. This money secured put gives an annualized yield of 4.5%.

Last Ideas

Promoting a money secured put, in its easiest type, is getting paid to agree to purchase at a value that you’d be pleased with. You would possibly use this technique to boost your money movement or to personal a safety at a price that you simply deem is truthful. Should you’re going to work with choices, you need to just remember to’d be content material with both facet of the settlement.

Associated: Promoting Weekly or Month-to-month Put Choices for Revenue in 11 Straightforward Methods

You is likely to be turned off from promoting put choices because of the added complexity, additional legwork or apprehension about by no means proudly owning a safety. Should you’re going to be kicking your self if shares rise greater, that is one thing that it is best to take into consideration earlier than initiating a money secured put earnings technology technique. The psychological boundaries are each bit as actual because the structural ones. The purpose is to determine what could also be best for you.

In any case, the money secured put possibility technique is appropriate for buyers who want to enhance the passive earnings generated by their funding portfolios.

The next Certain Dividend lists comprise many extra high quality dividend shares to think about:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].